Housekeeping: Good evening. Much of the post is in small chapters for easier reading. You can skip around for the parts that interest you most.

Contents:

- What is Happening?

- The Biggest Picture: The Crisis of Collateral

- The Macro Picture: Divisions Grow

- Friday’s Picture: What happened?

- To Start the Day Off:

- Jamie Dimon on Banking changes and effects on Markets:

- Did Gold and Silver shorts cover and what are the chances of follow through?

- Is this Normal Behavior?

- What are the chances of follow through Monday?

- New Highs Will Attract New Money:

- Why did Gold and Silver Rally Summarized

- Wars Speed Up All Risk Processes

- Less Obvious Drivers:

- Final Comment: Three is a Magic Number

1- What is happening?

Authored by GoldFix ZH Edit

The answer to that question has been available for months, if not years, at least in the biggest picture. The events of Friday however bear some specific comments.

2- The Biggest Picture: The Crisis of Collateral

The world has woken up to uncomfortable realities. However it started, Covid 19 revealed the world’s supply-chains are overextended and fragile. The pandemic accelerated a de-globalization trend that had started (ever so gingerly) post the Great Financial Crisis. Post 2020, whole regions began pulling in the reins on natural resources and logistical partnerships, leading to an every-nation-for-itself movement.

The world’s mercantilist1reactions largely consisted of natural resource protectionism (to get paid more), onshoring of supply chains (to safeguard against unreliable partners), and increased holdings of both Gold and Silver Bullion (alternatives to using the dollar), have caused major shortages of physical collateral needed for economies and financialization of trade.

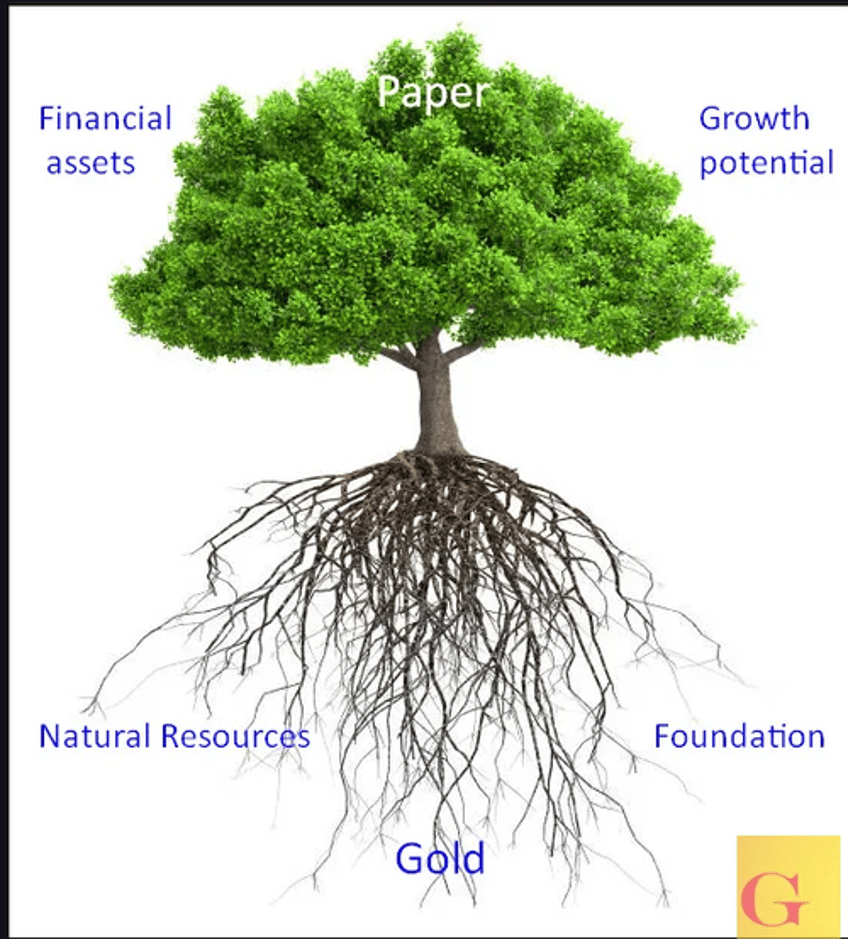

Exter's Tree

To put the collateral shortage part in perspective: the roots of global trade, natural resources, are not readily available for future deals to be put on anyone’s books2. The foundational blocks of trade are being contested.

