FindLeadingStocks.com AM Report - Forward Earnings, Watch Support, 2 Ugly Things Happened Yesterday, & Are Consumers Consuming Too Much?

Good Morning Team,

1. Market Is Sitting On Support - We saw some distribution (a.k.a. selling) show up yesterday but, once again, we had a late day rally save the day. The Nasdaq 100 (QQQ) fell yesterday but closed off its lows and is currently sitting near its 21-DMA line ($436-437 area) which is near-term support. If that level breaks, look at $433 and then the 50 DMA line near $425. I am still seeing breakouts (I share with you after the open every day) and that leads me to believe it is a matter of "when," not "if" we are heading higher.

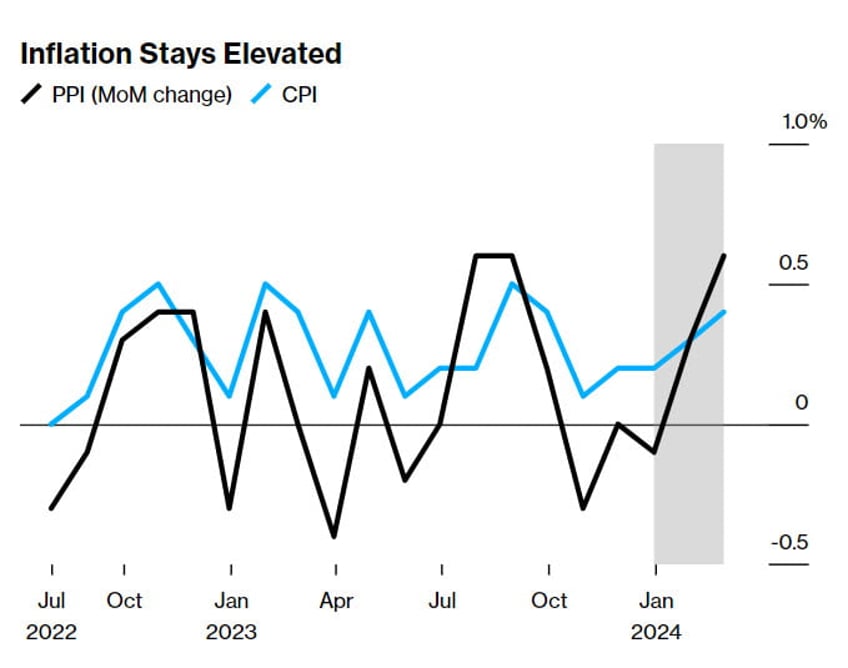

2. Two Ugly Things Happened Yesterday - Some inflation data came out on Thursday that implied the Fed might not be able to cut rates as fast as the market wants. If this continues, the Fed might have to raise rates (as "crazy" as that sounds, I wouldn't be surprised to see that happen). That caused the yield on the 10-year and the US Dollar to both spike which put some downward pressure on stocks, especially small (IWM) and mid cap stocks (MDY). Remember, a higher 10-year yield and a higher USD were the main two culprits that sent stocks lower during most of the 2022-2023 bear market. I'll be watching these two going forward. Since November, as stocks rallied, they have been quiet. But if they start to rally, that could (easily) put downward pressure on the stock market. Plus, the stock market is way overdue for a nice pullback. So this is something I'll be watching over the next few weeks.

Inflation Is Still High and Pointing "UP"...

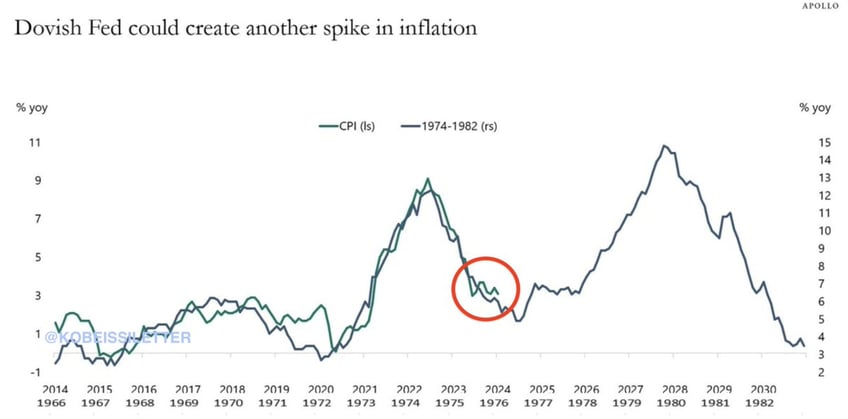

3. Dovish Fed May Spark Inflation - The Fed knows that if/when it starts cutting rates that can cause inflation to spike. When you study history we have "seen" that happen before. Since late 2023, I've been saying I don't think the Fed will slash rates aggressively this year. Will the Fed cut? Yes, most likely. But will it slash rates? Doubtful.

