US equity futures are higher this morning on the last day of a volatile week, amid healthy earnings results post market close yesterday. As of 8:00am, S&P futures are up 0.5%, while Nasdaq futures gain 0.8% with AAPL up +3.5% after first sliding after disappointing iPhone sales only to reverse losses on the company's (rather modest) guidance; Intel gained +1.4% as results were better-than-feared while Mag7 stocks were mostly higher (GOOGL +0.5%, AMZN +0.9%, AAPL +4%, MSFT +1%, META +0.5%, NVDA -1% and TSLA +0.2%). Europe’s Stoxx 600 index headed for its best month in two years as strong earnings reports burnished the appeal of the region’s stocks over pricier Wall Street equities. As we get closer to the Feb 1 deadline, headlines on Trump’s tariffs took the central stage. Trump’s reiteration of the 25% tariffs on Canada/Mexico led to some volatility yesterday, but the markets quickly rebounded and still managed to finish in the green. 10Y treasury yields were flat at 4.52% while the dollar gained ahead of President Donald Trump’s weekend tariff announcement. Today, key macro focus will be December PCE and Energy earnings (XOM and CVX).

In premarket trading, Apple rose 4% after the iPhone maker gave a modestly better-than-expected outlook (it guided single digit growth in sales, which probably is better than guiding to a contraction), helping to offset disappointing iPhone and China revenue in its first-quarter results. Chevron (CVX) declines 1% as profit underperformed expectations amid shrinking crude prices and fuel-making margins. Intel (INTC) rises 1.4% after the chipmaker reported fourth-quarter results that were better than investors expected as it navigates a difficult return to competitiveness. Here are some other notable premarket movers:

- AST SpaceMobile (ASTS) rises 6% after the company said that the Federal Communications Commission has granted it special temporary authority permitting testing service in the US with partners AT&T and Verizon Communications.

- Atlassian (TEAM) surges 20% after the software company reported second-quarter results that beat expectations and raised its full-year forecast.

- Autoliv (ALV) slips 2% after the seatbelt manufacturer’s 4Q sales fell short of estimates.

- Baker Hughes (BKR) rises 1.5% after the oil field services firm’s earnings beat estimates, with analysts saying this was impressive given the high bar as shares have risen 56% over the past 12 months.

- Boot Barn (BOOT) falls 7% after providing a fiscal 4Q profit forecast range with a midpoint that falls short of estimates.

- Cipher Mining (CIFR) jumps 11% after the Bitcoin mining company announced a $50 million PIPE investment from SoftBank that will support the high-performance computing business.

- Deckers Outdoor (DECK) slumps 14% after the footwear and apparel firm’s fiscal-year revenue forecast fell short of Wall Street expectations. Other footwear stocks trade lower: ON Holding (ONON) -2%, Crocs (CROX) -0.9%

- Vertex (VRTX) climbs 4% after the biotech’s non-opioid analgesic Journavx received FDA approval for moderate-to-severe acute pain in adults.

- Viavi (VIAV) surges 19% after the company’s net revenue forecast for the third quarter beat analysts’ estimates.

- Visa (V) gains 1.8% after the payments network company reported first-quarter adjusted earnings per share that were ahead of estimates.

- Walgreens Boots Alliance (WBA) falls 11% after the drugstore retailer suspended its quarterly dividend to conserve cash and strengthen its balance sheet.

Investors are starting to come around to the European region, and Bank of America’s Michael Hartnett recommended diversifying away from the big tech stocks that underpinned last year’s US outperformance. Meanwhile, Trump is poised to unleash his first wave of tariffs on Canada and Mexico on Saturday, taking a gauge of dollar strength toward its best week since mid-November. The cost of hedging against price swings in the Canadian dollar over the next week rose to its highest level since October 2022 in anticipation of greater currency volatility.

“Markets are being too simplistic about Trump,” said Daniel Loughney, head of fixed income at Mediolanum International Funds Ltd. “We feel he will negotiate and threaten, but there will also be carrots.”

