Submitted by QTR's Fringe Finance

It was another great week for gold, and this weekend I published an exclusive interview with Peter Schiff, wherein we talk about exactly how high he thinks the price of gold can go:

Peter Schiff Exclusive: Gold To $26,000?

🔥 80% OFF: If you are not yet a subscriber I am bringing back my 80% of all annual plans sale that I ran this summer. As I said this summer, I am never going to offer a larger discount than this and the discount stays applied for as long as you wish to remain a subscriber: Get 80% off forever

On top of that, last week I wrote a piece with my sentiments on the metal. It was my top play heading into 2024, but heading into 2025, do I feel differently? Read here:

Gold: Ride The Lightning

Last week I also published a primer on price controls and why the Harris plan to try and bring prices down is agreed upon by most economists as a fool’s errand:

Prices And Price Controls: An Introduction

And I also highlighted why the labor market under Biden-Harris has been gamed:

Biden-Harris' Magical Labor Market Claims

And I started the week writing about three winning stocks I am letting run:

Letting Three Winners Run

Earlier this month I published about why the trend in uranium prices remains higher:

The Trend In Uranium Prices "Remains Higher": Harris Kupperman

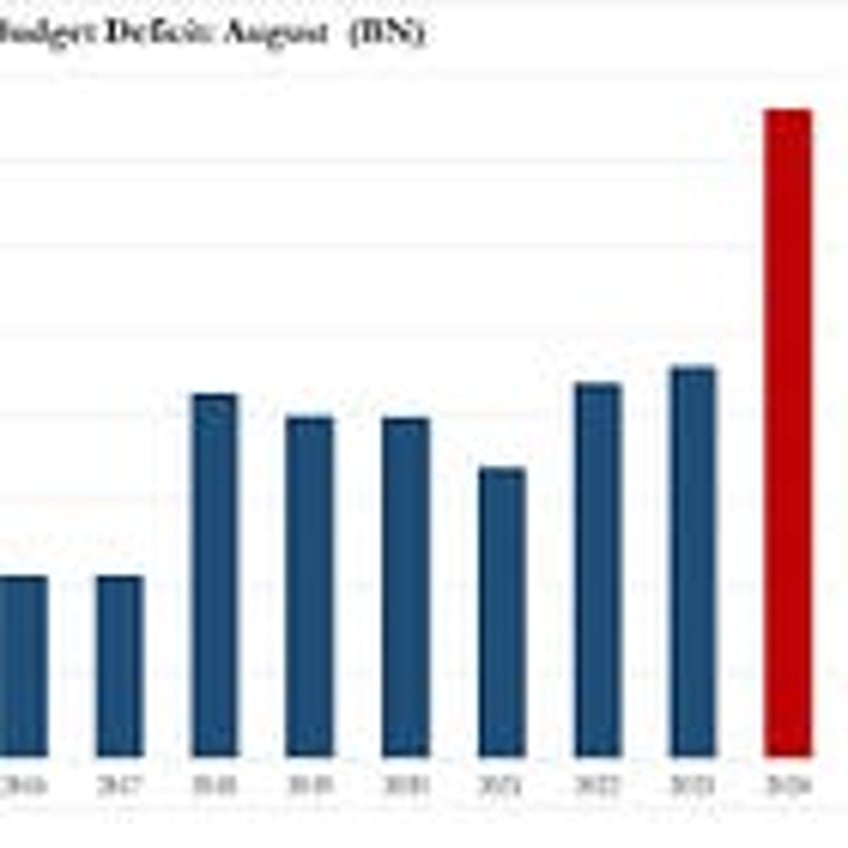

And shared several pieces about the unprecedented monetary destruction that could be on its way as a result of “Kamalanomics”.

An Unprecedented Monetary Destruction Is Coming

In trading earlier this month — before the 50 bps cut — I found it peculiar in the sense that both gold and equities were already raging higher together, like a market that has just thrown its hands up in the air and said “fuck it, we’re going the hyper-inflationary route”, as I said in a column last weekend:

A Plague On Both Your Monetary Houses

In politics, I also wrote last week about why I thought President Trump declining to do another debate with Kamala Harris was a good strategic move:

No More Debates, No More Mistakes

Here’s what else is new on the blog:

The Trend In Uranium Prices "Remains Higher": Harris Kupperman

Tonight's Debate Will Backfire Horribly For Both Kamala Harris And ABC

"It'll Crater The Market": Andy Schectman On Kamala Harris' Tax Policy

What Americans Can Learn From Venezuela’s Crackdown on ‘Price Gougers’

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.