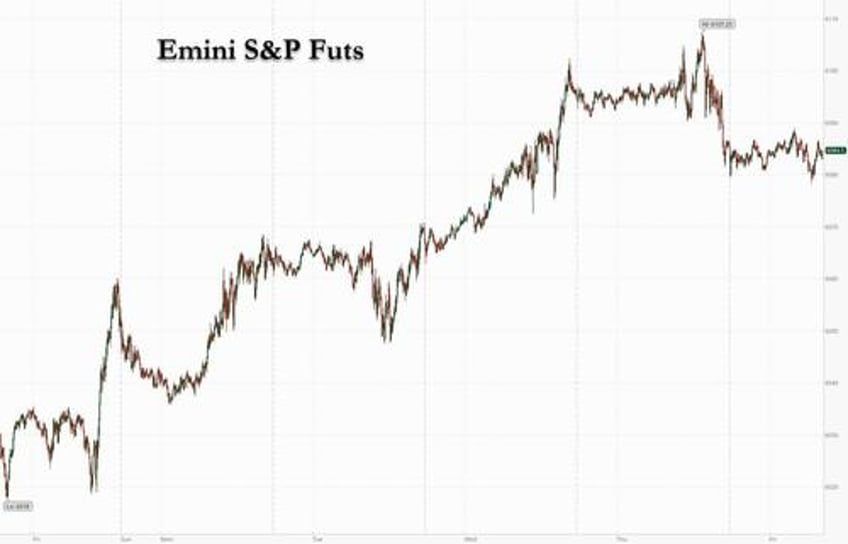

Futures are flat ahead of what Goldman called "the most important remaining macro report of 2024", the November jobs report, which will directly determine if the Fed cuts rates in two weeks. S&P futures were down 0.1% at 8:00am ET, flatlining in a quiet overnight session; Nasdaq 100 futures were fractionally in the green even as Mag 7 stocks are a touch lower this morning. China's CSI/HIS rallied, along with European Luxury/Autos names. Modest gains in the dollar put the greenback on course to rise for the ninth week out of the last 10. Treasury yields ticked higher by 1-3bps across the curve. Commodities are mostly lower for both oil and base metals; oil extended its slide to a third day. Bitcoin pulled back from its record high, after briefly tumbling as much as 7% before erasing most of the losses. Trump tapped prominent venture capitalist David Sacks as his crypto and AI guy and also picked David Perdue (former CEO of DG with excessive business experience in Asia) to be Ambassador to China last night; Today, all eyes on NFP (preview here): the Street’s estimate is for a 220k print, up sharply from 12k jobs in October, temporarily low due to hurricanes and strikes. For the unemployment rate the Street’s estimate is 4.1%.

In premarket trading, Lululemon surged 9% after the company edged up its full-year outlook on strong sales overseas, a sign the upscale activewear brand is fending off upstart competitors and navigating slower growth in consumer spending. Ulta Beauty jumped 11% after the cosmetics retailer increased its annual projections. Smith & Wesson Brands tumbled 13% after 2Q results at the gunmaker came in weaker than expected. Here are other notable premarket movers:

- Asana (ASAN) surges 25% after the provider of a software tool used by project managers posted a quarterly revenue beat.

- DocuSign (DOCU) gains 13% after the maker of electronic-signature software boosted its revenue forecast for the full year. Analysts are positive about early contract renewals.

- Gitlab (GTLB) rises 9% after the software development platform posted strong 3Q results and provided a 4Q EPS forecast that came in ahead of expectations.

- Petco (WOOF) rises 5% after the pet health and wellness company posted 3Q comparable sales that beat expectations.

- Rubrik (RBRK) gains 23% after the data management company boosted its full-year revenue guidance. Demand for data security drove the impressive results, analysts say.

- Veeva Systems (VEEV) rises 7% after the health-care software company boosted its full-year earnings forecast.

- Victoria’s Secret (VSCO) gains 4% after raising its outlook and reporting third-quarter sales that topped Wall Street expectations, saying shoppers had an early positive response to its holiday merchandise.

