When I hit the streets back in ’81

Found a heart in the gutter and a poet’s crown

I felt barbed wire kisses and icicle tears

Where have I been for all these years?

I saw political intrigue, political lies

Gonna wipe those smiles of self-satisfaction from their eyes

— Marillion, White Feather

In my last post, Part I, I asked the question, “Where do we go from here…” knowing that we have political upheaval in the West we haven’t seen in the US since the 1860’s. Joah Bii-Den! fulfilled his promise to divide the country further with a speech commemorating the riot at The Capitol that sounded better in the original German (H/T Dennis Miller).

The general theme of my first five observations on where things are headed in 2024 build off the basic premise that Davos et.al. would rather burn the world to the ground than give up their perception of control over it.

Like in 2023’s prediction post the controlling idea of inflation returning in the second half of the year informed most of my commentary, this Globalist Temper Tantrum is central to my thinking this year.

And believe me, I will be happy to be wrong about this. Happier than I can fully express in words.

That temper tantrum, however, is now facing the natural opposition from, for lack of a better term, normal people. So, bound up in these predictions will be the idea of the counter-revolution as people come into their own, master their fear of the establishment, and stride forth with purpose. I’ve seen it building for years across the West. 2024 is, I believe, where these two titanic societal forces meet on the battlefield and determine humanity’s future.

It will come down to how hard will they beat us while we decide just how ungovernable we will become. History tells me people always win over systems.

#6 – Political Upheaval in the Heart of Globalism

For years I’ve been developing the idea that the European Union is the model for Davos’ more perfect technocratic union. It’s built on many of the ideas put into practice in the 20th century in the USSR and China.

It’s one of the controlling ideas of everything I write about on Gold Goats ‘n Guns. Globalism isn’t just an idea, it is a religion and a process to be methodically implemented over time. This is a multi-generational thing. It doesn’t mean that anyone is actually in charge of anything, it means that there are people pulling levers as if they are in charge of everything.

So, what’s been building for years in Europe has been wholly predictable as there are wildly different cultures, histories of inter-tribal wars, language barriers, and differing legal constructs all embedded deeply within the DNA of the people who live there.

Hungary is off the reservation and takes control over the European Council Presidency in July. The Netherlands held massive farmers’ protests which ended in snap elections and Geert Wilders’ Party for Freedom (PVV) winning. The heart of the EU is seizing at the exact moment when the EU is pushing to consolidate political and economic power.

The European Parliamentary elections won’t likely change anything ultimately as the European People’s Party (EPP), currently the largest party in that body, will win again. There won’t be any change at the nominal top. It’s digging into the details of what is happening in Germany, however, that is the key to seeing what comes next.

Because the EU rests on the idea of a Germany willing not only to lead the EU, in a kind of political Fourth Reich, but also spending what’s left of its soul as Germany to make that happen.

I was expecting to write about Germany’s political woes in this post before I heard about their trucker’s revolt that’s going on as I type. The current coalition government is unwieldy. It’s polling numbers are actually worse than US Democrats’ at this point.

Germany, INSA poll:

— Europe Elects (@EuropeElects) January 7, 2024

CDU/CSU-EPP: 31% (-1)

AfD-ID: 23% (+0.5)

SPD-S&D: 16% (+1)

GRÜNE-G/EFA: 12% (-1)

FDP-RE: 5%

LINKE-LEFT: 4%

FW-RE: 3%

+/- vs. 29 December 2023-2 January 2024

Fieldwork: 2-5 January 2024

Sample size: 1,204

➤ https://t.co/obOCVirbpF #btw25 #Bundestag… pic.twitter.com/C4qNcIdiBS

And under anything close to normal circumstances, the German government would have already collapsed. But it hasn’t because it is still under orders not to give in. The Traffic Light Coalition’s job now is to ram through what they can before state elections later this year.

Brandenburg, Saxony and Thuringia all go to the polls to elect new governments in 2024. Alternative for Germany (AfD) is expected to sweep them, polling in the mid-30’s in those three states. Predicting an AfD win in those states is no challenge. Neither is predicting the roadblocks in front of them entering into any coalition government.

What is hard to predict is whether those roadblocks will succeed in stopping the populist juggernaut building in the former East Germany. Because if AfD wins a big enough victory in those states then that will preclude the kind of back-stabbing that Angela Merkel engaged in after Thuringia’s vote in 2020. Review my coverage on this from 2020. The effects on the CDU were profound, causing real and deep divisions within the party. You can see that the seeds to defying Merkelism (which is just Davos’ wishes) should sprout this spring into full blown political revolt.

