By Graham Summers, MBA | Chief Market Strategist

Yesterday I shared a chart that helped us to determine that the S&P 500’s correction was a “buy the dip” opportunity, NOT the start of a serious correction/ bear market.

By quick way of review…

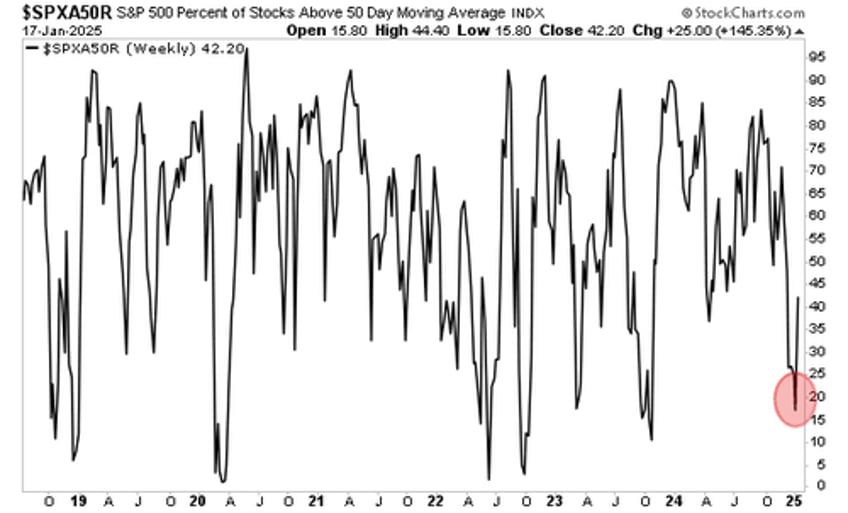

1) The chart showed the percentage of S&P 500 companies trading above their 50-day simple moving average (DSMA). This is a GREAT tool for tracking where the market is trading relative to its prior trend.

2) Prior to last week’s rally, the reading on this chart had fallen to ~15%.

3) A reading this low is typically associated with significant market bottoms. Indeed, the only times the reading has fallen lower during the last five years was during the pandemic crash or the major bottoms of the 2022 bear market.

You can review the chart below.

I sincerely hope all of you bought the dip. If you did, you’ve made a significant return on your trade as the S&P 500 has ripped higher by 280 points in the span of a single week.

Our research indicates this move is just getting started.

High yield credit typically leads the stock market. The reason for this is that high yield credit investors are typically more sophisticated/ sensitive to macro changes for the simple reason that they are investing in bonds that have a high probability of default. As a result of this, high yield credit can give clues as to where stocks will be heading.

The short answer today is “UP, A LOT.”

The high yield credit ETF (HYG) is back at its all-time highs. This strongly suggests stocks will be moving sharply higher from here.

Ultimately, it all comes down to this: as investors, our goal is MAKING MONEY.

To do that, you NEED to know when to “buy the dip” and when to get out of stocks to avoid bear markets. And the best way to do that is to use real quantifiable tools, not opinions, that tell you when to get out to the markets.

To start receiving these kinds of actionable insights, join 56,000 readers in over 56 countries in receiving our daily market alert every weekday before the markets open (9:30AM EST).

Subscribe to Gains Pains & Capital!

Best Regards

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research