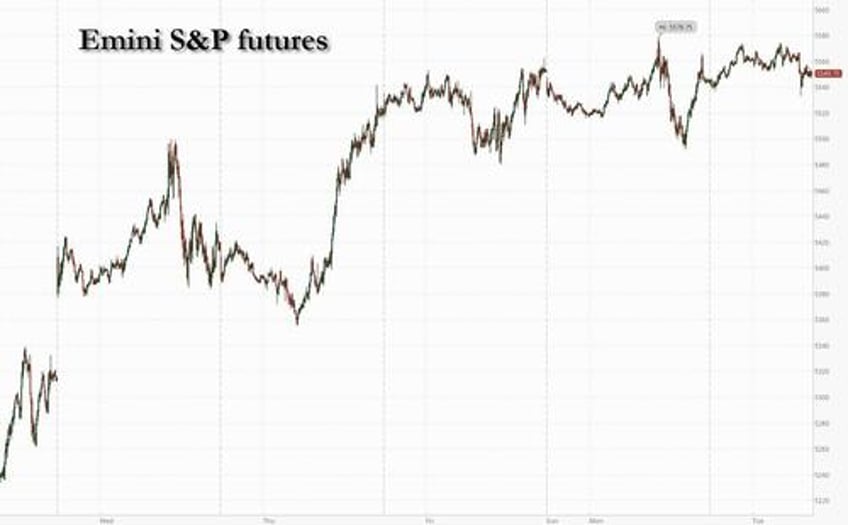

US equity futures were unchanged, erasing a modest gain and loss earlier, after General Motors pulled earnings guidance for 2025 and put share buybacks on hold until it has more clarity on the impact of US tariffs. As of 8:15am, S&P futures were flat, while Nasdaq futures were down 0.2% as TSLA rose +1.0% pre-mkt, followed by MSFT +0.5% and AMZN +0.5%. GM dropped in premarket trading, reversing an earlier gain, as it said it would suspend $4 billion of share repurchases. Bond yields and USD are higher (2-, 5-, 10-yr yields are 1.6bp, 2.9bp, 2.7bp higher). Commodities are mixed with WTI futures dropping 1.7%, adding to sharp losses seen Monday, Base Metals higher, and Precious Metals mixed. WSJ repeated a report from last week that Trump may ease his auto tariffs today; Elsewhere, Scott Bessent set July 4 as the goal to pass Trump’s tax cut package; he will announce the debt-ceiling X-date this week or next. Today, the key macro focus will be JOLTS Job Openings and Conf. Board Consumer Confidence.

In premarket trading, Magnificent Seven stocks are mixed as futures whipsaw )Amazon +0.2%, Alphabet +0.2%, Microsoft +0.1%, Apple +0.1%, Tesla -0.1%, Meta -0.1%, Nvidia -0.7%). General Motors (GM) shares fall 2.4% premarket after the automaker withdrew 2025 earnings guidance and paused $4 billion in share repurchases until it has more clarity on tariff impacts. Hims & Hers Health Inc. (HIMS) shares soared as much as 46% as it’s among companies Novo Nordisk A/S is partnering with to offer its popular weight-loss drug Wegovy to more US patients at a reduced price. Here are some other notable premarket movers:

- Crown Holdings (CCK) shares rise 3.3% after the beverage can maker reported adjusted earnings per share for the first quarter that beat the average analyst estimate. Analysts note strong volumes in Europe and Brazil

- Honeywell International Inc. (HON) shares gain 4.7% after the company raised its full-year guidance for earnings per share.

- PayPal (PYPL) shares are down 4.1% in premarket trading after the company reported fewer payment transactions in the first quarter than analysts expected.

- Okta (OKTA) shares rise 3.8% after S&P Dow Jones Indices announced that the stock will replace Berry Global in the S&P MidCap 400 before trading opens May 1.

- Regeneron (REGN) shares fall 7.5% after the drugmaker reported profit and sales for the first quarter that fell short of expectations.

- Ultra Clean (UCTT) shares are down 10% after the semiconductor manufacturing company reported first-quarter results that missed expectations and gave an outlook that is below the analyst consensus.