This is why there is a new CDU splinter group trying to head AfD off at the electoral pass, in the hopes of draining some of its support. Meanwhile AfD are preparing thousands of meals for the farmers protesting peacefully for a saner future. Winning of hearts and minds, exactly as I exhorted them to do when they first crossed the 16% Chasm.

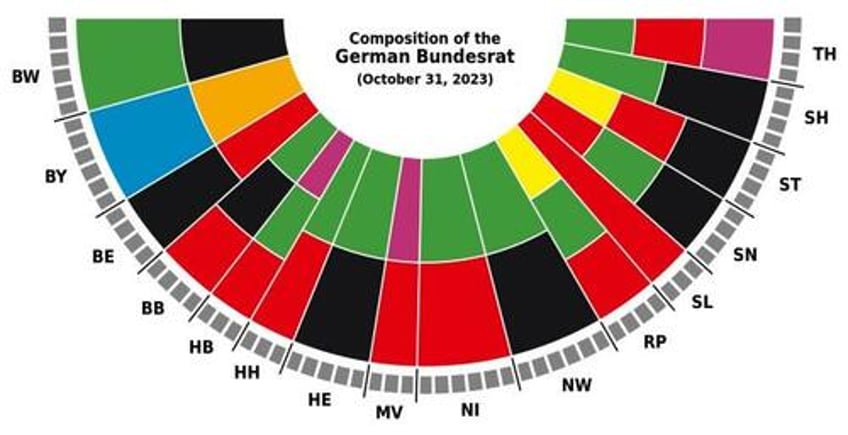

If AfD enters the governments of those three states it gives them veto power over 12 of the 69 votes in the German Upper House, the Bundesrat. The Greens will still have a massive veto majority. The question then is will that translate into a collapsed coalition for Scholz and snap elections later this year.

With the FDP voting last week to stay in the coalition, despite serious questions as to the vote’s legitimacy (where have we heard this before), the answer right now is no. But Mark Rutte was forced out of office in the Netherlands. Never say never.

#7 — Japan will Strengthen the Yen, Nikkei Will Soar

Per my last discussion with Francis Hunt, The Market Sniper, we came to the conclusion that Japan was one of the most interesting fulcra on which the global financial system rests. When former Bank of Japan chief Haruhiko Kuroda shocked markets in December 2022, at his last meeting, by widening the band on the bank’s yield curve control (YCC) policy to 0.5% it was a harbinger of big changes coming.

When the new guy, Kazuo Ueda took office he slow rolled those changes, disappointing markets that, as always, got way ahead of themselves. For most of 2023 I commented on Japan saying that the BoJ would re-enter the global game of monetary policy poker, after being the fish at the table for three decades.

The standard analysis of Japan is that they are screwed because of their insane debt-to-GDP ratio. But, in a world where all the first world economies are running massive deficits I have to ask the question as to why Japan gets singled out?

Japan is in the same position as the EU: an energy importer that needs to exit QE because the Fed has done so and has to contain inflation. For Japan, however, inflation burbled up slower than it did in the US and Europe. This is why Ueda has been able to slow roll his changes to monetary policy, with the YCC cap on the 10-Year JGB now a ‘soft’ 1%, up from Kuroda’s 0.5%.

Now, you can argue, rightfully, that 3% inflation in Japan is a far more important political issue than 4% or 5% here, but the point still stands, they have a much different problem than we’ve had.

As we enter 2024, the Q4 “Buy All the Things” Rally will attenuate across all asset classes. A stronger yen will tame inflation, especially at moderate energy prices, while also allowing the BoJ to begin shrinking its balance sheet. Japan will adopt Powell’s monetary policy.

Once rates rise above 1% on the 10-year JGB, the breakout and consolidation we’ve seen in the Nikkei 225 will end and a new rally will begin on the rotation trade. My target for the yen to hit 125 this year, with the Nikkei following along rallying towards 45,000.

#8 — Soft Secession in the US and Canada

In Canada the two themes of Climate Change and Sovereigntism came together beautifully in the form of a good ‘ol fashioned North American tax revolt. In the US states are openly defying the Federal government on immigration (Texas) and health policy (Florida declaring the vaccines dangerous).

Last fall in Alberta, Premier Danielle Smith invoked the Sovereignty Act to tell Ottawa to stuff their new energy grid regulations and demands up their ass. Right after that, in Saskatchewan Premier Scott Moe announced the province will stop collecting the carbon tax on both natural gas and electricity.

