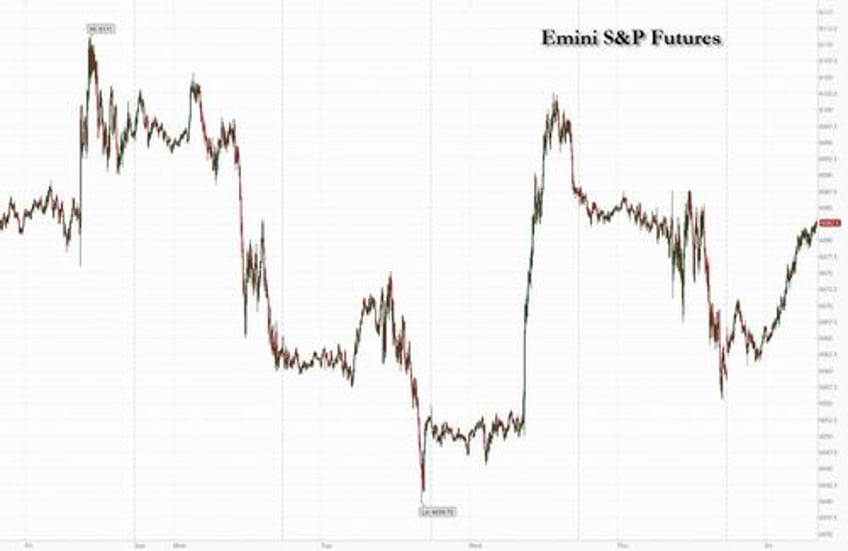

US equity futures pointed to a strong end to the week, as a premarket surge in Broadcom powered gains across the entire chip and tech complex, even as European bourses dipped and Asian markets took it on the chin after the latest Chinese stimulus disappointment. As of 8:00am S&P500 futs gained 0.4%, and Nasdaq 100 futures rose 0.7%, with shares in Broadcom surging 15% after it predicted a 65% increase in sales of AI chips in the fiscal first qtr; if gains holds, the stock will hit a record high, inching closer to a $1 trillion market cap. Peers Marvell, Micron, Nvidia and Advanced Micro Devices also rose. US 10Y yields gained 3bps rising to 4.35%, highest since Nov. 25; the dollar reversed earlier gains with the euro bouncing after Macron named centrist Bayou as the new French PM. Crude oil futures rose to a weekly high. On tap today we have US Import/Export prices (8:30am ET), Eurozone + UK Industrial production, Japan Industrial production

In premarket trading, Broadcom surged 18% after the chip supplier for Apple Inc. and other big tech companies predicted a boom in demand for its artificial intelligence chips. Costco shares also rose in premarket trading after the retailer reported first-quarter earnings per share that came in ahead of consensus estimates. TD Cowen noted that newness, quality and value are resonating strongly with US consumers. Here are some other notable premarket movers:

- EVgo (EVGO) rises 11% after the company closed on a $1.25 billion Energy Department loan to help expand its EV charging network. JPMorgan says “EVgo delivered an early holiday gift to investors.”

- RH (RH) jumps 18% after the furniture retailer raised its revenue forecast for 2025 and swung to a profit in the third quarter.

- TaskUS (TASK) gains 8% after Morgan Stanley turned bullish on the IT services firm, saying the company is a beneficiary from AI with exposure to key customers Meta and OpenAI, which will drive growth in 2025 and 2026.

