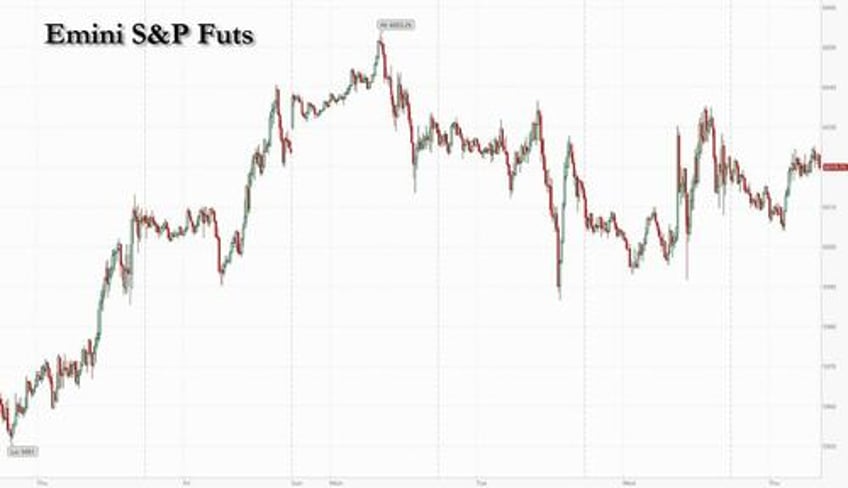

US equity futures have reversed the weakness of the prior two days and are higher, led by small caps as bond yields stabilize after the recent rout sent the 10Y yield to 4.45%. As of 8:00am ET, S&P and Nasdaq futures are up 0.1%, as investors wait to see if upcoming price data and a speech from Jerome Powell will boost expectations for a December interest-rate cut. Mag7 stocks mixed, but Semis have caught a bid after falling 6.3% over the last four sessions: as JPM puts it the pair trade of long Software vs. short Semis is +14.5% over the last 5 sessions. Treasury yields ticked lower, after Wednesday’s CPI data kept alive the hope of a December rate cut; however, Trump trades keep on trucking and the dollar index extended its rally on track for its 7th consecutive weekly gain and the strongest gain since April 2022 while Bitcoin traded at about $91,000, holding close to Wednesday’s record high. Commodities are lower but WTI is flat despite an IEA report of a more than 1 million barrel oversupply in 2025, driven by weaker Chinese demand. Today’s macro focus is on Jobless data and PPI, the latter to seek confirmation of CPI trends from yesterday. There are four Fed speakers today, including Jerome Powell himself.

In premarket trading, Cisco Systems fell after the networking company firm gave a conservative outlook, while Nu Holdings dropped after the fintech company reported third-quarter net interest income that missed consensus estimates. Disney jumped more than 10% after posting fiscal fourth-quarter sales and profit that beat Wall Street estimates and forecast earnings growth for the next three years. Here are some of the biggest US movers before the opening bell:

- Advance Auto (AAP) drops 7% after posting net sales for the quarter that missed the average analyst estimate. The company plans to close about 500 stores.

- Beazer Homes (BZH) jumps 5% after the homebuilder reported quarterly revenue that beat the average analyst estimate.

- Capri Holdings (CPRI) falls 5% and Tapestry (TPR) gains 6% after the pair ended an $8.5 billion plan to merge following a US court order freezing the deal due to antitrust regulators’ objections.

- CNH Industrial (CNH) rises 4% after David Einhorn revealed a new position in the farm equipment company.

- Harrow (HROW) sinks 21% after the eye-care pharmaceutical company reported revenue and core earnings for the third quarter that disappointed.

- Ibotta (IBTA) drops 22% after the cash-back mobile app company provided a fourth-quarter outlook that trails analyst estimates.

- Sonos (SONO) rises 5% as the home speaker company reported a largely in-line quarter as it navigates through the customer backlash over its recent app update.

- Zeta (ZETA) rises 9% after the software company announced a $100 million share buyback, setting the stock up for a rebound from two days of heavy losses following a short call.

