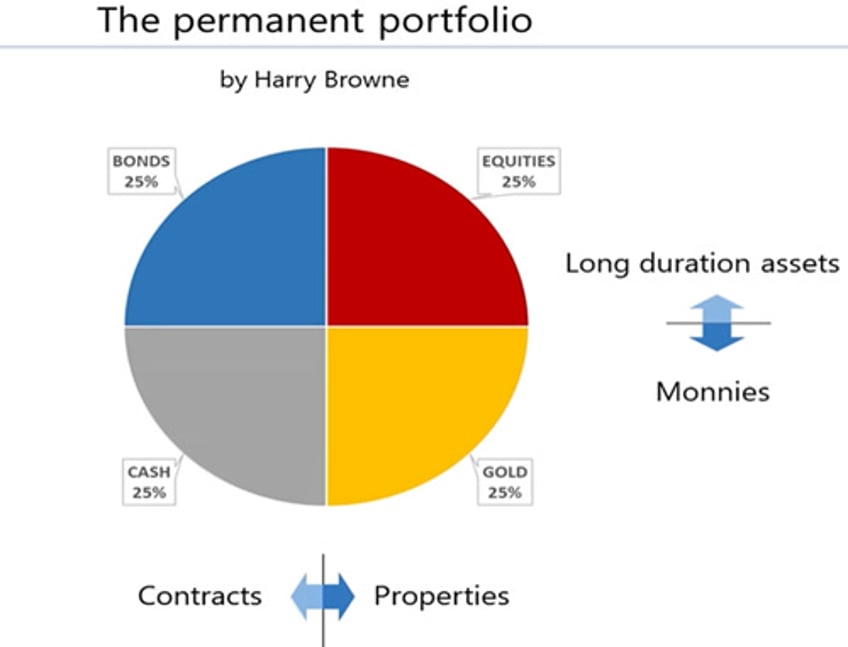

Savvy investors who have thoroughly studied the business cycle, the impact of monetary illusion on it, and its effects on asset allocation within the Permanent Browne portfolio should by now understand that in an inflationary environment, they should own only properties and avoid contracts.

Experienced investors understand that equities are relatively straightforward to value using methods like Discounted Cash Flow (DCF), Price-to-Earnings (P/E), Price-to-Book (P/B), and Dividend Discount Model (DDM). Other key metrics, such as EV/EBITDA, Price-to-Sales (P/S), Free Cash Flow (FCF) Yield, and the PEG ratio, provide additional insights. Comparative valuation, industry trends, and broader economic conditions further refine assessments, helping investors determine whether a stock is undervalued, overvalued, or fairly priced.

Valuing gold is far more complex than valuing equities, as its worth is driven by scarcity rather than utility or cash flows. Gold functions as money, a commodity, a financial asset, and a consumption good, making its valuation inherently challenging. With prices dictated by immediate supply and demand, the lack of a clear ‘fair value’ likely contributes to gold’s relative unpopularity among institutional investors.

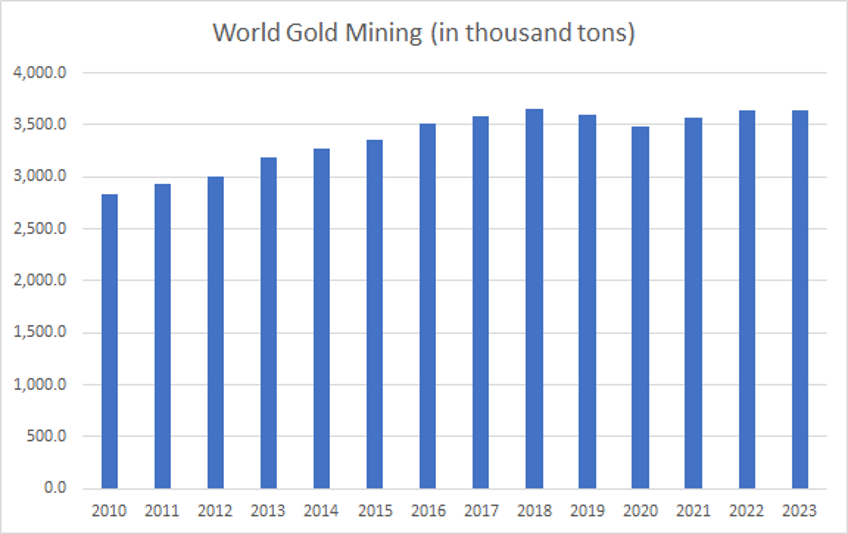

From a pure supply perspective, global gold production has essentially flatlined at around 3,500 tons per year since 2016, despite significant exploration and production budgets by miners. At today’s gold price, this translates to an annual supply increase of approximately $260 billion, less than two months' worth of the U.S. budget deficit. Meanwhile, the global population, GDP, money supply, and other factors tied to economic activity continue to grow.

