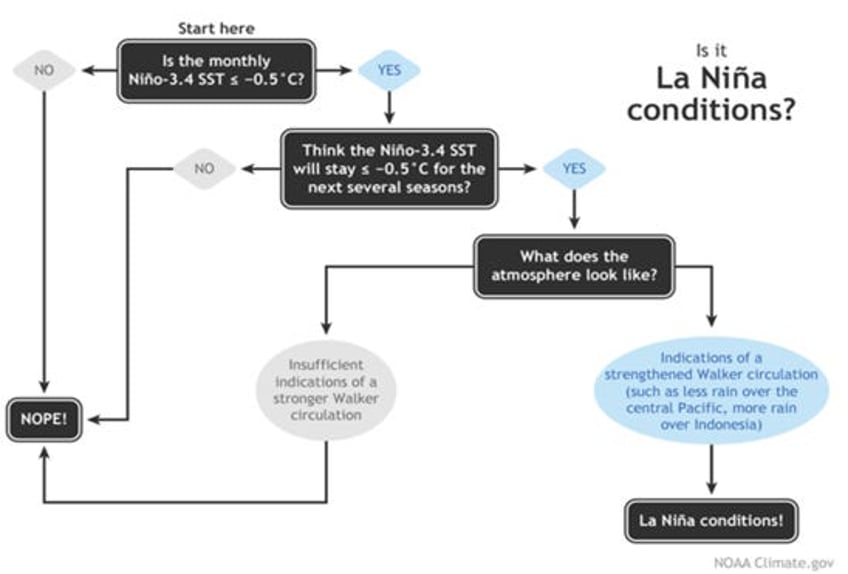

For investors who look at the financial world through the lens of the business cycle and use market ratios to allocate their portfolio among the four asset classes of the Permanent Brown Portfolio, listening to the news media can appear to be at best a source of distraction and at worst a source of unbearable noises. Outside the business cycle, investors who take the time to learn and act responsibly; rather than being driven by emotions like YOLO investors; know the importance of cycles in life. On that matter, it is not only the business cycle but also the climate cycle which has an impact on human beings’ life as the climate cycle has inevitable impacts on human behaviours. While the past 4 years have been all about the spread of the climate change scam by the green zealots leading the western world, the reality is that the solar cycle have short- and long-term impacts. The climate, like business, evolves in cycles. For climate, the short cycle alternates between La Niña and El Niño. As of January 2025, it is official, La Niña is here. La Niña conditions are currently present and are expected to persist through February-April 2025 (with a 59% probability), followed by a likely transition to ENSO-neutral during March-May 2025. This indicates that ocean temperatures have dropped to 0.9°F (0.5°C) below normal in key areas of the Pacific Ocean.

https://www.climate.gov/news-features/blogs/enso/january-2025-update-la-nina-here