In economic data, investors will be watching the latest core price index numbers from the US, the Fed’s preferred inflation gauge, which is expected to pick up slightly in December. Meanwhile, the tech-sector concerns about competitive threats from China, which dominated at the start of the week, showed signs of abating. Reports from some of the largest technology companies in the US have proved resilient, helping stocks recover after Chinese startup DeepSeek shook up markets with its cheaper AI model.

Europe’s Stoxx 600 index headed for its best month in two years as strong earnings reports burnished the appeal of the region’s stocks over pricier Wall Street equities. The European benchmark was set for a 6.5% jump in January amid robust corporate results, European Central Bank easing and speculation the region can avoid US tariffs. Stoxx 600 rose 0.5% on Friday with tech and healthcare are the biggest gainers, while real estate and telecoms are the only declining sectors. Here are some of the biggest movers on Friday:

- Novartis shares rise as much as 3.6% after the Swiss drugmaker reported better-than-expected profit and sales for the fourth quarter and forecast both operating income and net sales growing in 2025.

- Smiths Group shares rise as much as 17%, hitting a record high, after the company announced plans to unlock value by selling two divisions while increasing the size of its buyback.

- Ferragamo shares rise as much as 11% after the Italian luxury goods maker’s fourth-quarter revenue beat expectations, with analysts positive on signs of a turnaround.

- ALK-Abello shares rise as much as 8.2%, the most in more than five months, after Jefferies upgraded the stock to buy from hold, citing optimism about the Danish allergy drugmaker’s growth profile.

- Atoss Software shares gain as much as 6.5%, the most since July, after full-year results from the German workforce management solutions firm surpassed expectations, with analysts highighting margin strength.

- Sanofi shares rise as much as 1.1% after the French firm was upgraded to hold from sell at Deutsche Bank, which sees a “diminishing number of reasons to remain outright cautious” following the drugmaker’s 4Q results.

- Umicore shares fall as much as 7.9% after Kepler Cheuvreux downgraded the Belgian chemicals company to hold from buy, saying the upcoming capital markets day is unlikely to reassure investors about the return objectives of the battery materials business.

- Mexico-Exposed European stocks are underperforming broader markets in Europe on Friday as US President Donald Trump is set to impose tariffs on goods from the country.

- Crayon falls as much as 15%, the most since November 2023, after the Norwegian software and IT firm published preliminary full-year figures that fell short of the company’s own guidance.

- UK Housebuilders are underperforming on Friday after Nationwide Building Society’s report showed house prices stagnated at the start of 2025, suggesting the property market could finally be succumbing to high borrowing costs.

- Elisa shares decline as much as 5.6% after the telecom firm gave tepid guidance for the year, citing a stalling Finnish economy, competition in the domestic market and uncertainties around Russia’s war in Ukraine.

Earlier in the session, Asian equities slip, dragged by losses in Korean tech shares catching up with concerns about the artificial intelligence market after extended holidays. The MSCI Asia Pacific Index fell as much as 0.3%, with AI-trade beneficiary SK Hynix dropping 10%, and Samsung Electronics falling after missing profit expectations. Even with the recent concerns over the impact of DeepSeek’s cheap AI model, the regional benchmark is on track to post a gain for the Lunar New Year week, and its first monthly advance since September. The weakness in Korean memory chipmakers comes after the global selloff sparked by DeepSeek earlier this week. While the Seoul bourse reopened after a four-day holiday, markets remain closed in mainland China, Hong Kong, Taiwan and Vietnam.

In FX, the dollar gained ahead of President Donald Trump’s weekend tariff announcement; the Bloomberg Dollar Spot Index rises 0.2%. The yen underperforms with a 0.3% fall, while the euro slumped as well.

