Goldman's $3,000 Gold Forecast: Analyst Pushback Amidst China Surprise

Contents:(included)

- Summary

- Reasons Goldman Remains Steadfast

- Dollar Strength Does Not Drive Investor Gold Demand, Rates Do.

- Central Banks Don’t Want the Dollars Anyway

- Hedging Global Crises With Gold and Dollars

- Market Neutral Impact of China’s Easing

- China Buys 10x More Gold Than Publicly Stated

- Two-Way Risks to the Forecast and Conclusion

- Additional Takeaways

1- Summary:

Goldman Sachs analyst Lina Thomas forecasted that gold would hit $3,000 per ounce by the end of 2025. The main reasoning? Relentless central bank purchases, particularly from China’s voracious appetite for the metal.

However, the thesis quickly faced skepticism, as competing colleagues questioned whether gold could continue its ascent amid a strengthening U.S. dollar—a hallmark of consensus trades tied to Trump’s return.

Thomas, however, countered the skepticism in a note asserting that gold may still rally to $3,000 even if the dollar remains strong. She even noted that there is now upside risk to that price target adding $50+ if things continue as they have been. This report also allows for the Fed reducing rate cuts to only one more in 2025.

2- Reasons Goldman Remains Steadfast

Her argument is built on four key points:

Dollar Strength Does Not Drive ETF Gold Investors as Much as Rates Do.

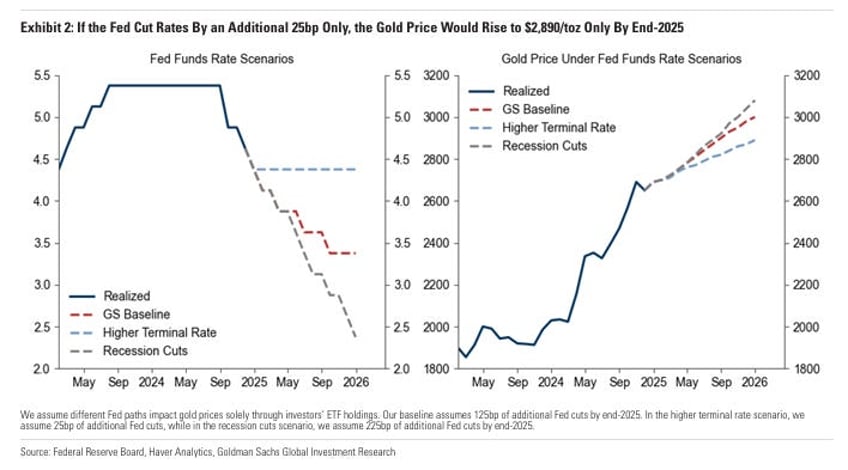

Goldman’s economists anticipate a global monetary easing cycle where both Fed rate cuts and a strong dollar coexist. Thomas argues that U.S. policy rates, not dollar strength, are the primary drivers of investor gold demand. In Goldman’s base case, a 100-basis-point Fed cut boosts gold prices by 7%, pushing the metal to $3,000.

Her next point we believe is key to the whole argument and an insightful giveaway to how things are transpiring unheard of most anywhere else. .Even if they are a little too bullish, Goldman is most definitely ahead of the Bank curve in understanding,—or at least in giving their clients some credit to be able to grasp the Bank's understanding—of the secular monetary dynamics at play.

Central Banks Don’t Want the Dollars Anyway

[Abridged]

