There’s no President Reagan to break the air-traffic controllers’ union, no worldwide push to boost fossil-fuel production. Quite the contrary: Interventionist politics, “energy transition” initiatives and labor shortages characterize the present-day policy agenda, along with nascent movements to “rearm, reshore and restock.”- ZP

Gold & Silver: Breaking Down ANZ's New Report

Contents:

- The ANZ Report’s Key Points

- Gold: A Precarious Balance

- Silver: A Symphony in Harmony with Gold

- Platinum: Unassuming

- ANZ Technicals

- GoldFix Comment

1- The ANZ Report’s Key Points

Authored by GoldFix ZH Edit

- A ‘Goldilocks’ scenario in the US has taken some sheen from gold in the short term.

- Our medium to long-term view on gold remains bullish as structural drivers are still in place.

- Technically, price is in a downtrend with key support lying near USD1900/oz. A break of this level could trigger a fresh sell-off.

Here is our writeup of their report

2- Gold: A Precarious Balance

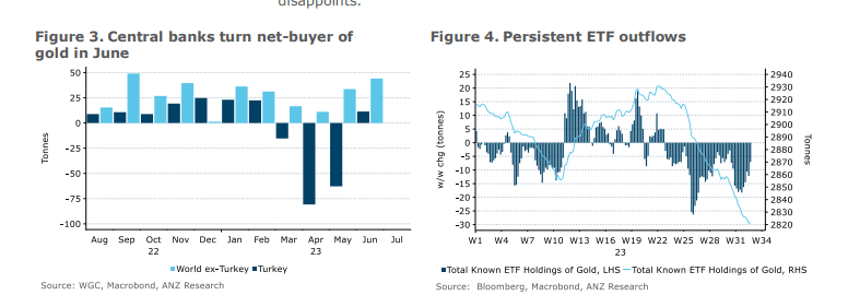

The new ANZ Bank report starts off focusing on the US macroeconomic landscape; noting it casts a shadow on the gold market. A 'Goldilocks' scenario, embodied by an ideal equilibrium, potentially poses a short-term drag on gold.