- UPS (UPS) shares are up 2% after the company reported adjusted earnings per share in the first quarter above what analysts expected

- Waste Management (WM) shares fall 1.7% after the firm’s first-quarter update missed revenue expectations and free cash flow dropped, with analysts saying that investors could have been hoping for more in order to support the stock’s year-to-date rally

- Wolfspeed (WOLF) shares are up 10% as the chipmaker is set for its sixth session of straight gains to match February’s winning streak

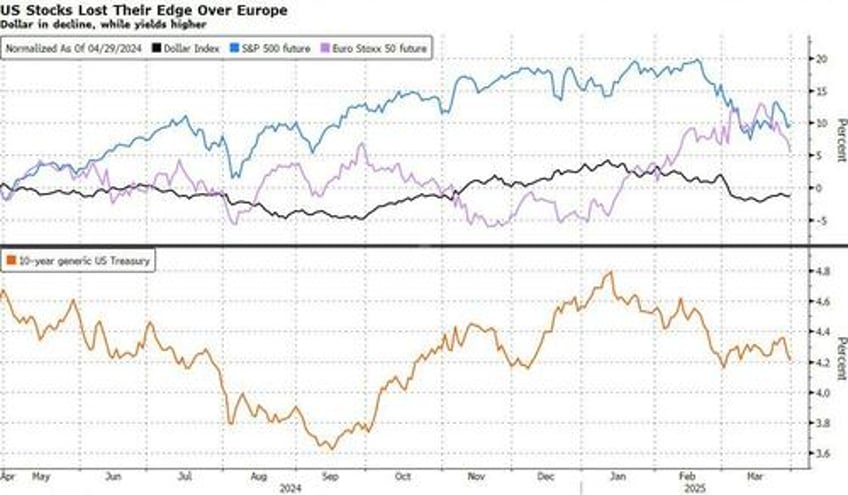

As Bloomberg notes, after weeks of intense volatility, markets now seem to be in a holding pattern. Gold is consolidating after hitting record highs, the DXY dollar index remains below its key 100 level, and oil is drifting lower. For investors, it’s difficult to find consensus, with risk management, confidence, and the guiding narrative on US exceptionalism upended by tariffs.

“With the uncertainty created by the tariffs we need to start pricing at least a probability of a US recession,” Johanna Kyrklund, chief investment officer at Schroders Plc, told Bloomberg TV. “As we analyze each company stock-by-stock, we’re looking for that risk to growth.”

Tariff sentiment continues to drive price action, with investors weighing plans by the Trump administration to ease the impact of auto tariffs by lifting some levies on foreign parts for cars and trucks made inside the US. However, it doesn’t look like a trade resolution is coming anytime soon. China’s top diplomat warned countries against caving in to US tariff threats, and Trump’s tactics are only serving to make China’s Xi Jinping more popular. At home, Treasury Secretary Bessent set a July 4 goal to pass a multi-trillion dollar tax cut package to appease voters getting fed up of Trump’s handling of the economy.

Still, with just over a third of S&P 500 companies reporting quarterly results, of those, 75% have beat estimates, according to data compiled by Bloomberg. S&P 500-listed companies worth $20 trillion are set to deliver results this week in one of the heaviest for 2025 earnings seasons. But the next few days are key: companies worth $20 trillion are set to deliver results this week in one of the heaviest for 2025 earnings seasons.

Beyond the plethora of earnings, investors will be tracking data for clues on economic resilience in the face of tariffs. Prospects for Federal Reserve interest-rate cuts will be guided by Friday’s US non-farm payrolls figures. Sentiment earlier was boosted by signs of easing trade tensions after a White House official said imported automobiles would be given a reprieve from separate tariffs on aluminum and steel.

In Canada, the Liberal Party is projected to win a fourth consecutive election, giving a mandate to former central banker Mark Carney.

European stocks rise 0.4%, with risk sentiment improving after the US said imported autos would be given a reprieve from separate tariffs on aluminum and steel. Miners, travel and banks are the strongest-performing European sectors, while the IBEX lags peers, dropping 0.5%, as Spain deals with the fallout of a massive blackout. In earnings, Deutsche Bank shares rise after its trading unit hit a record. HSBC climbs after announcing a fresh share buyback. BP shares fall after the oil major cut its buyback as profit missed forecasts. Here are some of the biggest movers on Tuesday:

- Rheinmetall shares rise as much as 7.3% after smashing expectations across the board with analysts praising a blowout quarter.

- Deutsche Bank shares gain as much as 4.6% after the lender posted a strong set of results, led by its trading unit hitting a record in the first quarter amid high market volatility.

