What’s behind the numbers?

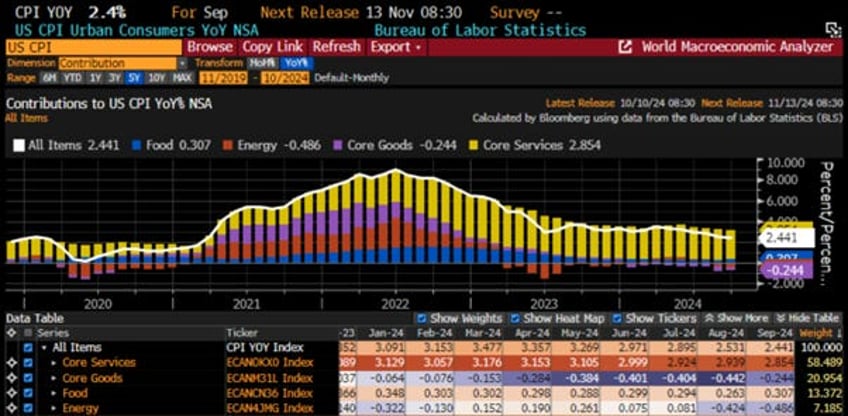

After the summer's relatively in-line CPI data, the third quarter ended with the US headline CPI rising +0.2% MoM, hotter than the expected +0.1% and unchanged from August's MoM change. Thanks to the last disinflationary base effect of the year, the YoY increase was +2.4%, above the expected +2.3% but lower than August's +2.5%. Energy and core goods saw another deflationary YoY in September, while core services, making up 58% of the headline CPI, grew 2.85% YoY in September, down from August's 2.93%. Food inflation reaccelerated from +0.26% YoY to +0.31% in September.

The core CPI rose by +0.3% MoM, exceeding the expected +0.2% and matching August’s pace. On a YoY basis, as the base effect no longer offers disinflation for core CPI, it increased by 3.3%, hotter than the expected +3.2% and slightly higher than August. Core services are still rising at +3.6% YoY, contradicting claims that inflation has been defeated. Core goods deflation eased from -0.55% YoY in August to -0.30% in September. Notably, this marks the 52nd consecutive month of MoM core CPI increases.

- On a more positive tone for those anticipating further illusionary disinflation, the Owners' Equivalent Rent (OER), a key indicator of inflation stickiness, decelerated from +0.49% MoM in August to +0.33% in September, marking the smallest monthly increase since June. On a YoY basis, this resulted in a +5.2% annual pace, down 0.2% from August, suggesting that while property-related inflation is moving in the right direction, it will remain a significant headwind for those hoping inflation is a thing of the past.

Finally, a data point that should concern the Fed Chairman, who prematurely declared ‘mission accomplished’ on inflation and recklessly cut the FED Funds rate by 50 bps in September to satisfy his partisan political ego, is the Super Core CPI. It reaccelerated on a MoM basis from +0.33% in August to +0.40% in September. This monthly increase pushes the YoY change to +4.59%, up from +4.49% last month, the highest since January 2023, and far above the increasingly unrealistic 2% inflation target.

Thoughts.

The September CPI is conveniently the last inflation data to be released before the D-day of the year of political hell (November 5th), and it also conveniently the last set of data to benefit from the illusory disinflationary base effect. This will give the current president's candidate responsible for the current inflation driven misery a reason to prattle to anyone willing to believe what lies behind the ‘CPLie’ that the fight against inflation has been declared a mission accomplished. However, even before the base effect becomes inflationary again, the September data shows that core and super-core CPI are rising once again on a yearly basis, signalling that investors should brace for the return of the inflation boomerang at the headline level sooner rather than later. Indeed, investors must remember that oil prices are up 11% month to date and that natural disasters are inflationary. They widen budget deficits, disrupt supply chains, and cause temporary surges in demand for certain goods, which will inevitably translate into higher goods inflation in the coming months, while services inflation is still running at over 3% year-over-year.

While some may still believe in the data delivered by the "CP-Lie" and fail to understand the concept of base effects, the reality, as Biden admitted on the campaign trail, is that the Inflation Reduction Act was never about reducing inflation but about implementing another round of Keynesian policies, which, much like the Affordable Care Act, has added to inflation-driven misery for consumers and investors. In fact, the less than 4-year Biden's presidency has shown a similar inflationary increase to what was recorded under George Bush Jr.'s two terms from 2000 to 2008.

