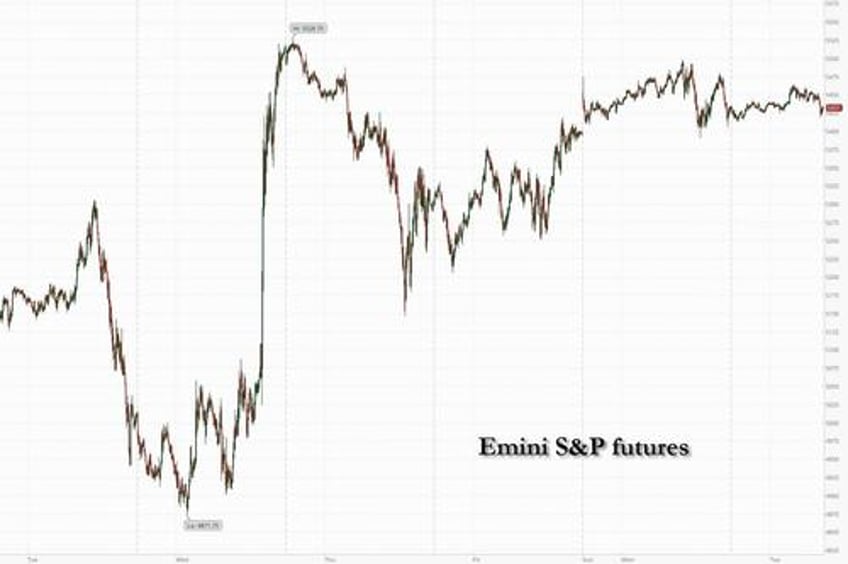

US stock futures swung between gains and losses after a two-day advance as traders focused on signs that the Trump administration may add more tariff exemptions to ease the economic turmoil of the trade war. As of 8:00am S&P 500 were down -0.3% and Nasdaq futures dipped -0.2%, although both indexes were in the green just minutes earlier with moves now happening so fast and jittery, it has become meaningless to keep tabs. Boeing sank 4% in premarket trading after China ordered airlines not to take any further deliveries of the company’s jets; elsewhere, Mag7 and Semis are leading TMT higher with Fins higher into earnings. Other Cyclicals like Energy/Industrials are mixed with Materials higher led by gold miners. In Europe, stocks pushed higher after Trump floated a pause in auto tariffs. Bond yields are +/- 1bp as the curve twists flatter; USD is flat as it looks to ease 5 consecutive days of losses. The commodity complex is weaker with crude and base weaker, gold up, and Ags mixed. The macro data focus is on import/export prices and Empire Mfg plus earnings from GSIB Banks, transports, and a HC (and Defensives factor) bellwether, JNJ.

In premarket trading, Mag7 stocks are mixed (Apple -0.5%, Nvidia -0.2%, Amazon +0.07%, Meta +0.2%, Tesla -0.4%, Alphabet +0.5%, Microsoft +0.2%). Boeing falls 3% after Bloomberg reported that China had ordered its airlines not to take any further deliveries of the planemaker’s jets.Here are some other notable premarket movers:

- Allegro MicroSystems (ALGM) drops 10% after ON Semiconductor withdrew its $6.9 billion bid to acquire the company.

- Applied Digital (APLD) slumps 11% after the data center operator posted quarterly results that missed expectations in terms of revenue and adjusted Ebitda.

- Bank of America (BAC) climbs 2% after its stock traders posted a record quarter due to volatile markets.

- Coty (COTY) declines 4.4% after BofA downgraded the cosmetics company, based on a lower valuation for both the prestige and consumer beauty segments due to slowing growth.

- Hexcel and Howmet shares decline as Wells Fargo downgrades both, turning more cautious on the aerospace sector to reflect impact from a global economic slowdown. (Hexcel (HXL) -2%, Howmet (HWM) -2%)

- Netflix (NFLX) climbs 2% after a Wall Street Journal report said the company aims to double its revenue and reach a $1 trillion market capitalization by 2030.