Source: https://www.gold.org/goldhub/data/gold-production-by-country#from-login=1

Those who understand the geopolitical dynamics of global finance will note that China and Russia, the two pillars of the Global South and BRICS, seeking to bypass the weaponization of USD assets, are by far the largest gold producers, together accounting for about 18% of annual global gold extraction.

https://www.gold.org/goldhub/data/gold-production-by-country#from-login=1

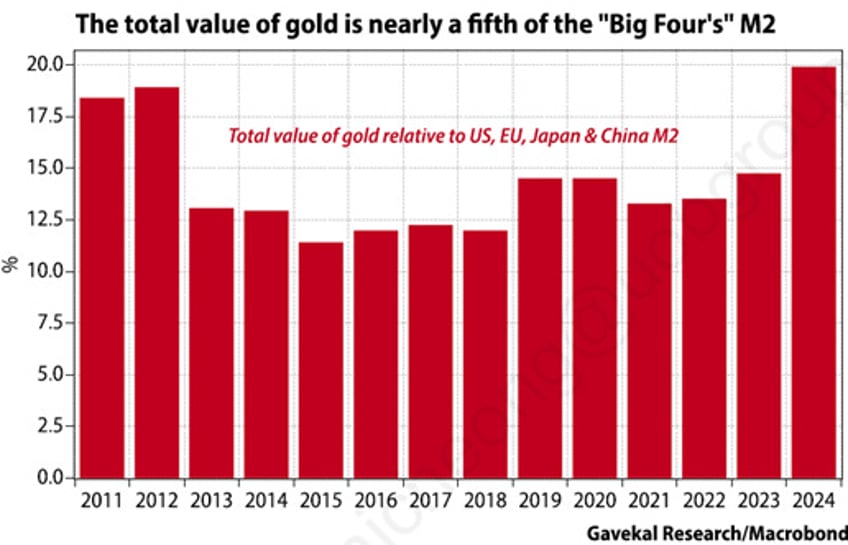

If gold is considered money, as John Pierpont Morgan famously stated, its value relative to the broad money supply in the ‘Big Four’ economies (U.S., EU, Japan, and China) should the reference point for its valuation. Over the past 15 years, this ratio has ranged between 12% and 18%. With the ongoing gold bull market and the contraction in U.S. M2, this ratio has now almost reached 20%, a historically elevated level. However, since it is clear that the global elite will continue printing money to inflate their way out of future crises, this high gold-to-money supply ratio may prove only ‘transitory’.

Indeed, the reality is that savvy investors understand the need to own gold in their portfolios for its antifragile characteristics and its hedge against reckless government spending, which ultimately lead to sovereign defaults. It should therefore come as no surprise that gold performs well when the U.S. debt-to-GDP ratio rises. The occupant of the White House may change, but the trend in the U.S. deficit will not, particularly in an environment where trade wars add to the burden of kinetic conflicts and therefore gold is far from being expensive on that metric.

Gold price in USD terms (blue line); US Public Debt to GDP ratio (red line).

Those who have studied the business cycle and how to gauge the economic environment using market data and ratios know that the best way to determine whether an economy is in an inflationary or deflationary phase is not by looking at CPI data or other government statistics, but by examining the Gold-to-Treasury ratio and its position relative to its 7-year moving average. Indeed, the quality of a fiat currency as a store of value can be assessed by comparing gold or the government bond market. Investors understand that if gold prices rise faster than bond prices and the Gold-to-Bond ratio is above its 7-year moving average, gold is the store of value, signalling inflation. Conversely, if bond prices rise faster than gold and the Gold-to-Bond ratio is below its 7-year average, bonds are the store of value, signalling deflation.

Given the explosive money supply, the weaponization of USD assets, and reckless government spending that have led to enormous fiscal deficits in the U.S., it should come as no surprise that the Gold-to-Treasury bond ratio has risen parabolically since the start of the current decade. However, it remains far from the extreme points reached in the late 1970s early 1980s, points which could be reached if tariffs introduce additional risks for investors in owning U.S. government bonds, once considered the ‘risk-free’ asset but no longer devoid of risk. Ultimately, those driven by a mercantilist spirit, which will inevitably clash with the new form of ‘American narcissistic imperialism’, aiming not only to preserve its economic dominance through executive orders and force to annex countries into the current 50 states of the union, will find in physical gold a necessary means to avoid the risks of another round of the weaponization of USD assets.