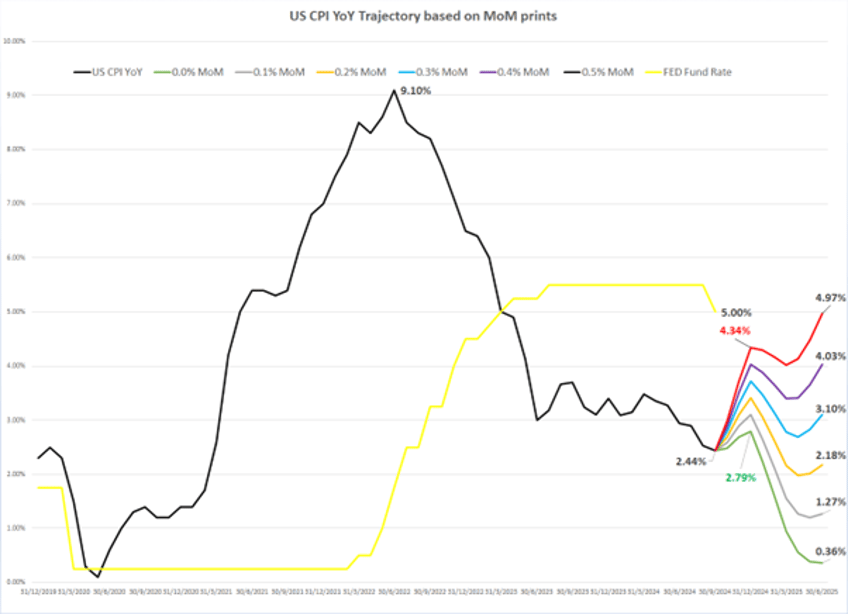

Instead of perpetuating the political forward illusion that the 2% inflation target is within reach sooner rather than later and declaring 'mission accomplished,' investors, likely savvier than the thousands of PhDs at the partisan FED, understand that hitting 2% by year-end is mathematically impossible. Even achieving this target by mid-2025 would require a miraculous disinflation to occur in the first six months under the 47th U.S. president, whoever that may be. Indeed, anyone who understands the base effect can draw the following conclusions:

A return to 2.0% inflation in 2024 is mathematically impossible. Even if the CPI prints 0.0% month-over-month for the remainder of the year, the year-over-year change will still end above 2.5% as the disinflationary base effect fades by the last quarter. Should month-over-month prices reaccelerate, as it should under with the recent rebound in oil prices, the CPI year-over-year figure would finish above 3% or even higher.

For the CPI year-over-year change to return to 2% or lower by the end of the first half of 2025, the monthly inflation rate would need to remain consistently at 0.2% or below for the next 9 months.

If the month-over-month inflation rate reaches 0.2% or higher over the next 9 months, the year-over-year CPI change will land between 3% and 5% by the end of June next year. This would then force the FED to raise rates in an economy already suffering from war-related shortages and increasingly resembling the war-driven economy of the 1940s.

Whoever is chosen as the next tenant of the White House in 2025 and beyond will have to deal with an inevitable return of inflation. Not only will the base effect of the CPI turn from disinflationary to re-inflationary due to simple mathematics, but the escalation of the war cycle, from Eastern Europe to the Middle East, and next North Asia will inevitably push oil prices higher, which will ultimately be inflationary for the US.

WTI price (blue line); US CPI YoY change (histogram) & Correlations.

As a matter of fact, higher oil prices will only be reflected in the US CPI YoY change after Americans have cast their votes. However, last month, the Food and Agriculture Organization's Food Price Index rose 3% from August, marking the fastest monthly increase in 18 months and marking the first positive YoY change since November 2022. This surge has been fuelled by the war in Eastern Europe, escalating Middle Eastern conflicts, disrupted supply chains, extreme weather, and aggressive monetary policies, all contributing to persistent food inflation.

UN Food and Agriculture World Food Price index (Upper panel; blue line); YoY change in UN Food and Agriculture World Food Price index (Lower panel; red line).