- Precision Biosciences (DTIL) gains 6% after the FDA granted fast track designation for PBGENE-HBV, the company’s lead wholly owned in vivo gene editing program aimed at chronic hepatitis.

- Paramount Group (PGRE) drops 5% as Morgan Stanley downgrades the office property manager, noting that the San Francisco financial district continues to face demand headwinds.

- Rocket Lab (RKLB) climbs 4% after winning defense contracts in the US and UK.

Tuesday’s market moves were milder than the big swings of late, reflecting hopes that there may be room for negotiations over Trump’s reciprocal levies. Investors were also watching the early stages of the earnings season, with Bank of America topping analysts’ estimates.

"The overall market mood is set on de"escalation,” said David Kruk, head of trading at La Financiere de L’Echiquier. “We got caught out last week with Trump’s reversal of fortunes, and this weekend as well, so we’re waiting before reacting now.”

The Fed’s President Raphael Bostic emphasized officials must wait for further clarity on President Donald Trump’s policies before adjusting interest rates. They will not get it: underscoring the uncertainty surrounding the trade war, China ordered its airlines not to take any further deliveries of Boeing jets, Bloomberg News has reported. The planemaker’s shares fell more than 3% in premarket trading. Rare earth mining stocks TMC and MP Materials are set to extend their gains.

The latest Bank of America fund manager survey struck a cautious tone, showing that a record number of global investors plan to cut their holdings of US equities. Among the respondents, 73% said that US exceptionalism has peaked. Elsewhere, Deutsche Bank CIO Christian Nolting says they will buy the dip if the S&P 500 falls closer to a recessionary level of 5,000.

And speaking of Bank of America, its shares rose in premarket after its stock traders posted a record quarter, as the company reaped the benefits of volatile markets. Elsewhere, Johnson & Johnson helt its profit outlook steady despite the potential for tariffs.

In Europe, the Stoxx 600 rose 0.9%, off session highs, led by gains in automakers after US President Donald Trump said he is exploring possible temporary exemptions to his tariffs on imported vehicles and parts. Luxury names provide a drag as LVMH shares plunge 7% after sales fell more than expected in the first quarter; as a result LVMH was overtaken by Hermes as the world’s most valuable luxury company. Here are the biggest movers Tuesday:

- European auto and auto parts stocks rise on Tuesday after US President Donald Trump said he is exploring possible temporary exemptions to his tariffs on the sector to give companies more time to set up US manufacturing

- Ericsson shares rally as much as 11% after the telecom equipment maker gave a stronger-than-expected margin guidance for its core networks division even after factoring 1 percentage point hit due to tariffs

- Beiersdorf shares rise as much as 3.5% after the German firm reported organic sales for the first quarter that beat estimates. Analysts say the market should be relieved due to concerns around beauty sector growth

- Publicis shares rise as much as 3.7%. The advertising firm reiterated its outlook for the year as new business was strong enough to offset the impact of a deteriorating macroeconomic environment

- Galp rises as much as 2.2% to €13, and trades 1.9% higher as of 8:28 a.m. in Lisbon. Portuguese oil company reported refining margin for the first quarter that beat the average analyst estimate

- B&M European Value Retail shares rise as much as 7.5%, the most since mid-2023, after the discount retailer said annual earnings are expected to be above the mid-point of its guidance range

- TomTom shares soar as much as 22%, the most since 2012, after the navigation specialist posted sales and earnings above expectations in the first quarter

- LVMH shares fall as much as 8.4% and weigh on luxury peers after the French group’s fashion and leather goods organic sales missed expectations, reflecting weakness in China

- Arcadis drops as much as 6.6% after ING Bank lowers its rating on the Dutch engineering firm to hold from buy and sets a new Street-low target, citing short-term challenges such as US tariffs

- Domino’s Pizza Group drops as much as 4.2% after being downgraded by Barclays, with analysts worried that a mature market and cost headwinds could put stress on the pizza company’s business model