Today's jobs report will determine whether the S&P 500 can build on its 27% rally this year. Excitement around artificial intelligence and optimism that President-elect Donald Trump’s policies will boost US markets have propelled the benchmark toward its best year since 2019. Economists estimate that US nonfarm payrolls rose by 220,000 in November as hiring rebounded from weather-related and strike disruptions (preview here). It’s the final payrolls report before the Fed’s next interest-rate decision, with swaps trading putting the odds of a quarter-point reduction later this month at around 65%.

“If we get a surprisingly hot number, you can expect pricing to come back more to 50-50,” said Michael Brown, a senior strategist at Pepperstone. “Given the time of the year, market volumes are lighter than usual, so you are more likely to see an outsize reaction — and that’s another reason for people to sit on their hands.”

The S&P 500’s price-to-book ratio has surged to 5.3 times in 2024, approaching a peak of 5.5 hit in March 2000 during the height of the technology bubble, according to data compiled by Bloomberg. BofA’s Hartnett said there’s a high risk of “overshoot” in early 2025 if the S&P 500 nears 6,666 points — about 10% above current levels. He also warned that the rally in US stocks as well as cryptocurrencies has left the asset classes looking frothy.

Meanwhile in Europe, France’s week of political tumult was set to end positively in markets. The nation’s bonds outperformed euro-area peers after National Rally leader Marine Le Pen told Bloomberg News a budget could be delivered within weeks. The euro was steady. As for European stocks, they rose again after six straight sessions of gains, led by a 1.4% gain in the CAC 40 as French President Macron meets with key politicians in an effort to cobble together a new administration. Swedish online pharmacy Apotea steals the spotlight, suriging over 50% in its stock-market debut. Meanwhile, Puig Brands fell to its lowest since IPO earlier this year. Here are the biggest movers Friday:

- Direct Line rises as much as 8.5% after the insurer said it is minded to recommend the latest takeover proposal from rival Aviva should a firm offer be made. Analysts believe the deal is good

- Apotea surges as much as 52% its debut in Stockholm on Friday, with the online pharmacy showing strong demand for one of Sweden’s biggest initial public offerings this year

- Derichebourg shares jump as much as 9.3% after the environmental services company reported better-than-expected annual results in tough conditions, according to CIC

- IMCD shares rise as much as 4.2% in Amsterdam as Kepler Cheuvreux resumes coverage of the chemicals distributor with a buy rating, following a €300m capital increase

- Troax Group gains as 3% on Friday as SEB Equities starts coverage on the machinery parts and warehouse fittings manufacturer with a buy rating, describing it as a “high-quality asset”

- Puig Brands shares falls to their lowest level since the Spanish beauty firm went public in May after its Charlotte Tilbury brand withdrew some batches of a setting spray product

- Serco drops as much as 5%, reaching a 13-month low, after being hit by a double-downgrade from UBS, which warned the outsourcing company is entering a period of flat earnings growth

- AJ Bell falls as much as 4.4% as Deutsche Bank and Panmure Liberum cut the UK financial services company to hold from buy after the stock hit a record high

- Berkeley Group gives up early gains to slip much as 2.3% as analysts said the housebuilder’s new plan to drive growth over the next decade is likely to lower shareholder returns

Earlier in the session, Asian stocks was little changed, as Korean equities extended declines on political uncertainty, while Chinese shares climbed ahead of a key policy meeting. The MSCI Asia Pacific Index erased a loss of as much as 0.5% and swung in a narrow range. Chipmakers TSMC and SK Hynix were among the biggest drags on the measure after the rally in tech shares halted on Wall Street overnight. Chinese megacaps Tencent and Alibaba were among the largest boosts to the regional gauge. South Korea’s Kospi fell 0.6% to close at its lowest level in three weeks. The nation’s ruling party leader called for swift suspension of the president’s duties, while local media reported speculation on a possible second order of martial law. Military officials said there’s no need to worry about a possible second martial law decree. Hong Kong and mainland China stocks strongly rebounded from Thursday’s loss, with traders looking to next week’s Central Economic Work Conference for more details on stimulus. Japanese and Australian equities tracked US peers lower. Stocks in India were steady after the central bank kept borrowing rates unchanged but eased the cash reserve ratio requirement.