- Neste shares gain as much as 13% after the Finnish refiner posted an increase in margins within its renewable product unit in the first quarter results.

- HelloFresh shares jump as much as 12% after the meal-kit company reported first-quarter adjusted Ebitda that beat estimates by roughly 30%, a sign that the firm is hastening its pivot to profitability as it cuts fulfillment and marketing expenses.

- Amundi shares slide as much as 2.4% after the investment manager’s first-quarter earnings showed a mixed performance that could weigh on consensus estimates, according to analysts.

- Porsche shares fall as much as 7.6%, their steepest drop since early February, after the luxury carmaker issued another profit warning.

- Deutsche Boerse shares fall as much as 5.7% after the German stock-exchange operator reported earnings for the first quarter that missed the average analyst estimate.

- Lufthansa shares fall as much as 2.9%. Results for the first quarter are largely in line and the carrier expects strong demand during the second quarter, though analysts note that weakening demand on the North Atlantic presents warning signs ahead of the peak summer season.

- Volvo Cars shares fall as much as 11% to a record low after the Swedish automaker posted first-quarter results that missed estimates and withdrew guidance for this year and next due to uncertainty around US tariffs.

- Elekta shares drop as much as 6.2% after an unidentified holder offered up to 15m shares via Goldman Sachs at a discount of 5.5% vs. Monday’s close, according to terms seen by Bloomberg.

- Nordic Semi shares slide as much as 9.4% after the chipmaker forecast 2Q sales below consensus estimates, citing increased risks from trade tensions and tariffs.

Asian equities advanced, rising to the highest level this month, on a rally in some Chinese technology shares and a sentiment boost from further signs of the US dialing down its trade rhetoric. The MSCI Asia Pacific Index gained as much as 0.7% Tuesday. TSMC and Meituan provided the biggest boost to the gauge, while India’s Reliance Industries extended its rally triggered by better-than-expected earnings. Benchmarks advanced in Hong Kong, Taiwan, India and South Korea. Japanese markets were closed for a holiday. Asian markets have largely recovered from the hit sparked by President Donald Trump’s reciprocal tariff announcements on April 2 amid hopes for trade deals. In the latest positive sign, Trump is on track to ease the impact of his auto tariffs, with changes sought by the industry that would lift some levies on foreign parts made inside the US.

- Australia: S&P/ASX 200 +0.92%, extending its winning streak to a 4th straight session as investors brushed off global trade uncertainties. Domestically, expectations are growing that the RBA will deliver another 25-bps cut in May, amid rising economic uncertainty and escalating global trade concerns. Investors are now awaiting Australian inflation data, due Wednesday, for further insight into the RBA’s next move.

- Taiwan: TAIEX +1%, was once again the best performing market in the region as sentiment continues to improve following recent rally in the US. TSMC 2330 TT +0.6% led the way as it closed above TWD900 for the first time since the tariff selloff in the first week of April. Small/mid-caps continued to outperform, as OTC index have rallied for 6th straight days, while beaten down AI ROBOTICS/BBU plays surged today.

- Korea: KOSPI +0.65%, rebounded. led by locals’ inflow. Locals extended their net buying streak for 3 consecutive days, mainly buying Tech (+$69mn) and Financials (+$94mn) today while foreigners remained as net sellers of equities, mainly selling Transport Equipment (-$231mn, comprised heavily of Shipbuilders, Defense, and Autos). Hanwha Ocean 042660 KR -12.1% as the name plunged after Co's shareholder KDB announced to raise up to W1.1trn (c. $735mn) through a block deal. Meanwhile, Korean Autos (KRXAUTO +1.6%) gained as President Trump is expected to soften the impact of this auto tariffs.

- Japan: The market is closed today (Showa Day) and will resume trading on April 30th.

- China: SHSZ300 -0.2%, traded choppy as Sino-US trade uncertainty weighed on sentiment. China reiterated that it is not involved in trade talks with the US. Small cap and TMTs overthrown large cap but neither of them gave a strong conviction. Innovance 300124 CH +4% post earnings beat. Healthcare rebounded, but A is lagging H. Xinqi pharma 300573 +14% post earnings 3x in 1Q. There is also a peer bank report released yesterday calling for China HC re-rating, especially in the domestic pure revenue names like Ping An Good Doctor, and Ali health.