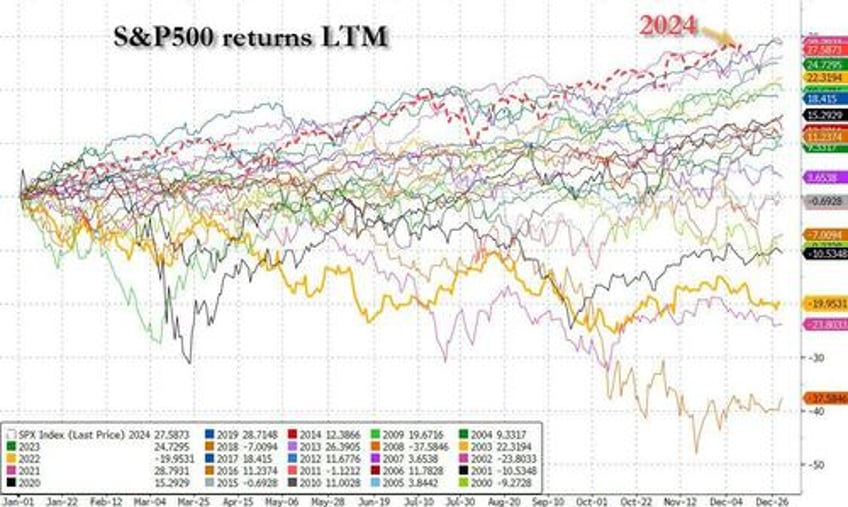

Stock markets are likely to extend their gains into next week, when the Fed is priced to deliver another quarter-point reduction. The S&P 500 has rallied 27% this year, and strategists polled by Bloomberg predict it will outpace European peers again in 2025. As of today, the S&P is on pace for the best full-year return this century.

"You have a US economy which is doing well and an incoming administration that is very pro-corporate — all that is in the price, but it doesn’t mean the rally can’t extend,” said Timothy Graf, head of EMEA macro strategy at State Street Global Markets.

Unlike the US where every day is a meltup, Europe’s Stoxx 600 index traded down 0.3% near session lows amid continued disappointment over the lack of concrete stimulus measures from China. Miners provided a drag, tracking iron ore futures lower after China’s Central Economic Work Conference seemed to underwhelm investors. Insurer Munich Re was a notable gainer after it forecast a net income boost next year. Here are the biggest movers Friday:

- Munich Re shares rise as much as 5.5% after the insurance giant outlined a net profit target for 2025 that was welcomed by analysts. Jefferies said it had anticipated a more cautious outlook, while Citi noted the target is being well-received considering its history of over-delivering

- Soitec shares shares gain as much as 7.7%. Bernstein analysts say visibility is finally improving at the semiconductor wafer maker, after a string of warnings

- St James’s Place shares rise as much as 4.6% after being upgraded by Deutsche Bank, which sees a more positive investment case for the UK wealth manager after digging deeper into the potential impact of an ongoing advice issue and new charging structure

- CD Projekt falls as much as 5.8% following the release of a 6-minute trailer of the new The Witcher IV game. The video is seen by analysts as a signal that the Polish studio aims to premiere its latest version of the medieval monster slayer game in 2026

- Outokumpu falls as much as 7.2%, the most since April, after the Finnish stainless steel manufacturer said its 4Q adjusted Ebitda will be close to breakeven or turn negative amid recent adverse developments in business in Europe

- TeamViewer shares fall as much as 6.7% after Berenberg downgrades the stock to hold from buy, seeing a risk that the software firm may have overpaid for its acquisition of 1E

- Impax shares fall as much as 24%, the most in over 21 years, after UK wealth manager St. James’s Place terminated the asset manager’s mandate to manage the Sustainable & Responsible Equity Fund

- Tullow Oil shares drops as much as 8.9% in London, paring initial gains after company confirmed preliminary talks with Kosmos Energy about an all-share offer by Kosmos for Tullow late Thursday

Earlier in the session, Asian shares fell led by losses in China after authorities again left investors waiting on the specifics of the fiscal stimulus even as their key policy meeting produced a vow to boost consumption. The MSCI Asia Pacific Index fell as much as 1.1%, the most in a month. Tencent, Meituan and Sony were among the biggest drags. Japanese gauges fell, while South Korean shares gained for a fourth day. Chinese stocks declined as traders parsed comments from the annual Central Economic Work Conference. Authorities vowed to raise China’s fiscal deficit target next year, and made “lifting consumption vigorously” and stimulating overall domestic demand their top priority. Retail sales data due next week will help shed light on the state of China’s economy. The week ahead is also packed with monetary policy decisions from the Federal Reserve as well as central banks in Japan, Indonesia, Thailand, Philippines and Taiwan.

“The market may have some hope that the CEWC would give more details on consumption stimulus and property inventory clearance packages, but it turned out a bit disappointing,” said Jason Chan, senior investment strategist at Bank of East Asia. “Investors may need to wait for more fiscal policy rollout in the first quarter, also the ‘Two Sessions’ held in March.”

A gauge of world stocks is headed for the worst week in nearly a month. “The newsflow has been underwhelming,” Beata Manthey, head of European equity strategy at Citigroup Inc., said of announcements from China. “The markets want numbers. We didn’t get the numbers.” However, Chinese 10-year government bond yields slid below 1.8% for the first time in history, as authorities vowed to cut policy rates and banks’ reserve ratios.