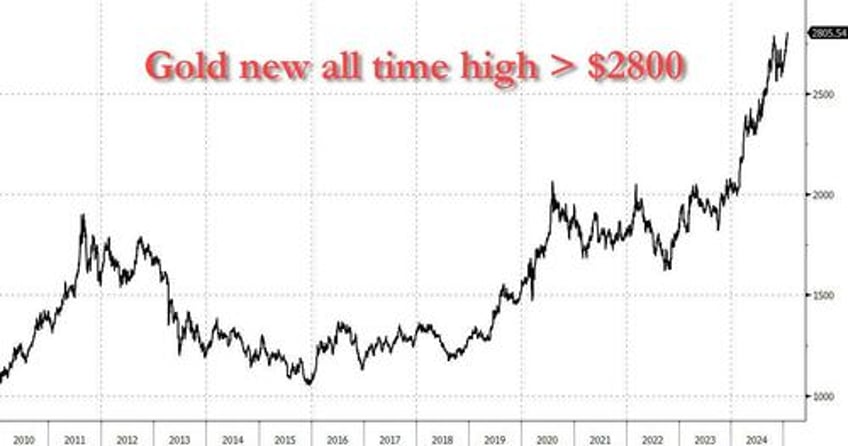

In rates, 10-Y Treasuries fell on bets the potential tariffs could spur inflation and keep interest rates high, while gold was on track for its best month since March as the danger of a trade war spurs haven demand. Long-end Treasury yields are ~1bp cheaper on the day following US President Trump’s late-Thursday repeated pledge of 25% tariffs on imports from Canada and Mexico on Feb. 1, with short-end little changed. US 10-year yield, up 1.2bp at 4.52%, underperforms Germany’s by 5bp, UK’s by 2.5bp; 2s10s and 5s30s spreads are ~1bp wider, near Thursday’s highs. European rates outperform, led by Germany’s, where soft regional inflation gauges unleashed a curve-steepening rally. Focal points of US session include December personal income and spending data including PCE price indexes and a speech by Fed Governor Bowman.

In commodities, oil prices are little changed, with WTI at $72.70. Commodity markets are pricing in elevated odds that crucial raw materials like oil will be included in sanctions against Canadian imports, Goldman Sachs said.

Spot gold surged to a new record high above $2800 and is now in a fast track to hit $3000 over the next few months.

The US economic data calendar includes 4Q employment cost index and December personal income and spending (8:30am) and January MNI Chicago PMI (9:45am, several minutes earlier to subscribers). Fed’s Bowman speaks on the economy and banks at 8:30am

Market Snapshot

- S&P 500 futures up 0.5% to 6,128.00

- STOXX Europe 600 up 0.6% to 542.02

- MXAP little changed at 184.07

- MXAPJ down 0.1% to 576.11

- Nikkei up 0.1% to 39,572.49

- Topix up 0.2% to 2,788.66

- Hang Seng Index up 0.1% to 20,225.11

- Shanghai Composite little changed at 3,250.60

- Sensex up 0.9% to 77,462.05

- Australia S&P/ASX 200 up 0.5% to 8,532.30

- Kospi down 0.8% to 2,517.37

- German 10Y yield little changed at 2.47%

- Euro down 0.2% to $1.0373

- Brent Futures down 0.2% to $76.75/bbl

- Gold spot up 0.1% to $2,796.29

- US Dollar Index up 0.48% to 108.32

Top Overnight News

- President Trump’s advisers are considering several offramps to avoid enacting the universal tariffs on Mexico and Canada that he had pledged, even as he reiterated Thursday that the tariffs are coming. Some officials are now concerned about using emergency powers for tariffs after a federal judge earlier this week temporarily blocked a White House Office of Management and Budget memo that sought to freeze federal grants and loans. WSJ

- US President Trump said China is going to end up paying a tariff as well.

- US President Trump posted on Truth Social that the US will require commitment from BRICS countries to neither create a new BRICS currency nor back any other currency to replace the mighty US Dollar or they will face 100% tariffs.