- HK: HSI +0.2%. SB turned net seller of -US$827mm today, continuing general trend of outflows from last week. On the flows front, the desk saw active managers sell into liquidity from passive buying. Wuxi AppTec 2359 HK +4.2% after 1Q25 earnings beat on both top and bottom line. Geely 175 HK also +4.2% after subsidiary Volvo indicated they would reduce costs. In contrast, BYD 1211 HK -2.6% as concerns of waning demand from yesterday persisted.

In FX, the Bloomberg Dollar Spot Index rose 0.2% after falling 0.5% on Monday, when a disappointing manufacturing activity report added to concerns over US economic growth; haven currencies the yen and Swiss franc, were the biggest underperformers versus the dollar, down 0.6% and 0.4% respectively

- CAD/USD was little-changed at 1.3831, outperforming other Group-of-10 currencies which were lower across the board

- EUR/USD fell 0.3% to 1.1388; 10-year bund yield fell 3bps to 2.49%

- GBP/USD also slipped, pulling away from a three-year high; gilts edged up, tracking gains in other European bonds

In rates, treasury futures drift lower into early US session, unwinding a portion of gains seen Monday and underperforming core European bonds. US yields cheaper by 1bp to 3bp across the curve with 2s10s steeper by 1bp on the day; US 10-year yields trade back up 3bps to around 4.24% with bunds and gilts outperforming by 4bp and 5.5bp in the sector.

In commodities, WTI drifts 1.6% lower to trade near $61.03. Spot gold falls roughly $29 to trade near $3,315/oz. Most base metals are in the green. Bitcoin climbs to around $95,000.

The US economic calendar includes March wholesale inventories, February S&P CoreLogic house prices (9am), March JOLTS job openings, April consumer confidence (10am) and April Dallas Fed services activity (10:30am). From central banks, we’ll hear from the ECB’s Cipollone and Holzmann, and the BoE’s Ramsden. The Fed's talking heads remain mute thanks to the communications blackout ahead of the May 7 FOMC meeting. Finally, earnings releases include Starbucks, Visa, Pfizer and UPS.

Market Snapshot

- S&P 500 mini +0.1%

- Nasdaq 100 mini +0.1%

- Russell 2000 mini +0.1%

- Stoxx Europe 600 +0.2%

- DAX +0.6%, CAC 40 -0.1%

- 10-year Treasury yield +2 basis points at 4.23%

- VIX -0.3 points at 24.86

- Bloomberg Dollar Index +0.2% at 1222.16

- euro -0.2% at $1.1394

- WTI crude -1.4% at $61.17/barrel

Top Overnight News

- Canada’s Liberal Party won a fourth straight election, handing Mark Carney a mandate but with a narrow margin of victory. The loonie was steady. The Liberals led with 168 seats, ahead of the Conservative Party’s 144 but short of the 172 required for a majority. The Bloc Québécois would hold the balance of power in a minority government, raising the likelihood of a looser fiscal policy than Carney wants. Carney vowed to win the trade war with the US and strengthen alliances with other countries. BBG

- President Trump is expected to soften the impact of his automotive tariffs, preventing duties on foreign-made cars from stacking on top of other tariffs he has imposed and easing some levies on foreign parts used to manufacture cars in the U.S. WSJ

- White House said Trump wants tax cuts in this reconciliation package, while it was separately reported that Bessent said he hopes the Trump tax bill can be done by July 4th.

- US Treasury Financing Estimates (Q2): expects to borrow USD 514bln in privately-held net marketable debt, assuming end of June cash balance of 850bln (prev. guided USD 123bln, assuming end of June cash balance USD 850bln).

- China’s copper stockpiles are on track to dwindle to nothing in just a few months, as the market suffers “one of the greatest tightening shocks” in its history on fears of US tariffs. FT

- China said it’s open to working with US companies after halting Boeing jet deliveries. India plans to highlight its large pipeline of Boeing orders and potential for more to secure a favorable trade deal with the US. BBG

- China said the US should stop making threats and pursue dialogue based on mutual respect. Earlier, Foreign Minister Wang Yi warned countries against caving in to tariff threats. BBG

- Eurozone inflation expectations rise, with 12-month climbing 30bp to 2.9% (highest since Apr ’24) and 36-month advancing 10bp to 2.5% (highest since Mar ’24). ECB