Earlier in the session, Asian stocks rose, with automakers helping to lead the charge after US President Donald Trump indicated a temporary reprieve from tariffs on imported vehicles and parts, adding to investor hopes for relief on some levies. The MSCI Asia Pacific Index gained as much as 1.3%, with TSMC and Toyota among the top contributors. Benchmarks in Japan, Singapore and Taiwan rose 1% or more. Stocks in China and Hong Kong fluctuated in the session, bucking the regional advance amid continued concerns over decoupling from the US, but ended higher. The MSCI regional gauge was on track for its first back-to-back daily gains since Trump announced the reciprocal tariff plan on April 2. Asian stocks have held up better than US peers in that span. Indian stocks rallied as trading resumed after a long weekend, with the benchmark equity index erasing all the losses triggered by US President Donald Trump’s reciprocal tariffs earlier this month.

In FX, the Bloomberg Dollar Spot Index was lower by 0.1%, on course for its longest losing streak in more than a year. The euro underperforms and is near flat versus against the greenback. The kiwi leads with a 0.7% gain while the pound adds 0.4%.

In rates, treasuries hold small losses across maturities, following bigger declines for German bonds after the oversubscription rate for a 5-year debt sale was the lowest since March 2023. And earlier in the day, the Japanese 20Yr bond sale drew the weakest demand ratio since Dec 2023, so slowly the global bond market is coming unglied. In the US, treasury yields are 1bp-2bp higher with curve spreads narrowly mixed, though 5s30s spread briefly exceeded Monday’s high; 10-year near 4.38% is higher by ~1bp vs 3.5bp increase for German 10-year. Gilts outperform their European peers, with UK 10-year borrowing costs falling 3 bps to 4.64% after UK businesses shed workers at the fastest pace since the start of the pandemic.

In commodities, oil prices are steady, with WTI near $61.50 a barrel. Spot gold rises $10 to around $3,221/oz. Bitcoin climbs 1.2% toward $86,000.

Looking at today's calendar, the US economic calendar includes April Empire manufacturing and March import/export price indexes (8:30am). Fed speaker slate includes Cook at 7:10pm. Chair Powell speaks Wednesday to the Economic Club of Chicago about the economic outlook

Market Snapshot

- S&P 500 mini -0.2%,

- Nasdaq 100 mini -0.3%,

- Russell 2000 mini -0.2%

- Stoxx Europe 600 +0.9%,

- DAX +1.1%,

- CAC 40 +0.3%

- 10-year Treasury yield +1 basis point at 4.38%

- VIX -0.8 points at 30.05

- Bloomberg Dollar Index little changed at 1229.76

- euro -0.1% at $1.1338

- WTI crude little changed at $61.5/barrel

Top Overnight News

- US Treasury Secretary Bessent said he does not think there is a dumping of US assets in the bond market and said this is one of those occasional shocks you get in the trading community. Bessent said the US still has the global reserve currency and a strong dollar policy, as well as noted it is a long way from needing contingency plans. Furthermore, he is pleasantly surprised at how quickly the tax bill is moving along and noted that they are thinking about a successor for Fed Chair Powell with the interviewing of candidates to begin in the fall: BBG

- State Dept. could see its funding slashed by as much as 50% according to a White House memo, w/the administration proposing to essentially eliminate all funds for the UN and NATO. NYT

- White House NEC Chair Hassett said the US is in the 'sweet spot' of growth and that President Trump wants to see tariff money up front, while he does not see a recession at all: Fox Business

- US State Department is expected to propose an unprecedented overhaul of the US government’s diplomatic footprint overseas, including the elimination of entire embassies and consulates: Punchbowl

- Chinese port activity slumped in early April, with data indicating that exports to the U.S. have been hammered by President Trump’s tariffs. The cargo handled by ports across China over the April 7-13 period tumbled 9.7% from the week before to 244 million tons. That’s sharply weaker than the 0.88% loss registered during the previous week, when Trump first announced his plan for reciprocal tariffs. WSJ

