Originally published at The Bitcoin Layer, subscribe here.

Welcome to TBL Weekly #89—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

See our Bitcoin & Macro Glossary for term definitions

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 full reserve multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

Good morning readers,

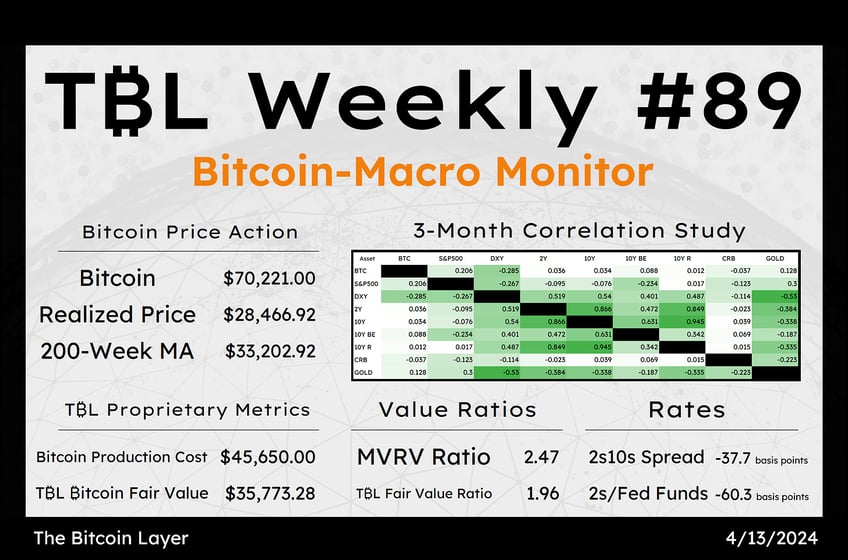

Yields tumbled to end the week in a last-minute flight to safety trade on Friday. Tensions in the Middle East stirred markets and drove capital into US Treasuries and gold despite an afternoon smackdown in the yellow metal, the two largest safe-haven assets in global capital markets. Twos and 10s both fell 6 basis points to close Friday. On the week though, 2s rose 14 basis points this week and 10s rose 12 basis points. Though Friday ended on a fearful note, Treasury yields are still very much gunning for cycle highs. Risk-off impulse is not fully here yet:

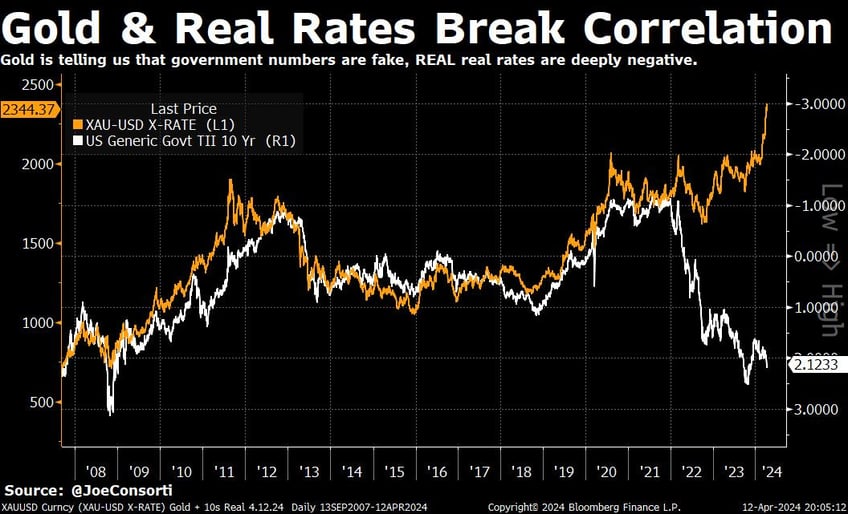

Gold also had plenty of action this week as safe-haven demand rose for the tried and true wartime asset. Gold rose as high as $2,430 on Friday before slipping and ending the day 1.5% lower. This year, gold has managed to rise almost 15%, finally breaking above the $2,100 ceiling that has constrained it since mid-2020:

The massive correlation break between gold and real rates continues to get worse. Gold is ripping higher while real rates also rise, breaking their historical inverse relationship. Both of these assets have historically reflected inflation. Since the massive boom of monetary and fiscal stimulus in 2021, the two assets have been dislocated from each other, and now the two look like they were never inversely correlated in the first place. Now as gold rises, real rates are rising too.

Why the about-face?