- US officials are probing whether DeepSeek dodged export curbs on advanced Nvidia chips by buying them through third parties in Singapore, people familiar said. Bloomberg Intelligence said scrutiny probably won’t dent China’s AI progress as it boosts supplies from Huawei. Samsung won approval to supply a less-advanced AI chip to Nvidia for the Chinese market, people familiar said. Shares in rival supplier Micron dipped premarket. BBG

- Japan’s Tokyo CPI for Jan was very hot on the headline at +3.4% (vs. the Street +3%) although core was inline at +1.9% (up slightly from +1.8% in Dec). WSJ

- Underlying inflation in Japan is still slightly below the central bank’s target of 2%, Bank of Japan Gov. Kazuo Ueda said, underlining that it is in no hurry to raise interest rates. WSJ

- France’s CPI for Jan runs slightly cooler at +1.8% (flat vs. Dec and below the Street’s +1.9%). WSJ

- German regional CPIs show a sharp cooling in Jan in certain cases, including Bavaria (+2.5% vs. +3% in Dec), Saxony (+2.4% vs. +3.2% in Dec), Baden Wuerttemberg (+2.3% vs. +2.6% in Dec), and North Rhine Westphalia (+2% vs. +2.5% in Dec). BBG

- Vertex Pharmaceuticals (VRTX) +8% in pre-mkt on light volume following FDA approval of Journavx, an oral, non-opioid painkiller. BBG

- The SEC approved part of an application for a novel ETF that would track the two largest cryptocurrencies, Bitcoin and Ethereum. BBG

- Apple climbed premarket (+3.5%) after reassuring investors that sales will rise in the low- to mid-single digits in the current quarter. Its Greater China revenue and iPhone sales missed. Evercore said the results show Apple can manage the China headwinds with growth elsewhere. BBG

- Buybacks… GS corporate repurchase window opened this Monday with ~28% of the corporate window open today, ~45% next Monday, and 60% by the end of next week (2/7). This demand dynamic switches on in full force next week. GS corporate trading team estimates a record ~$1.16 Trillion worth of executions in 2025 (including S&P and R3000). I use the word “Trillions” a lot. There are 250 trading days in 2025: this is $4.64 Billion per day on average days. This jumps up to ~$7 Billion during open window and drops to ~$3 Billion during closed windows.

A more detailed look at global markets courtesy of Newsquawk

Asian stocks were mostly higher but with gains capped at month-end and as participants digested earnings and tariff threats. ASX 200 printed a fresh all-time high with the index led by strength in gold miners and tech although the defensive sectors lagged. Nikkei 225 remained afloat albeit with momentum restricted by a choppy currency and a slew of earnings. KOSPI underperformed on return from the holiday closure with tech names pressured as SK Hynix got its first opportunity to react to the DeepSeek debacle and Samsung Electronics was also negative despite better-than-expected earnings for Q4 as it provided a pessimistic view for the current quarter.

Top Asian News

- Kalyan Ups Investor Outreach as Social Media Chatter Roil Shares

- RBI Injects $5.10 Billion Via Currency Swap to Ease Cash Crunch

- Asian Stocks Drop as Korean Tech Shares Fall After Holidays

- Philippines’ Stock Benchmark Plunges 4%, Enters Bear Market

- Gold Hits Record High as Trump Tariff Threats Aid Haven Demand

- Philippines’ Marcos Seeks Reassurances From Trump Over Alliance

European bourses (Stoxx 600 +0.5%) opened modestly firmer and continued to edge higher as the session progressed, with indices generally near highs. Overnight, a turnaround in futures began around the time the WSJ posted an article which suggested that the US administration could announce new tariffs by Saturday, but with a grace period to allow for negotiations (the grace period was not initially touted). European sectors opened mixed but now hold a strong positive bias. Tech is the outperformer today, with sentiment in the sector lifted by post-earning strength in Apple, which is higher by around 3.5% in US pre-market trade. Healthcare takes the second spot, lifted by post-earning strength in Novartis (+3.3%). US equity futures are mixed, with the RTY (-0.1%) marginally in the negative territory whilst the tech-heavy NQ (+0.6%) outperforms following results from Apple and Intel (details below).