- Chinese factories in Vietnam are seeing a “crazy” surge in orders as customers rush to get shipments during the 90-day pause window. SCMP

- Trump being pushed by some aides to take a tougher approach to Russia as Putin drags his feet on Ukraine negotiations. WSJ

- US will impose a 21% tariff on tomato imports from Mexico starting in Jul. BBG

- Treasury Sec Bessent downplayed the risk of foreign nations selling their US bonds and said he had a “big toolkit” to intervene and prevent a yield spike if needed (“we could up the buybacks if we wanted”). Bessent also said “everything is on the table” when asked about whether the reconciliation bill could raise taxes on the wealthy. BBG

- The biggest spending battle in Washington could start in May as Republicans begin the process of debating the Medicaid piece of the reconciliation bill. Politico

- The Commerce Dept formally proceeded with investigations into the drug and chip markets, the pretext required for the White House to eventually impose tariffs on both sectors. FT

- Oil consumption forecast cut by IEA - global oil demand growth for 2025 has been revised down by 300 kb/d since last month’s Report to 730 kb/d, as escalating trade tensions have negatively impacted the economic outlook. IEA

Tariffs/Trade

- China orders a halt to Boeing (BA) jet deliveries as the trade war expands, according to Bloomberg citing sources. Beijing has asked that Chinese carriers halt any purchases of aircraft-related equipment and parts from US companies Delivery paperwork and payment on some of these jets may have been completed before the reciprocal tariffs announced by China on April 11 took effect on April 12, and those planes may be allowed to enter China on a case-by-case basis, some of the people said.

- India Trade Official says the US and India have signed terms of reference for a trade deal; next round of India-EU talks are in May; India-UK trade negotiators are working to resolve pending issues

- Pakistan considers buying US crude to ease trade imbalance, via Reuters citing sources

- US President Trump said they will put tariffs on imported pharmaceuticals in the not-too-distant future and noted they do not make their own drugs, while he reiterated the EU is taking advantage of the US and has to come to the table which they're trying to. Trump also said he is looking to help car companies and there will maybe be some things coming up.

- US Treasury Secretary Bessent said US President Trump and Chinese President Xi have a very good relationship and noted that tariffs on China are big numbers and that no one thinks they are sustainable and wants them to remain. Bessent stated that tariffs on China are not a joke and that there doesn't have to be decoupling with China, but there could be and noted the US will negotiate tariff rates with partners in good faith and will run a robust process.

- US Secretary of Commerce initiated an investigation to determine the effects of national security of imports of pharmaceuticals and pharmaceutical ingredients and initiated Section 232 national security investigation of imports of semiconductors and semiconductor manufacturing equipment, according to the Federal Register.

- US Department of Commerce announced its intent to withdraw from the 2019 suspension agreement of fresh tomatoes from Mexico and with termination of the agreement, the Commerce Department will institute an anti-dumping duty order on July 14th, resulting in duties of 20.91% on most imports of tomatoes from Mexico.

- Argentina's President Milei says we understand the reciprocal tariffs from the US and are ready to sign a trade agreement along these lines.

- Chinese senior official for Hong Kong Affairs said the US tariff war goal is not to take Hong Kong's tariffs, "they want our life" and 145% tariff on Hong Kong is "brutally unreasonable, extremely shameless".

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded with a predominantly positive bias following on from the gains on Wall St where sentiment was underpinned by the recent US tariff exemptions and dovish comments by Fed's Waller. ASX 200 was led higher by strength in healthcare and financials but with the gains capped by a lack of fresh drivers and with very few clues from the RBA Minutes regarding when the next rate move will occur. Nikkei 225 outperformed with automakers among the best performers in the index after US President Trump suggested on Monday that he might temporarily exempt the auto industry from tariffs to give carmakers time to adjust their supply chains. Hang Seng and Shanghai Comp lagged with participants cautious after the US announced probes into pharmaceuticals and semiconductors, while local press noted domestic markets face liquidity pressures with more than CNY 570bln in reverse repo and MLF funds maturing this week, although the PBoC is expected to assist with liquidity.

