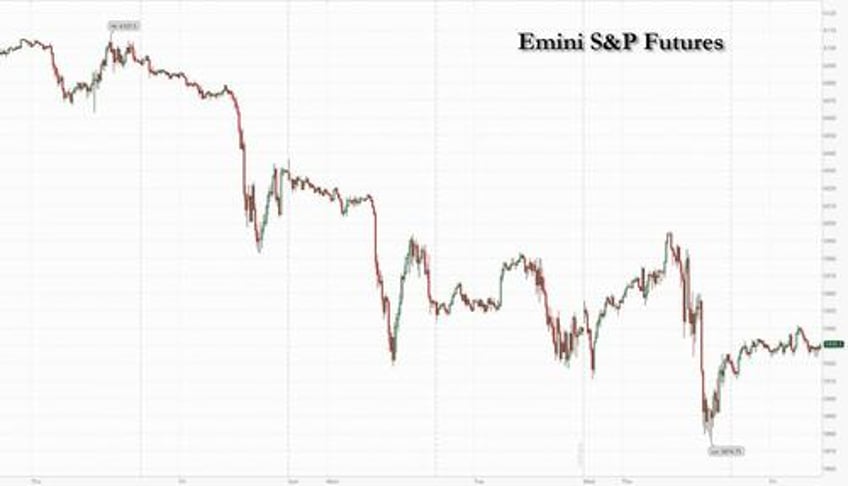

US equity futures posted modest gains suggesting stocks may finally halt a five-day losing streak, the longest since April, although we have seen early strength quickly turn to selling so it is unclear if today's modest bounce will last. As of 8:00am, S&P 500 contracts rose a modest 0.2%, fading stronger gains earlier, while the Nasdaq 100 rose 0.3%. European stocks dropped while Asian equities rebounded to erase Thursday’s losses, boosted by gains in the region’s technology companies even as Mainland China shares sank again as Chinese yields plunged to a new record low. And speaking of yields, the 10Y TSY yield ticked lower, dipping 2 bps to 4.54% while the dollar slipped from the two-year high it set Thursday. The US economic data calendar includes December ISM manufacturing at 10am. Fed speakers scheduled for the session include Barkin (11am).

In premarket trading, Tesla rebounding partially from Thursday’s slump prompted by disappointing vehicle sales numbers. US Still plunged more than 9% after reports that President Joe Biden has decided to block Nippon Steel’s purchase of the company. Here are some other notable premarket movers:

- Block rose 2% after Raymond James turned bullish on the digital payments firm, expressing confidence in the company’s seller gross payments volume.

- Nu Skin Enterprises jumped 12% on a pact to sell its Mavely marketing technology platform.

- Stellantis dropped slips 1.6% as some EV models that had previously received US tax credits for electric vehicles and plug-in hybrids failed to make it into the new list under tougher rules.

Overnight, Bloomberg reported that Biden has decided to block the sale of US Steel to Nippon Steel, ending a $14.1 billion deal that has faced months of vocal opposition and raising questions over the future of a US industrial giant. The news sent the stock sliding by double digits. The president had indicated his opposition to the proposed acquisition, arguing US Steel should remain American owned and operated, though the White House has never said outright that he would block the deal.

Separately, investors will be watching the US House Speaker vote Friday to see if Mike Johnson will retain his position. Republican squabbling over his reelection could bode ill for Trump’s agenda, according to Tom Essaye, founder of the Sevens report.

It’s been a volatile start to the year for stocks, with the S&P 500 index posting intraday gains in the previous two sessions, only to close lower. US manufacturing data due later will give investors clues on the health of the economy while they look ahead to Trump’s inauguration 17 days away to reduce uncertainty over future US policy.

“We really need to see more of that clarity on January 20th for markets to have greater conviction,” said Laura Cooper, global investment strategist at Nuveen. “But I think US exceptionalism will continue to be the dominant theme at least in the first half of the year, regardless of what some of those policies that come through are.”

