Reading through a new report by DB for write up and email later today and wanted to share an editorial thought.

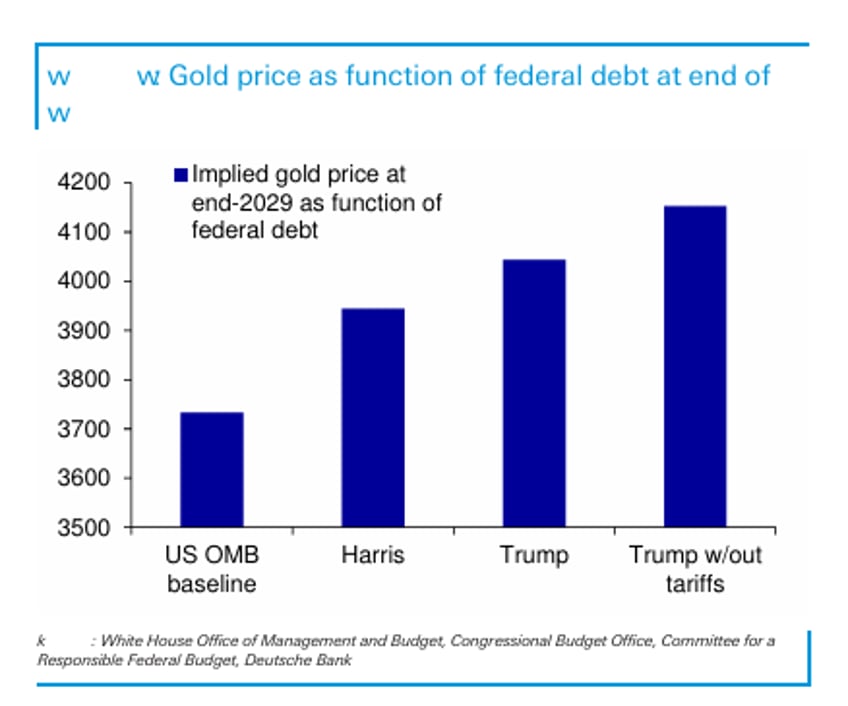

The last few months have seen many banks overhaul how they look at Gold pricing; which did not go unnoticed here. Goldman, along with several other Banks like, CITI, MUFG, GS, BOA, and UBS recently revealed a new way to model gold prices. Now, today we have DB with their own metric of measuring Gold price going forward.

Astonishingly, most of these firms, not all, are still (publicly) looking at Gold-price metrics through purely Western lenses. You may rightly ask “What does that mean?” It’s about the assumption that the West is driving price, when it is not. Here are some brief thoughts.

WESTERN PRICING BIAS

In the wake of Gold/Rates/USD correlations resetting, we’re getting the feeling many banks are struggling to come up with a new justification to put their ”science” behind and justify predictions (and therefore investment recommendations).

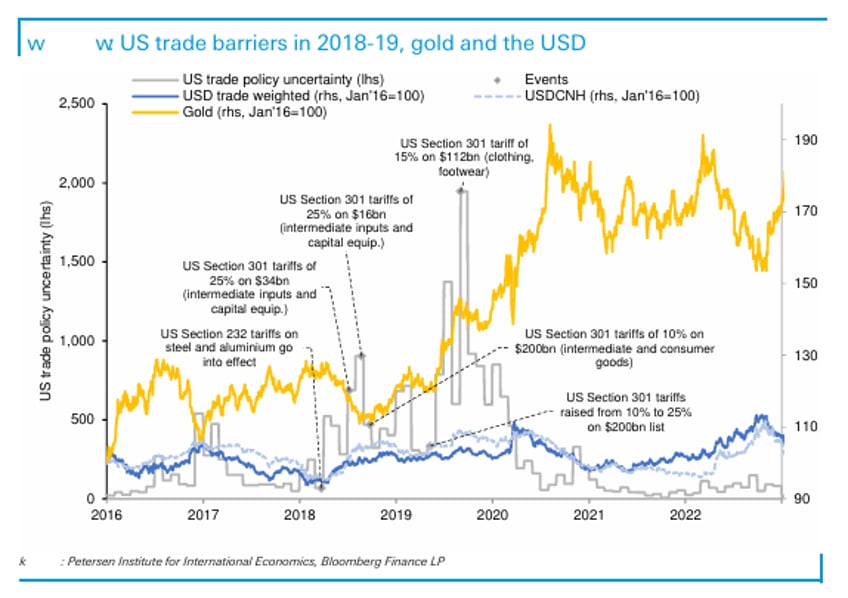

Gold and US Tariffs

GoldFix did the same thing but were lucky enough to look for correlations outside the West like in **What Governs Gold's Price Now? in which this was noted:

The Chinese economy is increasingly governing the price of Gold now3. Therefore, the price of Gold *must* be correlating with some Chinese data as well. That data will give a clue as to what is macro-economically (we know the secular reasons) driving both the PBOC and their public to buy Gold.

