American Superconductor (AMSC) has tremendous potential to capture upside on the coming power grid transformation, and, unlike most of the AI theme which tend to front-run performance by relentlessly bidding the stock, none of this is yet reflected in the price, giving it an asymmetric risk/reward profile. That can change as soon as the next earnings announcement, which is not yet officially scheduled but estimated for January 22nd.

Though the story here is not only about the potential to turn a quick buck when AMSC reports earnings later this month. It’s also one of my favorite emerging names in the AI space – specifically related to delivering power, a theme zerohedge wrote about extensively last year and a group that has since then outperformed AI MegaCap Growth stocks like Nvidia.

Of all the demand booms that have characterized the AI infrastructure buildout, power generation is all the rage. It has been impossible to miss headlines about nuclear energy, for example, being prioritized as a power source to meet the insatiable demands of data centers. The urgent need to reform the power grid such that it's able to support AI is not lost on Wall Street, where incentives are rapidly being reshuffled away from ESG-sponsored green energy hype of the Covid/ZIRP era and towards modes of power that can actually be relied on.

BlackRock CEO Larry Fink: "The world is going to be short power, short power. And to power these data companies you cannot have just this intermittent power like wind and solar. You need dispatchable power because you can't turn off and on these data centers." pic.twitter.com/WG89J5wVyK

— Camus (@newstart_2024) May 31, 2024

But “transforming the power grid” takes more than just the production of efficient power – it obviously must be able to deliver this power to end users, which, in its current form, it cannot. What is needed are improvements in the capacity of the electrical grid to deliver more power, more cleanly and above all more reliably. This demands the implementation of new and superior technologies.

Enter: superconductors.

A superconductor is any conductive material with properties that cause electrical resistance to disappear, in contrast to conventional conductive materials, such as aluminum and copper, which lose energy due to resistance. That means they don’t produce heat (i.e., they don’t waste energy), making them ideal for transmitting high-voltage electricity without physically enormous (and expensive) infrastructure. Depending on the physical dimensions, superconducting wire can carry anywhere between five and 200 times the electrical current of a typical copper wire.

The problem is that known superconductive materials only function when cooled down to super low temperatures, and even the most cutting edge so-called “high-temperature superconductors” (HTS) require liquid nitrogen to cool them below freezing. They are only “high temperature” in comparison to traditional superconductors that function below -10 degrees Fahrenheit. Because of the intricate and specialized cooling systems required for known superconductors, their applications have been limited.

But is this technology at all practical, or are all these possibilities only theoretical? HTS cables have already been deployed with great success. Several years ago, in Germany, an HTS cable project called “AmpaCity” was successfully utilized as the city proved too dense to economically support the buildout of a new substation for propagating electrical transmission. The result was a much more economical solution than extending the 110 kV grid.

Expect this HTS technology to be scaled up, refined and deployed when more and more use cases for AI necessitate a marked increase in the demand for power to be delivered economically.

The room-temperature superconductor (RTS) mania in 2023 resulted from the potential applications if these cooling requirements were alleviated – such technology would instantly allow for ultra high-speed digital interconnects between computers operating order of magnitude faster while consuming less power. Without the need for liquid nitrogen or other exotic coolants (and thus cooling jackets plus other specialized equipment), this ultra high speed electrical transmission would suddenly be markedly cheaper.

In July 2023, researchers from Korea claimed they had discovered a viable RTS material "that opens a new era for humankind", dubbing it LK-99:

incrediblehttps://t.co/MzR6Xe1YTM

— ib (@Indian_Bronson) July 26, 2023

"...LK-99 is the first room-temperature and ambient-pressure superconductor....We believe that our new development will be a brand-new historical event that opens a new era for humankind." https://t.co/6okR05SizI

If that sounds too good to be true, it unfortunately was: those claims turned out to be false. Until a room-temperature superconductor is discovered, which may not happen for a long time (think of RTS as one of the several 'holy grails' of energy that look great on paper but in reality prove unattainable), HTS technology offers the best option for meeting the challenges facing the electrical grid.

Wider scale deployment of HTS for power transmission has long been a future promise, but we are nearing an inflection point as the demand for power and a refined electrical grid will begin to weigh heavily on the broader AI theme. My favorite company in this space, American Superconductor (AMSC), has the best upside to the HTS inflection, but the story for this article is more about their exposures outside of HTS, of which there are a lot.

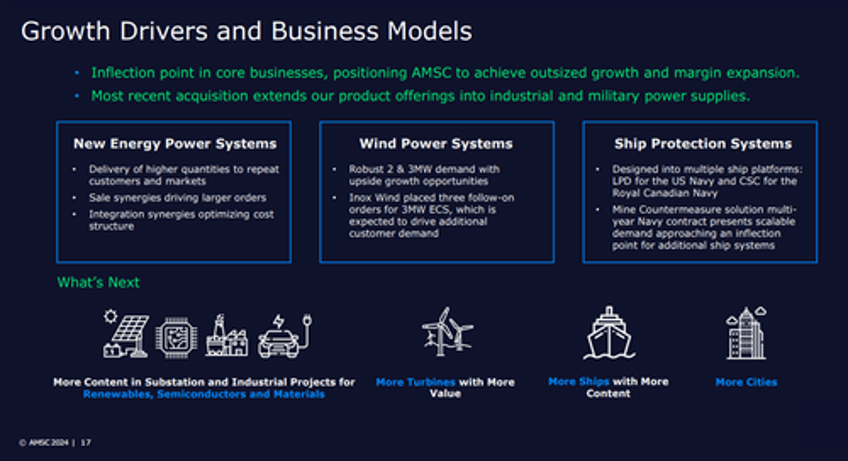

AMSC is a $1 billion company who, in their own words, “designs, develops and deploys power control systems that harmonize an increasingly complex energy system.” The company was founded on high temperature superconducting wire, and does supply products designed around HTS, but it has since significantly diversified its product set through acquisitions and R&D to include power supply, modulators, systems, and other electrical grid equipment, none of which is HTS-based. But it’s this diversified product set, in addition to HTS-based products, that’s capturing AMSC's huge opportunity at transforming the electrical grid.

