The precious metals market is kicking off 2025 with a strong start, and if you’re paying attention, this could be your year to seize the opportunities gold and silver offer. Here’s what’s shaping the market this year—and how you can act before it’s too late.

1. Tightening Supply Chains

Global mining output for gold and silver has hit a plateau, and major producers are signaling slower growth ahead. In 2024, silver mine production fell flat, with a projected growth of only 1%. Gold production saw modest gains—but with geopolitical tensions and environmental regulations squeezing mining operations, it may not be enough to meet demand.

2. Central Bank Gold Purchases Are Surging

Central banks globally are doubling down on gold. After record purchases in 2023 and 2024, this trend shows no signs of slowing. Countries like China and Russia are hoarding gold to reduce their reliance on the U.S. dollar. When central banks buy gold, it sends a clear message: the value of fiat currencies is shaky.

3. Industrial Demand Is Booming

Precious Metals aren’t just for coins and bars anymore—they’re essential in cutting-edge technologies and space exploration. Silver’s unparalleled conductivity and durability make it a cornerstone of the electronics industry, powering everything from smartphones to 5G networks. Meanwhile, gold, silver, and platinum all play a critical role in the booming space industry, where they’re used in satellites and spacecraft.

4. Inflation and Market Volatility Are Still in Play

Despite recent efforts to control inflation, the underlying structural issues—rising debt and loose monetary policies—persist. Gold has historically shone in volatile markets, and 2025 could be another year where it proves its mettle as a hedge against instability.

5. Platinum and Palladium Enter the Spotlight

While gold and silver dominate headlines, don’t overlook platinum and palladium. As industries like hydrogen fuel cell production grow, demand for these metals is climbing. According to the World Platinum Investment Council (WPIC), platinum supply remains “severely constrained” despite increasing demand across multiple sectors.

A Smart Way to Start Investing in 2025

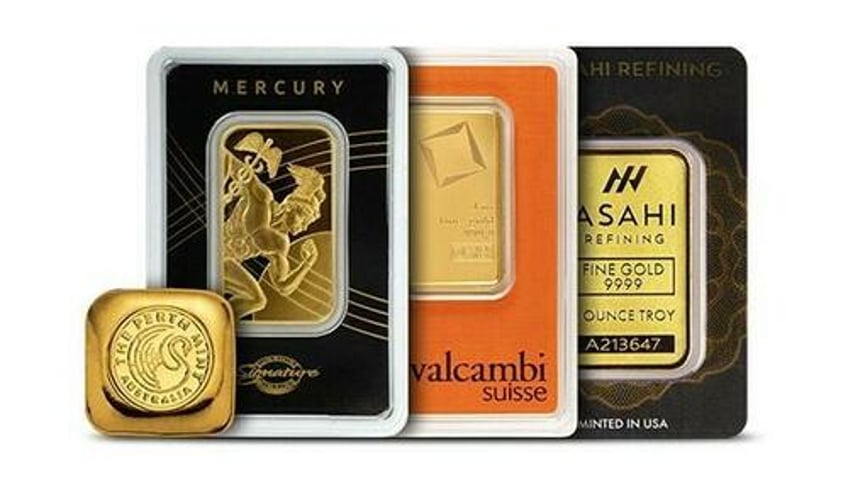

If you’re new to precious metals, there’s no better way to begin than with the Gold Starter Pack from JM Bullion, ZeroHedge’s preferred bullion dealer. This pack offers 1 oz of gold at spot price, sourced from trusted mints and delivered in secure packaging. It’s a simple, cost-effective entry into gold investing.

Prefer silver? The Silver Starter Pack provides 10 oz of .999 fine silver at spot price, featuring ten 1 oz rounds in a protective tube. Whether you’re starting with gold or silver, these starter packs give you immediate access to metals that hold real, lasting value.

Both packs are exclusively available to new JM Bullion customers, but supplies are limited. Don’t miss your chance to make 2025 the year you secure your financial future with gold and silver.