Investors are trying to balance a picture of easing inflation and falling rates against the possibility that President-elect Donald Trump will implement hardline pledges on taxes and tariffs, reigniting price growth next year. Confirmation of a Republican election clean sweep suggests more policy leeway for Trump and limits potential curbs on his power.

"We are seeing that there is a bit more discrimination between Trump trades,” said Amelie Derambure, senior multi-asset portfolio manager at Amundi. “There is expectation that Trump’s policies will be market friendly, growth friendly, will be impacting higher inflation but not massively, deregulation is going to be good for some sectors,” she said. “The assumption is we have good, soft Trump with no big negative impact priced by markets."

Traders’ eyes will now be on US PPI data which is expected to show headline and core producer prices rose year-over-year in October. Fed chief Jerome Powell is also due to speak later in the day.

European stocks reversed the recent rout as the Estoxx 50 advanced 1.4% over the early London session, supporting S&P futures. German industrial giant Siemens was the most significant outperformer, rising to a record high after a reassuring earnings print. France’s Alstom made a similar move, rallying on strong results. Among the biggest laggards, Merck KGaA slipped on weak sales and Stadler Rail plunged on a profit warning. Communication services and tech sectors lead gains after a pair of bullish outlooks from chip-equipment maker ASML Holding NV and German industrial giant Siemens AG, lifted the Stoxx 600 index by about 0.8% while the German DAX outperforms with a 1.2% gain. Here are the biggest movers Thursday:

- Siemens shares jump as much as 9%, hitting a record high, as analysts laud the German industrial group’s strong 4Q report, calling it a solid print amid macroeconomic challenges

- Burberry gains as much as 16% after the luxury-goods maker’s retail comparable sales for the first half surpassed expectations, with analysts particularly positive on the new CEO’s strategy

- Monte Paschi rises as much as 15% after Italy sold a 15% stake to investors including rival Banco BPM, Anima; Banco BPM meanwhile rises as much as 3.9% after buying a stake in Monte Paschi

- ALK-Abello gains as much as 8%, the most since August, after the Danish allergy drugmaker reported forecast-beating 3Q earnings, driven by solid tablet sales growth in the European market

- Alstom rallies as much as 8.1%, the most since May, with analysts viewing its results as a small beat and Citi highlighting probable relief after nervousness among investors ahead of the print

- Embracer shares rise as much as 12% as the Swedish gaming company’s plan to sell its Easybrain unit for $1.2 billion allowed analysts to look past its weak results and guidance

- 3i Group advances as much as 5.1%, the most in almost eight months, following the UK-listed private equity group’s first-half results. Analysts note the strong performance by Action division

- Stadler Rail plummets as much as 16%, the most on record and hitting a new low, after issuing a profit warning following a series of natural disasters, including floods in Valencia

- Merck KGaA shares slip as much as 2.4% to the lowest since July 19 after the German company reported third-quarter sales and earnings for the electronics business that missed estimates

- Shares in precious metals mining companies slid to two-month lows as a rallying dollar knocked gold prices lower for the fifth straight day, with bullion falling 1.2% in morning trading in Europe

- SMA Solar shares fall as much as 21% to their lowest in almost 10 years after the German renewable energy equipment manufacturer lowered its FY24 revenue and Ebitda guidance

- Capita shares drop as much as 7.8% after the outsourcing specialist was downgraded at Shore Capital. The broker sees Capita taking a hit from changes to national insurance contributions in the UK

- Swiss Re falls as much as 2.2% after the Swiss insurance group reported nine-month figures that were overall in line with pre-announced figures. The company’s Life & Health arm was a key disappointment