In FX, the dollar was steady against a basket of currencies, reversing earlier gains as the euro rebounded, but was still on track for a second straight week of gains. The pound weakened after Britain’s economy unexpectedly contracted for a second straight month in October. The euro strengthened after the ECB sounded less dovish on rates than some expected after its policy announcement Thursday and forcing traders to pared policy-easing bets for next year; it moved even higher after French PM Macron named centrist Bayrou as the new French PM. The yen is the weakest of the G-10 currencies, falling 0.5% against the greenback as traders bet that the Bank of Japan will keep interest rates unchanged next week, just as we warned.

In rates, treasuries are again cheaper across the curve, tracking bigger losses in European rates. The US yield curve steepening trend stalls following five straight increases in the 5s30s spread. US yields are 2bp-3bp cheaper across maturities with 10-year around 4.35%, highest since Nov. 25 outperforming German 10-year by ~2bp; major curve spreads are within 1bp of Thursday’s close. Bunds underperform their European peers, with German 10-year yields rising 3 bps to 2.23%. Gilts have been supported by soft GDP data from the UK while the surprise monthly economic contraction in October also weighs on the pound. IG issuance calendar empty so far. Gilts outperform after soft UK GDP data, which also weighed on the pound.

Graf of State Street expects more gains for the dollar, noting that the Fed’s easing cycle could prove shallow relative to Europe, where economic growth is weaker. Swap markets aren’t pricing a cut from the Bank of England at next week’s meeting, despite Friday’s weak data.

In commodities, oil prices advanced again, with WTI rising 0.8% to $70.60; Brent crude up 3.5% this week on the prospect for tighter US sanctions against Iran and Russia. Spot gold falls $12 to $2,668/oz.

US economic data calendar includes November import and export price indexes at 8:30am.

Market Snapshot

- S&P 500 futures up 0.2% to 6,075.75

- STOXX Europe 600 down 0.2% to 518.27

- MXAP down 0.9% to 185.75

- MXAPJ down 0.6% to 585.55

- Nikkei down 1.0% to 39,470.44

- Topix down 1.0% to 2,746.56

- Hang Seng Index down 2.1% to 19,971.24

- Shanghai Composite down 2.0% to 3,391.88

- Sensex up 0.9% to 82,021.18

- Australia S&P/ASX 200 down 0.4% to 8,295.96

- Kospi up 0.5% to 2,494.46

- German 10Y yield little changed at 2.22%

- Euro little changed at $1.0472

- Brent Futures up 0.4% to $73.69/bbl

- Gold spot down 0.3% to $2,672.66

- US Dollar Index up 0.13% to 107.09

Top Overnight News

- A top trade adviser to Donald Trump said that the new administration would not look "fondly" on any attempt by China to manipulate its currency, responding to a Reuters report that authorities there were considering allowing the yuan to weaken next year. Peter Navarro, Trump's incoming senior counselor for trade and manufacturing, said the White House would not interfere with the Treasury Department's biannual review looking in to whether foreign trade partners are manipulating their currencies. RTRS

- Trump considers options for preventing Iran from expanding its nuclear program, including the potential for airstrikes (Trump’s team feels Iran is uniquely weakened following events in Lebanon and Syria). WSJ

- Trump explores merging bank regulators (FDIC, OCC, and Fed) in an attempt to eliminate duplication and promote efficiency, but any change would require Congressional approval and is likely to be controversial. WSJ

- Elon Musk renewed his feud with the SEC, revealing that the agency is investigating Neuralink and may take action over his investments in Twitter. He’s also seeking to turn SpaceX’s Starbase site in Texas into a new city and move the company’s headquarters there. BBG

- Broadcom reported EPS/EBITDA upside while overall sales fell slightly short (semiconductor revenue was above expectations) and the guide was fine (the sales outlook was inline while the EBITDA margin forecast is ~250bp higher). Shares spiked 15% during the earnings call as mgmt. delivered a bullish message on AI demand, VMWare accretion, and its relationship w/Apple (the company downplayed the Bloomberg report about it being at risk of displacement in the iPhone). BBG

- Insurance stocks are rallying in Europe following bullish 2025 guidance from both Munich Re and Swiss Re. RTRS

- UK economic data in Oct falls short of expectations, including GDP, industrial production, and manufacturing production (GDP contracted for the second consecutive month). BBG