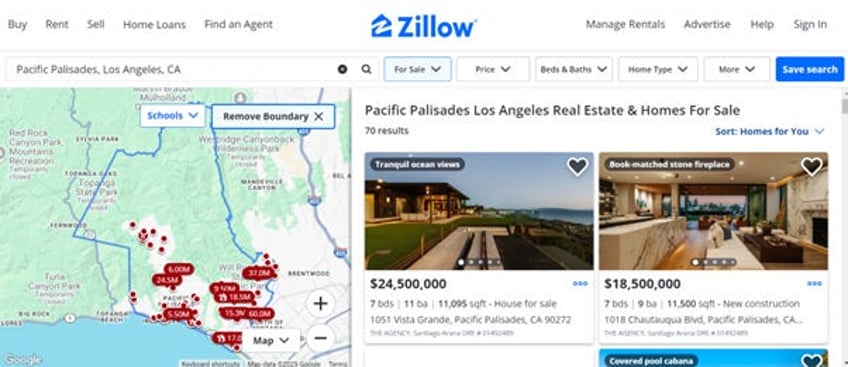

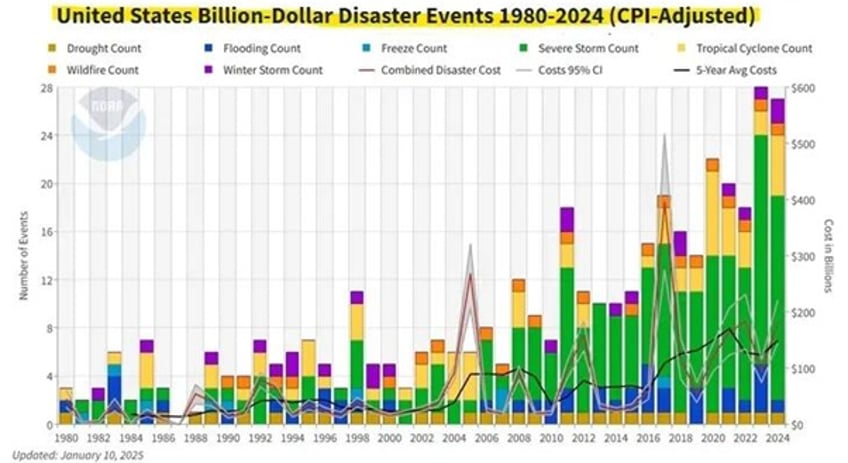

Beyond the potential impact of drought on grain production in the upcoming season in the Northern Hemisphere, which could lead to shortages and higher food prices, the U.S. has experienced a series of natural disasters over the past few months. These include Hurricanes Helene and Milton on the East Coast and the recent wildfires in Los Angeles. Aside from the dramatic personal toll of wildfires, as of end of December, Zillow reported that 6,125 homes were currently available for sale in Los Angeles. Some of the areas most affected by the wildfires had homes listed at prices ranging from $20 million to $40 million. Rough estimates indicate that approximately 70% of these homes have mortgages.

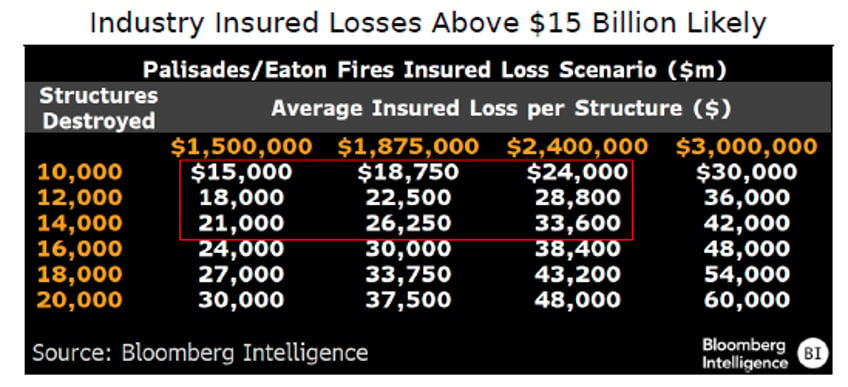

California is no stranger to wildfires. In 2018, the ‘Camp Fire’ wildfire set a record with costs of ~$12.5 billion. The ongoing "Palisades Fires" (a group of five fires) are now estimated to cost $150–200 billion, potentially making them the most expensive natural disaster in U.S. history. While this amount is likely to increase as the fires remain uncontrolled, the financial markets have not significantly addressed the impact of this natural disaster, which follows closely on the heels of Hurricanes Milton and Helene on the East Coast. The reality is that the series of natural disasters affecting millions of Americans in recent months is likely to spill over from the property and casualty insurance sector into broader areas of the U.S. economy. Savvy investors recognize that natural disasters are typically inflationary at first and then recessionary. In Pacific Palisades, over 90% of homes are valued above $1 million, with an average value exceeding $3 million, while homes near the Eaton Fire average over $1 million. If 10,000 structures were destroyed, P&C industry losses could reach $15 billion, assuming an average replacement cost of $1.5 million.