There was no bounce in Asia, where stock fell again, extending losses to the fifth straight session, as they were weighed by selling in Chinese shares and the region’s tech companies. The MSCI Asia Pacific index declined as much as 0.8%, with Chinese internet companies Alibaba Group and Meituan among the biggest laggards. A gauge of Chinese technology companies in Hong Kong lost more than 20% from its recent high. Chipmakers in the region also slipped, led by South Korea-based SK Hynix. Shares closed lower in mainland China and Hong Kong, where the market was open despite typhoon warnings. Investors are still watching for further measures from Chinese authorities to boost the world’s second largest economy, while monitoring President-elect Donald Trump’s cabinet appointments. In its latest steps, Beijing moved to cut taxes for homebuyers and developers. Stock benchmarks also dropped in Taiwan and Japan. Risk sentiment in the region took a hit as the dollar and US Treasury yields edged higher in Asian trading. Tencent Holdings’ shares fell 0.1% despite a 47% surge in quarterly profit and describing tentative signs of a Chinese economic bounce-back. Among other key China tech results, Meituan and JD.com are due to report later Thursday. Later this week, traders will also watch for Alibaba’s earnings, as well as Japan’s GDP figures and China’s retail sales.

Meanwhile, in FX the likelihood of so-called America-First policies has boosted the dollar more than 2% so far this month. Its gains are weighing on a raft of assets, sending gold prices near two-month lows and pushing the yen to the weakest since July, close to levels when Japanese authorities last intervened to prop up the currency. The dollar extended its rally versus major peers, follows confirmation of a Republican election sweep. Bloomberg Dollar Spot Index is up for a fifth day, 0.3% higher into early US session. The euro dropped as much as 0.5% to touch the lowest in more than a year, while MSCI’s index for emerging market currencies fell for a fifth day. USD/JPY was back above 156.

Analysts at BBH said that with Trump likely to have the wherewithal to carry out his agenda, the scope for rate cuts could be limited going forward. “Market pricing for the Fed has already adjusted, which is giving the dollar a huge lift,” they wrote, advising that “investors should continue to lean into dollar strength.”

Currently, money markets price around 19 basis points of rate cuts for December and several policymakers have urged a cautious approach. Fed Governor Adriana Kugler, for instance, said on Thursday that rate cuts should be paused if progress on inflation stalls.

In rates, treasuries are marginally richer across the curve with futures pushing higher into the early US session, unwinding losses seen at the start of Asia. The curve has held Wednesday’s sharp steepening move, which saw the biggest one-day widening move in the 5s30s spread so far this year. Treasury yields are slightly lower on the day across the curve, although remain within a couple of basis points of Wednesday’s close, while spreads broadly trade within one basis point of prior day. US 10-year yields trade around 4.44%, with bunds outperforming by 1.5bp and gilts slightly lagging in the sectoras traders added to their ECB interest-rate cut bets, boosting shorter-dated German bonds. German two-year yields fall 3 bps to 2.14%. US data includes PPI and weekly jobless claims.

In commodities, oil prices are steady, with WTI near $68.40 a barrel after the IEA said markets face a surplus of more than 1 million barrels a day next year. Spot gold falls another $26 to $2,546/oz. Bitcoin rises 3% and above $91,000.

On today's calendar, the main event will be a speech by Fed Chair Powell on the economic outlook. A text release at 3pm New York and a Q&A session is expected. US economic data calendar includes October PPI and initial jobless claims (8:30am). Fed speaker slate includes Kugler (7am), Barkin (9am), Powell (3pm) and Williams (4:45pm).

Market Snapshot

- S&P 500 futures little changed at 6,021.25

- STOXX Europe 600 up 0.5% to 504.25

- MXAP down 0.8% to 181.24

- MXAPJ down 0.8% to 574.03

- Nikkei down 0.5% to 38,535.70

- Topix down 0.3% to 2,701.22

- Hang Seng Index down 2.0% to 19,435.81

- Shanghai Composite down 1.7% to 3,379.84

- Sensex down 0.2% to 77,554.04

- Australia S&P/ASX 200 up 0.4% to 8,223.95

- Kospi little changed at 2,418.86

- German 10Y yield little changed at 2.40%

- Euro down 0.4% to $1.0520

- Brent Futures down 0.2% to $72.16/bbl

- Gold spot down 1.0% to $2,546.97

- US Dollar Index up 0.38% to 106.88

Top Overnight News

- USD strength piled more pressure on Asian stocks and currencies, with the yen slipping to its lowest level since July. Fears of imminent intervention are overstated, MLIV said. China supported the yuan for a second day. BBG