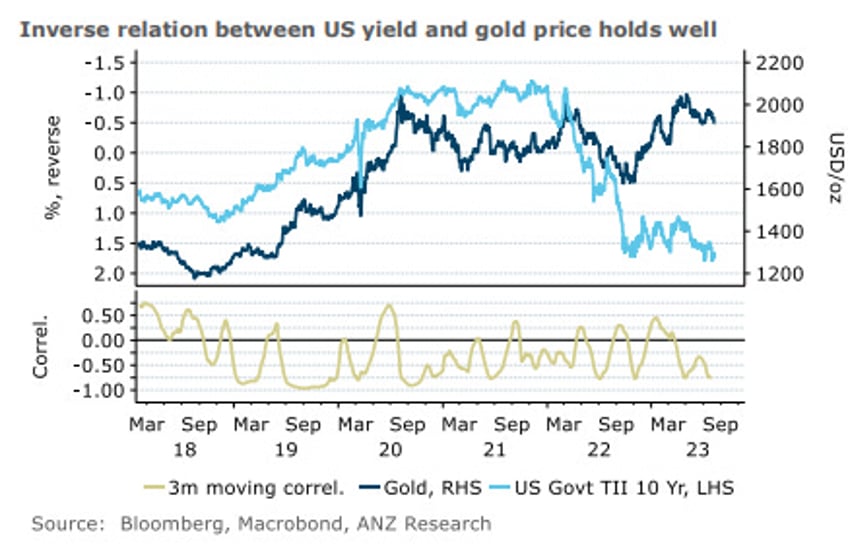

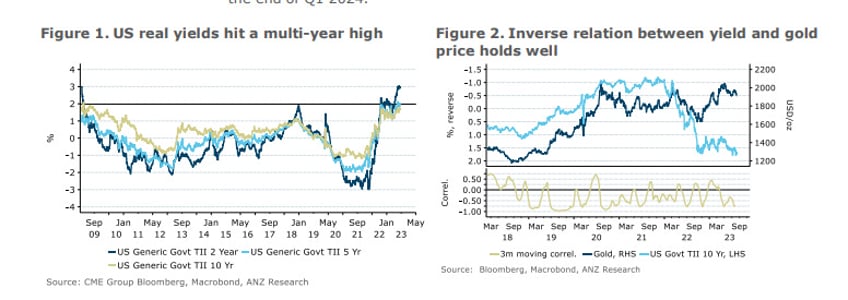

Amidst the Federal Reserve's unwavering hawkish stance and the backdrop of easing inflation, the looming specter of higher real rates ( indeed they are already here, and yet Gold still remains buoyant) and renewed US dollar strength emerges as headwinds.

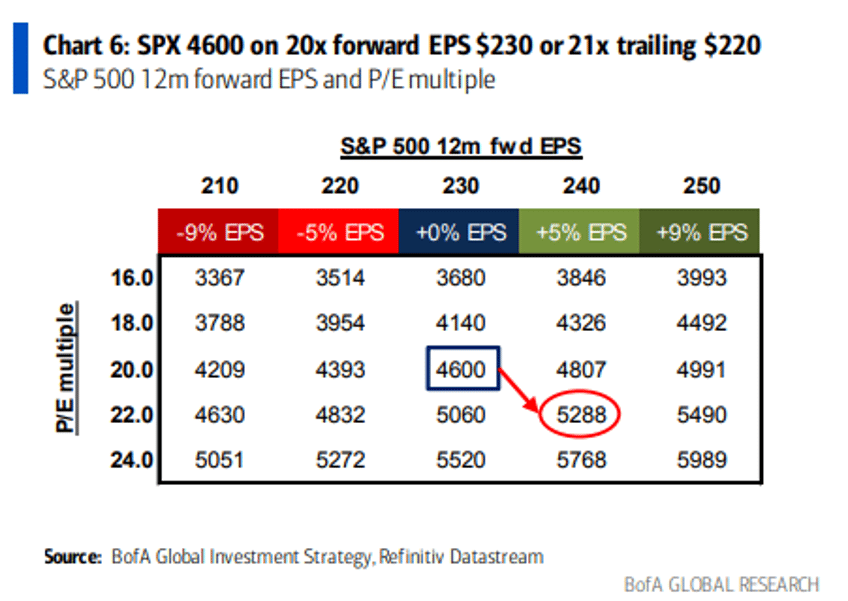

Beneath the surface, a more nuanced view emerges. The Fed, they think, approaches the twilight of this hiking cycle. We’re not so sure, but understand the logic. Even if they are, stocks are too high given where rates are and we’re afraid that has yet to work through the system.

The USD, ensnared in a structural downtrend, could be further weakened by the Bank of Japan's Yield Curve Control adjustment, bolstering their softer stance on the greenback.

Just yesterday we saw Argentina raise rates to 118% and the Peso weakened versus the USD. This is what happens when a market loses faith. Neither is the market happy so far with the BOJ tweak.

Weaker Peso versus the USD…

3- Silver: A Symphony in Harmony with Gold

Silver, often considered gold's symphonic counterpart, dances to a rhythm conducted by its golden partner according to ANZ. Amid a lackluster investment demand, silver's price plummeted to USD22.7/oz, swayed by gold's downward pressure. Yet, beneath the surface, silver's supportive fundamentals await their cue. As manufacturing activity rekindles in China and other developed markets, the stage is set for investment demand to once again grace the spotlight.

Industrial off-take, a record high at 580 million ounces in 2023, (Hello China!) orchestrates silver's rise. Solar installations emerge as a leading crescendo, propelling demand for silver. An impressive 250GW of solar capacity installed in 2022 preludes an anticipated encore of 350GW in 2023 according to the bank.

Continues here ...