In FX, the euro is little changed but is still one of the better performing G-10 currencies. The yen drops 0.4% while the kiwi is the weakest of the G-10’s. The Bloomberg Dollar Spot Index is up 0.1%.

In rates, treasuries are flat ahead of the US jobs report, with US 10-year yields unchanged at 4.18%. Treasuries extended Thursday’s curve-flattening move. Front-end yields are 1bp-2bp cheaper on the day with long-end slightly richer, amid similar price action in core European bonds. French bonds outperform after National Rally leader Marine Le Pen said Thursday that a budget could be delivered in weeks. US session includes November jobs report at 8:30am New York time and four scheduled Fed speakers ahead of self-imposed quiet period beginning Saturday.

In commodities, oil added to its declines on concerns that OPEC+’s decision to push back the revival of halted production won’t prevent a surplus forming next year. WTI fell 0.5% to $67.90 a barrel. Spot gold rises $5 to $2,637/oz. Bitcoin falls 1%, having failed to sustain a break above $100,000.

Looking at today's calendar, we get the November jobs report (8:30am), December preliminary University of Michigan sentiment (10am) and October consumer credit (3pm). Fed speaker slate includes Bowman (9:15am), Goolsbee (10:30am), Hammack (12pm) and Daly (1pm)

Market Snapshot

- S&P 500 futures little changed at 6,085.00

- STOXX Europe 600 up 0.2% to 520.74

- MXAP down 0.1% to 186.69

- MXAPJ up 0.2% to 587.00

- Nikkei down 0.8% to 39,091.17

- Topix down 0.5% to 2,727.22

- Hang Seng Index up 1.6% to 19,865.85

- Shanghai Composite up 1.0% to 3,404.08

- Sensex down 0.1% to 81,644.02

- Australia S&P/ASX 200 down 0.6% to 8,420.85

- Kospi down 0.6% to 2,428.16

- German 10Y yield little changed at 2.12%

- Euro down 0.1% to $1.0572

- Brent Futures down 0.5% to $71.75/bbl

- Gold spot up 0.3% to $2,640.27

- US Dollar Index up 0.15% to 105.87

Top Overnight News

- It looks increasingly like South Korean President Yoon Suk Yeol will be impeached after the ruling party’s leader called for his quick suspension. The acting defense minister denied rumors about a second imposition of martial law. BBG

- South Korea’s central bank chief warns that Trump’s trade policies and increased competition from Chinese exporters are a greater threat to the country’s economy than the current martial law crisis. FT

- The Bank of Japan is staying guarded on the timing of the next rate hike with December hardly a done deal given soft consumption, its governor's cautious decision-making style and anxiety over U.S. economic policy in a second Trump presidency. RTRS

- India’s central bank unexpectedly cut its cash reserve ratio by 50 bps to 4%, while keeping its key rate unchanged. The RBI announced measures to attract foreign inflows to stem a decline in the rupee. BBG

- German industrial production unexpectedly fell in October. Output decreased 1% from the previous month, worse than any forecast in a Bloomberg survey. BBG

- We estimate nonfarm payrolls rose by 235k in November, above consensus of +215k and the three-month average of +104k. Alternative measures of employment growth generally indicated a sequentially stronger pace of job creation, and the end of strikes and the recent hurricanes that weighed on October job growth will likely boost November job growth. GIR

- Trump picked former Sen. David Perdue, who was the CEO of Dollar General and has extensive business experience in Asia, to become the next ambassador to China. Politico

- Trump named venture capitalist David Sacks to become the “White House AI and Crypto Czar” and lead the Presidential Council of Advisors for Science and Technology. Donald Trump said the venture capitalist will focus on making the US the “clear leader” in the fields. Politico, BBG