In Europe, the Stoxx 600 fell 0.3% while French stocks underperform their regional peers. Autos, consumer products and miners are the biggest laggards on growing concerns about Chinese demand. Stellantis NV fell as much as 3.8% as some EV models that had previously received US tax credits for electric vehicles were excluded under tougher rules. Here are some other notable European movers:

- Tullow Oil gains after an international body found it wasn’t liable for a $320 million tax assessment in Ghana, where its key oil assets are located

- Outokumpu falls as much as 2.2% after being downgraded at BNP Paribas Exane in a review of its steelmaking coverage; Voestalpine meanwhile falls as much as 2.4% after also receiving a downgrade in the same review

- Shares of European hearing-aid makers GN Store Nord and Demant drop after EssilorLuxottica’s acquisition of Pulse Audition, a French startup delivering AI-based noise reduction and voice enhancement

Earlier in the session, Asian equities rebounded to erase Thursday’s losses, boosted by gains in the region’s technology companies. Mainland China shares sank extending their worst start to the year since 2016. The MSCI Asia Pacific excluding Japan index rose as much as 0.8%, the most since Dec. 23, with TSMC, Xiaomi and SK Hynix contributing the most. South Korean shares led the gains in the region after five days of selling. Benchmarks also gained in Hong Kong, Taiwan and Australia, while India’s fell. China’s stocks were mixed after a selloff on Thursday that saw mainland equities register their worst start to the year since 2016. China’s CSI 300 slumped 1.2%, while the Hang Seng Index rose 0.7%. The weakness was more prominent in the country’s small-caps stock after the CSI 2000 index marked its worst day in more than a week. The yuan fell to breach the psychological milestone of 7.3 per dollar for the first time since late 2023. The nation’s 10-year government bond yield slipped below 1.6% for the first time ever.

“There’s been many false dawns in China in recent months and it looks as though it’s unraveling again,” said Kenneth Broux, a strategist at Societe Generale. “We’ve seen three big days of selling which is not really conducive to sentiment.”

In FX, the Bloomberg Dollar Spot Index fell 0.2% from the two-year high it set Thursday, while the Swiss franc tops the G-10 FX leader board, rising 0.3% against the greenback. The onshore yuan weakened past 7.3 per dollar, a level that China had been defending since late last year.

In rates, Treasuries edged up, with US 10-year yields falling 2 bps to 4.54%. German government bonds underperform, more notably at the short-end of the curve with German two-year borrowing costs up 3 bps. Gilts advance.

In commodities, oil prices dipped with WTI falling 0.5% to $72.80 after a four-day rally. European natural gas prices are also in the red. Spot gold is steady near $2,656/oz on track for its biggest weekly gain since November. Bitcoin dropped for the first time in four days, trading below $97K.

Looking at today's calendar, US economic data calendar includes December ISM manufacturing at 10am. Fed speakers scheduled for the session include Barkin (11am).

Market Snapshot

- S&P 500 futures up 0.3% to 5,938.50

- STOXX Europe 600 down 0.2% to 509.80

- MXAP up 0.2% to 181.45

- MXAPJ up 0.3% to 568.60

- Nikkei down 1.0% to 39,894.54

- Topix down 0.6% to 2,784.92

- Hang Seng Index up 0.7% to 19,760.27

- Shanghai Composite down 1.6% to 3,211.43

- Sensex down 0.9% to 79,236.01

- Australia S&P/ASX 200 up 0.6% to 8,250.49

- Kospi up 1.8% to 2,441.92

- German 10Y yield little changed at 2.38%

- Euro up 0.3% to $1.0297

- Brent Futures down 0.5% to $75.58/bbl

- Gold spot down 0.1% to $2,654.67

- US Dollar Index down 0.39% to 108.97

Top Overnight News

- President-elect Donald Trump is throwing more weight behind Mike Johnson's speakership bid, as a handful of Republicans are weighing whether to block Johnson's attempt to reclaim the gavel. Trump has argued publicly and privately that Johnson is the only Republican who can secure the 218 necessary to win the post, a critical step for both Trump and GOP lawmakers to quickly implement his agenda. Politico

- US House Speaker vote is scheduled for today, NBC reports that the first call should begin at around 12pm EST.