- Germany’s Bundesbank slashed its growth forecast for the country, warning of another year of economic stagnation and cautioning that a trade war with the US would trigger recession. FT

- Trafigura reported a 62% drop in profit as it took $1.1 billion in losses related to alleged employee misconduct in its Mongolian oil business. The company is restating several years of prior accounts and took additional hits on its zinc smelting and retail fuel businesses. BBG

- Microsoft (MSFT) filed for debt shelf; size undisclosed, via SEC filing. Separately, Microsoft introduces Phi-4, the company's newest small language model specialising in complex reasoning

- Apple (AAPL) will begin assembling AirPods in India by early 2025, partnering with Foxconn (HNHPF): BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded lower across the board following a similar session on Wall Street after the hot US PPI, whilst sentiment in Asia-Pacific was somewhat hampered as participants digested the disappointing release from the Chinese Economic Work Conference. ASX 200 was pressured by the metals sectors, namely gold miners, after the recent slide in the yellow metal as the Buck ramped up. Nikkei 225 pulled back further under 40,000, failed to benefit from a softer JPY and largely overlooked higher-than-expected optimism among large Japanese manufacturers from the BoJ's Tankan Survey. Hang Seng and Shanghai Comp were both softer as traders digested the release from the Chinese Economic Work Conference, which overall seems like a disappointment as it offered little in terms of details whilst reaffirming the recent policy shift.

Top Asian News

- PBoC official Zou Lan says PBoC will deepen FX market reform next year, according to state TV. Will keep the Yuan 'basically' stable. Will respond vigorously to external shocks. Will increase treasury bond buying and selling operations. Will provide sound liquidity environment for government bond issuance.

- Trump Trade Advisor Navarro warned against currency manipulation after Reuters sources suggested China is mulling a weaker CNY.

- South Korean Finance Ministry said they will deploy more market stabilising measures if volatility heightens excessively, according to Reuters.

- BoJ Dec Tankan corporate price expectations survey: Japanese firms expect consumer prices to rise 2.4% a year from now (prev. +2.4%). 3-year expectation +2.3% (prev. +2.3%); 5-year expectation +2.2% (prev. +2.2%).

- Japan's small firms are spending more of their profits on wages than their larger counterparts and may struggle to keep raising pay, casting doubt on whether wage gains are broad enough for BoJ to keep hiking rates, according to Reuters analysis. Policymakers are reportedly looking at whether small firms (which employ 70% of Japan's workforce) can continue meeting pay demands.

- REUTERS POLL: BoJ to hold key interest rate at 0.25% in December, according to 58% of economists polled (vs 44% in Nov poll)

- Chinese President Xi is not planning to attend Trump's inauguration but might send a senior official to represent him, according to WSJ sources.

European bourses began the European session on a modestly mixed footing, but soon after the cash open then lifted to session highs to display a positive picture in Europe. European sectors are mixed vs initially opening with a slight negative bias. Autos is towards the top of the pile, continuing to build on the gains seen in the prior session. Insurance follows closely behind, buoyed by gains in Swiss Re and Munich Re. Healthcare lags alongside losses in Basic Resources. US equity futures are entirely in the green, with clear outperformance in the tech-heavy NQ after Broadcom (+14%) shoots higher following a strong earnings report. Broadcom (AVGO) reported Q4 adj. EPS of 1.42 (exp. 1.39), and Q4 adj. net revenue of USD 14.05bln (exp. 14.1bln). Raised quarterly dividend +11% to 0.59/shr. Q4 semiconductor solutions revenue USD 8.23bln (exp. 8.05bln). Exec sees Q1 AI revenue growth of 65%, and expects momentum in AI connectivity to be as strong. +15% pre-market

Top European News

- ECB's Villeroy says more rate cuts are to come. Notes that French bond spreads have moved away from Germany and closer to Italy.

- ECB's Kazaks says the direction of interest rates is clearly down, the neutral rate is closer to 2% than 3%, significant reduction in rates is still necessary.

- Goldman Sachs (GS) cuts UK's 2024 GDP growth forecast to 1.0% from 1.2%.

- ECB's Holzman says yesterday's decision was "good". If things go as expected, sees no danger for prices in cutting rates next year. Neutral rate is around 2%, rates could fall to this level.

- ECB's Vasle says decisions will be taken meeting-by-meeting in a data-dependent fashion.