- Investors have pumped almost $140bn into US equity funds since last month’s election as traders bet Donald Trump’s administration will unleash sweeping tax cuts and reforms in a boon to corporate America. FT

- $136.4bln inflow to cash in week to Wednesday - largest weekly inflow since March 2023. Stocks: USD 8.2bln inflow, Bonds: USD 4.9bln inflow, Crypto: USD 3bln (largest every 4-week inflow of 11bln), YTD inflows: USD 53bln annualised: BofA Weekly Flow Show: USD

A more detailed look at markets courtesy of Newsquawk

APAC stocks were mixed with some cautiousness in the region after the weak lead from Wall St and ahead of the key US jobs data. ASX 200 was dragged lower by early underperformance in tech and healthcare, while gold miners also suffered after initial declines in the precious metal. Nikkei 225 was the laggard and briefly fell beneath the 39,000 level despite encouraging Household Spending data. Hang Seng and Shanghai Comp were buoyed despite the lack of any major fresh catalysts heading into next week's trade and inflation data releases, as well as the Central Economic Work Conference where Chinese leaders are said to discuss economic growth and stimulus.

Top Asian News

- China may let provinces approve special bond projects, according to Caixin news.

- RBI kept the Repurchase Rate unchanged at 6.50%, as expected, while it maintained its neutral stance with the rate decision made by 4 out of 6 voting in favour of a hold and the policy stance vote was unanimous. However, RBI Governor Das later announced a surprise cut to the Cash Reserve Ratio by 50bps to 4.00% which will take effect in two tranches of 25bps each on December 14th and December 28th which will infuse liquidity of INR 1.16tln. Das said price stability is a mandate given to them and growth is also very important, while he noted the last mile of disinflation is prolonged and recent growth slowdown will lead to downward revision for full-year growth. Das acknowledged that inflation crossed the upper band and food inflation pressures will linger with food prices to start easing only in Q4, while headline inflation is likely to be elevated in Q3 and he noted a status quo in this policy is appropriate and essential. Das said the near-term inflation and growth outlook has turned somewhat adverse, while India's FY25 real GDP growth forecast was cut to 6.6% versus 7.2% previously and the FY25 CPI inflation forecast was raised to 4.8% versus 4.5% previously. Das also announced to introduce a new benchmark called the secured overnight rupee rate and said in order to attract more capital inflows, to increase interest rate ceilings on FCNR-B deposits.

- RBI Governor Das said expect tight liquidity in the next few months; there is a possibility of increase in currency in circulation.

- South Korean ruling party leader Han said President Yoon needs to be suspended from his office ASAP and that Yoon ordered to arrest prominent politicians on the grounds they are anti-state forces. It was also reported that South Korea's main opposition party said lawmakers were on high alert after many reports of another martial law declaration, although the South Korean Joint Chiefs of Staff later said there is no need to worry about a second martial law and the special warfare commander also said he would refuse should another martial law order come.

Mixed performance thus far from Europe following a flat open amidst a lack of fresh pertinent catalysts and in the run-up to the US jobs report later today which will help shape expectations for near-term Fed policy. European Sectors are mixed with no clear bias or theme, with the breadth of the market narrow at the open before gradually widening. In terms of majors, CAC 40 narrowly outperforms in the aftermath of the French political developments as President Macron looks to name a new PM within days, with French Banks once again seeing a strong performance. Furthermore, luxury stocks see upside amid a possible China play in the run-up to the Chinese Central Economic Work Conference next week. US equity futures see flat trade across the board but with a mild downward bias in the RTY in a continuation of its recent underperformance, with traders awaiting the latest US jobs report.

Top European News

- French Socialists have expressed a willingness to work with a Macronist or Republican Prime Minister if “reciprocal concessions” are made, according to Politics Global.

- Riksbank's Seim said if economic and inflation outlook remains unchanged, policy rate can be cut again in December and again in H1 2025.

FX

- USD is a touch firmer vs. most peers in the run-up to today's NFP print which is expected to pick up to 200k vs. October's weather/strike-impacted 12k.