- Pakistan’s army said it shot down an Indian spy drone along their disputed border in the Kashmir region, as tensions rise over last week’s militant attacks. BBG

- A union representing West Coast dockworkers has sharply criticized President Trump over his “reckless” tariffs that will hurt American workers. The union noted the tariffs have created tension with allies and are a “direct attack” on the working class. The Hill

- Scott Bessent set a July 4 goal to pass Trump’s multi-trillion dollar tax cut package. He also said the debt-ceiling X date will be announced this week or next. BBG

Tariffs/Trade

- US President Trump is expected to soften the impact of his automotive tariffs by preventing duties on foreign-made cars from stacking on top of other tariffs he imposed and easing some levies on foreign parts used to manufacture cars in the US, according to WSJ citing sources. Furthermore, a White House official said those actions are expected on Tuesday and Commerce Secretary Lutnick said President Trump is building an important partnership with both the domestic automakers and American workers, while Lutnick added this deal rewards companies who manufacture domestically, as well as provides a runway to manufacturers who have expressed commitment to invest in America and expand their domestic manufacturing.

- Chinese Foreign Minister Wang Yi said concession and retreat will only make the bully more aggressive.

- China's MOFCOM said on the report that Boeing flew back three 737 MAX planes to be delivered to Chinese airlines, that China and the US have maintained long-term mutually beneficial cooperation in the field of civil aviation, while it added the US wielded the big stick of tariffs to seriously impact the stability of global industrial and supply chains, and many enterprises were unable to carry out normal trade and investment activities.

- Italian PM Meloni says times are not mature yet for an EU-US summit, according to Corriere Della Sera.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly in the green but with some of the gains capped following the choppy performance stateside and in holiday-thinned conditions with Japanese markets closed for a holiday, while reports that US President Trump is expected to soften the impact of his automotive tariffs saw a muted reaction. ASX 200 gained amid outperformance in the energy, tech and resources sectors, while miners were also lifted as participants digested output updates. Hang Seng and Shanghai Comp were varied as the mainland lagged owing to uncertainty from the US-China trade war with US Treasury Secretary Bessent recently commenting that it is up to China to de-escalate and that he has an "escalation ladder in his back pocket", while China's Foreign Ministry reiterated its denial regarding a Trump-Xi call and Foreign Minister Wang Yi warned that compromise and backing down would only embolden the bully.

Top Asian News

- Japan and Malaysia are reportedly exploring broader economic ties including AI and automotive.

- Alibaba (9988 HK) introduced Qwen3 to set a new benchmark in open-source AI with hybrid reasoning.

- Earthquake of magnitude 5.0 strikes China's Tibet region, via CENC.

- Agricultural Bank (1288 HK) Q1 (CNH) Revenue 186bln (exp. 185bln), Net Income 72.1bln (exp. 73.95bln), +2.2% Y/Y, NII 140.6bln (exp. 142.7bln), CET1 11.23%.

- Industrial and Commercial Bank of China (1398 HK) Q1 (CNH) NII 156.78bln (exp. 161.29bln), Net Income 84.70bln, -4% Y/Y.

- China Construction Bank (939 HK) Q1 (CNH) NII 141.92bln, NIM 1.41%.

- Bank of China (3988 HK) Q1 (CNY) Net 54.36bln (exp. 57.4bln), NIM 1.29%, Operating Income 165bln (exp. 155bln)

European bourses opened modestly firmer/flat, but some modest pressure crept into the complex as the morning progressed – with indices generally off best levels, to show a mixed picture in Europe. European sectors hold a slight positive bias, albeit with the breadth of the market fairly narrow. Basic Resources takes the top spot, followed closely by Media and Banks. Energy is found at the foot of the pile, dragged down by post-earning losses in BP (-4%); the continued pressure in the crude complex is also not helping. Autos find themselves towards the middle of the bunch. For the sector more generally, US President Trump is expected to soften the impact of his automotive tariffs, by preventing duties on foreign-made cars from stacking on top of other tariffs he imposed and easing some levies on foreign parts used to manufacture cars in the US, via WSJ. For stock specifics, Porsche AG (-5%) dips after it cut FY25 guidance; Volvo Car (-8.3%) reported a significant miss on its EBIT and Revenue figure and launched a SEK 18bln cost and cash action plan.

