Submitted by QTR's Fringe Finance

Not trying to do too much on a Friday heading into a weekend, especially with no coffee in my system, but did have a couple things I wanted to note before I started the weekend. Publishing the two pieces I put out this week pretty much sums it up for me as to where things stand heading into the weekend.

The only new piece of information since yesterday is that CPI missed expectations, coming in hotter than expected and, as is the case with everything else, the market didn’t seem to give a shit at all. In my writeup on Thursday, I alluded to the fact that I believe indexes are being manipulated by people simply buying a few key names, i.e. the “Magnificent Seven” (Amazon, Apple, Google (Alphabet), Meta, Microsoft, Nvidia and Tesla). Whether those stocks - one in particular I’m thinking about - are also being manipulated via options remains to be seen.

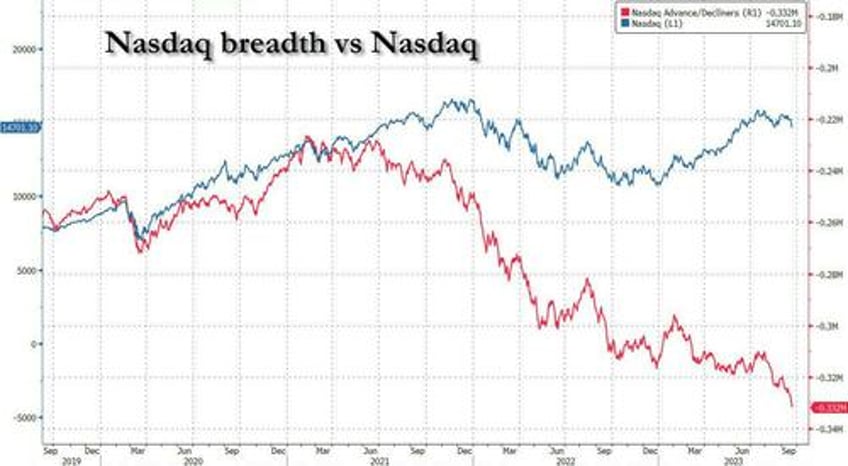

Zero Hedge supported that assertion on Thursday when they tweeted out this chart of the NASDAQ breadth vs. the NASDAQ, showing a growing divergence between the two, with the bottom line being that the “index” is really now just made up of a couple stocks.

It also lends credence to my assertions several weeks ago that both Nvidia (read here) and Apple (read here) could wind up being the “black swans” in this market. As a result, I’d keep a very close eye on both names, because along with the others they essentially are the stock market.

If you missed them, on Monday I published my portfolio review for October which I had been working on for several weeks. It detailed all my favorite positions and where my mind is at as it relates to portfolio construction heading into the back end of 2023.

On Friday, gold is up about $25 per ounce to start the day. I recently wrote why I think miners are the cheapest part of the market. I think this is a move that is only just beginning and that gold is - for lack of better terms - on the launchpad.

On Thursday, I published a less detailed wrap up of where my head is at as it relates to macro, without the specifics. I didn’t even plan on publishing again this week but the mood struck me Wednesday late night walking home from the pub: I am thoroughly convinced that things are going to head to a volatile - and most importantly unprecedented (read: as in, it’ll rattle us more than any other situation in recent memory) - end for not just equity markets, but the status quo in general.

If you still need a hype-man for investing in unprecedented times after reading my takes, you should read this Harris Kupperman piece from last week. Other than that, here’s my brain farts for today...(READ MORE HERE).