Exclusive: Goldman's Head of London Metals Trading on Gold

Chapters:

- Wake Me Up When September Ends

- Indian Demand and Diwali Season

- China Buying is Non-Stop

- Silver's Complex Position

- They Want the Silver Down Mexico Way

- DEDOLLARIZATION MANIFESTING

- EFP COMMENT

- Platinum's Challenges

- Palladium's Tight Range

- Full Slideshow

1-Wake Me Up When September Ends

Authored by GoldFix ZH Edit

He then goes on to describe the normal drivers, or lack therefore, for a continued rally into the third quarter in this report dated September 7th for institutional clients.

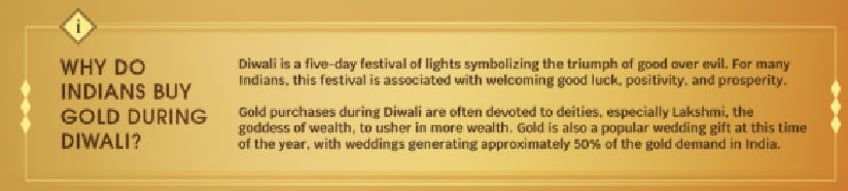

In September thus far, Goldman’s London trader sees a seasonally familiar pattern. Gold is currently declining for the ninth year out of the last ten in September with an average performance dip of approximately 2.76% since 2013.

September is (not) in the Pink…

His explanation for this recurring September slump lies in the strong summer performance, which tends to be followed by a correction in September.

The explanation for the last few years likely lies in the strong summer performance, with Gold giving back…

This makes sense for sure, as historically Gold frequently makes a high in Aug/Sept post the August contract rollover into December only then to drop lower until November when US based Buy Season comes calling.

It is important to note however, that this year had a bigger focus on Gold than past summers. The BRICS summit made sure of that. Related, Central Bank buying was extremely pronounced in the first half of 2023.

Therefore, the slump may be bigger than normal if Central Bank buying pulls back and global monetary policies do not facilitate economic recoveries in China, Russia, and a renewed vigor in the USA. Do not forget, Turkey has turned seller recently as well reflecting their own domestic problems. China will buy from them if they panic.

This mini-slump covers September as excess speculative longs offload their positions post summer. That does not necessarily end until November however due to other Hedge Funds also sellingin the course of business reducing their own positions in October. All of this is in preparation for November/ December redeployment during Buy Season.

September to Not Remember...

Which brings us to India’s Diwali demand preparations

2-Indian Demand and Diwali Season

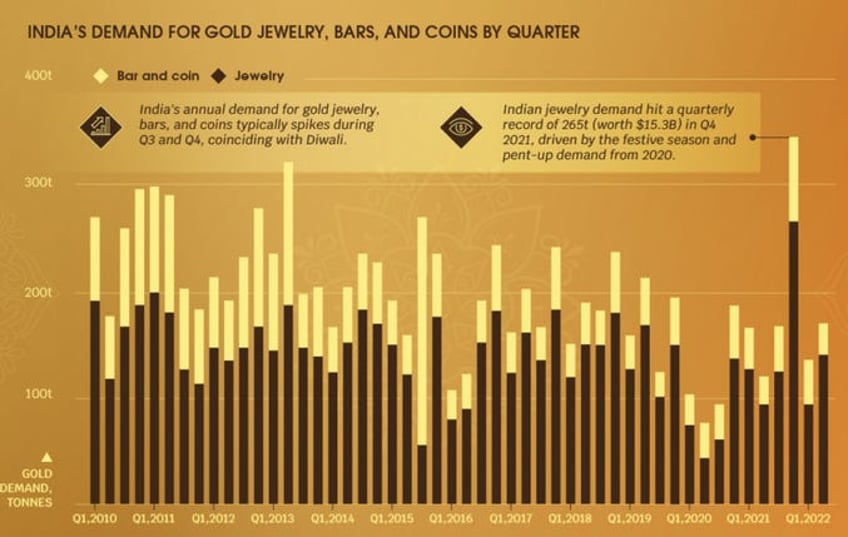

Taking a closer look at September’s context. Indian retail demand for Gold typically also experiences a dip in September before entering a revival phase in the fourth quarter, coinciding with the Diwali and Indian wedding season, and extending from late October to year-end.

via Mining.com

This coincides nicely with US fund allocations during Buy Season. If Diwali is seen as strong, then Funds will buy even more in November.

via Mining.com

So, if you're concerned about Gold's recent movements, it's worth noting that the gains over the past month haven't been particularly impressive, with a modest increase of 7.5%. But that isn’t chump change either.