- The BOJ should raise interest rates at least to 1% to roll back an "abnormally" huge stimulus that is causing unwelcome falls in the yen, said Takeshi Shina, the shadow finance minister of the country's largest opposition party. Reuters

- A close aide to Prime Minister Benjamin Netanyahu told Donal Trump and Jared Kushner this week that Israel is rushing to advance a cease-fire deal in Lebanon, according to three current and former Israeli officials briefed on the meeting, with the aim of delivering an early foreign policy win to the president-elect. Washington Post

- Ukraine sovereign bond values spike as investors anticipate the incoming Trump administration will push for a quick end to the war. FT

- Global oil markets face a huge surplus of more than 1 million barrels a day next year on faltering Chinese demand, and even with the curtailed supply from OPEC+, the IEA said. Supplies from producers such as the US and Canada will surge by 1.5 million b/d. BBG

- ASML reaffirmed its bullish long-term revenue outlook on AI-driven demand, projecting sales in 2030 of up to €60 billion. Shares rallied. BBG

- Howard Lutnick and his allies are lobbying for him to be picked as Treasury secretary, as some advisers to President-elect Donald Trump quietly signal skepticism about the top contender, investor Scott Bessent. WSJ

- The incoming Trump administration is considering a plan to bypass Congress and unilaterally adopt some of the Musk/Ramaswamy spending cut proposals. Washington Post

- Pennsylvania Senate seat race will be subjected to a recount after the vote result was within the threshold for an automatic recount under state law, according to NBC.

- Disney Beat in FY4Q EPS and revenues with slight operating income miss; constructive FY25 adj EPS guide of HSD, well above expectations of 4%; Stock is trading +10% thus far in the premarket

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly subdued following the indecisive lead from Wall Street where stock markets were choppy after in-line CPI data and continued 'Trump trade' flows, while there was a lack of fresh major catalysts to drive price action. ASX 200 gained as strength in Tech and Financials picked up the slack from the weakness in the commodity-related sectors but with the upside capped by disappointing jobs data. Nikkei 225 wiped out all of its initial gains and returned to beneath the 39,000 level despite a weaker currency. Hang Seng and Shanghai Comp remained pressured despite the lack of fresh catalysts and ahead of tomorrow's activity data with weakness seen in property stocks, while tech names are mixed ahead of key earnings, although Tencent was an early outperformer in Hong Kong after its quarterly results beat estimates on the bottom line.

Top Asian News

- China reportedly armed itself for a potential trade war with Trump as Beijing has enacted sweeping laws since the US President-elect’s first term that would allow it to retaliate if threatened, according to FT.

- Japan is planning a JPY 13.5tln extra budget to fund the stimulus package with PM Ishiba looking to finalise the stimulus package on November 22nd, according to Sankei.

- NetEase (9999 HK) Q3 Revenue (USD) 3.7bln (exp. 3.65bln).

European bourses hold a positive bias, with only a couple of indices residing in the red. Indices opened mixed/modestly firmer and sentiment gradually improved into the morning; indices generally reside at highs. European sectors hold a positive bias vs initially opening mixed. Tech is by far the clear outperformer, lifted by strength in ASML (+4.5%) after it reiterated its 2030 sales outlook. Healthcare resides at the foot of the pile, with Merck (-2.4%) weighing on the sector. Basic Resources is also incrementally in negative territory, with underlying metals prices hit by the continued strength in the Dollar. US equity futures are modestly firmer across the board, but with slight outperformance in the RTY as it attempts to pare back the hefty losses seen in the prior session.