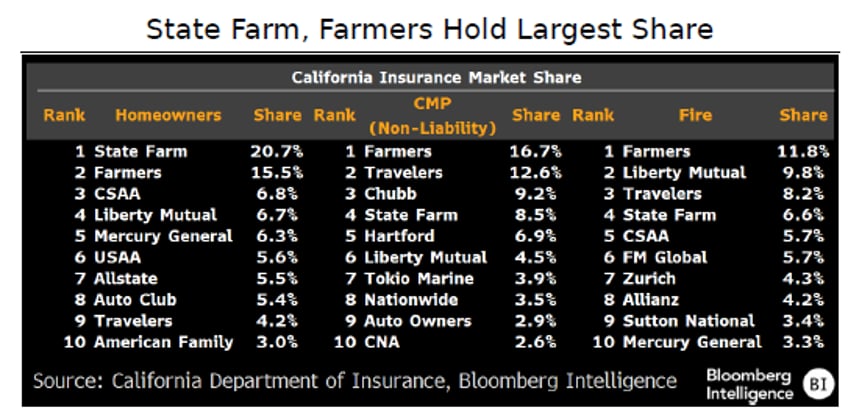

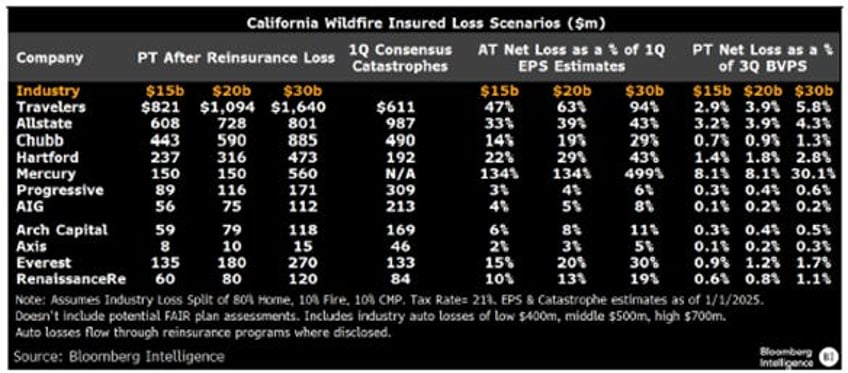

While mutual companies dominate the list of homeowners and commercial property/multi-peril carriers in California, publicly traded insurers such as Travelers, Chubb, and Allstate also have exposure in the state. Chubb, in particular, insures high-value homes, including some potentially at risk. State Farm was California's largest home insurer by market share in 2024, while Zurich-owned Farmers is the largest commercial insurer in the state—though it is currently non-renewing policies—followed by Travelers. However, market share is a blunt tool for estimating losses as it does not account for reinsurance protection or the geographic dispersion of business throughout the state.

In this context, the impact of the wildfires on Q1 2025 EPS and beyond for U.S. insurers could be significant, ranging from low single digits to as much as 60%. While mutual carriers lead the market in California, companies with concentrated exposure, like Mercury General, have already announced they will reach their reinsurance retention limits. Based on statewide market share and conservative modelling, Travelers, Allstate, and Chubb are expected to be the most affected by the tragic events in the California Palisades.

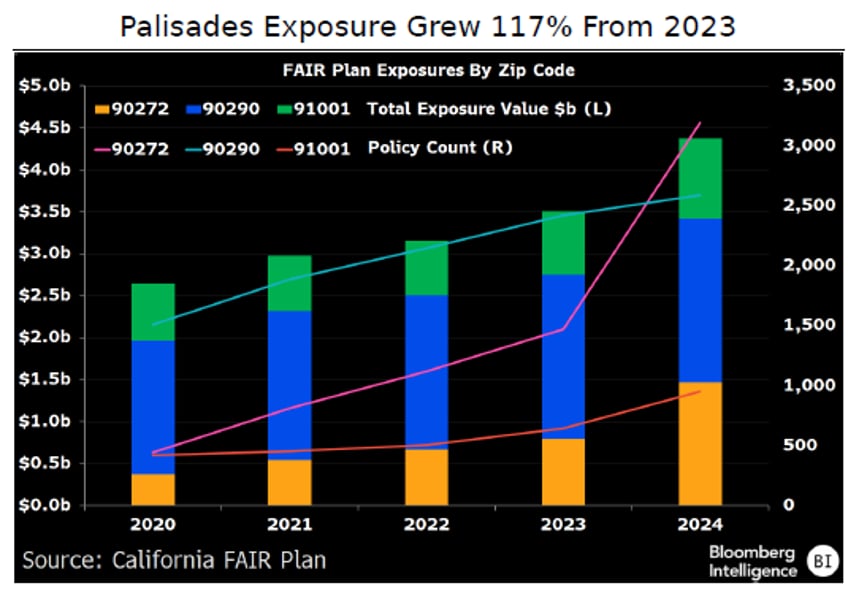

California's FAIR Plan, the state's insurer of last resort, covers about 4% of policies, primarily in high-risk wildfire regions. While its policies are more limited than private insurers, they do include wildfire coverage. As of September, residential policies accounted for $458 billion in exposure. Established in 1968 as a private entity, FAIR isn't taxpayer-funded but can levy assessments on insurers with the commissioner's approval, passing some costs to policyholders. The plan hasn’t issued assessments since 1994, despite its exposure now being 800% higher than during the 2018 Camp Fire. As of March 2024, the FAIR Plan reported $200 million in surplus, $700 million in cash, and $2.5 billion in reinsurance—less than $3 billion in total capacity. By comparison, its exposure in the 90272 Pacific Palisades zip code alone was $3.2 billion, with 1,430 policies (15% of homes). The adjoining 90290 zip code adds $2.5 billion in exposure.