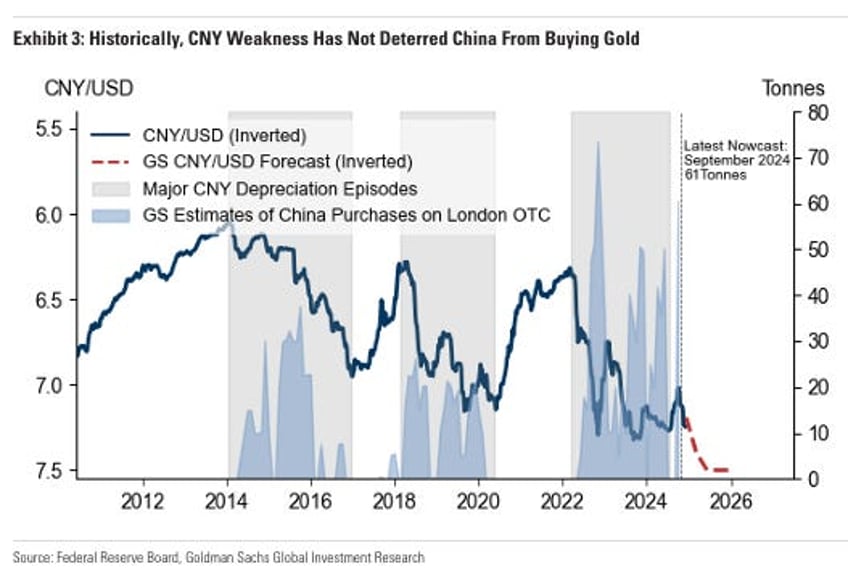

Thomas disputes the idea that a strong dollar would deter central bank purchases, which she estimates will contribute a 9% boost to gold prices by end-2025. Her key observation: Central banks typically purchase gold using dollar reserves. They use USD they already held and recently budgeted for using in their dedollarization/diversification operations. From the report:

We disagree with the view that dollar strength will halt structurally higher central bank purchases (which boosts the end-2025 gold price by 9% in our base case) because central banks tend to buy gold internationally from their dollar reserves. In fact, the large central bank buyers tend to raise their gold demand amid local currency weakness to boost confidence in their currency.

This is quite the insight into the resetting Gold/USD correlations observed here

Goldman is, we believe, describing a situation where Central Banks have already mandated liquidating dollars and using a portion of the proceeds to buy Gold as part of their need to get more of the monetary metal. This explains the correlation breakdown we have been on about for two years at GoldFix, but in a more practical and behaviorally-rooted way.

Thomas is implicitly stating Central Banks are no longer tactically targeting Dollar-Gold correlations i in an attempt to conserve dollars for future spending; Rather they are targeting quantities of Gold that need to be bought for future collateral/spending. These banks are not pricing Gold in dollars to conserve dollars. They are now closer to pricing dollars in Gold as they need to acquire more Gold and reduce more USD holdings.

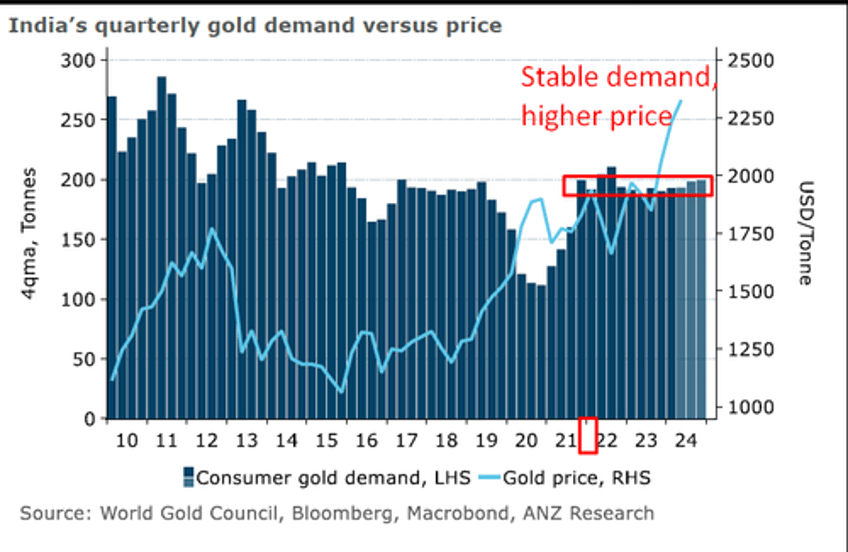

Central Bank demand is therefore becoming inelastic to Gold priced in USD as evidenced in multiple analyses by us, and Goldman Sachs. it's not just China buying regardless of USD price. Here's Indian demand since Covid

Inelastic Demand in action…

Put another way:

- What was a function of how many dollars you used to need on hand…

- If the dollar is weak versus Gold- Budget to spend more discretionary USD for gold.