- BoE Inflation Attitudes Survey (Nov.): Median expectations of the rate of inflation over the coming year were 3%, up from 2.7% in August 2024. Asked about expected inflation in the twelve months after that, respondents gave a median answer of 2.8%, up from 2.6% in August 2024. Asked about expectations of inflation in the longer term, say in five years’ time, respondents gave a median answer of 3.4%, up from 3.2% in August 2024.

- VCI says producer prices down 2.5% Y/Y, total sales - 2% Y/Y to EUR 221bln, industry sales will slacken due to higher producer pries and lo order backlogs in 2025.

- Bundesbank lowers its German growth outlook across the entire forecast horizon. Economy to stagnate in the "winter half-year" and then make a slow recovery across 2025. US President-elect Trump's proposed tariffs could lower growth by 1.3-1.4% through 2027. ECB's Nagel says protectionism is the biggest area of uncertainty. Growth Forecasts: 2024: -0.2%; 2025: 0.2%; 2026: 0.8%.

FX

- DXY is essentially flat after spending most of the European morning in positive territory. DXY currently sits towards the bottom end of a 106.93-107.18 range. Today's docket is light, with just US Import/Export Prices on deck.

- EUR is slightly firmer vs. the USD as the dust continues to settle on yesterday's 25bps ECB rate cut. Sources followed the announcement, noting that the GC is prepared for a quarter-point rate cut at the next two meetings inflation stabilizes at the 2% target and economic growth remains sluggish. ECB speak this morning has continued to stress the inevitability of further easing in the coming months.

- JPY has continued to lose out to the USD throughout the European morning. JPY saw some fleeting support overnight in response to the higher-than-expected optimism among large Japanese manufacturers from the BoJ's Tankan Survey. Recent JPY weakness has coincided with a pick-up in risk sentiment (CHF has also moved lower in tandem).

- GBP is on the backfoot and near the bottom of the G10 leaderboard following soft M/M GDP data for October which printed at -0.1% vs. Exp. +0.1%. That being said, PM has cut its Q4 Q/Q forecast to 0.1% from 0.3% (MPC expects 0.3%). Accordingly, Cable slipped below its 21DMA at 1.2670 and fell to a session low at 1.2620.

- Antipodeans are contained vs. the USD in quiet trade with upside for AUD capped by the soft performance for Chinese markets overnight as traders digested the release from the Chinese Economic Work Conference, which overall seems like a disappointment as it offered little in terms of details whilst reaffirming the recent policy shift.

- PBoC set USD/CNY mid-point at 7.1876 vs exp. 7.2745 (prev. 7.1854)

- RBI likely sold USD to support the INR, according to traders cited by Reuters.

Fixed Income

- USTs are steady overnight with specifics light and the docket ahead also limited as the countdown to the FOMC begins. Action in the European morning limited to a 110-09+ to 110-14 range. Yields little changed overall with no overt flattening/steepening bias thus far.

- Bunds began the morning in the red with EGBs trading in proximity to Thursday’s lows, after the ECB was judged to not be as dovish as some had hoped for. ECB speak this morning includes Muller saying the period of strong inflation is behind, Kazaks saying the direction is clearly down and the influential Villeroy remarking that there are more cuts to come. Since, the downside has extended slightly with Bunds at lows of 134.80 having faded below 135.00.

- OATs are down in tandem with the broader complex; once again, we are awaiting French President Macron’s announcement as to who the next PM will be.

- Initial leads for Gilts were bearish given the above but offset by a particularly soft set of UK growth data for October, with GDP missing across the board Services showing no growth while both Production and Construction fell in the period. Gilts in the red, though not as soft as EGBs are. Opened at a 94.89 session high before fading to a 94.66 trough.

Commodities

- WTI and Brent are on a modestly firmer footing after trading mostly rangebound overnight, amid the lack of pertinent newsflow for the complex. On geopolitics, Ukraine said Russia had attacked several Ukrainian energy facilities. As for the Middle East, the WSJ reported that "President-elect Trump is weighing options for stopping Iran from being able to build a nuclear weapon, including the possibility of preventive airstrikes". Brent'Feb 2025 currently sits around the USD 74/bbl mark.

- Gold is softer, potentially dented by the grind higher in risk sentiment seen in the European morning and continued DXY advances above 107.00.

- 3M LME Copper was flat for most the session but has just managed to recoup the USD 9.1k mark but remains markedly shy of Thursday’s USD 9.2k opening level and that session’s higher thereafter at USD 9.27k before the WTD USD 9.3k peak.