Gold to US Treasury Ratio (blue line); 84-month Moving Average of the Gold to US Treasury ratio (red line).

Another key ratio driving the business cycle is the S&P 500-to-Gold ratio, which serves as one of the best indicators for tracking monetary illusion in financial markets. Since people tend to perceive wealth in nominal terms (USD) rather than real terms (inflation-adjusted or gold adjusted), it is crucial to measure the performance of financial assets in gold terms rather in USD terms. Those studying the business cycle have learned from history that when the S&P 500-to-Gold ratio trades below its 7-year moving average, it has typically been a bad omen for the U.S. economy. In fact, the break of this ratio’s 7-year moving average has consistently been a leading indicator of the break in the S&P 500-to-Oil ratio and the onset of an economic bust in the U.S. within the next 6 to 9 months.

Upper Panel: S&P 500 to Gold Ratio (blue line); 84-month Moving Average of the S&P 500 to Gold Ratio (red line); Lower Panel: S&P 500 to WTI Ratio (green line); 84-month Moving Average of the S&P 500 to WTI Ratio (red line)

For those who view gold as a commodity, its valuation should be considered relative to essential commodities like oil and copper, which are key to prosperous economic growth. In this context, gold’s current value against oil and copper appears undeniably high, though it may simply be that oil and copper are undervalued in fiat currency terms at first.

Gold to Oil ratio (blue line); Gold to Copper ratio (red line) rebased at 100 as of December 31st, 1986.

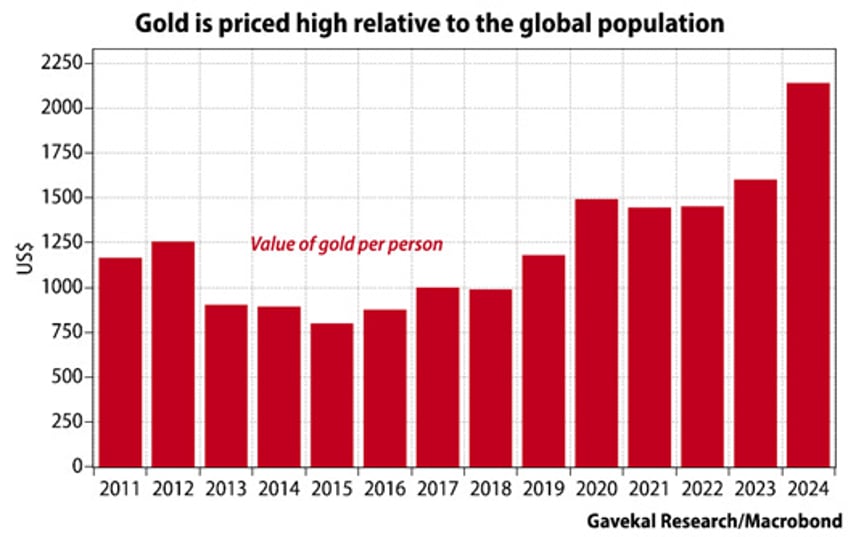

Gold has long been valued not only as a store of wealth but also as a consumption good, particularly in Asia, where its cultural significance dates back centuries. In India, gold plays a central role in traditions, with weddings and festivals driving strong demand for jewellery, which serves both decorative and financial purposes. In China, gold symbolizes prosperity and good fortune, with demand peaking during the Lunar New Year and other celebrations. Historically, Southeast Asian civilizations, such as those in Thailand and Vietnam, have used gold for ornaments, religious artifacts, and even as a medium of exchange. Across Asia, contrary than in the western world, gold remains integral to daily life, blending tradition with financial security, ensuring its relevance as both an investment and a consumption good. That's why it's important to consider the world's total gold stock relative to the global population, which is priced at around $2,150 per person alive today, a slightly higher level than in recent history. This could be problematic, as most of the marginal physical demand for gold comes from emerging economies like India, China, the Middle East, and Southeast Asia, where gold is relatively expensive compared to local wages.