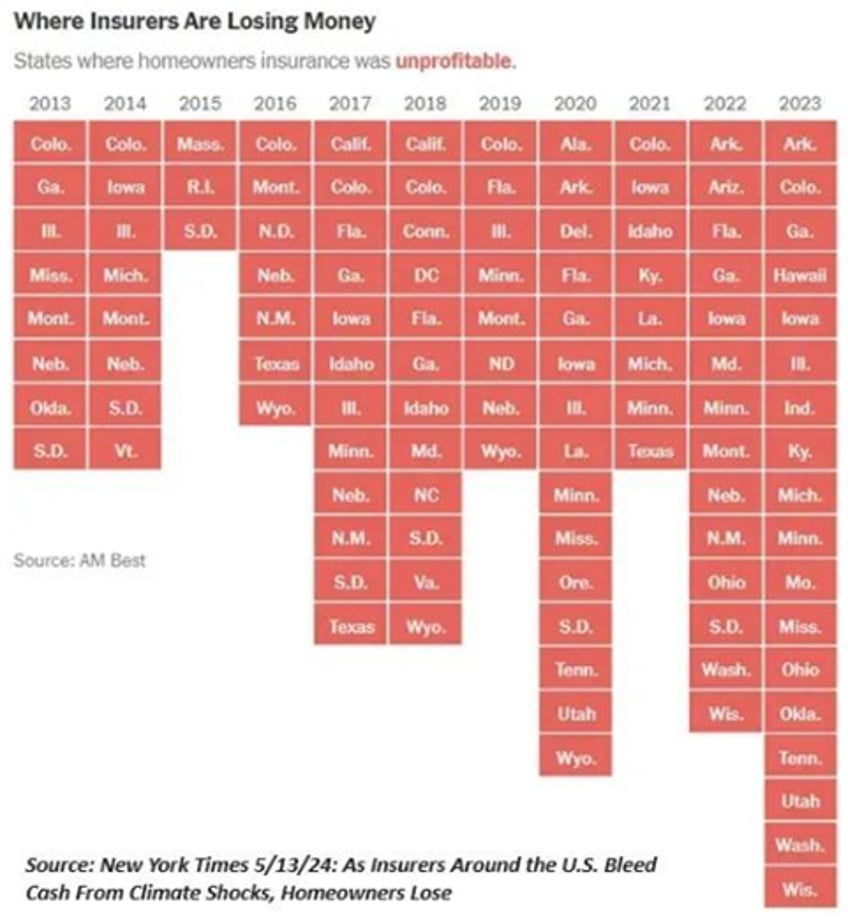

Beyond the episodic and historically inflationary impact of wildfires and other natural disasters, the real issue for financial markets is the broader effect of entering an era of heightened global risks. This is no abstract policy debate; insurers, operating in the real world, face soaring losses that drive decisions to withdraw from regions, reduce coverage, and raise premiums.

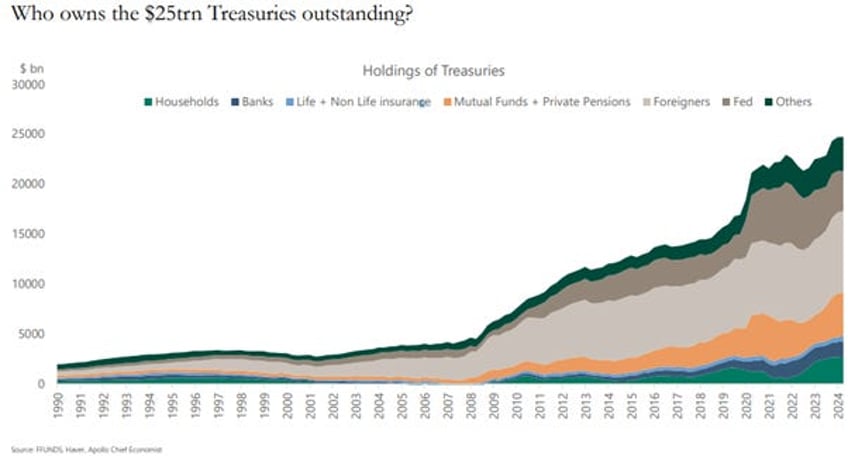

While everyone with a modicum of common sense knows that insurance companies are just ‘institutionalised fraud’ and will never meet their obligations to policyholders, some might believe that the rising costs of natural disasters will remain confined to the insurance sector. However, the real concern for investors is that natural disasters are stagflationary for the economy over time. Additionally, this issue could play a critical role in the upcoming $9+ trillion U.S. government debt refinancing in 2025. Of the $35+ trillion in total U.S. government debt, insurance companies hold about 1%, or nearly half a trillion USD. As a result, the current crisis in the insurance sector is likely to negatively impact not only investors with stakes in insurance companies but also the bond market. Weakened balance sheets may leave insurance companies struggling to absorb the impending refinancing wave, even forcing them to sell government bonds to cover damages from hurricanes and wildfires.