Breaking…

— Paul Mitchell (@PaulMitchell_AB) November 30, 2023

After declaring that he will stop collecting the Carbon Tax on Natural Gas on January 1st, Saskatchewan Premier Scott Moe said, “our government has decided that SaskPower will also stop collecting the Carbon Tax on electric heat effective January the 1st.”

Nice. 👍 pic.twitter.com/BUDSkIugDr

It will be met with indifference by Justin Tru-DOH! and the unfortunately-named (Freeland?) “Nationalist” bitch who actually runs the show there, but it won’t matter.

This is how you express your sovereignty. This is how you say, no. Simply just say, we’re not collecting the taxes and sending them to Ottawa. And, given that these two provinces provide the lion’s share of the tax revenue they have a lot of leverage.

You can expect to see a lot more of this going forward; open defiance of the central government. Number #6 is about Europe, but it’ll be expressions of state sovereignty and the return of Federalist principles that will make the difference.

Now, that said while this is a very good thing for Canada, it may not be for the US.

No one gives a damn about Canadian bond yields except the Canadian government. It’s not like the loonie and CGB’s are the backbone of the global financial system.

A state standing up to a corrupt central government over something as important as this is a direct attack on the validity of the central government and, by extension, its government bond markets/currency. Danielle Smith understands this. It’s why she went straight to the jugular in Ottawa.

This will put upward pressure on bond yields as Alberta takes one step after another towards financial and regulatory independence. Given the way the Bank of Canada has comported itself, Smith and Moe have more friends than you may think.

Expect Ottawa and Davos to strike back. But, again, like in Germany, if the attack fails and Smith wins this round, it will mark the beginning of the end of the central government in Ottawa.

Secession from Ottawa would be devastating to the British Crown, Davos, and all these freaking globalist ghouls.

Like Syria was to the Middle East — telling the OPEC nations someone could stand up to the US — Alberta standing up to Ottawa makes Saskatchewan stronger. It makes, by extension states like Idaho in the US stronger as well.

20 states in the US are organizing and introducing their versions of the Sound Money Act, making gold and silver transactional currencies. New Hampshire is first this week to present it to the legislature.

But, on the flip side, now consider California trying the same thing during a 2nd Trump term, but this time over the exact opposite, refusing to give up their mandated insanity for anyone doing business in California and threatening to break off.

That achieves the WEF goal of breaking the US bond market, creating political doubt over the very markets that prevent them from running the table and consolidating power in the West under Europe’s control.

I know I’ve made these points before but it’s important to keep tying current events to the general thesis of who’s agenda does which event serve and why. Alberta isn’t California for a lot of reasons, but the big one is whose debt-ox is gored by their acts of rebellion.

#9 — Removing the Putinator?

In April, Russia goes to the polls. 2023 ended with many bangs, escalations against Russian civilians with western-supplied weapons. 2024 continues this trend. Nothing about the war in Ukraine is over, even though most people want it over, especially Ukrainians, Russians and the people paying the bills for this globalist culling of Slavs.

Putin will win re-election. Of that there is no doubt. What also is not in doubt is the Neocon crazies continuing to degrade his position through attrition and embarrassment. Putin is no immune to political fatigue, despite what some folks may believe. Yes, he’s made a strong case to the Russian people that this is a civilizational war with the West. But everyone tires of seeing their sons come home in body bags.

He’s fighting a war against people who do not care about anyone except themselves. They will sacrifice us all to their ends. Like Trump, they will do anything to stop him from stopping them. So, we cannot rule out the possibility of one of these assassination attempts against Putin succeeding.

The point of the civilian bombings is to empower the hard core reactionaries in the Kremlin who feels Putin is too soft. Martin Armstrong has written extensively about this and I’m hard-pressed to disagree with him about this part of the story.

Putin’s temperance in the face of Neocon insanity has changed a lot of hearts and minds over the past two years. I run into new people all the time who I wouldn’t expect to see this and they offer to me that we’re damn lucky he’s running Russia.

Every crazy infrastructure attack — NS2, Kerch Bridge, supply ship in port, civilian bombing — radicalizes a few more Russians but also breaks the spell about the evil Putler for many in the West.

Armstrong has targeted his Economic Confidence Model’s turning point as May 7th, the day of Putin’s next inauguration. Will this be the time GCHQ finally gets their man?

Even if Putin survives and takes office, something is likely to happen surrounding Ukraine this summer that will ensure the war goes into 2025 and beyond.

Sec. of State Antony Blinken met with Saudi leader Mohammed bin Salman to keep the Israeli/Gaza situation from metastasizing further. Is Blinken suddenly becoming anti-war after ginning up three different major conflicts in as many years?