- Goldman Sachs said their base case is that Brent averages USD 76/bbl in 2025 given near offset between a modest 400k BPD surplus and a normalisation in currently low valuation.

- Moldovan Parliament declares state of emergency from Dec 16th amid the possible end of flow of Russian gas from Jan 1st, according to Reuters.

- Russian attacks on Ukrainian energy facilities were more focussed on gas infrastructure this time, via Reuters citing sources.

- UBS expects copper prices to rise to the USD 10-11k MT range, expects demand to rise above 3% Y/Y in 2025. Sees copper market that is modestly in deficit of around 250,000 .

Geopolitics

- US President-elect Trump said "For the great privilege of accessing our markets, these foreign companies should hire our incredible American Workers, instead of laying them off, and sending those profits back to foreign countries", via Truth Social.

- US President-elect Trump is weighing options for stopping Iran from being able to build a nuclear weapon, including the possibility of preventive airstrikes, according to WSJ.

- US Secretary of State Blinken says that in the last few weeks he has seen encouraging signs that a Gaza ceasefire is possible

- Israeli Defense Minister orders Israeli troops to prepare to remain on Mount Hermon during winter months, via Reuters citing a statement

- Russian attacks on Ukrainian energy facilities were more focussed on gas infrastructure this time, via Reuters citing sources.

- US Sectary of State Blinken says that in the last few weeks he has seen encouraging signs that a Gaza ceasefire is possible.

US Event Calendar

- 08:30: Nov. Import Price Index MoM, est. -0.2%, prior 0.3%

- 08:30: Nov. Export Price Index YoY, est. 0.3%, prior -0.1%

- 08:30: Nov. Export Price Index MoM, est. -0.3%, prior 0.8%

- 08:30: Nov. Import Price Index YoY, est. 1.0%, prior 0.8%

DB's Jim Reid concludes the overnight wrap

We had the London FIC and Macro Research Xmas Party last night and I hope none of my colleagues will be offended if I say it was a relatively tame but pleasant affair and very different to the ones of my early years in banking. However, it wasn't without shock as after having known him for more than ten years I learnt for the first time that my colleague Luke represented Australia in his specialist discipline. I'll keep you guessing what that was in and reveal the answer at the end.

Markets have lost a little poise over the last 24 hours, as the combination of underwhelming data and comments from ECB President Lagarde led to a cross-asset sell-off. That was most evident among sovereign bonds, and there was disappointment that the ECB didn’t take an even more dovish tone, not least after Lagarde said that inflation risks were “two-sided”. On top of that, the US PPI inflation reading surprised on the upside, even if core and the components that feed directly into core PCE were a touch softer. However, the year-on-year rate rose above 3% again for the first time since early 2023. So that led to a bit more doubt about how fast any rate cuts would be next year (remember DB think none after next week), and the S&P 500 also ended the day -0.54% lower. Although the S&P 500 is only -0.64% beneath its record high, yesterday was the ninth day in a row that more constituents fell than rose in the index, the longest such run since 2001, a fairly stunning stat. So ex-tech, the market is losing some momentum even if the aggregate moves are still small.

Starting with the ECB, the headline decision was much as expected, with a 25bp cut that took the deposit rate down to 3%. Moreover, the statement had some dovish shifts, as it dropped the language about keeping rates “sufficiently restrictive” to get inflation back to target. That was supported by the latest economic forecasts, which saw growth and inflation both downgraded over the years ahead. For instance, they now see growth in 2025 at just 1.1%, down two-tenths from last quarter, whilst the 2026 number was also revised a tenth lower to 1.4%. Meanwhile on inflation, they now expect headline inflation to fall to 2.1% in 2025, down a tenth from before, before falling to 1.9% in 2026.

But in spite of those seemingly dovish elements, European sovereign bonds saw a heavy sell-off yesterday. Indeed, yields on 10yr bunds (+7.8bps), OATs (+9.8bps) and BTPs (+15.9bps) all moved sharply higher. That sell-off began as Lagarde’s Q&A comments did little to follow through on the dovish points in the statement or the forecasts, and avoided getting drawn on the size and speed of future cuts. So while the direction of travel towards lower rates is clear, these comments cast doubt on how aggressively the ECB would actually cut rates next year. That said, our European economists see the latest ECB signal as consistent with maximal optionality and continue to see the risk of larger 50bp cuts, although the bar for such a move at the next meeting in January feels high. Given their expectation of below-trend growth and below-target inflation, our economists maintain a baseline of a below-neutral 1.50% terminal rate by end-2025. See their full reaction piece here.