Top European News

- ECB's Muller says rates are nearing the point where they will not curb investment, via Bloomberg

- ECB's Rehn says "we are confident that inflation will stabilise at its target as projected and monetary policy will cease to be restrictive in the near future"; estimates during the spring and summer.The pace and magnitude of rate cuts will be decided separately at each meeting

- ECB Consumer Expectations Survey (Dec): See inflation in next 12 months at 2.8% vs. Exp. 2.7% (prev. 2.6%); 3y ahead sees 2.4% (prev. 2.4%)

- ECB Survey of Professional Forecasters; sees 2025 inflation at 2.1% (prev. 1.9%); 2026 1.9% (prev. 1.9%), 2027 2.0%

Earnings Summary

- Apple (AAPL) +3.5% pre-market: Q1 revenue rose 4%, but iPhone sales missed expectations, and China sales fell; Mac and iPad sales improved, while wearables declined. The strong growth in its services segment supported its rise afterhours

- Intel (INTC) +1.4% pre-market: Better-than-expected Q4 earnings, though it issued weak guidance, citing seasonality and competition.

- Chevron Corp (CVX) -0.1% pre-market: Q4 EPS missed though revenue beat, announced USD 1.115bln impairment.Announces a 5% increase in Quarterly dividend

- Novartis (NOVN SW) +3.1%: Beat, lifts dividend, requests extended buyback authorisation.

- Samsung Electronics (005930 KS) -2.4%: Forecast slow sales for its AI chips in Q1 due to US export restrictions on China, and struggles to meet Nvidia's (NVDA) requirements, while also forecasting limited earnings growth amid weak memory chip demand.

FX

- DXY is extending on the upside seen yesterday following comments from US President Trump that he will put a 25% tariff on Canada and Mexico because of fentanyl, and stated that China is going to end up paying a tariff as well. It is worth noting that there was a more conciliatory piece overnight in the WSJ noting that the US Administration could announce new tariffs by Saturday, but with a grace period before implementation to allow for negotiation. For today's docket, focus will be on monthly PCE metrics for December, which follows yesterday's quarterly print. DXY has been as high as 108.37 with the next target coming via the 23rd Jan high at 108.51.

- EUR/USD is lower for a fourth consecutive session as the dust settles on yesterday's widely-expected 25bps rate cut from the ECB. Sources in the wake of the meeting revealed that if the GC delivers another 25bps cut in March,it will likely drop the “restrictive” reference to rates. Additionally on the inflation front, French CPI came in softer-than-expected whilst the regionals from Germany appear to be cooler than consensus for the mainland print at13:00GMT. EUR/USD has been as low as 1.0366; lowest since 21st January.

- JPY is softer vs. the USD with havens generally lagging vs. the USD. Overnight saw a deluge of data from Japan whereby headline Tokyo CPI came in firmer than expected, core in-line, IP and retail sales Y/Y beat. USD/JPY currently sits within yesterday's 153.78-155.23 range.

- GBP is slightly softer vs. the USD as UK-specific newsflow remains light in the run up to next week's BoE rate decision and MPR. GBP/USD has just slipped below the bottom end of yesterday's 1.2407-67 range with the next downside target coming via the 1.2392 low.

- Antipodeans are both firmer vs. the USD and attempting to claw back some of the losses from Trump's aforementioned tariff rhetoric yesterday.

Fixed Income

- USTs are in the red, weighed on by the latest Trump-tariff rhetoric. Action which has propped up yields stateside with the short-end leading ever so slightly given the potential near-term tariff implications of any measures. Action which took USTs to a 108-31 trough in the early European morning. However, the complex began to make its way gradually off lows as no late-Thursday announcement came from POTUS as some had guided us towards. Additionally, a WSJ sources piece implied that officials are working to find a way to dial-back the tariff rhetoric/situation. US PCE due.