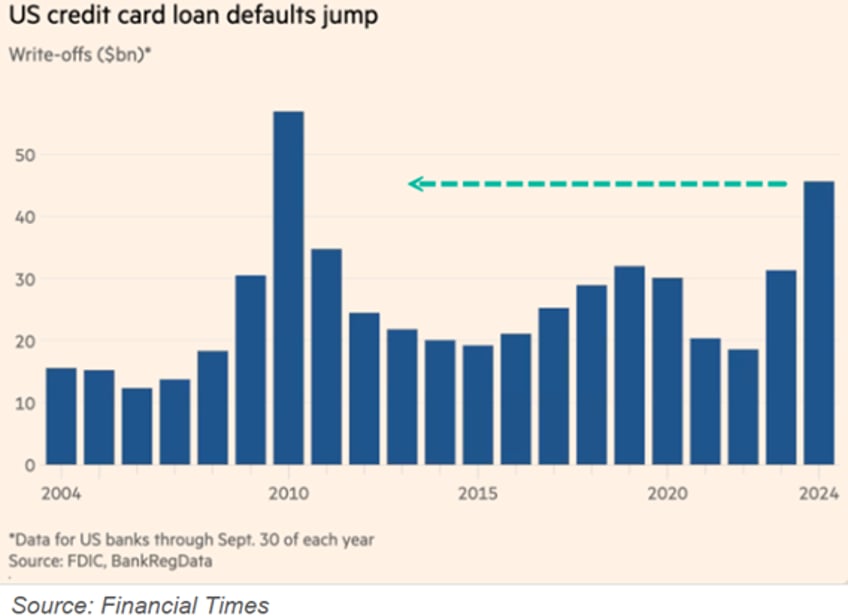

While insurance companies will have to absorb the costs of recent hurricanes and wildfires, the banking sector is facing rising defaults on credit cards, as the party has long been over for the bottom third of U.S. consumers. Maxed-out credit cards and depleted personal savings have pushed credit card loan defaults to their highest level since the 2008 financial crisis. According to the Financial Times, new data from BankRegData reveals that credit card companies wrote off $46 billion in "seriously delinquent loan" balances in the first nine months of 2024—an alarming 50% increase from the same period last year and the highest level in 14 years.

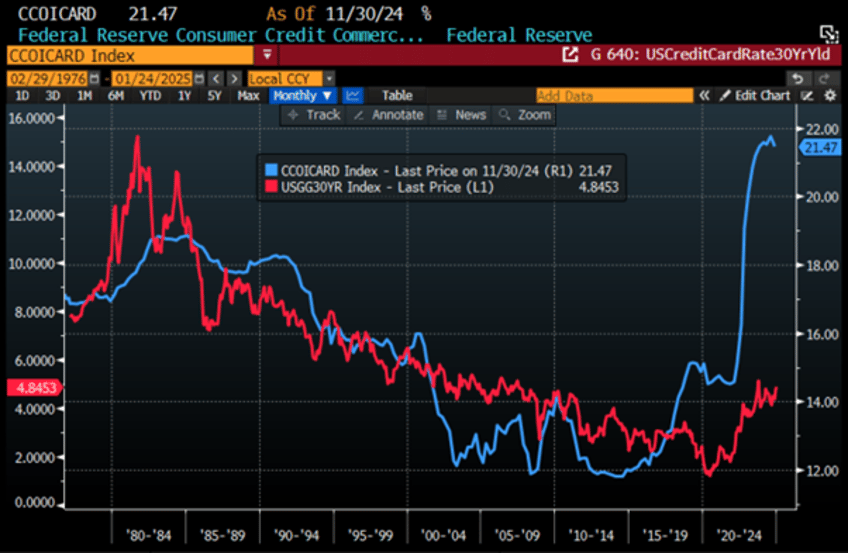

Outside the impact of natural disasters, US credit card debt recently surpassed $1 trillion and continues to grow rapidly. Compounding the issue, annual percentage rates (APRs) on credit card debt have reached record highs, worsening the financial strain on cash-strapped consumers. Despite the interest rate cut, the average APR on credit card debt hit a new record at the end of the third quarter and is expected to keep rising, as there has historically been a strong correlation between credit card interest rates and the U.S. 30-year yield.

US Credit Card Interest Rate (blue line); US 30-Year Treasury Yield (red line).

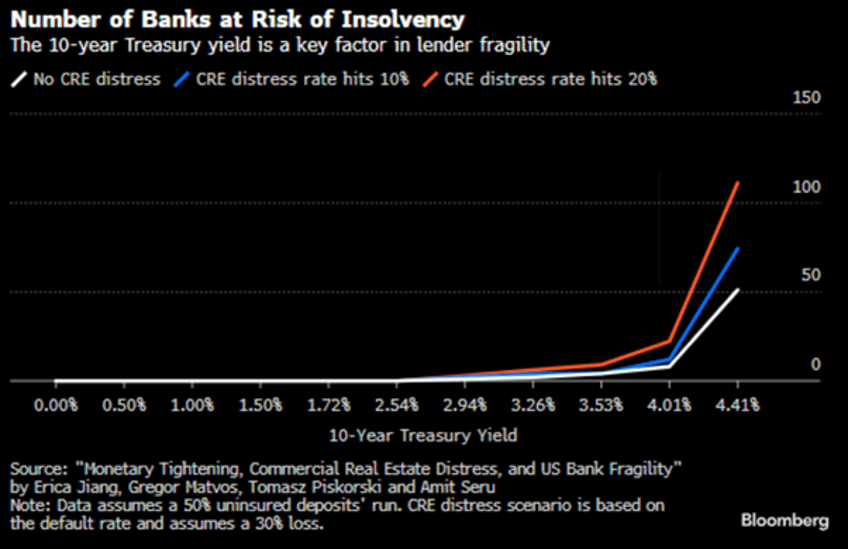

Aside from credit card defaults, another crisis brewing since the SVB collapse is linked to the Commercial Real Estate sector, which continues to struggle in an environment where offices are becoming increasingly irrelevant for companies adopting AI to improve productivity amid structurally higher costs. In this context, the bear steepener that has followed the partisan-driven Fed rate cuts of 2024 will inevitably impact U.S. regional banks sooner rather than later. If borrowing benchmarks remain high, regional banks risk higher losses on their commercial real estate loan books, as borrowers will struggle to refinance. About 14% of the $3.0 trillion in U.S. CRE loans are underwater, rising to 44% for offices.