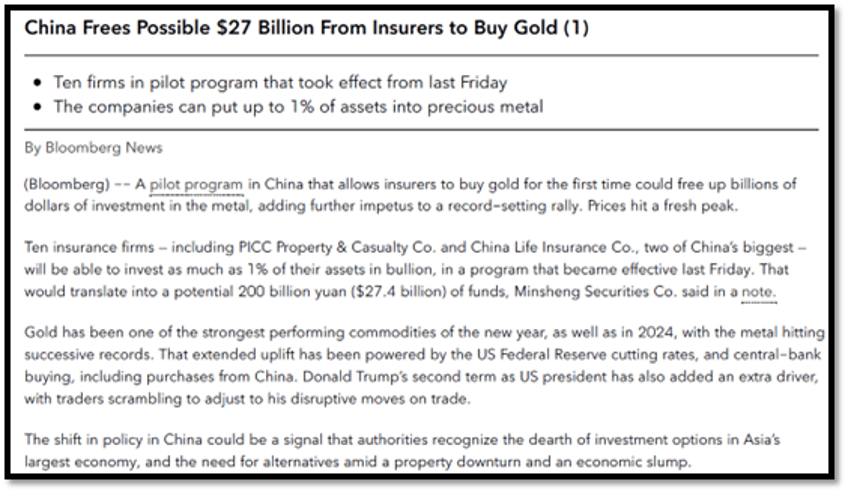

For those in the Western world who still doubt the stark contrast in how retail investors and regulators perceive gold in Asia compared to the U.S. and the rest of the West, recent developments in China offer a clear distinction. While Western financial regulators continue forcing banks and insurance companies to hold sovereign bonds, arguably the riskiest asset in the foreseeable future, the Chinese insurance regulator launched a pilot program on February 7th, allowing the country’s 10 largest insurers to allocate up to 1% of their assets to gold. This move could unleash over $27 billion in additional gold demand from Chinese institutional investors. While 1% may seem like a small allocation, it underscores that in China, gold is not just a consumer good or a hedge against the weaponization of USD assets but also a recognized financial asset within institutional mandates.

Rising gold prices have strained affordability for Chinese consumers but falling property values have made gold an increasingly attractive wealth-preservation asset. China's real estate market is experiencing its worst downturn since 2014, with record-high home inventories suggesting that current stimulus efforts may be insufficient and making gold one of the few assets domestic investors can own as the stock market remain subject to the uncertainties related to the heating trade war with the US and its allies.

Gold Price in CNY (blue line); China 70 Cities Newly Built Commercial & Residential Buildings Price YoY change (red line).

Coming back to the US and the affordability of gold for the US layman, it now takes the average U.S. worker about nine and a half hours to buy a gram of gold. This ratio is historically high, and based on this metric, gold can be considered overvalued.

The price of a Gram of Gold in USD divided by the US average hourly earnings of Private Non-farm employees.

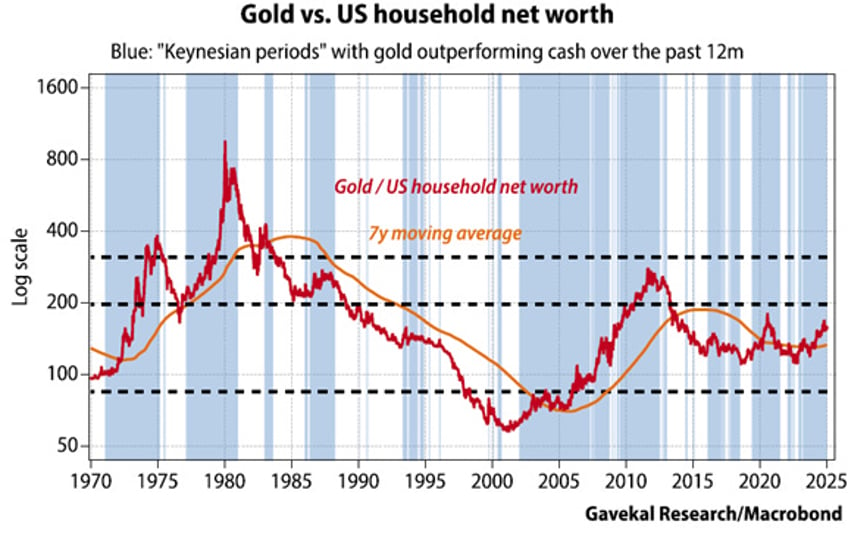

Taking a broader approach to U.S. household net worth and the value of gold relative to the net worth of U.S. citizens, it’s not especially high at current levels. This is likely because many U.S. citizens have been influenced by mass media and financial advisors, who claim that in a supposedly digital world, gold is no longer a necessary asset, leading to its underrepresentation in U.S. portfolios. In this context, gold’s relative position could easily double before the end of this decade, especially as YOLO investors realize that gold is and remains the only antifragile asset with no counterparty risk, whereas Bitcoin serves as a money-laundering tool promoted to enrich tech billionaires and 'techligarchs' within the Washington plutocracy.