- EUR's rally vs. the USD has paused for breath after vaulting from a 1.0508 low yesterday to a 1.0593 peak today. Support yesterday was derived from some relief around the French budget situation with Le Pen optimistic that a 2025 budget can be passed in the coming weeks.

- JPY is softer vs. the USD despite some fleeting support from comments by Japan's main Opposition party Chief who said the BoJ should normalise monetary policy, adding it is wrong to focus too much on keeping monetary policy loose when Japan is experiencing inflation. USD/JPY has made its way back onto a 150 handle with a current session peak @ 150.60 vs. yesterday's high @ 150.77. If breached, the 10DMA sits @ 150.99.

- GBP flat vs. the USD in quiet UK newsflow asides from comments by BoE's Greene who said UK services inflation has remained stubbornly high, underpinned by wage growth and the supply side of the UK economy is weak. Cable briefly rose above the top end of yesterday's 1.2693-1.2771 range before fading gains.

- Antipodeans are both softer vs. the USD and at the foot of the G10 leaderboard. AUD/USD briefly slipped below yesterday's 0.6421. If breached again, the next target is the 0.64 mark with Wednesday's low just below @ 0.6399. NZD/USD is just about holding above yesterday's 0.5848 low. If breached, Wednesday's low sits @ 0.5829.

- PBoC set USD/CNY mid-point at 7.1848 vs exp. 7.2396 (prev. 7.1879)

Fixed Income

- USTs are a touch lower following yesterday's flattening of the curve. Fresh macro drivers for the US are on the light side in the run-up to today's NFP print. Mar'25 UTSs are currently towards the top end of yesterday's 110.28+ to 111.08+ range.

- Bunds a touch higher but off best levels as support from soft German Industrial Production metrics proved to be fleeting. There was no clear driver for the pullback. However, German paper has continued to fall behind its French equivalent. This move garnered traction following comments from far-right leader Le Pen who stated she sees a 2025 budget being passed in the coming weeks. Accordingly, the FR/GE spread has narrowed to its lowest level since November 21st.

- Gilts are just above the unchanged mark with fresh UK drivers lacking since the "dovish" Governor Bailey interview earlier in the week. Thus far the Mar'25 contract sits towards the bottom end of yesterday's 95.69-96.18 range, whilst the 10yr yield remains north of 4.25%.

Commodities

- Crude complex experiences a modest downward tilt with prices lacklustre after the prior day's choppy performance amid the deluge of OPEC+ updates, with traders keeping an eye on geopolitical updates ahead of the US jobs report.

- Spot gold holds a modest upward bias ahead of NFP. Spot gold resides in a USD 2,613-2,645.73/oz range after dipping under yesterday's USD 2,623.61/oz low. Prices remain sandwiched between the 50 DMA (USD 2.667.96/oz) and 100 DMA (2,583.44/oz).

- Copper grinds higher as traders look ahead to the US jobs report, and thereafter the Chinese Central Economic Work Conference next week whereby the focus will likely be on whether there’s a new emphasis on boosting domestic demand or supporting the property market.

- Morgan Stanley raised its H2 2025 Brent price forecast to USD 70/bbl (prev. USD 66-68/bbl); and lowered its estimate for OPEC-9 production by 400k BPD for 2025 and 700k BPD by Q4 2025. The desk said the OPEC+ updated production agreement tightens its supply/demand outlook for 2025, particularly for H2. MS still estimates a surplus for the oil market next year, but smaller than before.

- Qatar set January Marine crude and Land crude OSP at Oman/Dubai plus USD 0.15/bbl.

- Oil supplies to Czech Republic via Druzbha were resumed today, according to CTK citing Orlen CEO.

Geopolitics: Middle East

- Senior Iranian official said Tehran has taken all necessary steps to increase number of military advisers in Syria and deploy troops; likely that Tehran will need to send military equipment, missiles, and drones to Syria.

- IDF announces interception of suspicious air target after warnings in Upper Galilee, according to Sky News Arabia.