In all likelihood, the inflation calculation included in real yields is so off the mark now that real yields have lost the ability to accurately reflect real inflation. Ostensibly, this chart tells us that CPI is so cooked that gold is one of the only assets that still accurately reflects inflation. Price inflation is much higher than the officially reported 3.5% figure taken from CPI, and gold is simply one of the last real fire alarms:

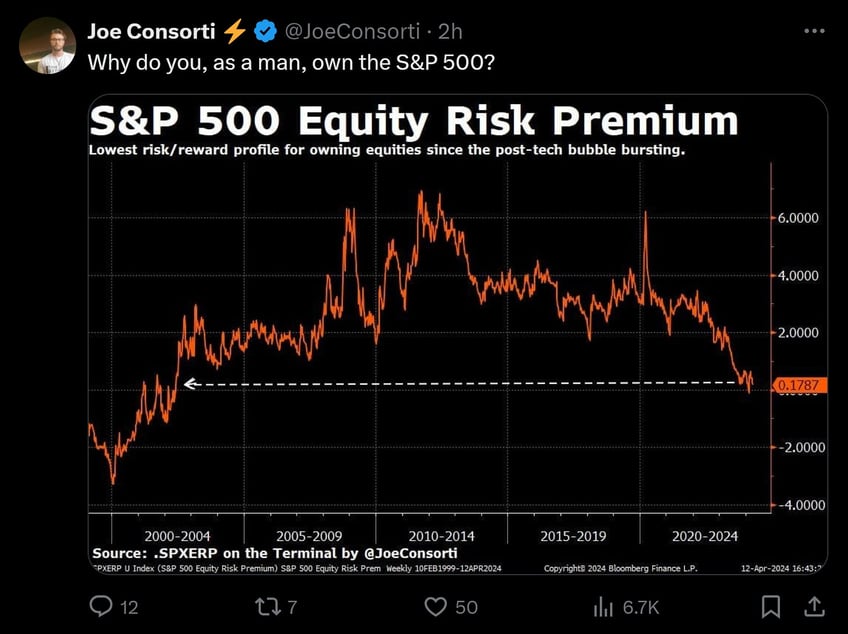

Elevated yields have also pummeled equity risk premiums, with the S&P 500’s premium over the 10-year US Treasury yield sitting at a 25-year low of just 17 basis points. In the last quarter century, owning stocks has never been less attractive:

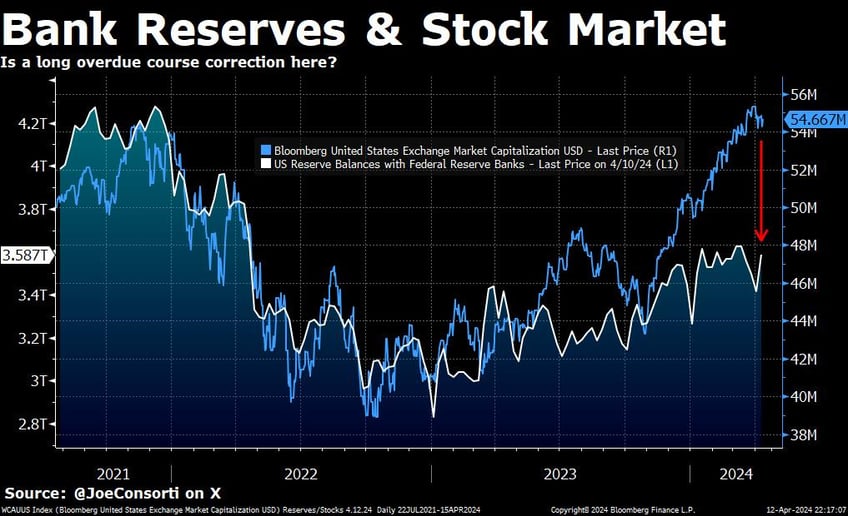

The same war jitters that have helped gold have hurt risk. VIX, stock market volatility that acts as a fear barometer, spiked to its highest levels of the year today. The stock market has massively diverged from bank reserves over the last 16 months, with the market cap of the US stock market appreciating far and away from the level of bank reserves in the financial system—we are not implying causation but continually appreciate the historic correlation of QE/QT and stock prices. At long last, stocks are on the move back down, potentially converging once again with the level of bank reserves. For now, the bull market remains intact, but we’ll keep our eye on this relationship:

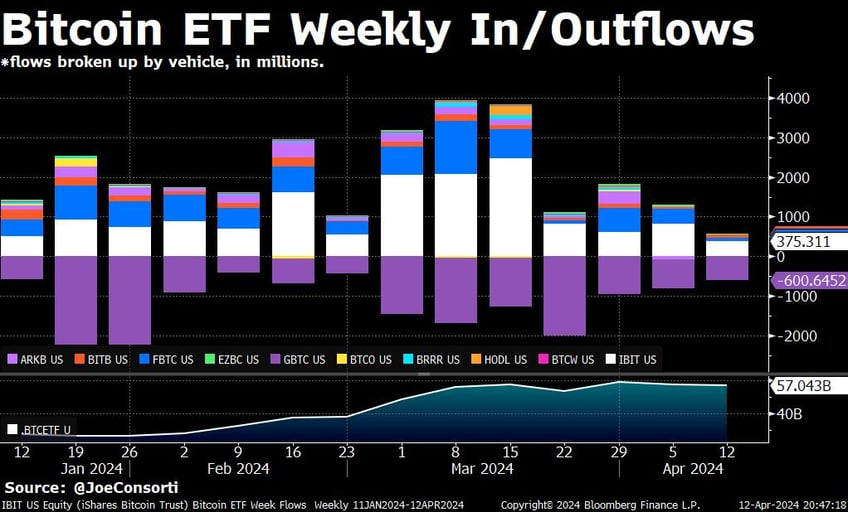

Inflows to the 9 new bitcoin ETFs, excluding GBTC, totaled $572 million this week, the lowest week to date. The jitters felt all across risk this week were felt particularly strongly in bitcoin, and the muted/negative action in bitcoin ETFs is no exception. Investor behavior is the same so far between bitcoin and its spot ETFs:

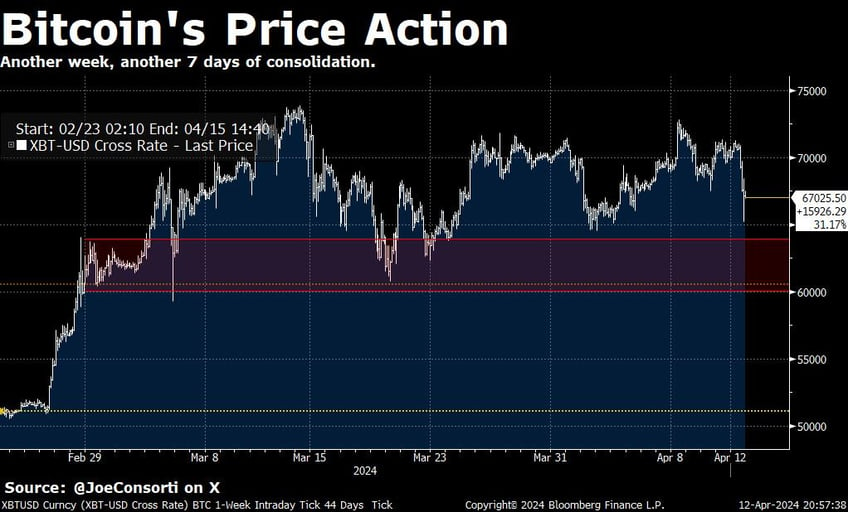

Bitcoin’s consolidation continues for the 6th-straight week. It seems to be a neverending honeymoon above the $65,000 mark. It isn’t up, it isn’t down, it’s rangebound, and there it will stay until the battle between buyers and sellers is won:

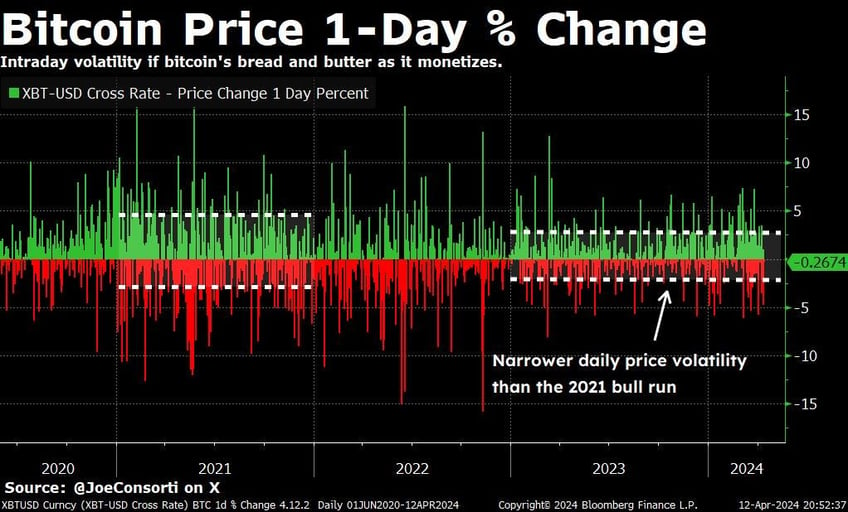

The consolidation BTC is experiencing now is muted compared to the last cycle. Here is a chart of the daily % change in bitcoin’s price for the last four years. Note that during the 2021 bull run, intraday price swings were much larger on average compared to today’s bull run. The range of daily % changes during the last bull market was roughly between -3% and +5%, while the range during this bull market is roughly between -2.5% and +3%. Though volatility is a hallmark of bitcoin’s monetization, it is getting less extreme with each passing cycle:

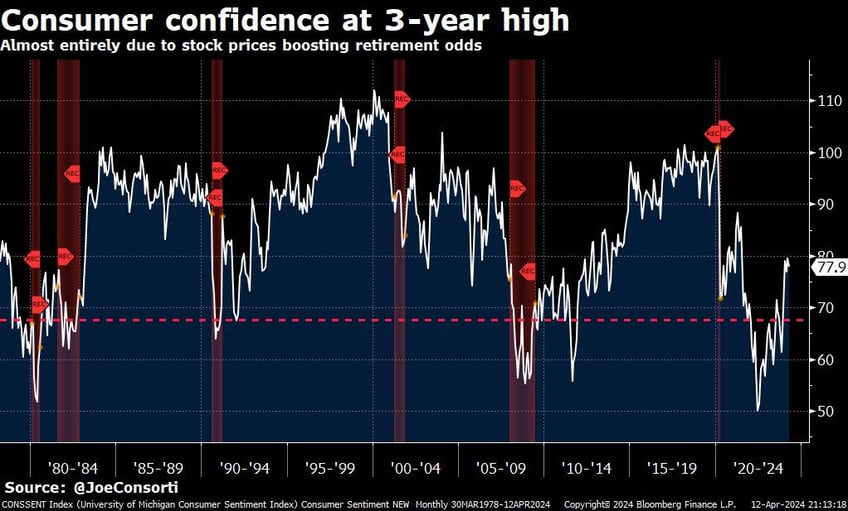

The prelim consumer survey from the University of Michigan for April was released on Friday. Inflation expectations on the 1-year and 5-10-year horizons came in higher than expected, in line with upstream prices that suggest price inflation will remain elevated for several months more, at least. Still, consumer sentiment remains at a 3-year high, almost entirely due to elevated stock prices. Asset owners are living the dream in this high-rate and inflationary environment. The asset poor? Not so much:

Finally, Fed members came out all throughout the day on Friday and walked back rate cut expectations for 2024, either calling for one or none. As discussed on Wednesday, this is in stark contrast to their tenor over the last six months. Powell seriously dropped the ball, and Fed members are scrambling to straddle the line between too-easy and too-tight financial conditions. As we come closer to the end of this year, the clock will be ticking on the Fed being able to bring down price inflation before the late-2024 corporate debt maturity wall approaches. If the Fed can’t bring down rates before that point due to still-stubborn price inflation, all bets are off on financial stability in 2025.