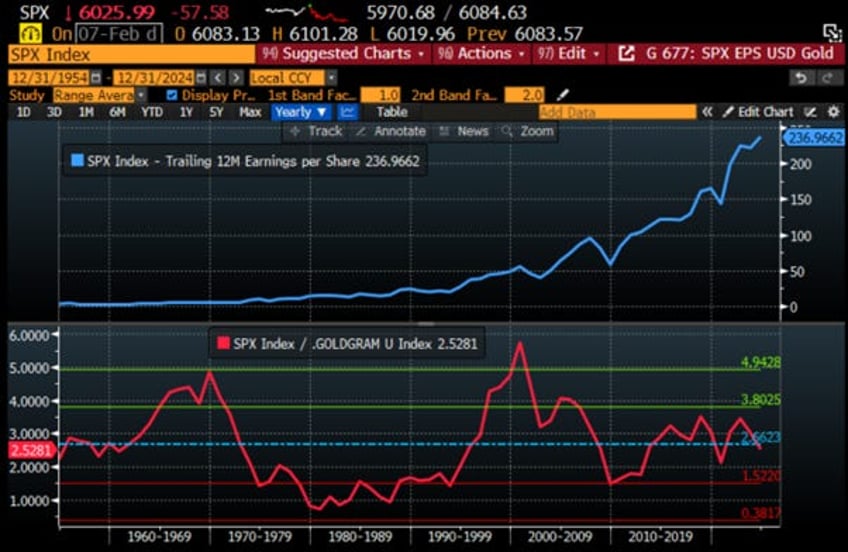

Circling back to financial markets, a look at the ratio of S&P 500 corporate earnings to gold shows that it is currently near its historical mean of around 2.66 grams of gold. If an economic bust materializes within the next four years, this ratio could easily fall to 1.5 grams or even lower. It’s important to note that each time the ratio has dropped below 1.5 grams (such as between 1972-1984 and in 2009), the U.S. has faced a severe economic crisis.

Trailing 12-months Earnings per share of S&P 500 index in USD (blue line); Trailing 12-months Earnings per share of the S&P 500 index expressed in grams of gold (red line).

Ultimately, gold thrives in wartime, preserving wealth as conflicts drive shortages in energy, metals, and food. History confirms this, from the Vietnam War and the Gulf War to today’s Ukraine conflict, where gold has outshone oil, stocks, and bonds. With ‘Trumperialism’ becoming a reality, gold remains the ultimate war asset, immune to price sensitivity as the imperialistic American diplomacy is used for striking plutocratic real estate deals.

Evolution of $100 invested Gold (blue line); S&P 500 (red line); Bloomberg US Agg Total Return Index (green line); Bloomberg T-bills 1-3 months Index (purple line) adjusted to inflation since 24th February 2022.

In summary, if gold is viewed as 'money', as it should be in a structurally inflationary environment, especially in the Western world, it is far from overvalued or nearing the extreme price levels seen during previous bull runs.

As a 'commodity', gold may seem expensive, but this is likely because other commodities are too cheap.

As a 'financial asset', gold can continue to rise relative to U.S. equities and treasuries.

As a 'consumption good', it may appear costly when compared to the average worker's income or the price relative to the global population, but it remains affordable when considering the strength of U.S. consumer balance sheets and corporate finances.

The bottom line is that gold is still far from reaching the extreme valuations seen at the peak of previous bull markets. While some indicators are raising caution, they are unlikely to be serious enough to end the current bull market, especially in an environment of rising global polarization and the increasing weaponization of USD assets, particularly for those who choose to not be the servant of the new American 'Tumperialism'.

As tariffs are increasingly used as tools of negotiation or even to spark perpetual kinetic bankers' wars, it’s clear that the world is heading toward a depression for some nations, driven by an impending sovereign debt crisis that will materialize first in the "Trump-Re-Flation." Ultimately, the global business cycle cannot be altered, regardless of who sits in the Oval Office. To weather the upcoming "Trump-Reflation’ morphing into the ‘Trump Stagflation," holding physical gold, the only antifragile asset with no counterparty risk, alongside a portfolio of short-dated investment-grade (IG) USD bonds with maturities of less than 12 months and Treasury bills (T-bills) with maturities not exceeding 3 months will provide stability as Trump’s economic decisions lead to "Trump stagflation."

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/gold-beyond-glitter

If this report has inspired you to invest in gold and silver, consider Hard Assets Alliance to buy your physical gold:

https://hardassetsalliance.com/?aff=TMB

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at

Unlock Your Financial Success with the Macro Butler!

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.