In revealing the fragility and inter dependency of each nation on the other, it also greatly raised BRICS nations’ awareness that their contribution to the global economic pie is (in their opinion) grossly undervalued.These behaviors are bound to increase international tensions. As one Founder commented to us, When there is only one beer left in the fridge, people at the party start to get angry. People are definitely getting angry now. Restriction of resources— especially when the restrictions are levied by ideological opposites— is the stuff of which wars are made. And we have been in an economic world war since February 2022 when Russia invaded Ukraine.

3- The Macro Picture: Divisions Grow

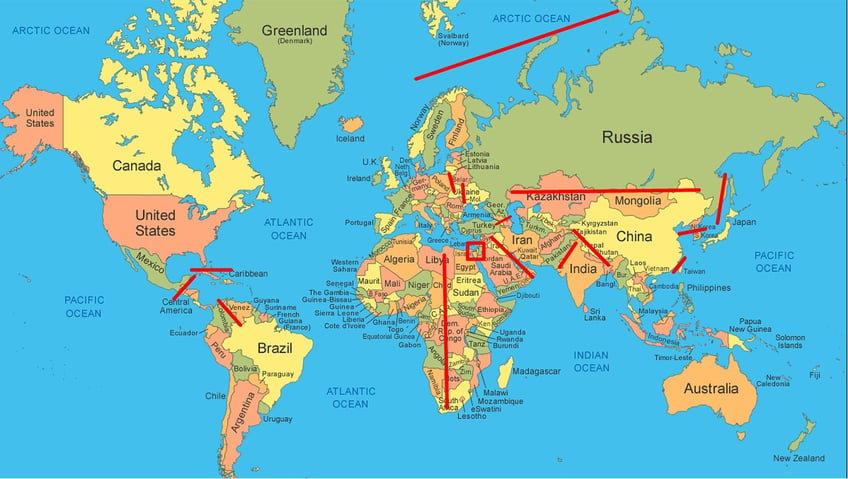

As a consequence and an integral part of the “Biggest Picture” above, Geopolitics is now a driver of all Macro economic policy in a world where no prior relationships can be taken for granted. Most wars, big and small, are fought over natural resources or ideological differences.

Wars over natural resources are usually boundary driven, like during the era prior to WW1 in Europe after their own world’s sloppy de-globalization post the weakening of both the Austro-Hungarian and Ottoman empires; Themselves successors of the Roman Empire’s collapse. Supply chains fragmented, resources were poorly distributed. Hubs could not hold the extremities together. War resulted.

Those that are more ideological (even if that is merely an excuse to capture resources) in nature are like Vietnam, Korea, Afghanistan and every religious war declared ever.

Right now we have both of these factors on the table. The natural resource reason is easy enough to see. But the ideological drivers have always been there, but placated by good commerce. Let’s face it, when the refrigerator is full of food and drink with the game on, ideological differences can be put aside at least temporarily. Those days are over. Globalism is dead.

Goods commerce is gone. Russia no longer will tolerate Western Imperialism and thus Ukraine is contested. Not to mention the nation is rich in natural resources both sides covet. This week the horrors of the Isreal- Palestinian war were thrust out in the open.

As Pax Americana weakens, purely ideological war risk increase. This is what we see in the Gaza section of Israel now.

So here we are: A tensely de-globalizing world in which once freely flowing resources (and supply logistics) are now restricted by the BRICS, Financial/technological resources blockaded, and borders in areas of ideological differences tenuous at best. Right now we have both drivers present antagonizing macro economic policies and geopolitical tensions in the world. Which brings us to Friday.

7- Summary: Why did Gold and Silver Rally so much on Friday?

Gold: Unchanged After 3 weeks as CTAs get punished both ways

Middle East war almost always forces weaker (who are frequently the smarter hands) hands to cover. We know this from multiple instances during Iraq 1, Iraq 2, And every other ME conflict traded through

War escalation chatter from both sides was almost non stop on Friday. That is a bad sign when the opposing sides haven’t even agreed to at least talk. Weekends and closed markets are a problem.

The US based CTAs are still short. This, in combination with the China SHFE speculators having finished dumping their holiday length, made for a recipe to go higher.

Number three above has the added importance of occurring during one of the most illiquid times of the year. Bigger players are definitely winding down in preparation for next years allocations. That is why we call it Sell-season.

Large Long Only funds close risk along with proprietary funds and banks. In combination with momentum chasing CTA types, moves can get very exaggerated. The CTAs caused undue volatility on the way down. They paid the price on the way back up.

The Government may shut down November 17th. This always makes organic selling less anxious, and dips bought more aggressively. This has to be a factor. More in: Founders: Don't Forget November 17th

Continues here ...