- Joe Biden will block the sale of US Steel to Nippon Steel. An announcement is expected today. The Washington Post said senior officials attempted to dissuade Biden, arguing it could damage relations with Japan. US Steel shares -8.5% in the premarket. BBG

- US President-elect Trump named a team to work in conjunction with US Treasury Secretary nominee Scott Bessent with Ken Kies to be Assistant Secretary for Tax Policy and he named Cora Alvi as Deputy Chief of Staff.

- China’s PBOC says it will cut interest rates this year “at an appropriate time” as it looks to shift and simplify its monetary policy framework toward a Fed/ECB-like focus on a single benchmark rate. FT

- China will sharply increase issuance of ultra-long treasury bonds in 2025 to spur business investment and consumer-boosting initiatives, a state planner official said on Friday, as Beijing cranks up fiscal stimulus to revitalize the faltering economy. RTRS

- Apple received another negative headline from China as reports suggest shipments of foreign-branded smartphones to the country (including the iPhone) slumped 47% Y/Y in November, down for the fourth straight month. RTRS

- The UN food price index came in at 127 in Dec, down 0.5% from Nov, as decreases in the price indices for sugar, dairy products, vegetable oils and cereals more than offset increases in meat. UN

- US EV sales jumped 12% in the fourth quarter, pushing the full-year total to a record 1.3 million, boosted by Trump’s threat to eliminate tax credits for plug-in cars, Cox Automotive said. Total car sales also rose. BBG

- Reserves in the US banking system fell to the lowest in over four years in the week through Jan. 1, as year-end dynamics forced lenders to pare balance-sheet intensive activities. At the same time, the Fed has been removing excess cash through its QT program. BBG

- Investors yanked a net $333 million from BlackRock’s iShares Bitcoin Trust ETF yesterday, the most withdrawn since the fund’s launch. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were ultimately mixed with most major indices higher although the gains were capped amid the holiday closure in Japan and after the negative handover from the US where the dollar strengthened and Tesla deliveries disappointed. ASX 200 was underpinned with energy and gold miners leading the advances after recent gains in underlying commodity prices. KOSPI outperformed despite reports of a standoff between a military unit and South Korean investigative authorities attempting to arrest impeached President Yoon, while acting President Choi ordered to deploy market stabilising measures swiftly and boldly if volatility heightens. Hang Seng and Shanghai Comp traded mixed despite falling yields amid a report the PBoC is said to plan a policy overhaul as pressure mounts on the economy and would likely cut interest rates from the current level of 1.5% at an appropriate time. Nonetheless, some support was seen for Hong Kong tech stocks after an NDRC official said they will sharply increase funding from ultra-long treasury bonds this year to support "two new" programmes and will broaden the consumer trade-in initiative to include smartphones, while the mainland failed to benefit amid the ongoing US-China trade-related frictions.

Top Asian News

- PBoC is reportedly to plan a policy overhaul as pressure mounts on the economy and said it was likely it would cut interest rates from the current level of 1.5% at an appropriate time, while the report noted it would prioritise “the role of interest rate adjustments” and move away from “quantitative objectives” for loan growth in what would amount to a transformation of Chinese monetary policy, according to FT.

- China's NDRC held a briefing regarding high-quality growth and announced it will sharply increase funding from ultra-long treasury bonds this year to support "two new" programmes, while it is to broaden the consumer trade-in initiative to include smartphones. NDRC expects consumption to maintain steady growth in 2025 and noted China's economy is facing many new difficulties and challenges in 2025 but added there is ample room for macro policies in 2025. Furthermore, the NDRC deputy head announced an allocation of CNY 100bln in 2025 for two new and two major projects in advance, while it will push major reforms in 2025 to stabilise expectations, boost confidence and promote development, as well as step up efforts surrounding employment.