Top European News

- UK Chancellor Reeves is planning on introducing pension legislation changes to create a series of "megafunds" by pooling pension savings, according to Bloomberg.

- ECB's de Guindos says has seen good news recently on inflation, but not so good for economic activity. Says inflation has come down quite a lot, all indicators on core inflation are heading in the right direction. Recent data on prices heading towards 2% goal. If inflation converges towards the goal, monetary policy will respond accordingly.

- German VDMA Engineering Association sees 1.5% revenue growth in China for German engineering companies in 2024

FX

- DXY's bull run since the election has continued into today's session with the DXY up around 3 handles since election day. Just above the 107.00 mark at best, if the move continues the 2023 high sits at 107.35. Today's data slate sees the release of US PPI which will be used as an input for PCE. Fed speak includes Powell, Barkin, Williams & Kugler.

- EUR/USD's recent run of losses has extended with the pair slipping further onto a 1.05 handle with a current session low at 1.0507 (fresh YTD low). The next obvious target for the pair is 1.05. If cracked, the 2023 low sits at 1.0448. Looking ahead for the Eurozone, ECB's Lagarde and Schnabel are due to speak.

- JPY is softer once again vs. the broadly stronger USD. In terms of fundamentals for Japan, reports suggest that the nation is planning a JPY 13.5tln extra budget to fund its stimulus package. However, this has done nothing to turn the tide for the pair.

- GBP lower vs. the USD for a 5th consecutive session. For now, this remains more of a USD story rather than one of pure GBP weakness. Today's UK data slate is light. However, BoE's Mann and Bailey are due to speak.

- Both antipodes are softer vs. the USD with AUD in focus following slightly softer-than-expected jobs data overnight. That being said, the release is unlikely to force the hand of the RBA into cutting rates in the immediate future.

- PBoC set USD/CNY mid-point at 7.1966 vs exp. 7.2326 (prev. 7.1991).

Fixed Income

- A slightly softer start to the session with USTs at a fresh 109-06 contract low. Yields bid across the curve with the belly leading and a very slight flattening bias overall. Docket ahead has PPI and IJC, which could spur reactions given the relevance for PCE and insight into the labour-side of the Fed’s mandate respectively. Thereafter, markets will await Fed Chair Powell and then Williams.

- Bunds are in the red but well off worst levels, currently near a 131.79 peak having bounced from an early 131.28 trough, a low which printed overnight when newsflow was light. The second read of EZ GDP figures were unrevised, whilst the Employment figures were revised slightly higher; metrics which ultimately had little impact on price action.

- Gilts are underperforming, holding above the 93.00 mark currently but did go as low as 92.97 just after the open. Specifics for the UK are somewhat light, aside from a lot of press focus on Reeves’ upcoming speech on pension reform; on the subject of speakers, BoE’s Bailey is also on the Mansion House docket but before that we expect a text release from Mann.

Commodities

- Crude is subdued and in choppy trade but within tight ranges amid a lack of macro catalysts but with eyes on the ever-evolving geopolitical landscape. Brent Jan trades between a USD 71.79-72.46/bbl range.

- Pressure seen across all precious metals as the Dollar continues to ramp higher as DXY rises further above 106.50 to levels closer to 107.00.

- Hefty losses across the board for base metals amid the ongoing USD strength and potential implications from protectionism under a Trump admin.

- IEA OMR: raises 2024 world oil demand growth forecast to 920k BPD (prev. 860k BPD); 2025 forecast at 990k BPD (prev. 1mln BPD); says China is the main drag on global oil demand growth; Chinese demand contracted for a sixth straight month in Oct.

- Private Inventory Data (bbls): Crude -0.8mln (exp. +0.1mln), Gasoline +0.3mln (exp. +0.6mln), Distillate +1.1mln (exp. +0.2mln), Cushing -1.9mln.