- EGBs derived a bid from the Prelim. French HICP figures which came in cooler than expected. Thereafter, cooler German State CPIs than implied by the forecasts for the 13:00GMT mainland release alongside a cut to the growth view in the ECB SPF sparked a dovish reaction, though perhaps somewhat capped by a jump in EBC SCE inflation views. Specifically, Bunds lifted from just below the 132.00 handle to a 132.45 session high over the course of five/six minutes vs current 132.30.

- Gilts moved in tandem with peers throughout the morning. Began the session with very modest upside, as the dovish impulse from the French data and general UST pickup off lows served to offset bearish pressure from the Trump tariff updates. Gilts currently around 92.60.

Commodities

- Crude benchmarks find themselves at session lows though the pressure is only modest thus far, WTI and Brent at the trough of USD 72.63-49/bbl and USD 75.69-76.44/bbl bands. Focus of course on the tariff situation and in particular Trump’s remark that he would be deciding by Thursday (i.e. yesterday) on whether or not to impose tariffs on oil on Canada and Mexico.

- Gold made fresh record highs above the USD 2800.00/oz mark. Thus far, has eclipsed the figure by exactly one dollar. Upside which has been driven despite the USD strength and overnight yield advances.

- Base metals are mixed, albeit with a slight downward bias; price action has been relatively rangebound with 3 LME copper within a USD 9,068-9108.80/oz range.

- Russian gas supplies to Europe via Turkstream pipeline have reached record monthly high of more than 50mcm per day in January

- Oman Crude OSP calculated at USD 80.26/bbl for March, up USD 7.10 vs Feb

- Kaztransoil says Kazakhstan plans to supply 22,000 T of oil from Kashagan field via Baku-Tbilisi-Ceyhan pipeline in January.

- Ukraine's Military says it struck an oil refinery in Russia's Volgograd region, causing a fire.

- Commerzbank sees upside potential for Palladium prices, expects it to rise to USD 1150/oz by end-2025

Geopolitics

- Lebanese media Al Mayadeen posted on X that Israeli warplanes struck several areas on Lebanon's eastern border with Syria which it stated marked another set of blatant violations of the ceasefire agreement.

- US military said it killed a senior operative of Al-Qaeda affiliate terror group Hurras Al-Din in northwest Syria.

- Israeli PM Netanyahu "will hold security consultations today to discuss the possibility of stopping the deal and the possibility of returning to fighting immediately", according to Al Jazeera.

US Event Calendar

- 08:30: Dec. Personal Income, est. 0.4%, prior 0.3%

- Dec. Personal Spending, est. 0.5%, prior 0.4%

- Dec. Real Personal Spending, est. 0.3%, prior 0.3%

- Dec. PCE Price Index MoM, est. 0.3%, prior 0.1%

- Dec. PCE Price Index YoY, est. 2.6%, prior 2.4%

- Dec. Core PCE Price Index YoY, est. 2.8%, prior 2.8%

- Dec. Core PCE Price Index MoM, est. 0.2%, prior 0.1%

- 08:30: 4Q Employment Cost Index, est. 0.9%, prior 0.8%

- 09:45: Jan. MNI Chicago PMI, est. 40.0, prior 36.9

DB's Jim Reid concludes the overnight wrap

It's a sad day today. My 5 year fixed mortgage at 1.45% runs out. If you've seen UK yields recently you know what comes next. While I reduce the kids pocket money tonight to help offset the sizeable increase, we come to the end of a frantic week, and month end, with a busy couple of days still ahead with US core PCE and European inflation data today and a self imposed tariff deadline from Trump to Canada and Mexico tomorrow.