- South Korean investigative authorities visited President Yoon's residence to attempt to carry out an arrest warrant but were prevented from carrying out the arrest amid a standoff with a military unit, while two South Korean military officials including the martial law commander were indicted and detained by prosecutors. Furthermore, South Korean acting President Choi ordered to deploy market stabilising measures swiftly and boldly if volatility heightens, as well as announced to prepare tax support measures for small and medium-sized firms to boost corporate investment.

European bourses opened modestly mixed, but quickly succumbed to some selling pressure to display a negative picture in Europe thus far. European sectors opened mixed, but now hold a slight negative bias. A broker upgrade for UBS has helped to prop up Financial Services; Consumer Products once again is towards the foot of the sector list, with Luxury names doing much of the dragging. US equity futures are modestly firmer, with modest outperformance in the NQ after trading lower in the prior session. Phone shipments within China -5.1% Y/Y at 29.61mln handsets in November (vs +1.8% Y/Y to 29.67mln units in October), according to CAICT; shipments of foreign branded phones including Apple (AAPL) iPhone within China -47.4% Y/Y at 3.04mln handsets in November (vs -44.3% Y/Y in October), according to Reuters calculations based on CAICT data.

Top European News

- UK Chancellor Reeves warned ministers to consider cuts to frontline services to fund above-inflation pay increases for public sector workers, according to The Times.

FX

- USD is giving back some of yesterday's gains vs. peers with DXY returning to a 108 handle after topping out at 109 yesterday (highest since November 2022); currently around the 109.00 mark. For today's data docket, focus will be on the December ISM manufacturing print which is expected to remain in contractionary territory at 48.4. Elsewhere, markets will be awaiting the outcome of the US House speaker vote (from around 17:00GMT, according to NBC).

- EUR has managed to claw back some lost ground vs. the broadly softer USD but is yet to undo a bulk of the damage yesterday which saw the pair slip from a 1.0375 peak to a 1.0224 low (lowest since November 2022).

- Japanese-specific newsflow remains on the light side with Japan way from market overnight. As such, the USD leg of the USD/JPY pair has been doing a bulk of the heavy lifting and therefore the broadly softer USD has dragged the pair lower. That being said, the pair has been unable to return to a 157 handle after delving as low as 156.44 yesterday.

- GBP is attempting to reverse some of yesterday's heavy selling pressure which dragged the pair from a 1.2540 peak to a 1.2353 low. Whilst there was no specific catalyst for yesterday's price action, desks pointed to a reversal of last year's relative outperformance of the GBP vs. peers (ex-USD).

- Antipodeans are both firmer vs. the broadly weaker USD with AUD managing to overlook losses in iron ore. Newsflow for both has been light, however, attention was on events in China overnight amid reports of support measures from China's state planner.

- RBI likely selling USD around 85.77-79 levels to support the INR, according to traders cited by Reuters.

- PBoC set USD/CNY mid-point at 7.1878 vs exp. 7.2868 (prev. 7.1879).

Fixed Income

- A relatively contained start for benchmarks, with USTs in a narrow 108-27+ to 109-01 band with the docket light until we get to the US morning when ISM Manufacturing PMI is due before the expected commencement of the vote concerning House Speaker Johnson at around 17:00GMT.

- Bunds hold a bearish bias as the benchmark pares some of the upside seen late-doors on Thursday. Currently, at the low-end of a 132.95-133.48 band, which remains entirely within but approaching the trough of Thursday’s 132.90-133.86 range.

- OATs are the EGB laggard, with pressure stemming from reports in Le Monde that French PM Bayrou is aiming for a 2025 budget deficit as a % of GDP of 5.4%, higher than the 5.0% targeted by Barnier’s failed administration.

- Gilts stand as the marginal outperformer, initially gapped higher at the open, but has since succumbed to the broader fixed income pressure; currently near the day's trough at 92.24. Specifics include mortgage and money supply data for November from the BoE, metrics which came in below forecast across the board but spurred no real Gilt follow through.

