Gold Under Every President From Carter to Trump

Contents: (500 words)

- Trump's Victory Sets Market Tone

- Commodities Outlook: Oil and Gold Under Pressure

- Mixed Medium-Term Outlook for Metals

- Gold’s Long-Term Drivers Remain Strong

- Impact on Oil: Reducing Middle East Exposure

- Tariffs Weigh on Base Metals; China’s Role Key

Trump's Victory Sets Market Tone

The “Trump Deal” is currently steering markets, driving the U.S. dollar, stocks, and cryptocurrencies higher. Meanwhile, concerns around potential tariff policies have put pressure on commodities, with crude oil, gold, and copper slipping 1-5%. Overnight, gold—the leading commodity—dropped 3%, while silver and copper declined over 4% yesterday.

Commodities Outlook: Oil and Gold Under Pressure

In a recent report, Citigroup forecasts that Trump’s return could push oil prices lower, with Brent crude potentially dropping to $60 per barrel by 2025. While a strong dollar and increased AI-driven trading may weigh on gold in the short term, Citigroup maintains a positive outlook on gold’s longer-term prospects, recommending it as a buy at levels below $2,700 per ounce and setting a six-month price target at $3,000.

Mixed Medium-Term Outlook for Metals

Citigroup’s outlook for base metals remains neutral, with a view that future pricing will hinge on developments in China and global trade dynamics. The medium-term trajectory for base metals is thus seen as uncertain.

Gold’s Long-Term Drivers Intact

Despite recent short-term weakness, Citi sees fundamental support for gold prices in the form of the U.S.’s high-interest rate environment, a deteriorating labor market, and sustained global demand for gold ETFs. Rising global debt and the de-dollarization trend are also bolstering the case for gold, with central banks expected to continue their heavy buying.

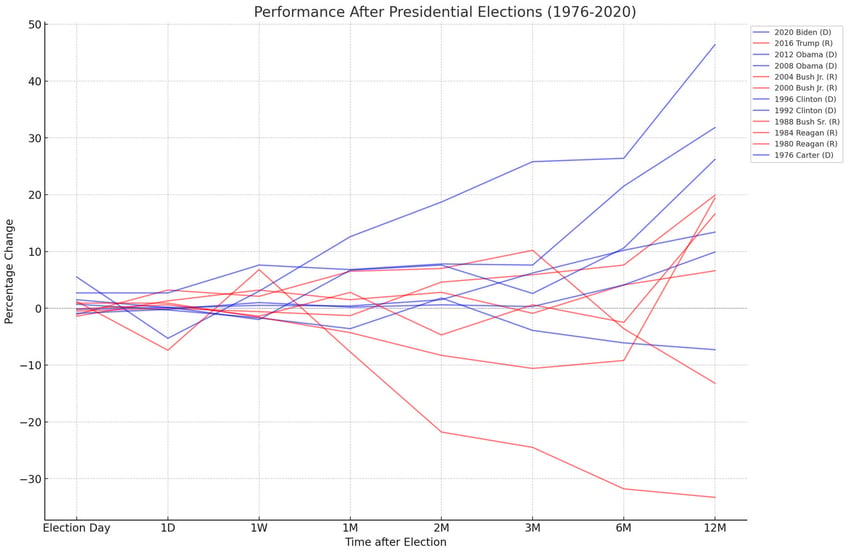

Democrats preside over upward Sloping Trends; Republicans preside over extremes in Price...

Sell Some Oil

Citigroup advises oil producers to limit exposure to Middle Eastern risks over the coming months, forecasting that Trump’s policies could press down on oil prices. The bank projects Brent crude to average $60 per barrel in 2025. Potential escalation in the Middle East remains a factor that could introduce volatility, but as Trump’s policies begin to take shape, the broader impact is expected to lean bearish.

Tariff risks also present a headwind for oil, with Citi simulations suggesting that a 10% U.S. tariff on global trade could reduce global GDP by 0.4-0.6%, directly impacting oil demand, especially for diesel. Trump may further impact oil by influencing OPEC+ production decisions.

Tariffs Weigh and Base Metals

Citi highlights that the immediate market reaction to Trump’s election and a Republican Senate sweep included a recalibration of tariff risk, pushing base metal prices lower. This has placed the base metals market in a “wait-and-see” posture.

In the bank’s baseline scenario, copper is forecasted to reach $11,000 per ton by late 2025, with aluminum expected to hit $2,900 per ton. The rationale includes potential Fed rate cuts, China’s anticipated economic easing, and falling oil prices supporting a manufacturing recovery. Additionally, demand growth tied to decarbonization is seen as a likely boost to metal prices.