Submitted by QTR's Fringe Finance

“Freddo, you handle the pitch. But on the translation controllers, all backwards. So if the Earth starts drifting down you need to thrust aft, not forwards.”

— Tom Hanks as Jim Lovell, Apollo 13

I watched Apollo 13 on Netflix this weekend and was having recollections of this scene as I thought about the stock market getting ready for the week ahead.

The scene is as the crew are preparing for their manual burn to right their course, as they attempt an emergency landing back on Earth. Astronaut Jim Lovell is essentially reminding one of his crewmembers, who is maneuvering their lunar module, that all of the controls are backwards.

Talk about a great analogy for the stock market.

If there’s a lesson to be learned about being dead wrong about the market crashing due to high interest rates, it should be that because the market is a forward-looking mechanism, and because economic data often arrives with a lag, sometimes stocks literally do the polar opposite of what they "should" do.

Here’s the performance of stocks during the fastest and highest rate hike cycle in history, sitting on top of the largest pile of debt humanity has ever seen accrue:

It wasn’t really insane to postulate over the last two years that a quick spike in interest rates would eventually lead to economic calamity and markets crashing. Hell, it may still very well happen. But, putting aside whether or not I got the timing or the thesis wrong, let’s examine quickly why I’ve been wrong so far to begin with.

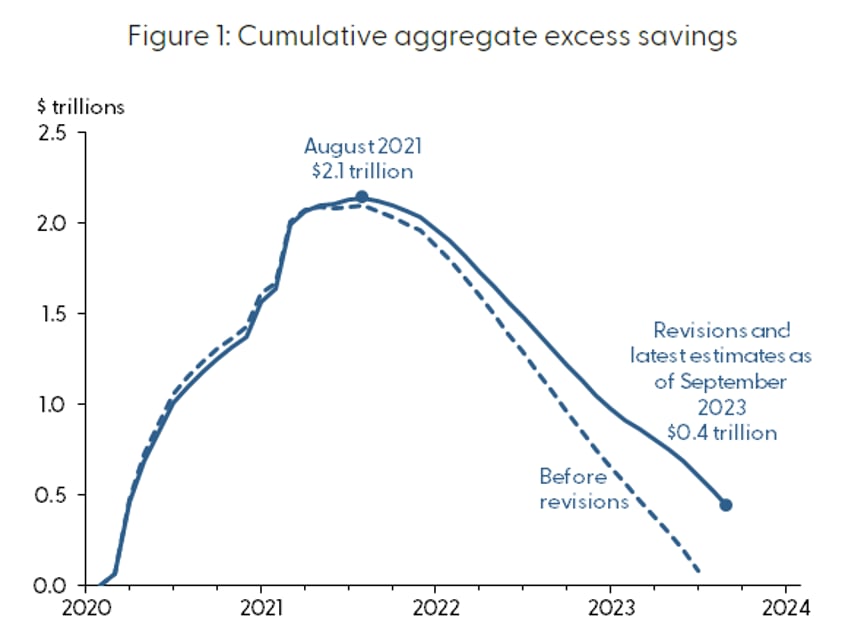

First, as I noted in an article last week, there is more excess savings left over from the multi-trillion dollar Covid liquidity dump that the Fed set off back in 2020 than expected. Ergo, this gives people more discretionary income and staves off the economic time bomb for a little bit longer than it normally would have taken to blow up with rates at 5%.

Second, rates moved higher than any time in recent history, but they also did it faster than any time in recent history as well. Given that there is about an 18 month to 2 year lag from the time rate hikes go into effect until they have an impact on the economy, we literally may not have even “hit the wall” yet. We could be looking at more of a blindingly quick, unexpected crash into the side of the mountain, as opposed to a prolonged, slow, grueling chokehold of rate hikes, which resulted in the crashes that we saw back in December 2018 — the worst December since 1931. To believe in the soft landing bullshit, you have to look at the below chart and believe the first slow, chokehold of rates moving higher caused a crash, but that the second increase in rates will not cause a crash.

Third: think of this analogy: we are standing...(READ THIS FULL ARTICLE HERE).