Goldman on Financial Repression

"Keep an open mind, or get financially repressed"- Z. Pozsar Feb 1, 2023

Authored by GoldFix ZH Edit

Intro: In a must-read report dated May 22nd Goldman Sachs laid out in clinical, objective economic terms a very harsh reality surrounding the sustainability of our current deficit path. What follows is our analysis of that report followed by a more clinical breakdown of the same report.

Analysis Sections: (1400 words)

- Report Bottom Line

- The Operative Paragraphs

- Given Full Employment the deficit is too high. Given this deficit, rates must rise…

- Deficits should shrink when not in a recession, not grow…

- As a measure of economic health, Debt to GDP will rise considerably because of this…

- Greater productivity, and faster GDP growth would lessen this risk…

- History says it must get worse before it gets better…

- Debt Reduction Can be achieved one of two ways…

- Why They Will Default to Financial Repression…

- The Report

- The Investment Themes

1- Report Bottom Line

The report screams two things.

- It is Goldman’s clinical opinion the US deficit and current spending is an unsustainable situation…

- It will get much worse before it gets any better based on historical human behavior

2- The Operative Paragraphs

Screams “Buy Hard Assets”

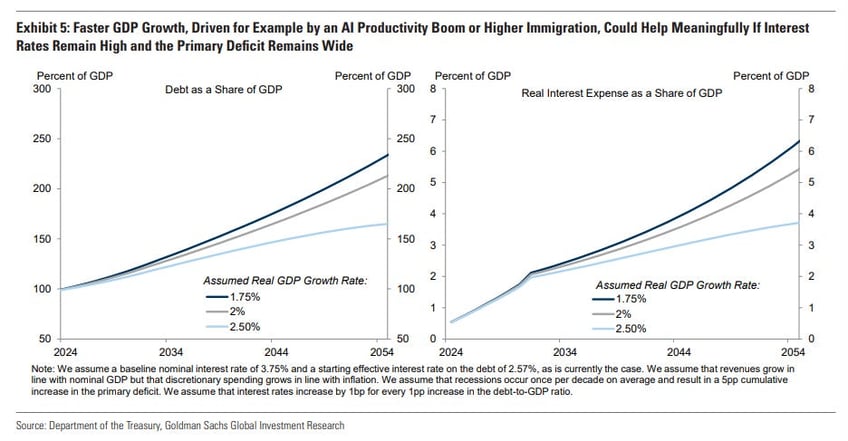

We update our debt projections using our long-term forecasts for the average interest rate on government debt, nominal GDP growth, and the primary deficit outside of recessions. We follow our earlier fiscal sustainability analysis in accounting for the impact of recessions on the deficit and of the rising debt stock on interest rates. We now project that the current fiscal path would push the debt-to-GDP ratio to 130% by 2034 (vs. 97% in that year under our 2019 projections) and real interest expense to 2.3% of GDP (vs. 1.5%).

Screams “Due to lack of Political Will, Financial Repression will solve this”

First, large debt reductions have been achieved in different ways—some almost entirely with sustained fiscal surpluses, others with combinations of low interest rates relative to GDP growth, high and unexpected inflation, and financial repression.

Some key observations that reinforce this:

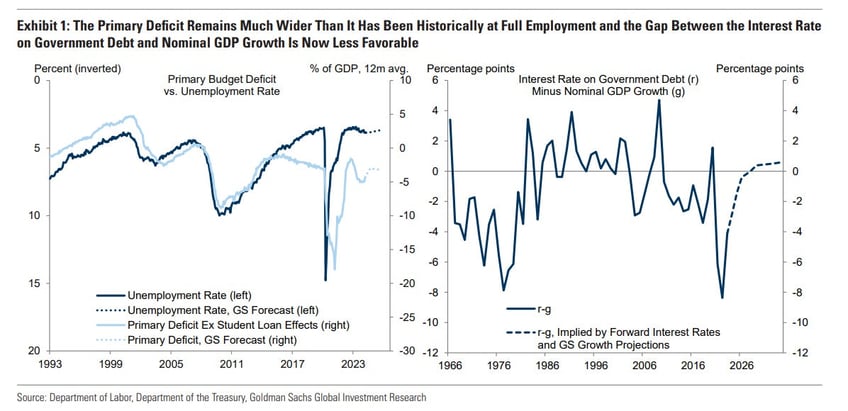

3- Given Full Employment the deficit is too high. Given this deficit, rates must rise…

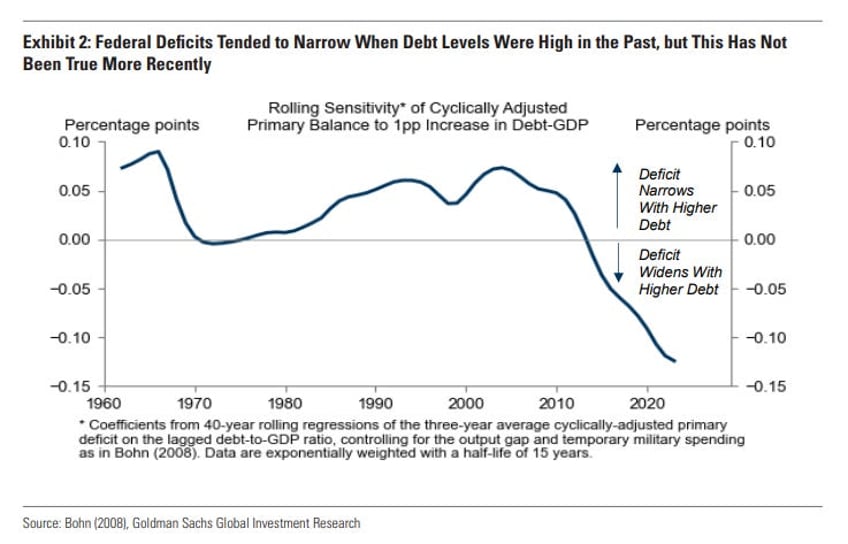

Despite this, the focus on fiscal sustainability has diminished in Washington in recent decades and remains low today. Exhibit 2 shows that the federal government had long tended to respond to a rising debt-to-GDP ratio by increasing the primary balance—a key requirement for avoiding unsustainable fiscal paths—but this has not been the case recently

Bottom line: Either too many people are working unproductively, inflation is too low, or stocks are too high

4- Deficits should shrink when out of recession, not grow…

5- As a measure of economic health, Debt to GDP will rise considerably because of this…

Bottom Line: They will not bite the bullet, you will

6- Greater productivity, and faster GDP growth would lessen this risk…

More here