Commodities

- Subdued trade in the crude complex as prices take a breather from the prior day's surge, and amid a generally cautious risk tone. Brent sits in a USD 75.53-76.26/bbl parameter.

- Nat gas is slightly softer intraday in tandem with broader energy markets, with Dutch TTF front-month oscillating on either side of EUR 50/MWh.

- Mixed trade across precious metals with Palladium clearly benefitting from the softer Dollar, whilst silver ekes mild gains and gold trades subdued. Spot gold resides towards the middle of a current USD 2,649.95-2,665.40/oz range.

- Base metals are modestly higher but with price action contained to a tight range between 8,781.50-8,852.00/t awaiting the next catalyst.

- Goldman Sachs sees significant risks that TTF gas prices rally towards oil-switching economics in a EUR 63-84/MWh range in the coming months.

- Russian oil product exports from the Black Sea port of Tuapse are reportedly planned at 0.798mln/T in January (0.885mln/T scheduled in Dec.), via Reuters citing sources.

- Austria's Grid Manager says other NatGas sources are compensating for the loss of Russian fuel via Ukraine, gas imports via Germany and Italy are sufficient, according to Bloomberg's Stapczynski.

- Indonesia Minister says Indonesia is reviewing nickel ore mining quote, seeking to prevent further price falls.

Geopolitics

- Israeli PM Netanyahu will convene a meeting today to discuss the mandate of the Israeli delegation that will leave for Qatar, according to Journalist Stein.

- Israeli army noted sirens sounded in several areas of central Israel after a rocket was fired from Yemen, according to Sky News Arabia.

- Sky News Arabia correspondent reported huge explosions in Syria's Aleppo amid Israeli raids.

US Event Calendar

- 10:00: Dec. ISM Manufacturing, est. 48.2, prior 48.4

- Dec. ISM Employment, prior 48.1

- Dec. ISM New Orders, prior 50.4

- Dec. ISM Prices Paid, est. 51.8, prior 50.3

DB's Jim Reid concludes the overnight wrap

Markets got 2025 off to a gloomy start yesterday, with the S&P 500 (-0.22%) extending its post-Christmas losses as various headlines added to the downbeat tone. The latest decline is now the 5th consecutive move lower for the S&P, making it the longest run of declines for the index since April. But as we mentioned yesterday, the first trading day has been a very poor guide to the rest of the year in recent times, so we shouldn’t extrapolate things too far. Indeed, both of the last two years saw the S&P 500 lose ground on the first day, before going on to rise more than +20% over the year as a whole.

Several factors helped to extend the selloff over the last 24 hours. First up, we had a lot of negative headlines out of Europe, as concerns mounted about the energy situation after the expiry of the transit deal between Russia and Ukraine. That meant European natural gas futures closed above €50/MWh for the first time since October 2023, and the end of the transit deal has also coincided with some very cold temperatures in northern Europe right now. So the fear is that higher gas prices are going to add to inflationary pressures, whilst gas storage has been falling faster than usual this year as well.

That backdrop saw the euro (-0.88%) close at its weakest level against the US Dollar since November 2022, ending the session at $1.0265. This continues the declining trend that’s been evident since late-September, as the prospect of US tariffs and a more hawkish Fed have put the currency under pressure. In the meantime, sterling saw even bigger losses, falling by -1.09% to $1.2380, which is its weakest closing level since April. And with inflationary pressures mounting, including from a weaker currency, sovereign bonds struggled across much of Europe, with yields on 10yr bunds (+1.2bps), OATs (+3.8bps) and gilts (+3.1bps) all moving higher. In fact, for another sign of the risk-off tone yesterday, the Franco-German 10yr spread moved up to 85.6bps, which is the widest it’s been since December 2, the day that the National Rally announced they’d back a motion of no confidence in Michel Barnier’s government.

