Here's the FindLeadingStocks.com AM Report - 7 Things I'm Watching Today 1/3/24

Good Morning Team,

- Pullback Time - The long awaited pullback I discussed several times recently finally arrived on Wall Street as many of the leading stocks in 2023 fell (hard) on Tuesday. Now, the question becomes will this turn into a healthy pullback (shallow in size and scope) or an unhealthy one? I'm still leaning bullish until we see material damage show up. Remember, the market was up 9 weeks in a row. That is one of the longest runs in modern history. It is perfectly normal and healthy to see "down" weeks in broader uptrends. We have the Fed minutes today and the jobs report on Friday. A lot can happen between now and Friday's close.

- Love Tap: Yesterday was one "bad" day. It is important to remember that in the market bad days happen. The good news is most days (good days and bad days) don't matter in the long-run. That said, being able to anticipate and react to good and bad days very important for successful investors. Why? Because most novice traders panic and sell because they don't see it coming. Experienced traders learn to anticipate it and prepare for both good and bad days. In a recent report I said I'm expecting a "love tap" to hit the market. And this is exactly what a love tap looks like. (No, love tap, is not a technical term, just a term I use to explain what occasionally happens in the market). Going forward, I want to see if the bulls show up and defend support or if we just roll over and fall. For our newer readers, my process, by design, requires me to plan ahead because my work is done on the weekend when the market is closed and my stops (buy stops and sell stops) are in during the week. This way I always know (in advance) the three most important questions on Wall Street: Where will I enter? Where will I exit? & How much will I risk if I'm wrong?

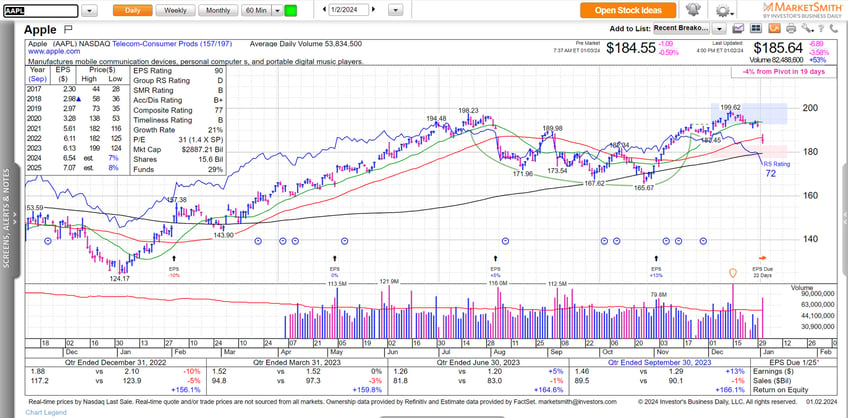

- Bad Apple: Apple fell hard yesterday after an analyst pointed out that the ~50% rally it enjoyed in 2023 doesn't make sense due to slowing iPhone sales. Apple led the market, and a slew of leading stocks, lower on Tuesday.

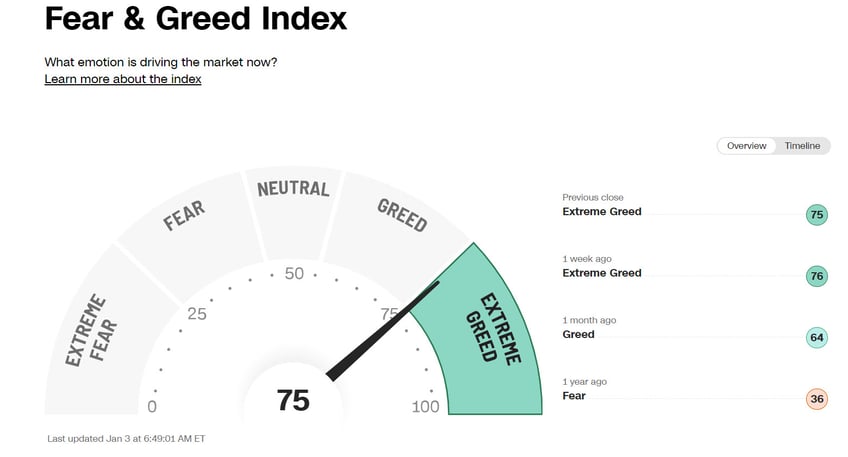

Charts and Data are courtesy of MarketSmith Incorporated. Join MarketSmith here. - Very Crowded Trade: At the end of 2023, nearly "everyone" was bullish. Normally, very crowded trades don't work. Pullbacks serve a purpose on Wall Street. They help shake out the weak/late hands and set the stage for a new uptrend. Most pullbacks are healthy and pave the way for higher prices. The CNN Fear/Greed index hit Extreme Greed at the end of 2023 and is still at Extreme Greed -even after yesterday's ugly decline. The last time it hit extreme greed was in July and I pointed that out back in July and said we were due for a pullback and that's exactly what happened from July-October. Then, in October I showed you that the reading moved to extreme fear and that paved the way for the very strong rally we enjoyed over the last 9 weeks.