Top Asian News

- RBA Minutes from the March 31st-April 1st meeting stated it is not yet possible to determine the timing of the next move in rates and it is not appropriate at this stage for policy to react to potential risks. RBA also commented that the May meeting would be an opportune time to reconsider and the decision was not predetermined, while it stated it is possible that global uncertainty over US tariffs could have a significant impact and the board saw risks on both the upside and downside for the Australian economy and inflation.

European bourses (STOXX 600 +1%) are almost entirely in the green, as the mostly positive risk tone in the APAC session reverberates into Europe. Price action so far has really only been one way today, and that’s up; as its stands, indices reside at highs. European sectors hold a strong positive bias, in-fitting with the positive risk tone. Consumer Products is the sole industry in the red today – thanks to the Luxury sector, which has been hampered by poor LVMH (-7.7%) results. Autos parks itself in top spot after US President Trump said he is looking to help car companies and that there will maybe be some things coming up.

Top European News

- Barclaycard UK March Consumer Spending rose 0.5% Y/Y (prev. +1.0%). It was also reported that UK consumers plan to 'buy British' amid Trump's trade war with around 71% of respondents in a survey by Barclays wanting to support UK businesses by buying items that were "made in Britain", according to FT.

- ECB Bank Lending Survey: Credit standards for loans to firms tightened slightly further, and net loan demand moved back into slightly negative territory

FX

- The Dollar initially kicked off the session relatively contained with US (and global) tariff policy showing some stability after recent toing and froing. However, the index adopted more of a downside bias in early European trade. DXY briefly dipped under 99.50 following reports that China ordered a halt to Boeing (BA) jet deliveries as the trade war expands, according to Bloomberg citing sources. Ahead, there is little of note for the Dollar on the docket during the European session, with the focus turning (in the absence of tariff updates) to Fed Chair Powell's speech tomorrow on the economic outlook. As it stands, DXY currently resides in a 99.47-99.97 band.

- EUR is modestly firmer/flat. EUR/USD currently trades in a 1.1314-1.1378 range, well within Monday's 1.1188-1.1473 parameter. German ZEW was mixed with Current Conditions missing forecasts and Economic Sentiment contracting. ZEW highlighted that erratic changes in US trade policy are weighing heavily on German expectations. EUR saw short-lived two-way action on the data before returning to pre-announcement levels.

- JPY was modestly lower in early portion of the morning largely as a function of the positive risk environment. Though some modest strength in the JPY was seen around the aforementioned China/Boeing reporting, which weighed on risk sentiment, a move which has since continued to a current 142.69 low for USD/JPY.

- A positive session for Sterling as it remains underpinned by the softer Dollar, whilst trade updates on the US-UK front have been constructive. UK government sources via BBC have suggested that recent talks with the US on a trade deal have been making good progress. Elsewhere, UK jobs data was mixed and resulted in no immediate reaction for the Pound. GBP/USD has topped the peak from 3rd April (1.3207) and trades in a current 1.3165-1.3227 range.

- The Loonie is mildly firmer this morning as traders look ahead to the Canadian CPI prints later today which could shape expectations for tomorrow's BoC confab. Y/Y CPI is forecast at 2.6% (prev. 2.6%) whilst the Median and Trim metrics are seen ticking up to 3.0% from 2.9%.

- Antipodeans are both firmer benefitting from another leg lower in the Dollar coupled with hopes of Chinese stimulus to cushion the blow from US tariffs. The overall positive risk tone and the firmer PBoC reference rate setting also underpins the high-beta FX. The latest RBA minutes provided little fresh clues as it stated it was not yet possible to determine the timing of the next move in rates and it was not appropriate at this stage for policy to react to potential risks.

- PBoC set USD/CNY mid-point at 7.2096 vs exp. 7.3094 (Prev. 7.2110).

