Federal Reserve officials agreed to hold interest rates steady on Wednesday but indicated that they are likely to raise their benchmark target later this year.

“Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have slowed in recent months but remain strong, and the unemployment rate has remained low. Inflation remains elevated,” the Fed said in a statement at the conclusion of its two-day monetary policy meeting on Wednesday.

The Fed released new economic projections on Wednesday, the first since the June meeting. These indicated that the Fed expects to hold rates at elevated levels through next year. The projections also show that officials now expect the economy to grow more rapidly this year than they did in June.

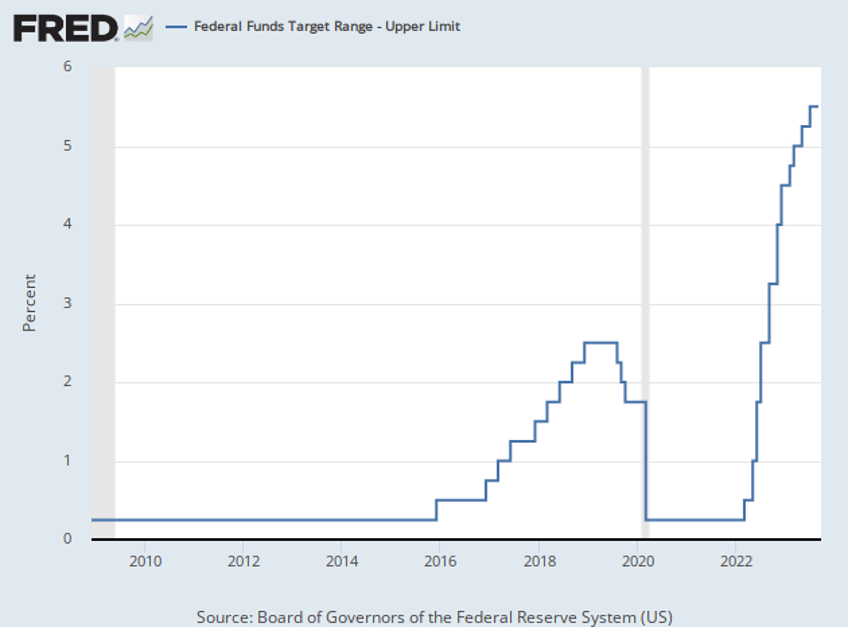

The Fed held its benchmark rate target at a range of zero to 0.25 for years following the financial crisis and Great Recession. In 2016, the Fed began raising its interest rate target, believing the economy had become sturdy enough to withstand higher interest rates. The Fed hiked rates seven times during Donald Trump’s presidency, leading to a public clash between the White House and the central bank. Trump argued that the Fed’s hikes were undermining his programs aimed at raising the growth rate of the economy.

When the pandemic struck, the Fed quickly dropped its target back down to near zero. Even as the economy recovered and inflation began rising, Fed officials kept the target rate unchanged, incorrectly believing that inflation was a “transitory” effect of gnarled supply chains.

Beginning in March of last year, the Fed hiked rates at every meeting, bringing the federal funds rate up by a cumulative 5 percentage points. This was the most rapid pace of hikes since the Fed began setting an interest rate target. 1980s. In June, the Fed held rates steady but signaled they were prepared to raise rates one or two more times this year. In August, the Fed raised the target to a range of 5.25 percent to 5.5 percent.

The new projections from Fed officials showed that they now expect the economy to grow 2.1 percent this year, a big increase from the one percent growth they projected in June. Officials reiterated their expectation that the bank will hike rates another 0.25 percentage point before year end.

Fed officials also penciled in higher rates for next year. At the June meeting, the median expectation was for the federal funds target to be down to 4.6 percent by the end of 2024, implying as many as four cuts from the 5.6 percent they said they expect this year. The new projections show the target rate being cut to 5.1 percent. The following year’s expected rate was raised to 3.9 percent from 3.4 percent.