Published at Theya. Follow Joe on X.

Theya is the world's simplest Bitcoin self-custody solution. With our modular multi-sig vaults, you decide how to hold your keys.

Whether you want all your keys offline, shared custody with trusted contacts, or robust mobile vaults across multiple iPhones, it's Your Keys, Your Bitcoin.

Download Theya on the App Store.

the cliff-notes:

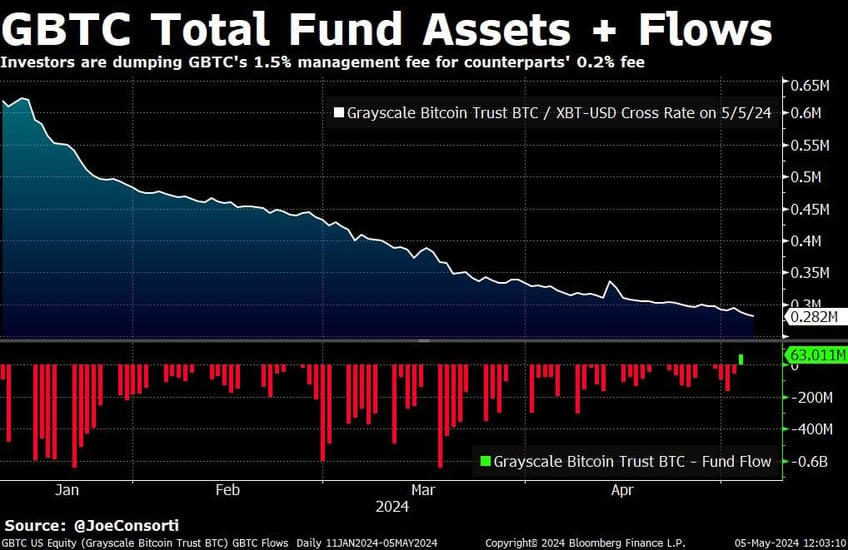

- GBTC had its first net inflow since converting to a spot ETF in January

- Bitcoin has plenty of room to run thanks to buyer behavior and macro factors

Welcome back to Theya. GBTC saw its first inflow on Friday, some $63-million came into the vehicle. This is a big paradigm shift. GBTC has persistently had net outflows, over 80 trading days of them. During the outflow regime, it sold over 300,000 bitcoin, making Grayscale the single-largest net seller of bitcoin for 4 months straight.

This is great news. It paints a picture of bullishness towards bitcoin in the broader market, following suit with the recovery in stocks after its own correction following 7 months of green candles. It also means that the largest net seller of bitcoin is, at least for now, a net buyer:

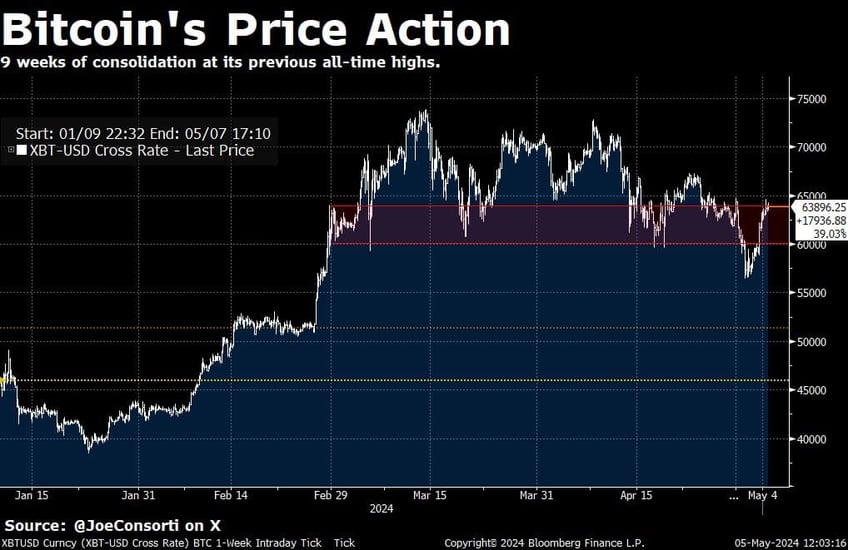

During those same 4 months when one entity was dumping 1.52% of bitcoin's circulating supply, it still managed to rise over 40% and breach new all-time highs. It has also remained rangebound during the marketwide selloff in risk that began with stocks. Now that the single-largest entity is a net seller and marketwide risk appetite is increasing again after the correction, the case for continuation in the bitcoin bull market is made even stronger:

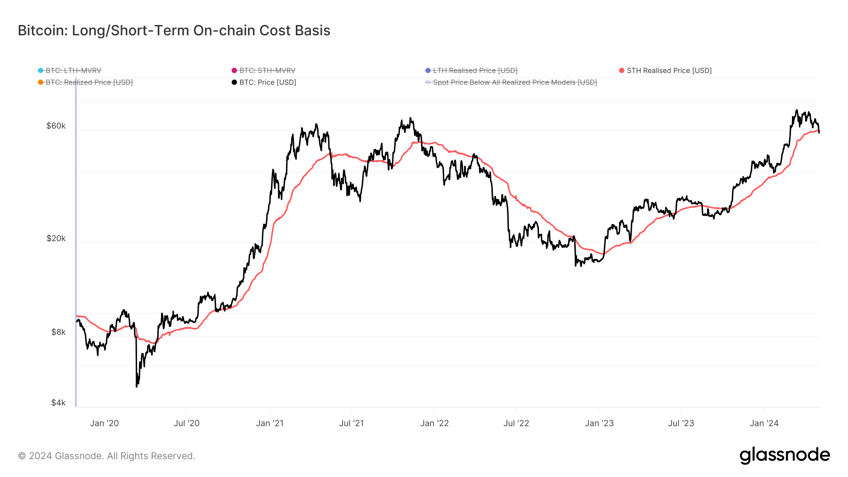

Note how cleanly bitcoin bounced off of the short-term holder cost basis. This level is important. Short-term, in-and-out-type buyers are a staple of bitcoin bull markets.

When the market price dips below the average purchase price and keeps dipping, it sparks a massive feedback loop of selling as these fairweather buyers try to cut their losses, sending bitcoin's price tanking. When the market price bounces cleanly off of the STH cost basis, it indicates that buyers are doubling down on their purchase, and scooping up some more coins at their former purchase price in an effort to gain even more exposure to the bull run they expect to continue.

More optimism on the side that this bull run has plenty of steam left in it:

The monetary policy-side of it all is leaning from restrictiveness to easiness, at least on the horizon.

Huge job misses last week and the unemployment rate ticking up by 10 basis points has elicited a more-dovish-than-expected response from the Fed. I've talked about how the pricing for interest rate cuts has been pushed out into next year and the size of expected cuts has been reduced—following the recent slew of less-than impressive data and last week's cautiously dovish FOMC meeting, the odds of larger rate cuts sooner have risen. The Fed also went on to confirm it would be going ahead with its already-announced plan to slow the pace of reducing its balance sheet assets, which supports financial markets and will let risk-taking thrive as we head into the November election.

Given this forecasted easiness in rates and balance sheet restrictiveness, it may be said that the dollar's strength relative to other foreign currencies has topped out for this cycle. This is good for bitcoin. When the dollar (candles) is weak bitcoin (blue line) is strong and vice versa:

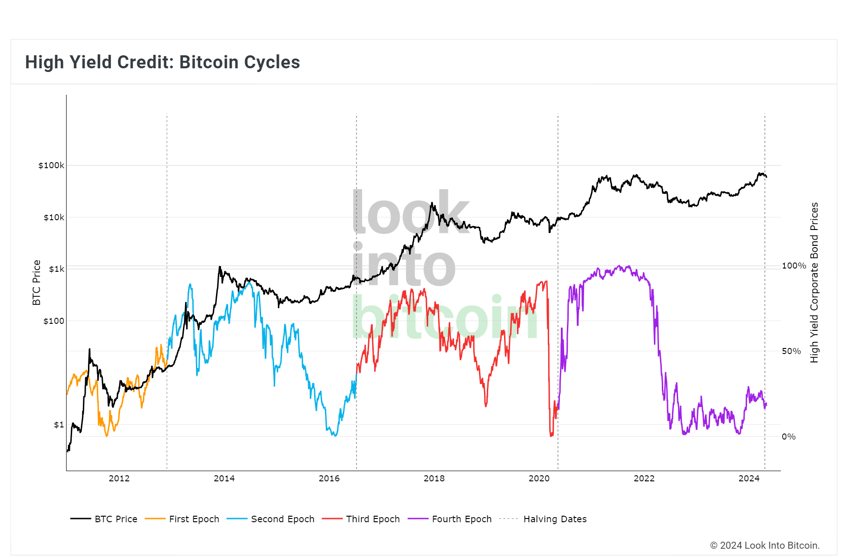

One final chart for today: the price of high-yield corporate bonds has not reached anywhere near its historical peaks during credit cycles. Bitcoin has historically risen when HY corporate bond prices are soaring and yields are low. Judging by this relationship, bitcoin still has plenty of gas in the tank from a macro risk-on perspective:

Final thought: have an excellent week everyone, and start self-custody with Theya!

Take it easy,

Joe Consorti

Theya is the world's simplest Bitcoin self-custody solution. With our modular multi-sig vaults, you decide how to hold your keys.

Whether you want all your keys offline, shared custody with trusted contacts, or robust mobile vaults across multiple iPhones, it's Your Keys, Your Bitcoin.