- South African Mining Production YY (Sep) 4.7% vs. Exp. 2.2% (Prev. 0.3%); Gold Production YY (Sep) -3.7% (Prev. -4.6%)

Geopolitics

- "Syria reports the activation of the air defense system against a UAV in southern Homs in central Syria", according to Israel Radio Correspondent

- Iranian Foreign Minister Araqchi says Iran is ready to negotiate based on it's national interests & inalienable right

- Israeli army warned of striking buildings in Haret Hreik and Burj al-Barajneh in the southern suburbs of Beirut, while it was later reported that Israeli warplanes attacked Beirut's southern suburbs.

- Iraqi armed factions said they attacked a vital target in northern Israel with drones, according to Sky News Arabia.

- White House said US President Biden reinforced the need to back Ukraine in the meeting with President-elect Trump.

US Event Calendar

- 08:30: Oct. PPI Final Demand MoM, est. 0.2%, prior 0%

- Oct. PPI Final Demand YoY, est. 2.3%, prior 1.8%

- Oct. PPI Ex Food and Energy MoM, est. 0.2%, prior 0.2%

- Oct. PPI Ex Food and Energy YoY, est. 3.0%, prior 2.8%

- 08:30: Nov. Initial Jobless Claims, est. 220,000, prior 221,000

- Nov. Continuing Claims, est. 1.87m, prior 1.89m

Fed Speakrs

- 07:00: Fed’s Kugler Speaks on Economic Outlook

- 09:00: Fed’s Barkin Discusses Economy in Fireside Chat

- 15:00: Powell Speaks on Economic Outlook in Dallas

- 16:45: Fed’s Williams Speaks at NYFed Event

DB's Jim Reid concludes the overnight wrap

The past 24 hours saw investors growing more confident about a December rate cut after US CPI was in line with expectations. Admittedly, the report wasn’t actually that good compared with some recent months, as monthly headline CPI was the fastest in six months, and core CPI was still a bit faster than the Fed would ideally like. This helped to reassure investors that the Fed was still on a path towards at least a cut in December, but long-end yields rose to multi-month highs, as fears about upcoming tariffs and a potential re-acceleration of inflation lingered. The S&P 500 (+0.02%) was little changed, some but other “Trump trades” prevailed with the dollar rising to its highest in over a year and Bitcoin reaching at an all-time high of $93,413 in the US session yesterday. It was as low as $52,598 on September 6.

In terms of the details from the report, core CPI was at a monthly +0.28% in October (vs. +0.3% expected), so markets were relieved we didn’t get the +0.4% print some had feared. That said, it wasn’t all good news, as that’s the third consecutive reading which rounds to +0.3%. So the 3-month annualised rate of core CPI now stands at +3.6%, up from just +1.6% three months ago, when it felt like inflationary pressures were a lot more tame and the Fed were pivoting towards their 50bp rate cut in September. In the meantime, headline CPI was also broadly as expected at +0.24% (vs. +0.2% expected), but it wasn’t far from rounding up to +0.3% as well, and it was also the fastest headline CPI print since April. In turn, that pushed the 3m annualised rate up to +2.5%, whilst the year-on-year rate ticked up to +2.6%, ending a run of six consecutive monthly declines in the annual rate.

Nevertheless it could have been worse and investors dialled up the chance of the Fed cutting rates again at the December meeting, with futures now giving that an 82% probability. That was down to 59% just before the release, so there was a meaningful rise intraday. In turn, that led to a decent rally in front-end Treasuries, with the 2yr yield down -5.4bps on the day to 4.29%. However, 10yr yields rose +2.3bps to 4.45%, their highest since the start of July, and rising nearly 10bps from their intra-day low in the hour or so after the CPI release. And 30yr yields (+6.8bps) rose to their highest since May, with the 2s30s slope seeing its sharpest steepening YTD. There wasn’t a single clear driver for the long-end sell-off with strong corporate issuance so far this week potentially playing a role, while the “Trump trade” factor again appeared to dominate. Overnight, 2yr (+2.8bps) and 10yr USTs (+2.0bps) are trading at 4.313% and 4.471%, respectively, as we go to print.