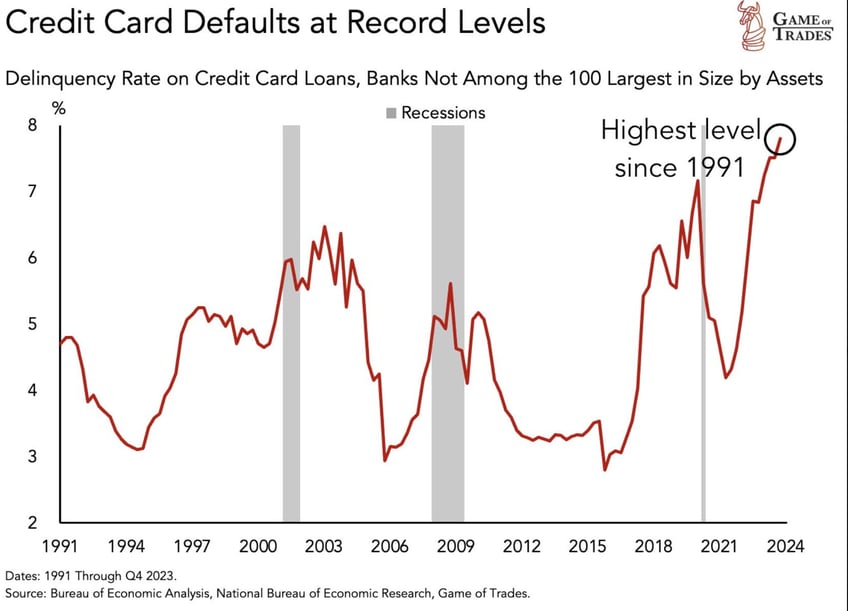

4. Consumers Are Consuming Too Much - People Can't Pay Their Credit Card Bills: The economy is the biggest it is ever been. The stock market is at fresh record highs. Unemployment is near historic lows, yet credit card delinquencies are soaring! Clearly, trouble is brewing. File this in the "it is not important until it is important folder".

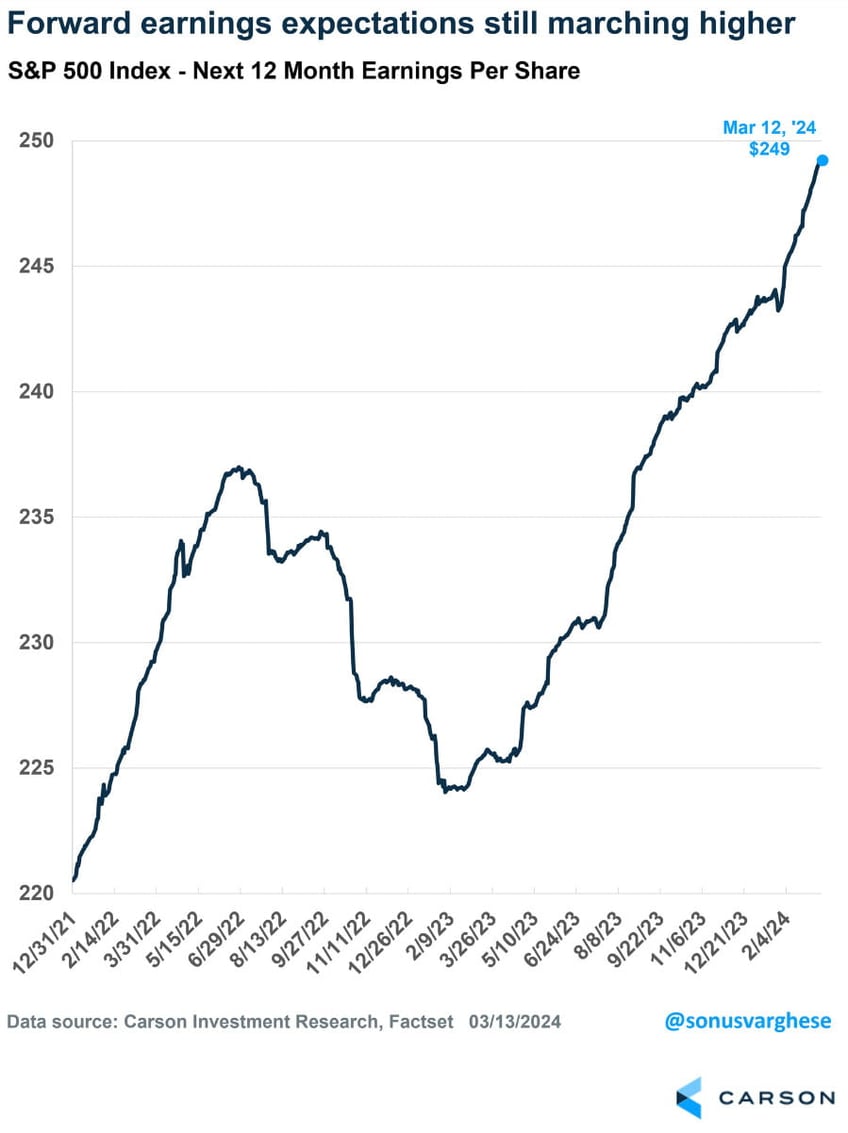

5. This is a very powerful and bullish chart...

Have a great day!

Adam