It's not just food prices that have risen recently. As China implements a new stimulus designed to reinvigorate its domestic consumers' confidence, even industrial metals have been on the rise, as shown by the recent rebound in the Bloomberg Industrial Metals Index. Higher food, oil, and industrial metal prices will accelerate the inevitable return of the inflation boomerang, as the Malthusian agenda linked to wars and the climate change scam, imposed by the reckless governments ruling the US and the Western world, remains the principal source of structural inflationary pressures.

Bloomberg Industrial Metals Index (blue line); US CPI YoY change (histogram) & Correlations.

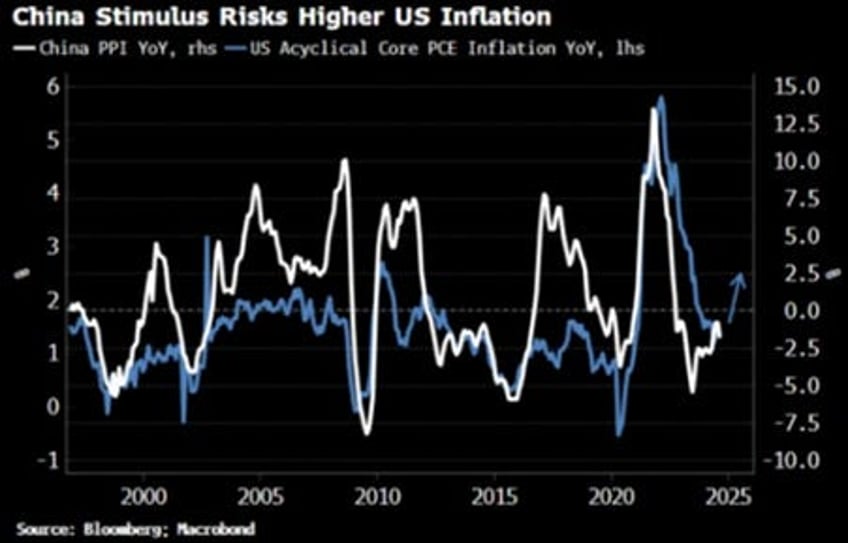

Adding to the reflationary threats from the politically and partisan-driven FED rate cut in September is the recent stimulus launched by China, which is likely to accelerate the return of the inflation boomerang in the US and across the Western world. The San Francisco FED breaks down core PCE into cyclical and acyclical components: cyclical components are highly correlated with FED policy, while acyclical components cover the rest. Over the past 24 months, the bulk of the disinflationary illusion in core PCE has been driven by the fall in acyclical PCE, while core PCE remains at 40-year highs. Unsurprisingly, for those with a basic knowledge of economics, acyclical PCE has closely tracked the ups and downs of China's PPI (linked to China economic activity) over the past two decades.

At the end of the day, before popping the champagne and declaring inflation a thing of the past, investors should never forget that historically, inflation moves in waves. As the 2020s resemble the 1970s lost decade, with geopolitical unrest (i.e., wars) and structural inflation driven by tighter regulations, tied to the climate change scam and the ludicrous Diversity, Equity, and Inclusion narrative, investors should hold their breath for the second wave of inflation.

US CPI YoY Change between 1970 and 1979 (blue line); between 2017 and 2027 (red line).

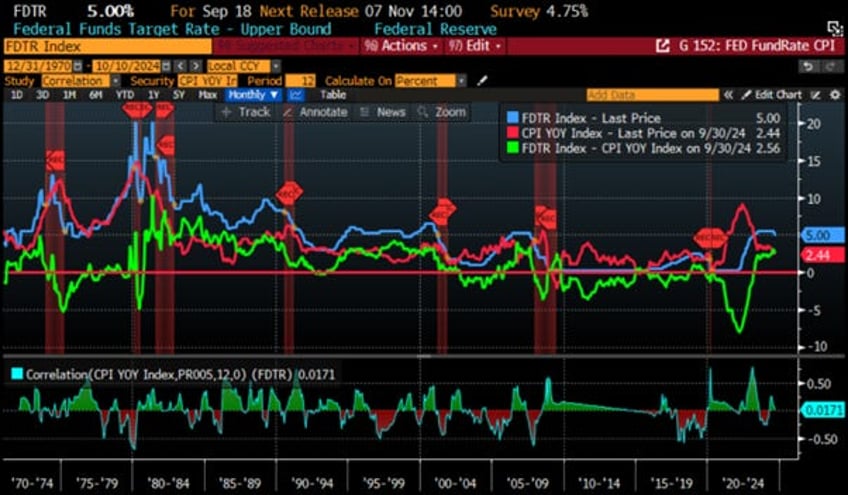

Therefore, the 2% target is now at best a floor rather than a ceiling or average. This means that in a 3%-4% inflation environment, a 5% interest rate is far from being restrictive.

