The revival of nuclear power generation could get an enormous boost as more than a dozen of the world's largest banks and financial institutions are pledging support to new projects aimed at tripling global nuclear energy capacity by mid-century.

Financial Times reports that White House climate policy adviser John Podesta and fourteen of the world's largest banks and financial institutions, including Bank of America, Barclays, BNP Paribas, Citi, Morgan Stanley, and Goldman Sachs, on Monday are expected to support a COP28 declaration outlined in late 2023 to triple nuclear energy capacity by 2050.

The banks appear to be aligning with COP28's "Declaration to Triple Nuclear Energy," which specifies, "Recognizing the key role of nuclear energy in achieving global net-zero greenhouse gas emissions/carbon neutrality by or around mid-century and in keeping a 1.5°C limit on temperature rise within reach."

No specifics will be mentioned today about how the banks plan to support nuclear power projects, but FT quoted energy experts who said this support has been long-awaited as atomic power will be crucial to power AI data centers, electric vehicles, and other quickly emerging electrification trends.

"This event is going to be a game-changer," said George Borovas, head of the nuclear practice at law firm Hunton Andrews Kurth and a World Nuclear Association board member. He said that until now, banks have discovered that funding new nuclear projects is very tricky.

Borovas said, "Banks at their senior management level would just say, we don't understand anything about nuclear. We just know it's very difficult, very controversial." He added that support from the banks would allow nuclear power to be "part of the solution for climate change" rather than "a necessary evil."

Today's event with Podesta and big banks comes just days after the owner of Three Mile Island announced plans to invest about $1.6 billion to revive the nuclear power plant near Middletown, Pa., and locked in a 20-year energy contract to sell the power to Microsoft. Microsoft is seeking low-cost 'green' power to supply regional artificial intelligence data centers.

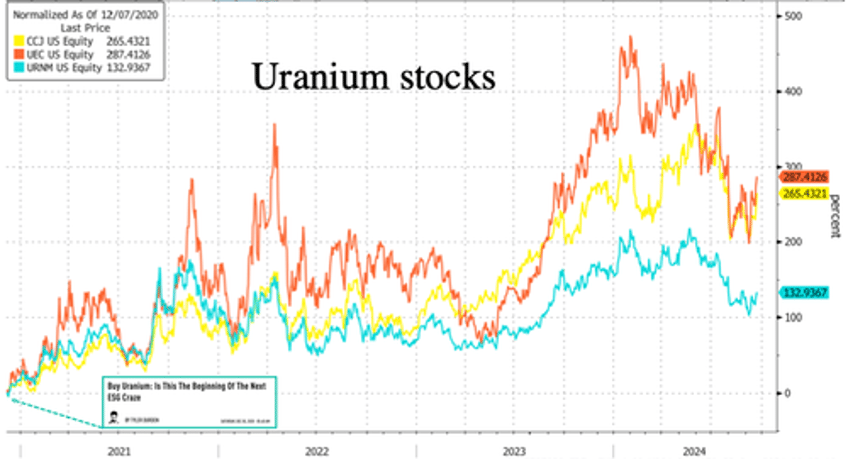

This momentum continues our "Next AI Trade," which we pointed out in April of this year, where we outlined various investment opportunities for powering up America, which are already underway. It goes back nearly four years ago to when we first told readers, "Buy Uranium: Is This The Beginning Of The Next ESG Craze."

BNP told FT there was "no scenario" in which the world could achieve carbon neutrality by 2050 without atomic power. Barclays noted that its nuclear support comes from wind and solar power generation, which is unreliable on grids.

FT noted that other financial institutions expressing support for nuclear power include Abu Dhabi Commercial Bank, Ares Management, Brookfield, Crédit Agricole CIB, Guggenheim Securities, Rothschild & Co, Segra Capital Management, and Société Générale.

Meanwhile, the West needs to wake up to the radical climate activists within governments who have pushed damaging de-growth policies by targeting fossil fuels. These policies have driven energy prices sky-high, while Asia continues to operate fossil fuel power plants and expand nuclear capacity. In other words, these climate activists are essentially allowing China to gain more economic power while the West sputters into energy chaos. It's time to reverse this nonsense.

Furthermore, here's Goldman's latest note on uranium prices that are only expected to "stairstep" higher over time.