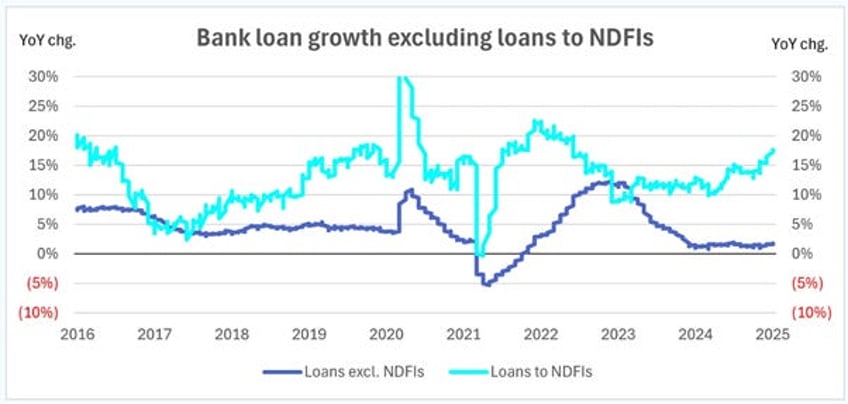

Another sign that something may be rotten in the republic of the USA is the increasing importance of NDFI lending (Non-Depositary Financial Institutions) lending or in a more layman’s term ‘Shadow Banking’. NDFI lending is lending done by financial entities that do not collect deposits or their equivalent from the public. They include various types of financial intermediaries such as mortgage brokers, mortgage lenders, check cashers, money transmitters, and seller of payment instruments. To say the least, non-NDFI lending is weak is an understatement, but the demand for leverage for non-bank financial institutions continues to grow. Eventually, someone says, “No” and the music stops. But where (and when) that is will only be known in hindsight.

In this context, anyone with a modicum of common sense would expect that the Q4-2024 bank earnings season, which officially started on January 15th with JPMorgan, Wells Fargo, Goldman Sachs, BNY Mellon, and Citigroup, would be very different from the traditional "beat expectations" parade.

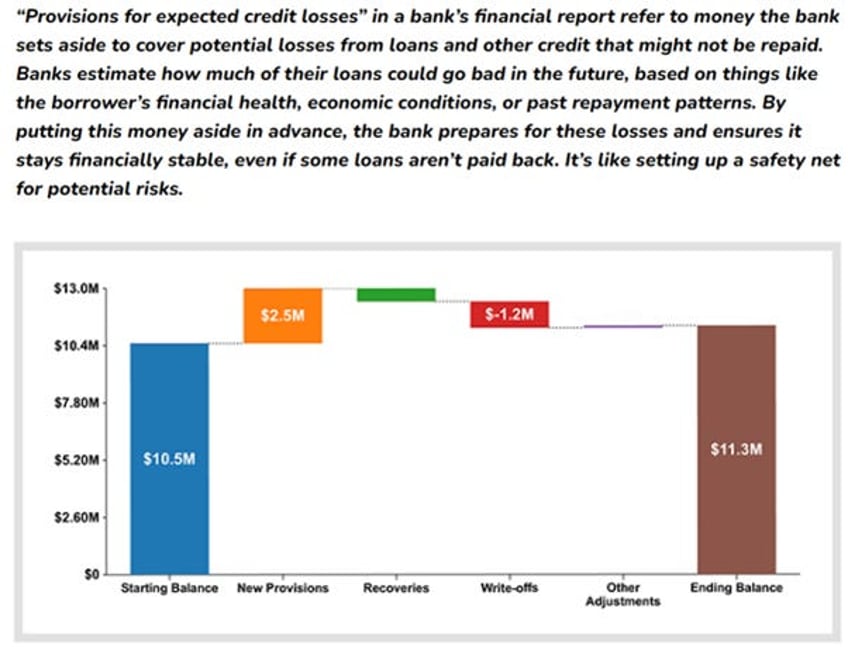

Between one "Kumbaya!" and a "High Five!", one small detail across all these earnings reports clashes significantly with reality: provisions for expected credit losses. Before diving into the banks’ reports, anyone living in the real world knows that rising defaults on credit cards, a structural CRE crisis, and much higher interest costs for much longer should translate into much higher ‘reserves for expected loan losses,’ also commonly referred to as ‘provisions for expected credit losses.’ Looking at a succinct definition of ‘provisions for expected credit losses,’ anyone with a modicum of accounting knowledge knows that:

Let’s start with the almighty JPMorgan. JPMorgan announced that its reserves for loan losses as of December 31st increased to $24.34 billion, up from $23.9 billion at the end of Q3 2024, and the highest since Q1 2020, when the reserve for loan losses began to skyrocket due to the impact of COVID-related lockdowns. When compared to the total amount of loans on the bank’s balance sheet (~$1.3 trillion), only one word can describe these provisions: peanuts. Overall, in 2024, the total for this item is less than $2.0 billion higher, or less than 9% higher compared to 2023. Looking at Wells Fargo, one of the major U.S. banks with the highest market share in California, incredibly, reserves for loan losses decreased in Q4 2024 to $14.18 billion from $14.33 billion at the end of Q3 2024. Even more spectacular than JPMorgan and Wells Fargo, Bank of America, which has seen its major shareholder, Berkshire Hathaway, cashing out over the past 12 months due to concerns over its increasingly dubious accounting practices, saw its reserve for loan losses being almost unchanged at $13.24 billion at the end of Q4 2024, versus $13.25 billion at the end of Q3 2024.

By now, it is crystal clear how disconnected the world portrayed by banks’ figures is from what’s happening in the real world, where a deteriorating economic environment, paired with rising yields because of reigniting inflation, is wreaking havoc in the corporate space. Bankruptcies are piling up, with little sign that this trend will slow down anytime soon.

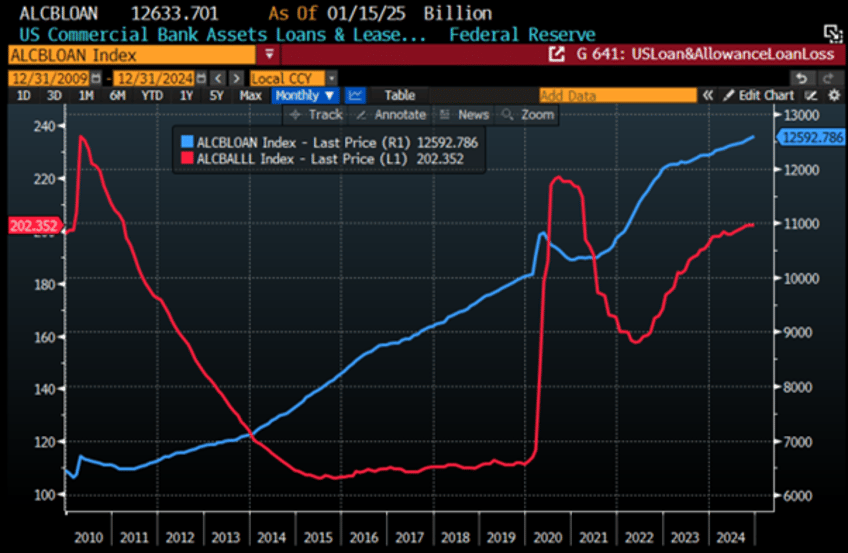

US Commercial Bank Assets Loans & Leases Bank Credit SA (blue line); US Commercial Bank Assets Allowance for Loan & Lease Losses SA (red line).

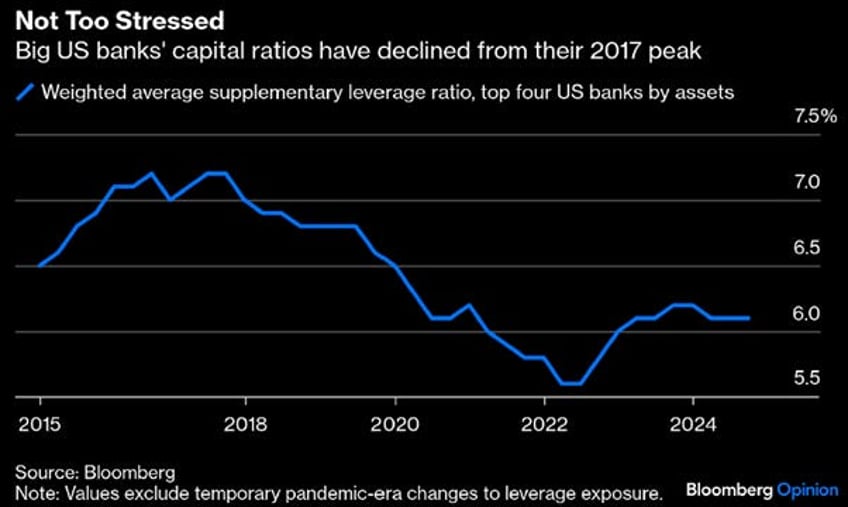

The FED stress tests, once vital in preventing a 2009 financial collapse, have become flawed and predictable, no longer simulating real crises effectively. Originally aimed at improving risk management, they now create a false sense of security. Loss-absorbing equity at the largest US banks has declined significantly since 2017. In 2020, the tests became directly tied to capital requirements, but this has led to lower equity levels and volatility. The FED should either improve the tests or decouple them from capital requirements to better prepare for future crises.

