Gold’s resiliency intact despite hot US inflation dampening Fed rate cut expectations

Authored by GoldFix ZH Edit

MUFG, the largest bank in Japan and a consistently objective voice in commodities just released a note reiterating their 2024 Gold call report. This is important for several reasons.

First and foremost, they are the only bank of this size to put this type of research out *after* a selloff while maintaining their price target. By contrast, last month’s UBS report which got all the CNBC attention, was actually a reduction in price target to $2200 from their target a month prior at $2250. (Noone else reported this besides GoldFix)

Secondly, not being a bullion dealer and not being US Based, MUFG are less constrained by US Dollar Politics Finally, it is noteworthy Gold has not gotten pummeled too badly post the Fed rate cut pullback and we have said as much. Today a major financial player with little conflict sees it as well. Here are a few excerpts from that report.

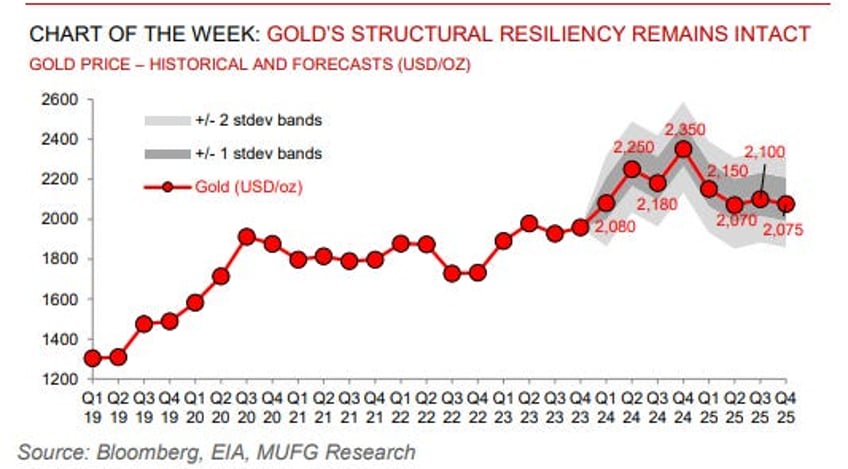

Global commodities: Gold prices have remained in consolidation form as hotterthan-expected US inflation has dampened hopes for a rate cut in the first half of 2024. Beyond the sticky inflation reading, elevated yields have found further support following the recent FOMC meeting – removing the tightening bias with Fed Chair Powell signalling that a March cut “is probably not the most likely case”.

Whilst higher for longer rates is bearish for non-interest bearing bullion, we hold conviction that the other two channels that are central to our bullish 2024 gold view remain intact, namely, robust EM central bank purchases on reserve diversification and its role as the geopolitical hedge of last resort. (that report here1 )

Key Points

- Whilst higher for longer rates is bearish for non-interest bearing bullion, we hold conviction that the other two channels that are central to our bullish 2024 gold view remain intact – central bank demand and geopolitics

- Central bank purchases – particularly from China and India – have been the central offset against the rates-driven ETF liquidation

- Consumer’s “wealth effect” continues to be another strong dimension of higher bullion consumption

- We acknowledge downside risks to our constructive USD 2,350/oz year-end forecasts but remain constructive on bullion this year

Continues here

Free Posts To Your Mailbox