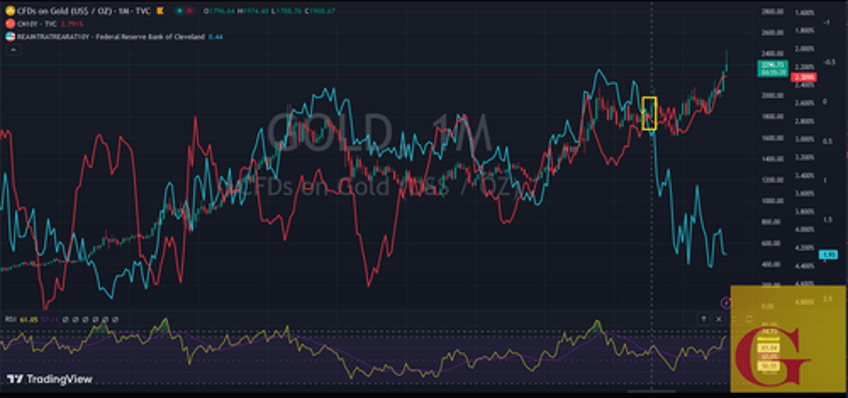

Here's the result, actually astonishing.Post the Russian sanctions (rectangle), Gold's relationship (already getting pretty tight) tightened even more to CGBs while it completely ignored US rates.

Gold versus UST and CGB yields (both inverted)...

Meanwhile, it’s actually far simpler than that. They just want the gold.

This continued US-Centric way of looking at gold (Not dollars, it's rates. Not rates, deficits! That's the key! ) continues to assume US’ dominant influence as positive price driver. We're not. The buyers' receding trust (and the increasing feeling of our own citizenry's misplaced trust) in a system we've championed is the driver. The American dream under neo-keynesian economics has run into a wall and the ROW is slowly (or not) waking up to it

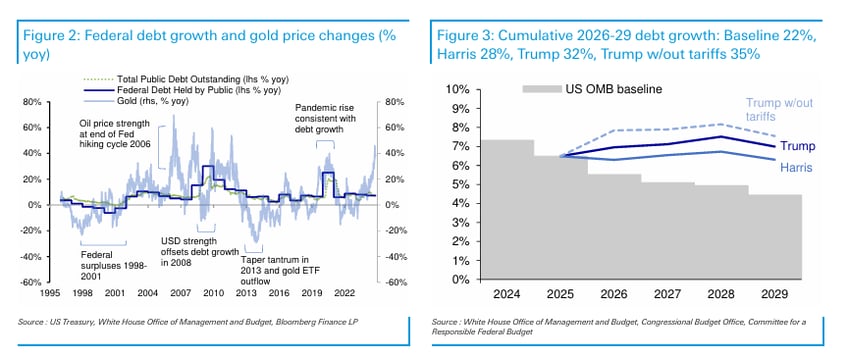

US Deficits and Gold...

This isn't just high-finance, its existential-finance to the BRICS. And increasingly to people in the west see it that way as well.

The value of gold will be continue to determined by non US buyers who feel they need it for a store of value and can/are actually developing use-cases that necessitate physical presence that hopefully will not add much transactional friction to new-payment chains

The demand for door-stops and pet-rocks (not the idea of a door-stop/pet-rock) is real, not some derivative of our debt..

US Presidents and Gold...

Anyway….Banks are trying to justify what they have yet to acknowledge. We, in the west don't want the Gold for the most part, and the BRICS feel they need the gold.

What are we in the west doing to fix that? Nothing. Nor can we. That will take time. Keep stacking. The DB write up will be out later today.

Bottom line is: Most American banks treat Gold is if it is a derivative of dollars, and that is backwards

Cheers

Continues here.

Free Posts To Your Mailbox