- If the dollar is strong against Gold- Budget to conserve USD, Sell Gold

- Has become a function of how much Gold you will need…

- If the dollar is weak versus Gold- Buy 1,000 ounces

- If the dollar is strong against Gold- Buy 1,000 ounces

The bullets above are the underlying behavior for why USD correlations have broken down (correlations have “reset” as Goldman and us noted. Their “beta changed” as TS Lombard foresaw) the last two years.

From that October analysis: "While the gold-price-to-rates relationship remains intact in changes, the ‘secret’ buyer has elevated prices and reset the relationship in absolute levels"

Continues..

3- China Buys 10x More Gold Than Publicly Stated

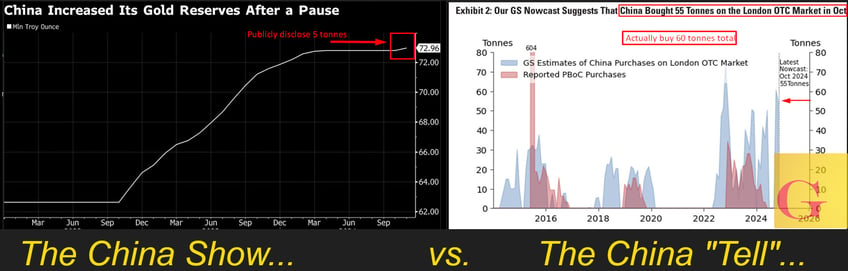

As Goldman's thesis unfolds, one aspect is already materializing: massive central bank gold purchases. The bank's October nowcast revealed 64 tonnes of central bank purchases on the London OTC market, compared to a pre-2022 monthly average of 17 tonnes.

Within that analysis, China reportedly added 55 tonnes of gold, far exceeding the official figure of about 5 tonnes released by the People’s Bank of China (PBOC). This suggests China as Zerohedge first noted last week is acquiring gold at nearly 10 times the rate it publicly admits.

From: China Secretly Buying Up Massive Amounts Of Gold,...

"What is far more striking is the staggering (and growing) divergence between the modest amounts of gold purchases reported by the PBOC [5 tonnes] and the far greater amount China has actually purchased [55 tonnes]on the London OTC market"

The Goldman report's “Nowcast” analysis notes an uptake of registered 64 tonnes in October, surpassing the pre-2022 average of 17 tonnes. China emerged as the largest buyer, (as ZeroHedge notes below) adding 55 tonnes, while Azerbaijan and the UAE contributed smaller amounts at 3 tonnes each.

4- Two-Way Risks to the Forecast

Thomas identifies the primary downside risk to her $3,000 gold forecast as the Fed cutting rates less than anticipated. Ironically, while fewer rate cuts might weigh on gold prices in the short term, they could also exacerbate inflationary pressures if a slowdown triggers panic cuts due to stagflation, potentially driving gold even higher in the long run. When answering the question surrounding her second point about China demand being inelastic to USD strength she noted:

From Central Banks Double Down on Gold; October Nowcast Hits 64 Tonnes

If our GS nowcast were to consistently come in 10 tonnes stronger each month than currently forecasted, we would see $50 of upside to our end-2025 gold price forecast, rising to $3,050/toz (vs. $3,000/toz in baseline).

The key word is "consistently" here. The primary assumption has been some banks leading up to the 2024 POTUS election were more impulsive buyers. Logically, they should slow down somewhat in its aftermath. But with Trump's tariff threats, that may keep China's buying in earnest. Otherwise, the market should resume pricing-in a buying slowdown and increased price sensitivity for CBs in 2025.

5- Additional Takeaways

Frankly, as traders, it is not easy agreeing with Goldman. So let’s just say Goldman is agreeing with GoldFix for a change. This report is not a reason to buy. It is a reason to assume the BRIC central bank buying is still exceeding Western expectations-- which may be a reason to buy in itself. The next signpost is likely when Trump either makes good or backs away on tariff threats. Finally, here are some observations noted when examining this report alluded to above but spelled out a little more clearly...