Fixed Income

- USTs are in the red, with some modest pressure seen in early European trade as the general risk tone improved - this took USTs to a 110-17 low. However, the tone was clipped by a BBG source report that China has ordered a halt to Boeing deliveries, a report which lifted USTs from the mentioned trough to just above opening levels of 110-21+; as such, USTs are closer to unchanged on the session with yields slightly mixed but the curve still flatter.

- Bunds were in the green but now flat having been pulling back from its 131.57 overnight high throughout the morning as the risk tone improves, as outlined above. Down to an initial 131.18 low but was lifted off that by around 15 ticks by the aforementioned China and Boeing update. Thereafter, a weak German 2030 Bobl outing led Bunds down to a fresh 131.02 trough.

- Gilts are firmer, gapped higher by 23 ticks to 91.72 before pulling back modestly to a 91.67 trough as the tone improved. However, the discussed Boeing-China report moved the benchmark above opening levels and to a 91.93 peak. Follows the morning’s labour market data, the series didn’t really spark much movement in GBP at the time. In brief, the series points to a continued cooling of the labour market and while the employment metrics are net-dovish for the BoE, the cooling is yet to materialise significantly in wages which remain elevated. Nonetheless, the series has been superseded by more timely tariff updates. The 2035 auction was broadly in-line with the prior, a slightly lower yield on offer which tailed a touch less than last time though the cover was softer.

- UK sells GBP 4bln 4.5% 2035 Gilt: b/c 2.85x (prev. 2.92x), average yield 4.638% (prev. 4.679%), and tail 0.4bps (prev. 0.5bps).

- Germany sells EUR 3.549bln vs exp. EUR 4.5bln 2.40% 2030 Bobl: b/c 1.4x (prev. 1.90x), Average yield 2.06% (prev. 2.44%) & retention 21.1% (prev. 23.76%)

Commodities

- Crude began the European session modestly firmer, with upside facilitated by a softer Dollar and broadly positive risk-tone. However, more recently, the complex has gradually edged lower and now resides just off session lows. Some of the pressure could be attributed to China halting Boeing jet deliveries (hitting sentiment) and the IEA cutting its 2025 oil demand forecast. Brent Jun'25 currently towards the lower end of a USD 64.66-65.40/bbl range.

- Precious metals are mixed, with spot silver a little lower whilst spot gold edges higher. XAU currently higher by around USD 20/oz and sits above USD 3,230/oz in a USD 3,210.05-3,232.72/oz range.

- Mixed trade across base metals as traders weigh the demand impact from a US-Sino trade war with expected Chinese stimulus. That being said, some desks expected the base metals complex to continue trending lower, contingent on the scope of tariffs and the time in force. 3M LME copper resides in a 9,154.35-9,249.05/t range.

- EU is reportedly exploring legal options for ending Russian gas deals, according to FT.

- IEA OMR: cuts 2025 oil demand forecasts amid tariffs; sees 2026 surplus; cuts 2025 forecast to 730k BPD from 1.03mln BPD. Escalating trade tensions have negatively impacted the economic and oil demand outlook IEA, in first detailed look at balances for 2026, says world oil demand growth to slow further in 2026 to 690k BPD IEA cuts 2025 global supply growth forecast by 260k BPD to 1.2mln BPD due to a decrease in US and Venezuelan output

Geopolitcs: Middle East

- "IRGC says Iran's military capabilities are 'red lines' in any talks with US", according to Sky News Arabia

- US State Department said Secretary of State Rubio spoke to the Turkish Foreign Minister about dangers to regional security and stability posed by Iran and its proxies.

- White House Envoy Witkoff said the conversation with Iran will be about verification on the enrichment program and then ultimately verification on weaponisation.

- Houthi media reported US warplanes launched two raids on Al-Abdiya district in Marib and three raids on the areas of Al-Juhf and Al-Qadeer in Al-Hazm District in Al-Jawf Governorate in Yemen.

- Yemeni pro-government militias are planning a ground offensive against Houthis in an attempt to take advantage of a US bombing campaign that has degraded the militant group's capabilities, according to WSJ citing Yemeni and US officials.

