Global Intel Hub -- Knoxville, TN -- May 1, 2024 -- ZERO HEDGE EXCLUSIVE-- FTX was one of the largest Crypto scams in history. The bankruptcy administrator is doing a great job of selling assets. Although FTX was a reckless fraud, they made many legitimate investments which have made money. We don't have any insider details, but it seems like the legit investments have paid back investors with a profit. Of course, with any situation like this, 30% is going to the lawyer vampires (we saw this in Refco, and many others) for seemingly no reason. But, with returns in companies like Anthropic, Open AI, SOL, and others - returns on those assets can pay the lawyers, cover the fraud, and make everyone whole (so hope the claimants).

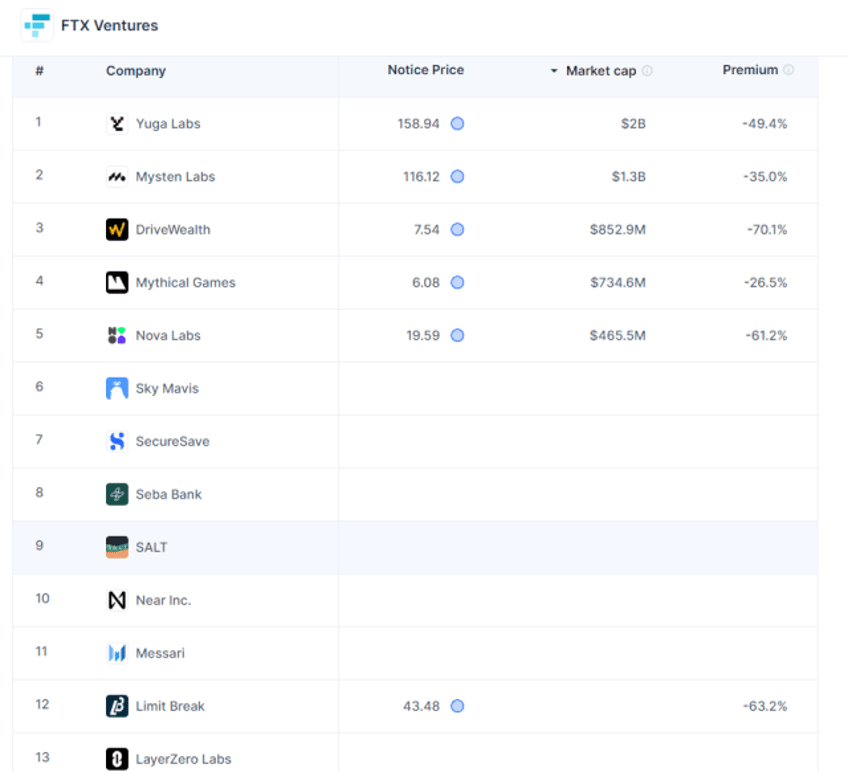

Selling assets at a discount to pay back investors isn't a new idea, it's what bankruptcy administrators do. What's interesting about FTX is their portfolio. FTX was an owner in companies like OpenAI, Anthropic, Circle, SALT, and many others: [1]

Ongoing liquidations are still happening, and brokers like Venture Capital Cross are providing access to those sales, and others. FTX was a global operation that managed many entities, not only in Crypto. According to PWC: [2]

FTX Digital Markets Limited (“FTX Digital Markets”) was the main regulated and licensed entity for the FTX International Platform. The Liquidators of FTX Digital Markets and the US Chapter 11 Debtors have agreed to a Global Settlement Agreement, which among other things, contemplates pooling of assets from both estates so as to allow FTX.com customers to receive the same recoveries. The Settlement also allows the estates to coordinate asset realisations and distributions – allowing customers to lodge a claim in either the Bahamas Process or the US Process.

The positive news for clients and shareholders of defunct FTX is that many of the investments are in solid companies, like Circle. It seems like there's a silver lining in the Crypto clouds, after all.

For access to private Blockchain / Crypto companies like Kraken, Circle, Chainalysis, and more - checkout Venture Capital Cross.

[1] https://notice.co/investors/ventures-ftx

[2] https://www.pwc.com/bs/en/services/business-restructuring-ftx-digital-markets.html