Top European News

- ECB Consumer Expectations Survey: March: See inflation in next 12 months at 2.9% (prev. 2.6%); 3y ahead sees 2.5% (prev. 2.4%); 12-month is highest since April 2024. Economic growth expectations for the next 12 months were stable in March, standing at -1.2%.

- ECB's Cipollone says that ECB staff estimates suggest that the recently observed increase in financial market volatility might imply lower GDP growth of about 0.2ppts in 2025.

FX

- USD is attempting to claw back some of yesterday's losses that were in part driven by a soft outturn for Dallas Fed Manufacturing data. On the trade front, US President Trump is expected today to announce measures to soften the impact of his automotive tariffs by preventing duties on foreign-made cars from stacking on top of other tariffs, according to WSJ. DXY has risen as high as 99.31 but is yet to venture near Monday's best at 99.83.

- EUR/USD has faded some of its recent gains and failed to sustain the 1.1400 status with recent price action largely driven by moves in the greenback. Spanish CPI metrics which printed hotter-than-expected on a Y/Y, M/M and core basis. EUR/USD is currently contained within Monday's 1.1329-1.1425 range.

- USD/JPY marginally rebounded from support around the 142.00 level after sliding yesterday owing to the early initial risk aversion and lower US yield environment but with the recovery limited in the absence of Japanese participants. USD/JPY has ventured as high as 142.57 but is some way off Monday's opening level at 143.57.

- GBP is a touch softer after Monday's session of outperformance which didn't appear to be driven by any obvious catalyst. BoE's Ramsden is due later; Cable matched its YTD high printed yesterday at 1.3444 before pulling back.

- Antipodeans are both softer vs. the greenback amid a lack of pertinent newsflow out of Australia and New Zealand. That will change tomorrow for AUD with Australian Q1 CPI due on deck.

- CAD in focus after Canada's ruling Liberals, led by Mark Carney, won the national election. However, the outcome was closer than predicted by polls and will require the party to form a minority government. Accordingly, initial support for CAD has faded as markets reprice away from expectations of a majority government. USD/CAD currently sits towards the bottom end of yesterday's 1.3816-92 range.

- Canada's ruling Liberals led by Mark Carney won the national election but will need to form a minority government, according to CTV.

- PBoC set USD/CNY mid-point at 7.2029 vs exp. 7.2781 (Prev. 7.2043).

Fixed Income

- A contained start for fixed income given the Japanese holiday (Showa Day) overnight, meaning that there was no cash trade. USTs currently at the lower-end of a very thin 111-22 to 111-30 band and one that is within Monday’s 111-10 to 111-31 confines. Focus ahead is on, US Consumer Confidence, Advance Goods Trade and JOLTS Job Openings.

- Bunds is modestly firmer. On the data front, Spain’s inflation printed hotter-than-expected across the board and sent Bunds to a 131.16 low with Alphabet’s presence in the market perhaps also weighing. Thereafter, Bunds have recovered a touch and are back into the green and just off a 131.46 session high; a high that printed as the European risk tone came under a little bit of pressure after the Russian Kremlin said Ukraine has not responded to its latest ceasefire proposal.

- Gilts are flat given the lack of leads from sparse overnight trade and a European morning that has been devoid of UK-specifics aside from earnings. At the lower end of a 92.96 to 93.25 band, comfortably within Monday’s 92.79 to 93.33 range. BoE's Ramsden is due later.

- UK sells GBP 900mln 1.25% 2054 I/L Gilt: b/c 3.31x (prev. 3.06x) & real yield 2.175% (prev. 2.126%).

- Italy sells EUR 7.5bln vs exp. EUR 6.5-7.5bln 2.95% 2030, 3.60% 2035 BTP & EUR vs exp. EUR 1.5-2.0bln 2033 CCTeu.

- Alphabet (GOOGL) kicks of debut sale of EUR debt 4yr IPTs mid-swaps +85bps area. 8yr IPTs mid-swaps +105bps area. 12yr IPTs mid-swaps +125bps area.

Commodities

- Crude is on the backfoot, extending on the prior day's losses; there has been little by way of fresh oil-specific newsflow, so focus has been on updates out of Russia/Ukraine; most recently, Russia's Kremlin suggested Ukraine had not responded to offers to commence negotiations. Brent July'25 currently trades in a USD 63.62-64.81/bbl range.