- "Iran is expected to oppose a US plan to transfer its stockpile of highly enriched uranium to a third country such as Russia", according to Sky News Arabia.

- Next round of Iran-US talks will be held in Muscat, Oman, on April 19th, according to IRNA. Reporting on Monday intimated that the next round would be in Italy

Geopolitics: Ukraine

- Russian Defence Ministry says Ukraine Carried out six attacks on Russian Energy infrastructure over the past 24 hours, via Ria.

- Russia's Head of the Foreign Intelligence Service Naryshkin says in the event of NATO aggression against Russia or Belarus, damage will be inflicted on NATO as a whole; Poland and Baltic states will suffer first, according to Ria.

- Russia's Head of the Foreign Intelligence Service Naryshkin says Russia continues to comply with the moratorium on energy infrastructure strikes, according to Ria

- US President Trump said thinks they will get some very good proposals on stopping the Ukraine war very soon..

- Blasts reportedly shook the Russian city of Kursk near the Ukrainian border and damaged residential buildings.

- "Russian Foreign Minister: It is not easy to agree with the United States on the main aspects of a possible peace agreement to end the war in Ukraine", via Sky News Arabia.

Geopolitics: Other

- China's embassy in Argentina said it is strongly dissatisfied and firmly opposes US Treasury Secretary Bessent's remarks about China which it said "maliciously slandered, smeared" China for carrying out normal cooperation with other countries, while it added that some people with ulterior motives are trying to sow discord between China and Argentina. Furthermore, it said they advise the US to adjust its mindset instead of spending time repeatedly smearing and attacking China, as well as meddling in the foreign cooperation of regional countries.

- China's Harbin Public Security Bureau said US NSA agents are on the wanted list for being involved in a cyberattack on the Asian Winter Games, while it traced down the three agents and two US universities involved in the implementation of cyber attacks.

US Event Calendar

- 8:30 am: Apr Empire Manufacturing, est. -13.5, prior -20

- 8:30 am: Mar Import Price Index MoM, est. 0%, prior 0.4%

DB's Jim Reid concludes the overnight wrap

Markets continued to stabilise over the last 24 hours, with the S&P 500 (+0.79%) posting back-to-back gains for the first time since the reciprocal tariffs were announced on April 2. The recovery followed the weekend exemption of smartphones and other electronics from the tariffs, which added to investor hopes that the direction of travel would now be towards tariff reductions. On top of that, sentiment got a further boost thanks to positive noises about trade negotiations, which added to the sense that the administration is focused on making deals that could see the tariffs come down. So that newsflow helped multiple asset classes to unwind their tariff-related moves, with Treasuries recovering and HY spreads tightening as well.

That move towards potential tariff exclusions was supported by comments from President Trump yesterday, who said that he was looking at exemptions around autos, saying “I’m looking at something to help car companies with it”. Moreover, the administration is also sounding positive about trade talks, with NEC director Kevin Hassett, saying there were “more than 10 deals where there’s very, very good, amazing offers made to us.” That said, there was an indication of further sectoral tariffs, as the Commerce Department announced it had started trade probes on April 1 into semiconductors and pharmaceutical imports.

Overall, this created a positive backdrop for risk assets, and there were clear indications that market stress was easing back again. For instance, the S&P 500 rose another +0.79%, whilst Europe’s STOXX 600 saw a larger +2.69% increase. The S&P did give up some of its +1.79% early gain, mostly due to the Mag-7 (-0.07%) which posted a modest fall. But the tech stocks most affected by the tariff exemptions still outperformed, including Apple (+2.21%) and ASML (+2.20%). Overall, it was a day of broad gains as 85% of the S&P 500 constituents advanced on the day, with automakers including Stellantis (+5.64%), Ford (+4.07%) and GM (+3.46%) outperforming as well after President Trump’s auto tariff comments. Volatility continued to fall back too, with the VIX index coming down a further -6.67pts to 30.89pts, its lowest since April 3. And in another sign of easing financial conditions, US HY credit spreads tightened for a second day, coming down -10bps to 409bps.