In terms of post-election news, a Republican sweep was confirmed yesterday as the party has now secured 218 of the 435 seats in the House of Representatives, with nine seats still to be called. We also had further news on Trump’s cabinet picks, with Trump confirming senator Marco Rubio as his nominee for Secretary of State and nominating representative Matt Gaetz for Attorney General. However, we are still waiting on names for most of the key economic positions, including Treasury Secretary, Commerce Secretary and US Trade Representative.

Looking at the Fed, there was a fair amount of commentary from officials yesterday. For instance, Minneapolis Fed President Kashkari said that “I think that inflation is headed in the right direction”, and Dallas Fed President Logan said that “I think it behooves us to proceed cautiously at this point”. This tone of heightened uncertainty was echoed by Kansas City Fed President Schmid, who said that “it remains to be seen how much further interest rates will decline or where they might eventually settle”, while St Louis Fed President Musalem commented that officials should assess incoming data “judiciously and patiently”.

Even as investors grew more confident about a December rate cut, the US Dollar continued its relentless move higher yesterday. In fact, the dollar index (+0.43%) closed at its highest level in over a year, whilst the euro closed at a one-year low of $1.0569. To some extent, that could be explained by the fact that even as front-end nominal yields were moving lower, longer-dated real yields actually hit their highest in months. That included the 10yr real yield, which was up +2.5bps to a 4-month high of 2.09%, and the 30yr real yield (+6.0bps) also hit a 5-month high of 2.32%.

Meanwhile for equity markets, there was a fairly steady performance yesterday, with the S&P 500 (+0.02%) little changed. Tech stocks underperformed, with the NASDAQ (-0.26%) falling back and the Philadelphia Semiconductor index (-2.00%) posting its fourth decline in a row. Over in Europe, the story was also one of small moves in either direction, with the STOXX 600 (-0.13%) closing at a three-month low.

Elsewhere in Europe, sovereign bonds struggled a touch, with yields on 10yr bunds (+2.6bps) and OATs (+1.9bps) moving higher. Interestingly, that came as the CDU/CSU chancellor candidate Friedrich Merz, suggested he was open to reform of the debt brake yesterday. So that could open up the door to a potential fiscal expansion, and DB’s chief German economist Robin Winkler put out a note on this yesterday (link here), where he points out that Merz’s comments offer room for manoeuvre in potential coalition talks after the election, even if it remains unlikely that the CDU/CSU would endorse more debt-financed investment during the election campaign. Clearly, there’s also the question as to whether the electoral arithmetic would allow for a change in the constitution, as that would require a two-thirds majority. But he thinks there is a growing probability of a meaningful fiscal expansion after the election.

Asian equity markets are mixed this morning but with the Hang Seng (-1.47%) leading losses on tariff fears and with the Shanghai Composite (-0.86%) being pulled lower by property and tech stocks. Elsewhere, the KOSPI (+0.09%) is hanging onto gains but the Nikkei (-0.20%) has slipped lower as I've been typing, even with the Japanese yen (-0.37%) sliding for the fourth consecutive day, dropping to fresh multi-month low of 156.08 against the dollar. This decline has brought the yen closer to levels where Japanese authorities last intervened to support their currency. US futures are down around a tenth of a percent.

Early morning data showed that Australia’s unemployment rate remained steady at 4.1% for the third consecutive month in October as the number of employed people increased by 15,900. Economists had believed employers would add a net 25,000 jobs in October. Meanwhile, there is a slight drop in the participation rate from a record 67.2%, edging down to 67.1% in October.

To the day ahead now, and we’ll hear from plenty of central bank speakers, including Fed Chair Powell, the Fed’s Kugler, Barkin and Williams, ECB Vice President de Guindos, the ECB’s Schnabel, BoE Governor Bailey, and the BoE’s Mann. We’ll also get the ECB’s account of their October meeting. And US data releases include PPI for October and the weekly initial jobless claims. Lastly, earnings releases include Walt Disney.