- TTF is lower on the day, after finishing Monday’s session modestly higher, surrounding a number of updates including the blackout in Spain and a three-day ceasefire proposal from Russia. With Spain and Portugal’s blackout almost fully resolved today’s attention now shifts to Russia's ceasefire proposal, announced for May 8th-11th. As it stands, Russia says Ukraine is not responding to the proposal.

- Spot gold continues its reversal from recent record highs, with a number of risk events ahead including US consumer confidence and pivotal speakers such as Commerce Secretary Lutnick and Treasury Secretary Bessent who are likely to speak on auto tariffs. Thus far, today’s low has been recorded at USD 3,314/oz, with a high of USD 3,359/oz.

- Copper is a little firmer after a broad base metals bid this morning, lifting it from near session lows of USD 9,368/t, to session highs of USD 9,455/t, currently holding just off best levels.

- Spain's PM said the government will release 3 days worth of strategic oil reserves, while the grid operator later restored nearly all power.

- China's copper supplies are on track to be depleted in just a few months as the market suffers one of the greatest tightening shocks due to fears of US tariffs, according to commodities trading house Mercuria cited by FT.

- Kazakhstan Q1 oil exports +7% Y/Y to 1.63mln BPD, according to Reuters calculations and official data.

Geopolitics: Middle East

- US President Trump intends to extend the two-month deadline allocated for US-Iran negotiations, according to Israel Hayom citing Israeli officials

- Gaza talks in Cairo are said to be witnessing a "significant breakthrough" and parties agreed on a number of issues including consensus on a long-term ceasefire in Gaza, although some sticking points remain including Hamas arms, according to Reuters citing two Egyptian sources.

Geopolitics: Ukraine

- Explosions were heard in Kyiv after the Ukraine air force issued air raid alerts and air defence systems were engaged in repelling a Russian air attack.

- Russian Kremlin says Ukraine has not responded to many offers by President Putin to commence negotiations without any preconditions, according to Tass Direct talks with Ukraine need to commence, adding this is primary and the legitimacy of Zelensky is secondary. 30-day ceasefire is impossible without settling all the nuances.

US Event Calendar

- 8:30 am: Mar P Wholesale Inventories MoM, est. 0.6%, prior 0.3%

- 9:00 am: Feb FHFA House Price Index MoM, est. 0.3%, prior 0.2%

- 9:00 am: Feb S&P CoreLogic CS 20-City YoY NSA, est. 4.7%, prior 4.67%

- 10:00 am: Mar JOLTS Job Openings, est. 7500k, prior 7568k

- 10:00 am: Apr Conf. Board Consumer Confidence, est. 88, prior 92.9

DB's Jim Reid concludes the overnight wrap

It's shorts and sandals weather here in the UK which is lovely unless it forces you to look at the horrible brusing of my broken little toe. Enjoy the sunshine if you're in Europe this week.

After last week’s rally, markets saw a choppy start to a busy week with the S&P 500 recovering from a -1% decline to narrowly post a fifth consecutive gain (+0.06%) last night, even as the Mag-7 (-0.36%) lagged ahead of Meta and Microsoft earnings tomorrow and Apple and Amazon on Thursday. 10yr Treasuries (-2.7bps) also gained for a fifth session in a row, falling to their lowest level in three weeks at 4.21%.

On tariffs, the latest newsflow was actually fairly positive at face value, as US officials continued to sound optimistic about potential trade deals yesterday. For instance, Treasury Secretary Bessent said that they’d had “many countries come forward and present some very good proposals”. He also said “I would guess that India would be one of the first trade deals we would sign”. Separately, White House Press Secretary Karoline Leavitt also said that more details on trade talks would be announced this week. And later on, Bessent tweeted that they were “continuing to make substantive movement on negotiations with many of our trading partners.” So the rhetoric from the administration is still pointing towards negotiations, rather than further escalation. However, there was still little sign of dialogue between the US and China, with Bessent saying “I believe it’s up to China to de-escalate”. Overnight the incremental positive news has continued with the White House confirming an earlier WSJ story that imported autos would not also face additional aluminum and steel tariffs. This has helped lift S&P (+0.19%) and Nasdaq (+0.24%) futures this morning.