- Russian Foreign Minister Lavrov said they are very worried after what happened in Syria, while he spoke with his Turkish and Iranian counterparts and they agreed to meet this week, according to Al Jazeera

Geopolitics: Ukraine

- White House stated regarding National Security Advisor Sullivan's meeting with Ukrainian officials that Sullivan focused the discussion on the President’s theory of the case to improve Ukraine’s position in its war against Russia, while it was stated that Ukraine’s position in this war will improve relative to Russia's as we enter into 2025 and will allow Ukraine to enter any future negotiating process from a position of strength.

- Russia's Foreign Minister Lavrov said the use of hypersonic missiles in Ukraine means the West must understand that Russia is ready to use anything to stop notions of inflicting a strategic defeat on Moscow, while he added it is a mistake for anyone in the West to suggest that Russia has no red lines. It was separately reported that the Foreign Minister said Russia sees no reason why Moscow and Washington should not cooperate for the sake of the world.

Geopolitics: Other

- Taiwan's President Lai said he hopes China does not take any unilateral actions and noted that more Chinese military drills won't win respect from any other countries in the region, while he added that authoritarian countries should not see Taiwan's engagement with other countries as a provocation and hopes China returns to rules-based international order. Furthermore, he said Taiwan's people cannot accept China's military operating around Taiwan, as well as noted that peace is priceless and there’s no winner in a war but also stated they cannot have any illusions about peace and must continue to strengthen defences.

- Armed forces from Japan, Philippines, and US conducted "multilateral maritime cooperative activity" within the Philippines’ exclusive economic zone.

US Event Calendar

- 08:30: Nov. Change in Nonfarm Payrolls, est. 220,000, prior 12,000

- Nov. Change in Manufact. Payrolls, est. 30,000, prior -46,000

- Nov. Change in Private Payrolls, est. 205,000, prior -28,000

- Nov. Unemployment Rate, est. 4.1%, prior 4.1%

- Nov. Labor Force Participation Rate, est. 62.7%, prior 62.6%

- Nov. Underemployment Rate, prior 7.7%

- Nov. Average Weekly Hours All Emplo, est. 34.3, prior 34.3

- Nov. Average Hourly Earnings YoY, est. 3.9%, prior 4.0%

- Nov. Average Hourly Earnings MoM, est. 0.3%, prior 0.4%

- 10:00: Dec. U. of Mich. Sentiment, est. 73.3, prior 71.8

- Dec. U. of Mich. Current Conditions, est. 65.2, prior 63.9

- Dec. U. of Mich. Expectations, est. 77.7, prior 76.9

- Dec. U. of Mich. 1 Yr Inflation, est. 2.7%, prior 2.6%

- Dec. U. of Mich. 5-10 Yr Inflation, est. 3.1%, prior 3.2%

- 15:00: Oct. Consumer Credit, est. $10b, prior $6b

DB's Jim Reid concludes the overnight wrap

Just two weeks now until most people's Xmas vacation start and one of my 7-year old twins last night declared for the first time that he didn't think Santa was real which means the only holdouts in the family now thinking Santa is real are his identical brother and Brontë the dog. The end of the innocence is nearer in our family.

Just when you thought it was safe to relax into Christmas, along comes US payrolls today to keep you on your toes, especially with an upcoming close call as to whether the Fed cuts in 12 days time. Futures are currently pricing in a 70% probability that they will.

The Santa Claus rally we've seen over the last few weeks took a little breather last night in the US ahead of the data today. The S&P 500 (-0.19%) just missed out on 12 days of gains in the last 13 sessions, which would have been the first such run since 2013. However a more recent run continued in Europe yesterday as the STOXX 600 (+0.40%) was up for a 6th consecutive session.

As a background to today's report, last month underwhelmed, with nonfarm payrolls printing at just +12k, which was the weakest since December 2020 when the pandemic was still buffeting the economy. Private payrolls were at -28k, the first negative print since December 2020. But those numbers were impacted by strike action, whilst Hurricane Milton also hit Florida during the survey reference period. Our US economists expect a decent bounce back to +215k today. That would leave the unemployment rate unchanged at 4.1%, and they also see average hourly earnings growth at +0.3%.