This latter topic moved back to the top of investors’ attention late in the US session yesterday as Trump said that he plans to follow through on his threat to impose 25% tariffs on Feb 1, saying that “we’ll be announcing the tariffs on Canada and Mexico for a number of reasons”, citing trade deficits, immigration and fentanyl flows. In the context of fentanyl, Trump also again raised the prospects of new tariffs on China. Trump’s comments did leave an open question on the exact scope of tariffs to be announced, notably saying he was still considering whether Canadian oil would be exempted. We’ll have to wait and see just what measures are implemented, or indeed if last minute concessions might yet be reached, or if the most aggressive tariffs are short lived. But it does look less likely that Feb 1st will pass with no tariff action and the exact approach may be instructive for how the new administration are going to approach the tariff question more broadly. I mentioned at the start of the week that Mr Trump has to follow through on some of his threats or he will lose some negotiating power.

Markets again showed that they’re reactive to tariff headlines even if only a relatively mild tariff agenda is broadly priced in. The most persistent reaction last night came in FX, with the broad dollar index trading +0.38% above yesterday’s European close as I type, while the Mexican peso and Canadian dollar closed -1.05% and -0.46% weaker respectively. Trump’s comments also drove a broader risk-off reaction, though this proved mostly short-lived as the exact scope of the tariff threat remained unclear. The S&P 500 fell from trading up +0.7% to being flat on the day, but then recovered to close +0.53% higher. Traditional US automakers were particularly affected, with GM and Ford initially slumping by -6% and -2% respectively, though they reversed about half of the drop by the close.

The other main event overnight were Apple’s results after the bell. The world’s most valuable company (taking over from Nvidia on Monday) delivered a marginal earnings and sales beat, with disappointing iPhone sales and China revenues offset by strong growth in the company’s services division. On the whole, investors appeared reassured by guidance that revenue growth is expected in the low- to mid-single digits in the coming quarter, with Apple’s shares rising 3% in after-market trading after retreating -0.74% in the regular session yesterday. This morning in Asia, S&P 500 (+0.24%) and NASDAQ 100 (+0.54%) futures are higher with the former exactly where it was now before the tariff headlines last night.

Notwithstanding the tariff-driven volatility late in the US session, markets put in a solid performance yesterday, with the S&P 500 (+0.53%) seeing 413 stocks advance, whilst gold prices (+1.28%) closed at a record high of $2,74.59/oz. That was supported by a robust set of US data, which showed the economy rounded out 2024 in decent shape, whilst the weekly jobless claims also came in beneath expectations. However, it was a very different story in Europe, where data showed the German and French economies contracted in Q4, whilst the Euro Area as a whole was stagnant. Yet despite the clear divergence in economic outcomes, European assets still put in the much stronger performance yesterday, with the STOXX 600 (+0.86%) up to another record.

Looking at the US data in more detail, Q4 GDP growth came in at an annualised pace of +2.3% (vs. +2.6% expected), whilst the full-year number for 2024 was at +2.8%, just a tenth beneath the +2.9% rate in 2023. So there was little in the way of obvious warning signs, and the inflation numbers were broadly as expected too, with core PCE running at a +2.5% rate. At the same time, there were fresh signs that the labour market was still strong into 2025, with the weekly initial jobless claims down to 207k in the week ending January 25 (vs. 225k expected). Moreover, that pushed the 4-week moving average down to 212.5k, which is its lowest level since April.

This helped US equities advance, with broad positive sentiment outweighing lingering concerns around big tech. The overall positivity saw the equal-weighted S&P 500 rise +1.03% on the day, whilst the small-cap Russell 2000 was up a similar +1.07%. On the other hand, the Magnificent 7 underperformed (+0.04%). This was mainly because of Microsoft’s decline (-6.18%) following its earnings the previous day, but there was also heightened volatility for Nvidia, which at one point was down -4.5% to within a percent of its Deep Seek inspired lows from Monday, but recovered to close +0.77% higher on the day. Separately, UPS (-14.11%) posted its worst daily performance since it went public in 1999, after its revenue forecast for 2025 fell short of analysts’ expectations. In the meantime, US Treasuries posted modest gains, with the 10yr yield ending the day down -1.3bps to a new 2025 low of 4.52%. They are back to 4.54% overnight.

