Summary:

- Gold Shorts Covered, Silver did not- CTA report confirms Sunday discussion

- Israel is now a real wild card- it’s beyond Gaza now

- JPM’s Kolanovic gets more bullish on Gold- That’s actually not good

1- Gold Shorts Covered

Authored by GoldFix ZH Edit

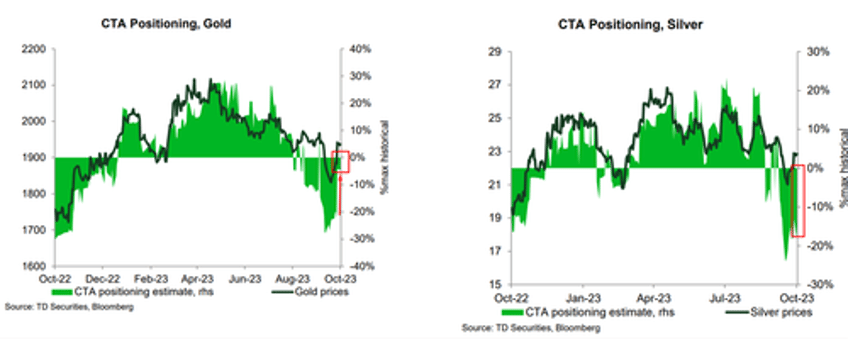

TD’s latest CTA report today (see attached) shows Gold shorts covering aggressively the last 2 days confirming our analysis Sunday (and Monday’s special post). What it also shows that is a little surprising, but not foreign, is Silver CTAs got shorter again Monday after covering some on Friday.

The reason this Gold/Silver stuff is not foreign: It is not uncommon for funds of all sizes to trade Silver and Gold against each other. We have talked about it in this space over the years. They do not trade the actual spread. They trade the perceived economic differences.

CTAs Cover Gold and Silver, then kick some Silver back out...

The simplified idea is: A Fund wants safe haven exposure, but not economic exposure. They will then sell Silver and buy Gold. It is a version of the old “Recession means sell copper, buy gold” trade.This occurs usually in two types of events. War (which we are seeing now, and also saw this in February/March when Gold rallied first after Ukraine started) is the first. Fed tightening starting April 2022 also instigated this.

The practical reason is, Firms give some cross-margining on Gold versus Silver and treat it like a spread. Therefore it ties up less money for CTAs.These guys will trade Gold/Silver like an energy crack spread. CTAs frequently will buy heating oil and sell crude going into winter for the same idea. Going back to trading floor days we saw this. Same idea…

Prognosis: Silver will lead next leg up ( if there is one) unless there is news. We are seeing that to an extent today as Silver catches up a little.But do not expect things to get frothy until November when new money comes in. That is our tactical wish anyway.

3- JPM’s Kolanovic gets more bullish on Gold

JPM’s head strategist said this in a report out yesterday.

Given the above, we maintain a defensive allocation in our model portfolio, with an UW in equities and credit vs. OW in cash and commodities. This month, we reverse last month’s well-timed cut to our model portfolio’s duration exposure. While it remains uncertain whether bonds have bottomed, we add back 1% to our government bond allocation given geopolitical risk, cheap valuations, and less pronounced positioning. We additionally increase our allocation within commodities to gold, both as a geopolitical hedge, and given an expected retracement in real bond yields.

Last time he did this was May 23rd 2023. Also noted here:

"Within commodities, we rotate from energy (given recession risks and a potentially fading China growth impulse), to gold following its recent sell-off (on its safe-haven demand and as a debt ceiling hedge)"

Gold from May 23rd to June 1st...

Continues here ...