AMSC’s equipment is being installed at grid connection points – which is where producers and consumers connect to the grid – to improve efficiency and reliability. This is critical for new power sources that generate lots of energy, like nuclear, or generate energy intermittently, like renewables, and it’s important for users of power that require high reliability and need to correct for voltage instability problems from existing transmission networks.

Through selling this equipment, AMSC has also developed expertise in electrical system design and maintenance, which has allowed them to develop a consulting offering for customers, like the US Navy and other allied navies, to complement equipment sales.

Grid solutions and ship equipment collectively account for about 90% of AMSC’s revenue and have driven the explosive growth in the business. Meanwhile, the remaining 10% of the business supplies electrical control systems (ECS) to wind turbine producers. Wind-based energy is not popular in the US, but AMSC’s major customer for wind ECS, Inox Wind, is in India, where the wind business is expanding rapidly.

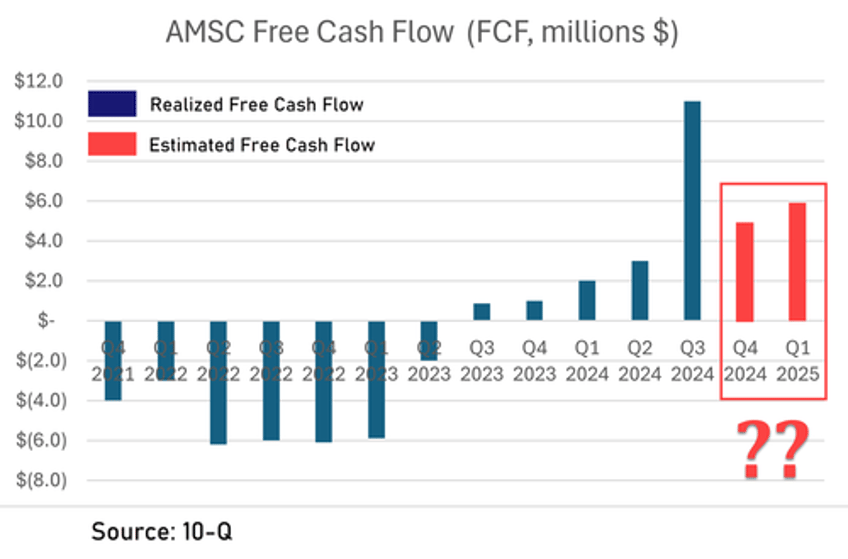

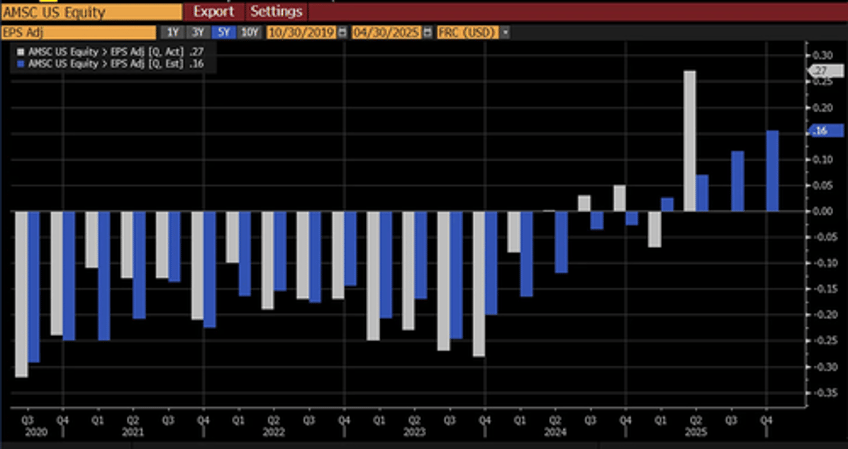

In fact, AMSC indicated on a conference call recently that this key customer has a record $250 million backlog, expected to bring in $80 million annually over the next three years. This alone could drive over 50% annual revenue growth for AMSC, far exceeding previous market estimates of just 5% annual growth. Recent strong performance, including free cash flow reaching $11 million last quarter, suggests the company is already outperforming expectations handily.

In other words, that means the wind business, accounting for only 10% of AMSC’s total, would generate more revenue in 2025 than current estimates for the entire company. On top of that, upcoming deployments and recent price increases could boost gross margins to around 30% and operating margins to 20% or more, far above the market's conservative projection of 10%.

This is the fat right tail opportunity that the stock and rest of the market appear to remain oblivious to.

AMSC is on track to generate approximately $50 million in annual free cash flow (FCF), reflecting a 5% yield with significant growth ahead. Factoring in its expanding grid and ship businesses, recovering wind revenue, rising transmission demand, and improving profitability, AMSC would surpass $100 million in EBITDA within two years, up from $8 million where it last is.

This means the company is trading at a 65% discount to electrical equipment peers, even though it is growing much more quickly. I believe the picture will be clearer by their next earnings report on January 22nd (as said earlier, the exact date is still TBD) but, with virtually no debt, over $70 million in cash, and a proven, well-aligned management team, AMSC is positioned as an undervalued growth opportunity – great for a trade or, if you’re thinking about it like I am, even better as an investment.

Expect AMSC stock to appreciate by multiples of its current value in the next couple of years as investors become more aware of this foundational enabler of the power delivery megatrend - one that is just beginning.