Moving back to the business cycle, it should be clear to anyone who understands that rising long-dated yields, as well as natural disasters, will only create more hardship for the American people who are not part of the plutocracy or the inner circle of oligarchs surrounding the tenant of the White House whoever he is. A rise in the percentage of allowances for loan losses relative to the total loans in the U.S. banking system has historically been associated with a peak in the S&P 500-to-oil ratio, which when it slingshots back below its 7-year moving average is an indicator that the economy is entering a bust period of the business cycle, a time which has historically been a good omen for the U.S. economy and, ultimately, for investors.

S&P 500 to WTI ratio (blue line); 84-Month Moving Average of S&P 500 to Oil Ratio (red line); Ratio of US Commercial Bank Assets Allowance for Loan & Lease Losses SA to US Commercial Bank Assets Loans & Leases Bank Credit SA (axis inverted; green line).

Savvy investors know that the health of a banking sector's role in the economy can be assessed by comparing the market value of banks to the value of the country's bond market. Investors should track this ratio against its 7-year moving average. If the ratio is above the moving average, it signals favourable economic conditions with low borrowing costs and banks offering financial conditions conducive to an economic boom. Conversely, if the ratio is below the moving average, it indicates restrictive financial conditions, likely leading to an economic bust sooner rather than later. As widely expected by those who understand that the market is forward-looking, the Bank index to bond ratio usually breaks below its 7-year moving average before the Ratio of US Commercial Bank Assets Allowance for Loan & Lease Losses to US Commercial Bank Assets Loans & Leases Bank Credit spikes, reflecting the onset of a banking crisis.

KBW Bank Index to US Treasury Index ratio (blue line); 84 months Moving Average of the KBW Bank Index to US Treasury Index ratio (red line); Ratio of US Commercial Bank Assets Allowance for Loan & Lease Losses SA to US Commercial Bank Assets Loans & Leases Bank Credit SA (axis inverted; green line)

Investors tracking the business cycle with the Permanent Browne Portfolio should note the recent divergence between the KBW Bank Index to US Treasury Index ratio and the S&P 500 to Gold ratio against their 7-year moving averages. This signals potential risks in the banking sector that could lead to a broader crisis.

Upper Panel: KBW Bank Index to US Treasury Index ratio (green line); 84 months Moving Average of the KBW Bank Index to US Treasury Index ratio (red line); Lower Panel: S&P 500 to Gold ratio (blue line); 84 months Moving Average of the S&P 500 to Gold ratio (red line).

As it should be only a matter of time before the US economy moves from the current inflationary boom into an inflationary bust, a look at the relative performance of the S&P 500 ex-Financials & Real Estate Index, which can be proxied by the ProShares S&P 500 Ex-Financials ETF (SPXN US), versus the S&P 500 Index ETF (SPY) during the last period of inflationary bust in the US (from January 2022 to October 2023) shows that passive investors who decided to stay away from the financial and real estate sectors outperformed the S&P 500. However, they underperformed investors who favored energy-producing companies (i.e., the S&P 500 Energy Sector) and the Aerospace & Defense sector (i.e., the S&P Aerospace & Defense Industry Index) over the same period.

Relative Performance of S&P 500 Ex-Financials to S&P 500 Index (blue line); Relative Performance of S&P 500 Ex-Financials to S&P 500 Energy Index (red line); Relative Performance of S&P 500 Ex-Financials to Aerospace & Defence Industry Index (green line) between January 2022 and October 2023.

In English, "misfire" means to fail to work as intended or to fail to achieve the desired result. Looking at the real economy, not the one portrayed by Wall Street and its parrots, it should be clear to anyone who can look around that regulators are currently allowing banks to keep real losses on their loans and credit lines buried in their ‘Hold to Maturity’ assets, as they always do before every financial crisis, in the interest (as they always claim) of financial stability and to avoid creating unnecessary panic in the market. This action will inevitably backfire, not only for the banking sector but also for the regulators, as the can cannot be kicked down the road forever, especially when central banks' bandwidth to bail out everyone is becoming limited and the "too big to fail" are notoriously becoming "too big to rescue." As these losses will have to surface sooner or later (as they always do), it is already time to understand that bank deposits carry counterparty risk.

To weather the storm, holding physical gold, the ONLY ANTIFRAGILE ASSET with no counterparty risks, a portfolio of short-dated IG USD bonds with a maturity of less than 12 months, and some T-bills with a maturity not exceeding 3 months will help when Financial Misfire sparks into Financial Wildfire. By then, those who have prioritized the Return OF Capital over the Return ON Capital will enjoy peace of mind and wealth.

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/financial-misfire

If this report has inspired you to invest in gold and silver, consider Hard Assets Alliance to buy your physical gold:

https://hardassetsalliance.com/?aff=TMB

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at

Unlock Your Financial Success with the Macro Butler!

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.