FED Fund Rate (blue line); US CPI YoY change (red line); Spread between FED Fund Rate & US CPI YoY Change (green line) and correlation.

This also means that the rebound in long-dated yields since the partisan and politically driven FED rate cut on September 18th is far from over, and the new normal after the US presidential election will likely see the US 10-year yield between 4% and 5%, rather than below 4%.

US 10-Year Yield (blue line); US CPI YoY Change (histogram); Correlation & US Recessions.

- Those who believe that a partisan FED chairman and 'Kamunism' will solve the inflation problem are in for a rude awakening, as price controls, taxes on unrealized gains, and further uneconomical spending on the climate change scam and DEI fantasies will only lead to more inflation-driven misery.

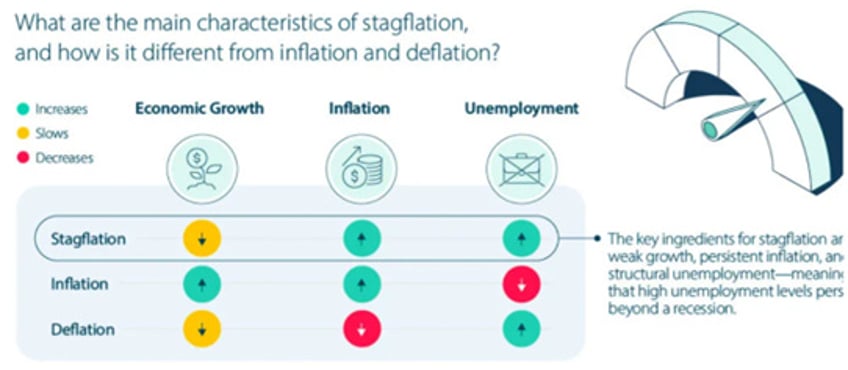

Finally, combining the latest 'CPLie' report with the September non-farm payroll report, which showed that job creation is being driven by government-related sectors, jobs that are notoriously unproductive and do not contribute to GDP while further growing the national debt, the US, like other Western countries, is entering a period where the inflation rate will exceed economic growth. This is the essence of STAGFLATION and will be painful for investors who have not prepared their portfolios for such a scenario. This means people will buy even less for even more, and this environment will be painful for those still blindly following Wall Street's ‘Forward Confusion’ narrative of seeking refuge into fixed income and government bonds while physical gold is the only asset to thrive across an inflationary bust.

Bottom line: Any savvy investor should know that, regardless of who occupies the White House after January 20th, the US is just months away from a reflation that will trigger a second wave of inflation, much like the 1970s. Although inflation has cooled, it is now reaccelerating at the core level, and with the base effect fading, headline inflation is set to rebound. With rising geopolitical and domestic unrest, stagflation will likely worsen in the coming quarters. As in the 1970s, when wars and turmoil drove inflation, actively trading equities and holding a substantial part of the portfolio in hard assets like physical gold, rather than long-dated bonds, will be the best strategy for preserving wealth amid rising taxes and structural inflation driven by war-induced shortages.

While some believe more government intervention, price controls, and taxes on unrealized gains will reduce inflation, anyone with common sense knows that, as Ronald Reagan famously said, 'We don’t have inflation because the people are living too well. We have inflation because the government is living too well.'

Read more and discover how to position your portfolio here: https://themacrobutler.substack.com/p/get-ready-for-reflation

If this report has inspired you to invest in gold and silver, consider Hard Assets Alliance to buy your physical gold:

https://hardassetsalliance.com/?aff=TMB

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at

Unlock Your Financial Success with the Macro Butler!

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.