3- China Buying is Non-Stop

Shifting his focus to the international perspective, the trader notes Chinese private demand for Gold has eased somewhat after the record-high Shanghai Gold Exchange (SGE) premiums seen at the end of August.

Meanwhile China just keeps buying…

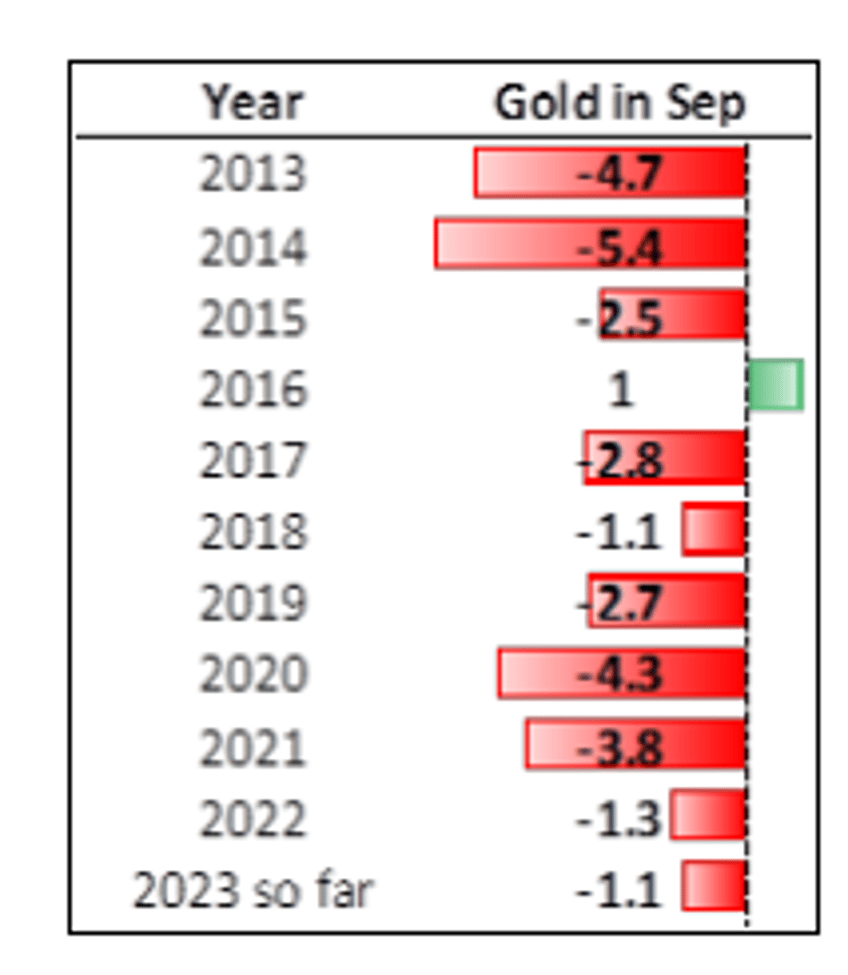

Nevertheless, the People's Bank of China (PBOC) continues to increase its Gold reserves for the tenth consecutive month, aligning with the ongoing narrative of wealth transfer from the West to the East.

Interestingly enough, Banks are now openly discussing this West/East wealth transfer, whereas bullion professionals have noted industry changes since 2013 when Goldman, JPMorgan and others opend vaults in Asia in anticipation of the new inflows.

China is still buying Gold for its Central Bank seemingly hand over fist. For now assume the public demand, which has been leaving a bigger finger-print ( See TD’s Report at bottom) on global prices recently, will be more patient unless given the go-ahead by the CCP to add again via easing capital controls.

China has yet to go all in on fighting deflation…

H/T ForexLive

4- Silver's Complex Position

Silver finds itself in an interesting position. It lacks the affordability that drove record demand in India in 2022 and the excitement that characterized 2020 and 2021.

Silver seems to be stuck in a phase where interest is subdued, and its volatility closely mirrors broader market trends.

Continues here ...