With the latest advance for equities, that now means that the S&P 500 has recovered to -4.67% beneath its level at the tariff announcement, and -12.01% beneath its mid-February peak. That’s clearly a significant decline, but it’s still some distance from a normal recession decline, or even some of the larger non-recession bear markets of recent years like 2022, which saw a -25% peak-to-trough fall. So it’s clear that investors aren’t convinced that a recession is inevitable just yet.

Whilst equities were recovering, arguably a bigger relief for investors was the recovery in the bond market, which eased fears about some sort of serious financial turmoil developing. Investors had already been alarmed, and last week’s +49.5bp jump in the 10yr Treasury yield was the biggest weekly jump since 2001, with the yield moving higher every day last week. However, that began to reverse yesterday, with the 10yr yield (-11.6bps) down to 4.37%, and this morning it’s fallen a further -2.3bps to 4.35%. The moves got further support later in the session thanks to dovish comments from Fed Governor Waller, who said that although “the tariffs after April 9 were very large, I still believe they would have only a temporary effect on inflation.”

A further relief for Treasuries came from the New York Fed’s latest Survey of Consumer Expectations. It showed long-term inflation expectations were stable in March, with the 5yr measure actually coming down a tenth to +2.9%. So that will be a relief for the Fed, as the survey painted a very different picture to the University of Michigan’s survey, where long-term inflation expectations surged to multi-decade highs. Indeed, Chair Powell himself has spoken about how the Fed’s “obligation is to keep longer-term inflation expectations well anchored”, so it’s a crucial question for markets. It’s true that the NY Fed’s 1yr expectation measure rose half a point to 3.6% in the NY Fed’s survey, but even that was far more subdued than the University of Michigan’s number, where the 1yr measure was at +5.0% in March, and +6.7% in April.

Over in Europe, the sovereign bond rally also gathered pace, with 10yr bund yields coming down -5.8bps to 2.51%. So remarkably, the tariff developments have seen yields unwind nearly all of their rise after the German fiscal shift, as it was only just over a month ago (March 5) that 10yr bund yields saw their biggest daily jump (+29.8bps) since German reunification in 1990. Elsewhere, it was much the same picture, with yields on 10yr gilts (-9.7bps), OATs (-8.0bps) and BTPs (-13.3bps) all coming down as well. The moves also come ahead of this Thursday’s ECB decision, where it is widely expected to cut rates by another 25bps, which would take the deposit rate down to 2.25%.

Whilst most assets were unwinding their moves since Liberation Day, one exception to this pattern was the US Dollar, with the dollar index (-0.46%) falling to a 3-year low yesterday. So that was one sign that investors were still nervous about the outlook for US assets. But there were signs elsewhere that the tariff-related moves were unwinding in FX, as the Swiss Franc was the worst-performing G10 currency yesterday (having been the best performer since Liberation Day). Separately, gold (-0.82%) also fell back after seeing its strongest week since March 2020 last week.

Overnight in Asia, the major indices are mostly putting in a decent performance, following on from Wall Street’s gains yesterday. For instance, the Nikkei (+1.07%) and the KOSPI (+0.98%) have both posted decent advances. That’s been supported by several auto companies following the potential pause that was suggested, with strong gains for Toyota (+5.04%) and Honda (+4.02%). However, equities in mainland China have lost a bit of ground, with the CSI 300 (-0.06%) and the Shanghai Comp (-0.07%) posting a modest fall. And looking forward, futures on the S&P 500 (-0.06%) and the NASDAQ 100 (-0.09%) have also fallen back a bit, although in Europe, futures on the FTSE 100 (+0.32%) and the DAX (+0.38%) are in positive territory.

To the day ahead now, and data releases include UK unemployment and Euro Area industrial production for February, along with the German ZEW survey for April. From central banks, we’ll hear from the Fed’s Cook, and get the ECB’s Bank Lending Survey. Earnings releases include Citigroup and Bank of America.