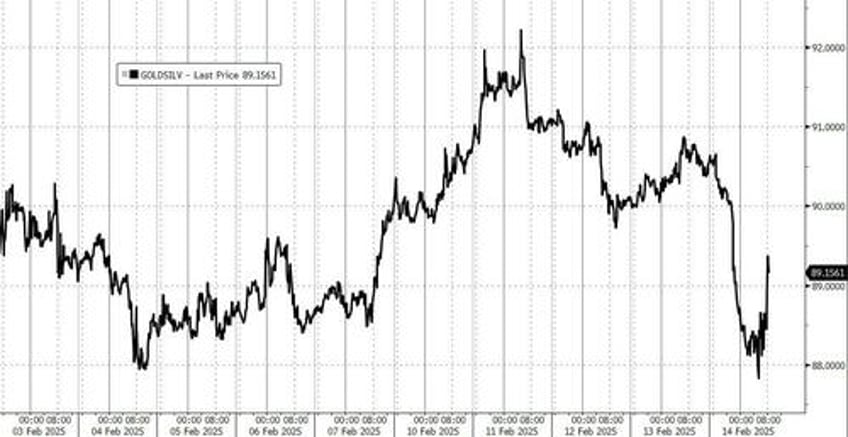

Gold has reached new all-time highs, and the gold-to-silver ratio now exceeds 90:1.

Such a high ratio has often signaled an impending breakout for silver prices. It indicates that silver could be undervalued, and we may be on the verge of a major price surge. Sometimes, if you miss a price run-up for gold, you can make up for it by buying silver instead as it catches up to its yellow cousin.

With gold trading at $2,940 and silver still down at $32.22, the gold-to-silver ratio is over 90 to 1. Since gold is highly likely to continue rising, an explosive catch-up move in silver is likely soon. So if you think you missed the boat on gold, just buy some silver instead.

— Peter Schiff (@PeterSchiff) February 11, 2025

The gold-to-silver ratio measures how many ounces of silver it takes to buy one ounce of gold. Over the past century, this ratio has typically ranged between 40:1 and 70:1. When it rises above 80:1, silver has often experienced sharp upward movements in price. Currently, with gold soaring past previous highs and silver lagging behind, the imbalance suggests that silver could be due for a strong rally.

That’s especially true as gold is unlikely to be done with its trend of hitting all-time highs this year, and may surge further into the stratosphere. Now silver is edging back up—are we about to witness an epic breakout?

Gold-Silver Ratio, 1-Week

History shows that extreme gold-to-silver ratios have frequently preceded silver bull runs. For example:

1991: The ratio spiked to nearly 100:1 before silver surged by over 50% in the following years.

2003: The ratio stood at 80:1 before silver began a multi-year rally, climbing from $4.50 per ounce to over $20 by 2008.

2008-2011: After the financial crisis, the ratio hit about 83:1, and silver rocketed from $9 per ounce to nearly $50 by 2011.

2020: The ratio briefly exceeded an incredible 120:1 during the pandemic market crash, but silver rebounded from $12 to over $28 within months.

Each of these instances followed a pattern: when the ratio climbed to extreme levels, silver eventually outperformed gold in percentage terms as it caught up, even though gold tends to outperform silver in the longer-run.

Several factors support the case for a silver breakout. The first is monetary policy and inflation. Even as Jerome Powell announces a pause to rate cuts to tamper down inflation, the money supply finds a way to expand. When central banks continue to print money, it fuels inflation and increasing demand for hard assets. Gold’s rally suggests that investors are seeking protection against devaluation, and silver, historically a store of value, tends to follow gold’s lead with higher volatility.

Industrial demand for silver is also widespread. Silver’s role extends beyond investment; it is a key component in solar panels, electronics, and electric vehicles. With the global push toward green energy, demand for silver in industrial applications is rising. The Silver Institute forecasts industrial silver demand to remain buoyed by growing industrial need in the coming years, with 2025 marking the fifth consecutive year of demand outpacing supply even as it declines for jewelry and other uses.

Unlike gold, much of the silver mined is consumed in industrial processes, making above-ground supplies more limited. Primary silver mines are scarce, and supply chains have faced disruptions in recent years. Silver also remains historically undervalued compared to gold. As more investors recognize this discrepancy, demand for silver could surge, driving prices higher.

Silver vs USD 1-Month

If history repeats itself, a breakout in silver could happen swiftly. When silver moves, it often does so aggressively. In past rallies, it has outpaced gold’s gains on a percentage basis, rewarding investors who positioned themselves early.

Buy this morning's dip in silver, back below $32. One day, silver will trade below $32 for the last time. It's possible that day is today.

— Peter Schiff (@PeterSchiff) February 11, 2025

https://t.co/fTTdTp4NfB

With gold reaching new highs and the gold-to-silver ratio at extreme levels, conditions appear ripe for silver to follow suit. After all, gold isn’t all that glitters — keep an eye on silver in the coming months as investors watch Trump tariffs, Fed decisions, and the state of multiple global conflicts in Gaza and Ukraine as the Trump administration enters full swing.