Next Week

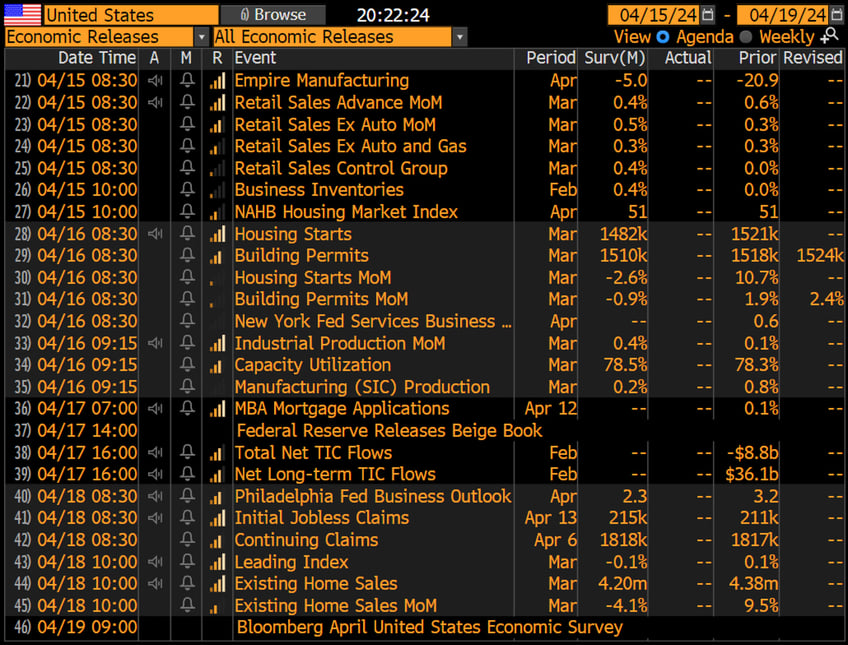

In the week ahead, we receive our first look at March consumer numbers in retail sales on Monday and a variety of housing data. We are much more focused on Tax Day and Treasury settlement on Monday, as the 10- and 30-year auctions saw large primary dealer takedowns, meaning dealers will scramble to fund Treasury positions on Monday or sell inventory into the market. With our eyes on SOFR and the broad repo funding market, we’ll look to any minutia next week in the money markets for signs that ample reserves are no longer ample and whether the Fed starts to discuss the early end to Quantitative Tightening. Generally, the market will be more focused on the aftermath of last week’s CPI and its impact on volatility. War drums have also started to sound, meaning that Friday price action could see reversals next week or intensification depending on geopolitical developments. Twenty-year Treasuries will also be auctioned next week:

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Subscribe to The Bitcoin Layer

Here are some quick links to all the TBL content you may have missed this week:

Tuesday

In this episode, Nik is joined by veteran trader Craig Shapiro to discuss the diminishing role of the dollar in international trade settlement. Craig introduces the petrodollar as an instrument in marginal decline since 2022, why China is resisting US calls for it to revalue its currency stronger, and how gold is responding to a new international monetary system. Learn why the oil trade, Treasury yield curve, and gold's new all-time high are all related.

Check out—$4,000 Gold On MASSIVE Changes To Global Finance

Wednesday

March consumer prices came in hotter than analyst expectations. The headline number rose from 3.2% prior to 3.5% in March, beating estimates of 3.4%. Core inflation, which removes volatile food and energy prices (despite those being what most people are impacted by), was flat at 3.8%, beating estimates of 3.7%.

Supercore inflation, which is inflation in core services excluding housing, rose to 4.8% year-over-year. According to Torsten Slock from Apollo, core services inflation, which is hugely indicative of consumer spending activity, is accelerating. With a 3-month annualized rate of 8% up from its 6-month annualized rate of 6%, consumers aren’t backing away from services—they are spending more. Even after the holidays.

CPI has now spent 10 of the past 12 months totally unmoved above 3%, which is a full 50% higher than the Fed’s long-run target range of 2% yearly growth. With the Fed’s no-recession mandate further solidified by it being an election year wherein economic slowdowns are forbidden, a price inflation rate of 3.5%, 1.5 times higher than what you’ve been used to for 25 years, is the new normal for the foreseeable future.

Check out—Price Inflation Is 1.5x As High As Before, And It's Not Coming Back Down

In this episode, Joe sits down with Matthew Pines, Director of Security Advisory at Sentinel One National Security Fellow. Live at the 2nd Annual Bitcoin Policy Summit hosted by the Bitcoin Policy Institute, Matt delivers his geopolitical analysis, discusses how American companies are working directly with eastern countries, the US-China cold war that is brewing on the tech, trade, and currency fronts, and how complacency with BTC policy will severely set the United States back on the global stage.

Check out—Bitcoin Is America's Edge In The US-China Cold War

Thursday

In this episode, Nik is joined by ResiClub co-founder Lance Lambert to discuss the US residential housing market. Lance explains why he is labeling the housing market 'constrained,' including how high mortgage rates are limiting buyer affordability while trapping sellers who don't want to give up sub-4% notes. He also breaks down regional differences in the market, addresses short-term rentals (AirBnB), and contrasts multi-family properties to residential housing.

Check out—Housing Inventory Up & Affordability At 24-Year Low

Friday

In this episode, Nik brings us a timely chart pack to discuss a wild week in financial markets. With weakness in the stock market, Nik goes through charts on bitcoin, the dollar versus euro and Asian currencies, the latest in Japanese yen weakness, China's currency prospects, US & global debt to GDP, the latest inflation numbers, and recession likelihood. Throughout, Nik wonders if there is a major shift underway in the global monetary system.

Check out—WILD WEEK: Gold Up, Stocks Down, Monetary Reset?

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

Subscribe to The Bitcoin Layer

That’s all for our markets recap—have a great weekend, everyone!

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 full reserve multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.