Over in Europe, the main story was the ECB’s latest decision yesterday, where they delivered a 25bp rate cut as expected. That took their deposit rate down to 2.75%, meaning that they’ve now cut by a total of 125bps since they began last June. Looking forward, it was clear that further cuts were on the agenda, as the statement still described monetary policy as “restrictive”, and President Lagarde said “we are not at the neutral rate”. However, Lagarde didn’t want to signal how long they’d keep cutting for, saying that “it would be premature at this point in time to talk about the point where we have to stop”. Our European economists did not see anything in yesterday’s press conference to suggest that a “skip” has become more likely at the upcoming meetings. They maintain a baseline of 25bps continuing through H1, predicated on their view of below-trend growth and inflation falling moderately below target. Later in the day, we did hear some more hawkish ECB sources stories suggesting that ECB could drop the description of stance as “restrictive” at the next meeting in March and that some of the policymakers were open to the possibility of a pause by the April meeting.

European bonds rallied across the continent, with yields on 10yr bunds (-6.6bps), OATs (-5.8bps) and BTPs (-6.3bps) all falling. However, much of the decline in yields came earlier on after data showed that major economies saw weaker growth than expected in Q4, which added to the sense that the ECB would have to keep cutting rates in the months ahead. For example, the German economy contracted by -0.2% (vs. -0.1% expected), while France contracted by -0.1% (vs. 0.0% expected). In turn, that meant the Euro Area as a whole saw no growth in Q4 (vs. +0.1% expected). But despite the weak growth momentum, European equities continued to rally, with the STOXX 600 up +0.86% to a new record high. In fact, that now brings its YTD gains for 2025 up to +6.15%, which means it’s already surpassed the +5.98% gain it made in 2024.

Elsewhere in Europe, we’re now just over three weeks away from the German election, which is taking place on February 23. Our German economics team published an interesting blog on the campaign yesterday (link here), where they write how the campaign has become more heated and fraught in the last week. That comes after the CDU tabled a plan for a material tightening of German migration policy, which passed with the votes of the AfD, marking the first time that a centrist party has submitted a motion implicitly relying on AfD support. They point out how these events could cause a material shift in the polls, and challenge mutual trust between the Conservatives and the SPD and the Greens, thus challenging the cohesion of the next coalition from the start.

In Asia, the Nikkei (+0.26%) and the S&P/ASX 200 (+0.55%) are trading higher while the KOSPI (-1.21%) is trading sharply lower following a four-day break after index heavyweight – Samsung Electronics reported a smaller-than-expected profit. Elsewhere, markets in mainland China and Hong Kong remain closed for the Lunar New year holiday.

Early morning data showed that retail sales in Japan surged at its fastest pace since June 2024, jumping +3.7% y/y in December (v/s +3.2% expected), much higher than the +2.8% increase in the previous month. Meanwhile, industrial output rebounded +0.3% m/m in December (v/s +0.2% expected), picking up from the -2.2% contraction seen in the previous month. Separately, Tokyo CPI, excluding fresh food, rose +2.5% y/y in January, compared with +2.4% the previous month. This was is in line with Bloomberg estimates. Japan’s unemployment rate for December fell to 2.4% from 2.5% in the previous month (2.5% expected). Australia’s PPI rose +3.7% through the year to the December 2024 quarter. This is the lowest reading since the December 2021 quarter.

To the day ahead now, and data releases from the US include PCE inflation for December, the Employment Cost Index for Q4, and the MNI Chicago PMI for January. Meanwhile in Europe, there’s the German and French CPI prints for January, and in Germany we’ll also get December’s retail sales and January’s unemployment. From central banks, we’ll hear from the Fed’s Bowman and the ECB’s Villeroy. Finally, earnings releases include ExxonMobil.