This steady flow of mostly more positive trade headlines lifted the S&P 500 from as low as -1.02% mid-way through yesterday's session to ultimately close marginally higher on the day (+0.06%). That left the index still narrowly in technical correction territory, closing -10.02% below its peak in mid-February, but its slightly above that mark again this morning. It was actually a decent day in terms of market breadth, with two-thirds of the S&P 500 constituents moving higher on the day and its equal-weighted version up +0.30%. By contrast, tech stock underperformance saw the Magnificent 7 decline by -0.36%, led by a -2.05% fall for Nvidia as the chipmaker struggled following news that China’s Huawei is set to test a new chip that could end up being a competitor.

Earlier in yesterday’s session, the mood at the lows wasn’t helped by the Dallas Fed’s manufacturing survey, which plunged to its lowest level since May 2020. Specifically, the general business activity index was down to -35.8, and the raw materials prices index also moved up to its highest level since mid-2022, at 48.4. So that added to the stagflationary narrative, although it’s worth noting that this is a survey once again rather than hard data, and so far the surveys have tended to suggest a worse performance relative to the hard data. As a result, markets weren’t too reactive to the print directly, but it added to the more downbeat backdrop going into this week’s other releases.

US Treasuries saw a more consistent performance, with 10yr yields falling -2.7bps to 4.21% and 2yr yields down -5.4bps to 3.70%, their lowest level since April 4th. Yesterday afternoon, the Treasury released its latest quarterly borrowing estimates, with the Q2 issuance estimate revised up to $514bn from $123bn due to a lower starting cash balance and with the Q3 estimate at $554bn. These figures were slightly above our rate strategists expectations but this may be due to the Treasury not yet factoring in increased tariff revenues. The announcement had limited impact on yields, which closed near the session’s lows. In other fiscal news, after the US close Treasury Secretary Bessent said the administration hoped to have Congress pass their tax bill by July 4.

With rates moving lower, one US asset that did lose ground yesterday was the dollar, with the dollar index down -0.54%, as the safe haven currencies of the Swiss franc (+1.02%) and Japanese yen (+1.17%) outperformed.

Back in Europe, there was a stronger risk-on tone, which reinstated the pattern of European outperformance in 2025. In fact, at the intraday peak, the DAX (+0.13% at the close) even managed to entirely erase its losses since Liberation Day, although by the end of the session it was still -0.53% beneath its levels on April 2. Nevertheless, the index was still up for the 8th time in the last 9 sessions, and those gains were echoed across the continent. For instance, the STOXX 600 (+0.53%) advanced for a 5th consecutive day, as did France’s CAC 40 (+0.50%). The smallest yet most notable rise was the FTSE 100 (+0.02%), which posted an 11th consecutive advance for the first time since 2019, and if it manages a 12th consecutive gain today, that would be the first time since 2017.

Consistent with that risk-on tone, European sovereign bond yields also moved higher, with those on 10yr bunds (+5.1bps), OATs (+4.9bps) and BTPs (+5.5bps) all rising. Likewise, credit spreads tightened further, with Euro HY spreads down -4bps to 349bps, edging closer to their Liberation Day level of 322bps.

In political news, Prime Minister Mark Carney's Liberal Party is projected to win the Canadian federal election. However, with projections showing the Liberals leading in only 155 of 343 seats – shy of the 172 needed for a majority – Carney is likely facing a minority government and will need to negotiate with other parties to pass legislation. The Conservatives are currently projected to win 150 seats. So a remarkable comeback for the Liberals relative to their January lows when they were over 25pp down in the polls but seemingly not quite as good as they would have hoped as the polls closed last night.

In Asia the fresh overnight news on auto tariffs we discussed at the top seems to be helping push markets higher. The S&P/ASX 200 (+0.91%) has hit a near 2-month high with the KOSPI (+0.65%) and the Hang Seng (+0.38%) also edging higher while Chinese equities are bucking the positive trend with the CSI (-0.14%) and the Shanghai Composite (-0.05%) seeing minor losses. Elsewhere, Japanese markets are closed for a public holiday. There’s no trading of cash Treasuries in Asia as Japan is closed.

To the day ahead now, and data releases from the US include the JOLTS report for March, the Conference Board’s consumer confidence indicator for April, and the FHFA’s house price index for February. Meanwhile in the Euro Area, we’ll get the M3 money supply for March, and the European Commission’s economic sentiment indicator for April. From central banks, we’ll hear from the ECB’s Cipollone and Holzmann, and the BoE’s Ramsden. Finally, earnings releases include Starbucks, Visa, Pfizer and UPS.