Hellz no. He’s a neocon through and through. Any ‘pause’ in any conflict is simply an admission that we’re not prepared for escalation today, so let’s have a ‘ceasefire’ so they can reload. Or are people still confused about what the Minsk Accords were all about?

Putin understands that when the West, especially British-aligned US actors, offer a ceasefire that means it’s time to step up operations, not down. This is why Russia pressures Ukraine across the entire front, probing for weaknesses, degrading their capabilities.

Ukraine will look like it’s on the back burner in 2024, but it will be the biggest poison pill for whoever is president in 2025. It will leave Putin with few options but to continue focusing his economic output on it.

#10 — No Recession in 2024

The hardest part of making predictions in a chaotic world isn’t just that the data is faulty, it is that the past isn’t much of a guideline beyond what you can expect from the main actors. We understand how the Fed views the economy. We know what the Globalists’ goal structure looks like. We can even know how a lot of these things meet and interact.

What we don’t know is how the people will react to them and what their overall behavior will be. And that, ultimately, is what decides whether there will or won’t be an economic contraction. Recessions are very technically-defined things. Two consecutive quarters of contracting spending, GDP contraction.

In the real world it’s far more complex and difficult. Last year I stuck to the technical definition of a recession and was right. GDP growth never went negative. Deficits are high, while the Fed is doing QT Congress is outspending the Fed’s balance sheet improvements. Something will give in 2024.

Barring a six-sigma event, which so far we have avoided in the capital markets, there won’t be a recession in the US in 2024 either. We needed one of those in 2023 to set the stage for this year. We didn’t get one. We may get one this year, but that would set up for the big event in 2025.

Think the repo event of 2007 setting up Bear Stearns, then Lehman Bros. The Repo seizure in September 2019 setting up the COVID crisis, the attack on Oil prices, the CARES Act and the return to the zero-bound in 2020.

There needs to be that inciting incident beforehand to get the main event later, with at least a six-month lag effect. We’re still at least three months from the Reverse Repo Facility running out of money and then there will still be months of set up before the banks have a crisis of reserves.

So, with that said, and even if fiscal ‘sanity’ begins to take root in Washington as we approach the election this November, there is too much money still floating around to see spending go negative. Sorry, folks, but in the GDP game, no ticky, no washy. You have to have the spending stop to get the recession.

We may buy hookers, blow, and South American revolutionaries with it… wait, this isn’t the 80’s…

We may buy Pornhub subs, Cheetos, and Ukrainian Naht-sees with it, but it’s still spending.

The question is what will we buy that money, not Hunter Biden.

If the Fed cuts rates a little bit (50-75 bps in 2024), begins talk of tapering QT even starting in Q3, then we’ll see things get tougher, but not so much that spending retards overall. The quality of the spending will go down the value chain, towards lower-order good (food, shelter, etc.). But the spending will still be there.

I’m with Joseph Wang on this, per his latest interview with Blockworks. Lower rates, as we’ve seen in the mortgage markets, will improve Main St.’s balance sheets to the point where we can and will muddle through. Inflation will still be higher than anyone wants. It may suck, but from a household spending perspective, so what?

That won’t necessitate something radical from the Fed. What will is a sovereign debt crisis from a major government collapsing. But, I still maintain that is much more likely somewhere other than the US (despite Obama’s gaslighting) first. When Reuters is running articles like this:

Far-right rise could make Europe ungovernable - EU liberals https://t.co/88VPvoYSqN pic.twitter.com/OGomF44SAa

— Reuters (@Reuters) January 9, 2024

That’s where you should be looking. If you want your black swan event to undermine this call just think about what Europe will do to prevent Viktor Orban from running the European Council for more than the normal six-month term.

* * *

All of the trends highlighted last year are still happening this year. The US dollar is still stronger than anyone expected. De-dollarization is still happening, it’s just that De-euroization of global trade happened first (in 2023). Iraq is now openly hostile to US military presence there. US troops in Syria are coming under increasingly heavy fire in retaliation, I think, for the UK and Ukraine attacking civilians in Belgorod.

And the Globalist soul-sucking vampires still bear their fangs, and make pronouncements of how much blood we owe them. But, the less said about Ursula Von der Leyen the better at this point.

I will wear your white feather I will carry your white flag

I will swear I have no nation but I’m proud to own my heart

We don’t need no uniforms, we have no disguise

Divided we stand, together we’ll rise

* * *

Join my Patreon if you want to become #ungovernable