Whilst the ECB provided the main attention yesterday, there were a couple of US data prints that also disappointed investors. In particular, the PPI reading for November came in on the upside, which added to the sense that inflation was still lingering in a zone that would make it difficult to cut rates much further. For instance, the monthly headline PPI was running at +0.4% (vs. +0.2% expected), and the previous month’s reading was revised up a tenth to +0.3%. In turn, that pushed the year-on-year reading up to +3.0% (vs. +2.6% expected). However, the upside PPI surprise was in part due to one-offs (notably egg prices of all things), and with some respite from categories that feed into PCE inflation (which the Fed targets). These were on the weaker side alongside core PPI which printed at +0.1% MoM, below the +0.2% expected. So on paper, that still gives the Fed space to cut rates at next week’s meeting, even if the moves beyond that are in more doubt. In my opinion, there’s enough concern on inflation not to cut next week, but the Fed doesn’t like to provide big surprises to markets this close to the event, and with investors now pricing a 96% chance of a cut, the Fed would have to act astonishingly out of character to not do so.

The other release of potential concern were the weekly jobless claims, which saw initial claims at 242k over the week ending December 7 (vs. 220k expected), above every economist’s expectation on Bloomberg. Continuing claims for the previous week also surprised to the upside (1886k vs 1877k expected), though data may have been distorted by seasonal factors post-Thanksgiving. And while Treasuries initially rallied following the US data, the bond sell-off that has dominated so far this week resumed as the day wore on. By the close, 2yr (+3.9bps) and 10yr yields (+5.7bps) both posted a fourth consecutive increase to 4.19% and 4.33%, respectively. This leaves 10yr yields on course for their biggest weekly rise since early October (+17.5bps so far).

For equities it was also an underwhelming session yesterday. This was most visible in the US, where the S&P 500 was down -0.54%, and the small-cap Russell 2000 fell by a larger -1.38%. The tech megacaps also suffered from the downbeat mood, with the Magnificent 7 (-0.71%) reversing some of its +3.09% gain the previous day. As mentioned at the top, the number of decliners outpaced the advancers for a ninth consecutive session. Meanwhile in Europe, the losses were more marginal with the STOXX 600 down -0.14% and several indices posting modest gains, as the DAX (+0.13%) just about moved up to a new record.

Elsewhere in Europe, Swiss bonds outperformed after the Swiss National Bank delivered a 50bp rate cut yesterday. That came as something of a surprise, as both market pricing and the consensus of economists had leant towards a 25bp move as more likely. So there was a decent market reaction, which left the country’s 10yr yields down -0.7bps on the day, in contrast to the sizeable moves higher across the rest of Europe. In addition, the Swiss franc weakened by -0.37% against the US Dollar.

Overnight in Asia, equity markets are mostly sliding after the readout from China’s Central Economic Work Conference (CEWC) didn’t have much new policy details. That’s meant Chinese equities are underperforming, with the CSI 300 (-1.67%) and the Shanghai Comp (-1.36%) both losing ground, and the Hang Seng is also down -1.66%. Elsewhere, the Nikkei (-0.91%) is also trading noticeably lower, along with Australia’s S&P/ASX 200 (-0.41%). The one exception to this pattern is the KOSPI (+0.43%), and looking forward, US equity futures are pointing to a modest recovery, with those on the S&P 500 (+0.07%) and NASDAQ 100 (+0.28%) trading higher.

There was also a significant milestone in Chinese bond markets, as the 10yr government bond yield fell beneath 1.8% for the first time ever. That continues the downward momentum in Chinese yields over recent months, and the country’s 30yr yields are already trading beneath Japan’s 30yr yields.

In terms of data overnight, the Bank of Japan’s quarterly Tankan report showed that sentiment among the biggest Japanese manufacturers moved up to 14 in Q4, which was the highest reading since Q1 2022. However, the index for large non-manufacturers ticked down a point from last quarter to 33. In the meantime, the Japanese yen (-0.23%) is on track to weaken for a fifth consecutive session, and is currently trading at 152.97 against the dollar, its weakest since November 26.

To the day ahead now, and data releases include UK GDP for October and Euro Area industrial production for October. Meanwhile from central banks, we’ll hear from the ECB’s Villeroy, Holzmann and Centeno.