That downbeat European narrative got a further push yesterday from the final manufacturing PMIs for December, which saw modest downward revisions compared to the flash prints. For example, the Euro Area manufacturing PMI came down a tenth to 45.1, and the UK reading came down three-tenths to 47.0. And in the UK’s case, that also leaves the manufacturing PMI at an 11-month low.

To be fair, the European equity performance was pretty good in the circumstances, with the STOXX 600 (+0.60%) and all the other major indices advancing. That was driven by an outperformance from energy stocks given the upward moves for energy commodities, and Brent crude oil ended the session up+1.73% at $75.93/bbl, marking its 4th consecutive move higher. That trend has continued this morning too, with Brent crude prices up another +0.28% to $76.14/bbl. But for US equities there was a much more negative story, with the S&P 500 (-0.22%) posting a 5th consecutive loss, driven by even deeper losses for the Magnificent 7 (-0.69%). In fact, Tesla (-6.08%) was the worst performer in the entire S&P 500 after they reported that their annual vehicle sales had fallen for the first time since 2011. The NASDAQ (-0.16%) and the Dow Jones (-0.36%) lost ground as well, with the small-cap Russell 2000 (+0.07%) outperforming as it posted a modest gain.

Whilst there were several negative headlines yesterday, a more positive story were some upside surprises in the US data. For instance, the weekly initial jobless claims fell to their lowest since April over the week ending December 28, coming in at just 211k (vs. 221k expected). That pushed the 4-week moving average down to 223.25k, and the continuing claims for the previous week also fell to their lowest since September, at 1.844m (vs. 1.890m expected). Separately, we had the final manufacturing PMI for December, which was revised up from the flash reading to 49.4 (vs. flash 48.3). So that was all coming in on the upside.

But even with those upside data surprises, it meant investors dialled back their expectations for rate cuts from the Fed over the next few months, so that meant risk assets lost a bit of support. Moreover, given the latest moves in energy prices, investors moved to raise their near-term inflation expectations, with the US 1yr inflation swap up +4.9bps yesterday to 2.57%. And after the jobless claims numbers were out, the 2yr Treasury yield (-0.2bps) moved off its intraday low of 4.20%, paring back that decline to end the session at 4.24%. It was a similar story for the 10yr yield (-1.0bps) too, which came off its intraday low of 4.51% to close at 4.56%.

Overnight, there have been some signs of a recovery, with advances for South Korea’s KOSPI (+1.78%) and Australia’s S&P/ASX 200 (+0.60%). And looking forward, US equity futures are also positive, with those on the S&P 500 up +0.14%. However, Chinese equities have continued to lose ground, with both the CSI 300 (-0.25%) and the Shanghai Comp (-0.69%) extending their 2025 losses. That comes as China’s 10yr government bond yield has fallen below 1.6% intraday for the first time ever this morning, whilst the FT reported comments from the People’s Bank of China that they would likely cut interest rates “at an appropriate time” this year. The article said that the PBoC would prioritise “the role of interest rate adjustments”, moving away from “quantitative objectives” for loan growth. Otherwise, Japanese markets remain closed for a holiday.

Looking forward, one thing to look out for today will be the start of the new session of Congress in the United States, including the vote to elect the Speaker of the House of Representatives. The incumbent Speaker Mike Johnson is trying to stay in post and has the endorsement of Donald Trump, but the Republicans have a very tight majority in the House, with a 220-215 margin over the Democrats. A few Republicans haven’t committed to voting for Johnson for Speaker, and two years ago it took 15 ballots over multiple days before Kevin McCarthy was elected. From a market standpoint, this will be an interesting test as to the unity of the new Republican majority as they seek to enact Trump’s second term agenda, as it’s a much tighter margin than they had after the 2016 election, when the Republicans began with a 241-194 majority in the House.

To the day ahead now, and data releases include the US ISM manufacturing print for December, German unemployment for December, and UK mortgage approvals for November. From central banks, we’ll hear from the Fed’s Barkin and the ECB’s Lane.