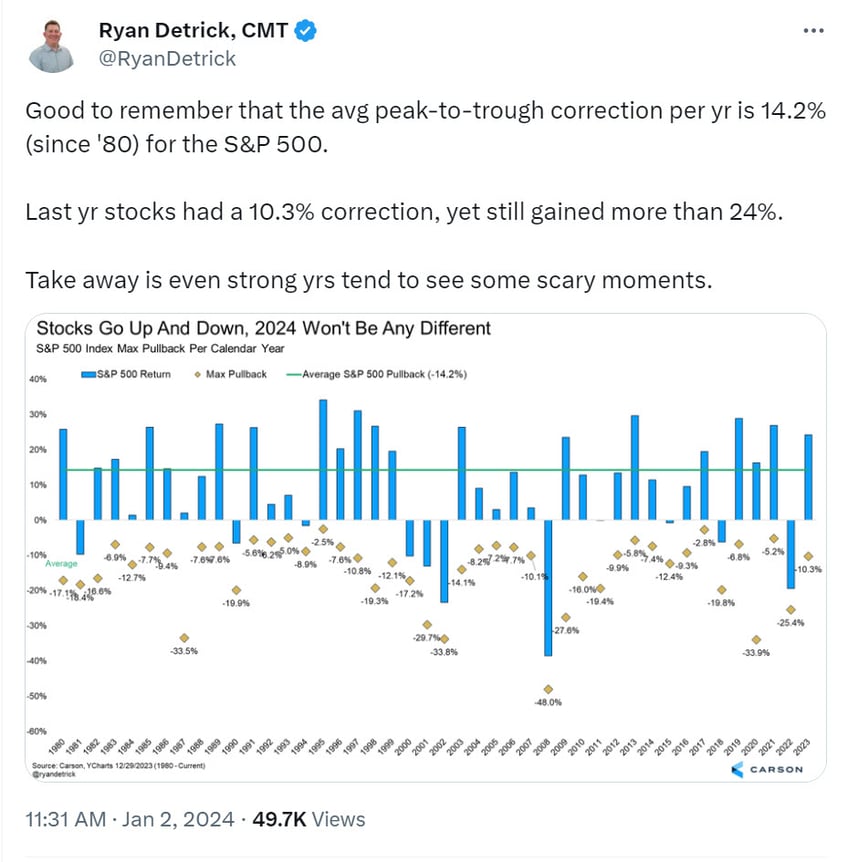

- Average Decline 14.2% Since 1980: It is also important to note, since 1980, the average decline for the S&P 500 is 14.2%. Here's a tweet from my friend Ryan Detrick at Carson.