Moving back across the Atlantic, France continues to serve up an abundance of headlines. Michel Barnier has now officially resigned, but will be staying on until a new Prime Minister is appointed. President Macron, in a televised speech last night, reiterated his plan to remain President for the remainder of his term until 2027 and said he would appoint a new PM in the “coming days.” Macron criticised both political flanks, saying that far-left and far-right legislators tried to provoke an early presidential election, before stating that the new government’s priority will be approving a budget. There is a concern amongst some lawmakers that the special stopgap emergency powers could lead to higher taxes for millions of families, however Le Pen called the stopgap legislation better than former PM Barnier’s plan.

Before Macron’s evening speech, markets became increasingly relaxed about France’s debt risk, with the Franco-German 10yr spread tightening a further -5.7bps tighter yesterday to 77.8bps. That came as Marine Le Pen gave a surprise Bloomberg interview, which was taken constructively by investors, as she said that France could pass a budget in “a matter of weeks” if the next PM was prepared to cut the deficit at a slower pace. So that suggestion of a compromise helped spreads to tighten, and the move yesterday was actually the biggest daily decline in the spread since July right after the first round of the legislative election.

For more information, Henry wrote a note here on why this is a long way from the sovereign debt crisis. One particular difference is we’ve not seen any signs of contagion from France to other countries, and only yesterday both the Italian and the Spanish 10yr spreads over bunds reached their tightest level in 3 years, at 108.7bps and 65.5bps respectively.

In response to the more stable politics, European equities had a decent session yesterday but the French market didn't out-perform as with their Government debt. Nevertheless, the STOXX 600 (+0.40%), the CAC 40 (+0.37%) and the DAX (+0.63%) all advanced for a 6th consecutive session with the DAX hitting a fresh record high.

The S&P 500 oscillated between gains and losses before ultimately closing -0.19% lower. That said, there was quite a divergence between mega caps and small caps, as the Magnificent 7 (+0.38%) moved up to another record, whilst the small-cap Russell 2000 fell -1.25%. Treasury curves flattened as the 2yr yield was +1.8bps up to 4.144%, whilst the 10yr yield (-0.04bps) was broadly flat at 4.176%. Later on, Richmond Fed President Barkin spoke to the potential inflationary pressures of the Trump administration’s tariff plan, saying that tariffs are an "inflationary pressure," and that the overall impact depends on how consumers, corporates and the Fed all deal with them. He also noted that consumers have started pushing back on higher prices, and demand may not stay as strong if prices continue to climb. We’ll hear from a few more Fed speakers today after the jobs report, and bear in mind that it’s the last opportunity for them to speak ahead of their pre-meeting blackout period.

In terms of data yesterday, the weekly initial jobless claims were a bit worse than expected. They ticked up to a 6-week high of 224k (vs. 215k expected) in the week ending November 30, which slightly pushed up the 4-week average to 218.25k. The rise wasn’t particularly big, and the continuing claims for the previous week came down, so it wasn’t a one-sided picture.

Asian equity markets are mostly trading lower outside of China this morning. The Nikkei (-0.88%) is leading losses with the KOSPI (-0.37%) also lower but both well off their lows. Chinese stocks are outperforming with the Hang Seng (+1.34%) and the Shanghai Composite (+1.01%) strong ahead of a key Chinese economic meeting next week. S&P 500 (-0.10%) and NASDAQ 100 (-0.01%) futures are just on the wrong side of flat.

Early morning data showed that Japan’s household spending contracted in October for the third straight month, falling -1.3% y/y (but better than the -2.5% expected) as against a -1.1% drop the previous month. Separately, Base pay for full-time workers increased by +2.8% in October from a year ago, the biggest gain for comparable data back to 1994.

To the day ahead now, and the main data highlight will be the US jobs report for November, but we’ll also get the University of Michigan’s preliminary consumer sentiment index for December, and German industrial production for October. From central banks, we’ll hear from the Fed’s Bowman, Goolsbee, Hammack and Daly.