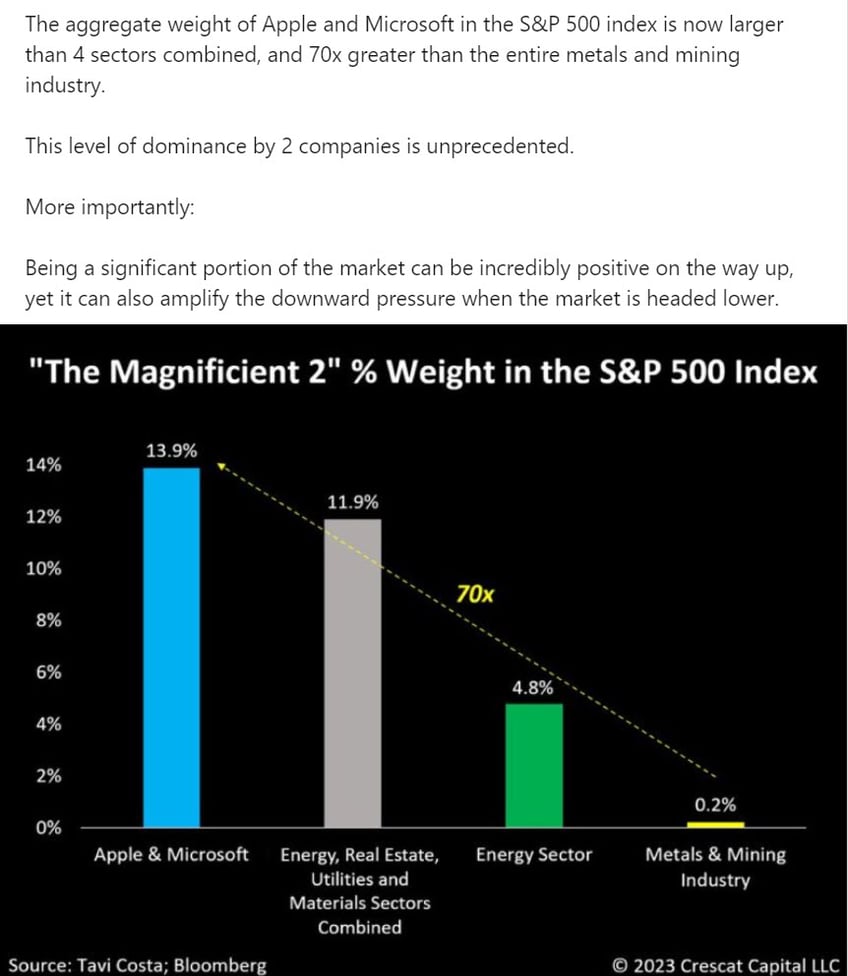

- Magnificent 2: File this in the "it is not important, until it is important folder"...

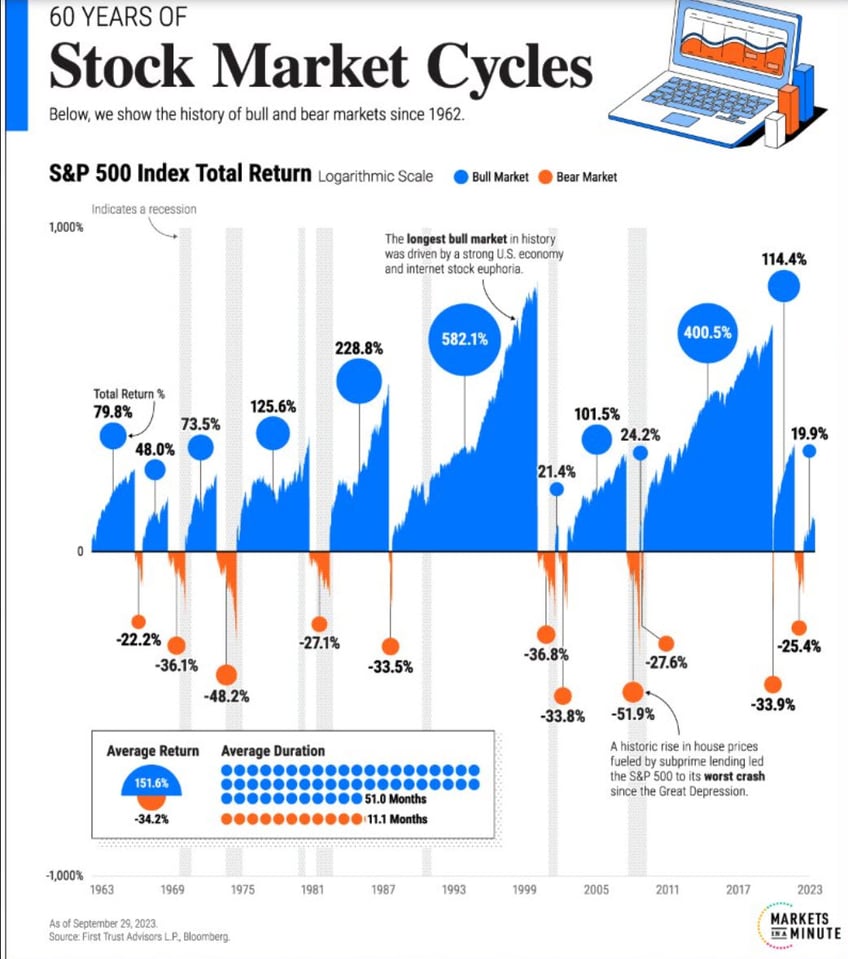

- Stock Market Cycles: Someone sent me this chart and it is more evidence to support my bullish stance. Until the market proves me wrong (a.k.a. heavy selling shows up), I'm still operating that we are in the early stages of a new bull market. Here is a long term look at market cycles. Yes, during every bull market I have studied there were very bad/steep drawdowns. But that's "normal" and part of the process. The good news is that after every "dip" we saw a new higher high! The short-term will likely get bumpy but I expect higher prices to follow as long as the major indices stay above their important moving averages. The first level of support I'm watching for will be the 50 DMA line.

Have a great day!

Adam