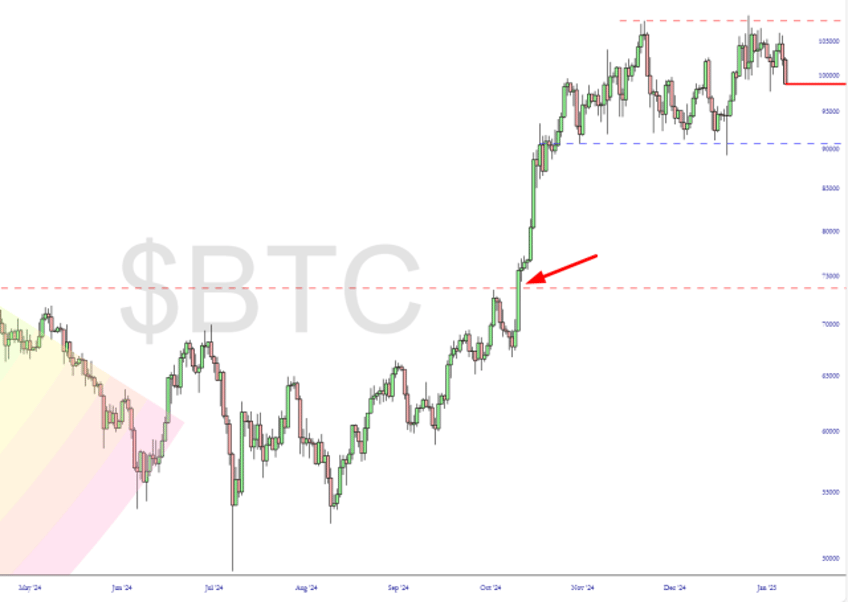

Metaphors and analogies are how I tend to make sense of the world, and a new one occurred to me today between two unlikely situations: the purchase of my company in 2005 and the price of Bitcoin, show below (with an arrow marking the Presidential election).

I built a company called Prophet from 1992 until 2005, when I sold it to a much larger financial firm called INVESTools, which later was absorbed into Ameritrade. Prophet, like my existing business Slope of Hope, was a labor of love.

Prophet also, like Slope, had a "freemium" model, in which we offered all kinds of goodies for absolutely nothing while simultaneously begging for our users to do the right thing and hand us a few bucks for even more goodies. Over the course of many years, many advertisements, and many trade shows (see below) we accrued a user base of about 3,400 paying subscribers, which in those days was enough to have a profitable 21-person company. Good times!

When INVESTools purchased us, they were much more than a 21-person company. They occupied a very large multi-story building in Provo, Utah, filled to the brim with employees. They were publicly-traded on the NASDAQ (symbol INVS, if memory serves, although at one point I had to talk them out of the not-very-good idea to change the ticker to TOOL). In the midst of all the excitement, I was assured that Prophet.net's subscriber base was nothing compared to what was coming. With their massive marketing budget and reach, we were about to get buried in subscribers.

I think you know where this is heading. They bought us on January 26, 2005, and the marketing melee commenced. Our subscriber base grew...............a little. But as the weeks, and then the months, passed by, it became pretty clear that my tiny little company had already squeezed out of Earth just about everyone who actually was willing to pay for such a niche service.

Prophet, it turned out, was about as big as it was going to get, even with all the advantages INVESTools (and, soon thereafter, Ameritrade) brought to the table. The market was tapped out. We had already done a yeoman's job bringing in the customers that were possible.

Let us now turn our attention to Bitcoin, which as we've all been told endlessly began as a one penny financial instrument way back in 2009 and, since then, has (on occasion) pushed to almost $110,000. This ascent in "value" is astonishing, which goes a long way to explaining why the crypto community is the biggest bunch of defensive hair-triggered blowhard zealots ever to inhabit this planet.

I'd like you to take a moment to study the entire history of Bitcoin, beautifully portrayed within SlopeCharts and artfully augmented by the arrows I have drawn.

Surely you notice something important about the arrows, which is their angle of ascent.

The first one is almost vertical. The next one, less so, And then less. And less. And then so much less that it looks like the next one will be close to flat. It's losing energy. Losing momentum. And, thus, the crypto bros, whether they know it or not, are losing their minds, which is precisely why they bristle if someone like me who is not clinically insane mentions that their dreams of $BTC going to $1 million are crazy.

So, where's the analog, Tim? Settle down, I'm getting to that. You sure expect a lot for a free article!

Bitcoin, as with Prophet, has recently had just about every possible advantage thrown at it:

- A new administration so cloying and sycophant to this crypto community as to be cringeworthy;

- An enormously visible launch of digital coins by none other than the President and First Lady (the collapse of these aforementioned assets notwithstanding);

- A grotesque cadre, led by the absolutely uncharismatic nebbish David Sacks, placed in positions of the highest authority in the government and who have pledged a U.S.-led crypto revolution;

- Deeply serious and well-telegraphed talks of establishing a massive "strategic reserve" of Bitcoin for the government of the United States;

- An assertion from the new government that the adoption of Bitcoin will, in fact, pay off a third of the our national debt in a couple of decades.

That's honestly just off the top of my head, because I'm certain there are other items that are probably even more positive all of which, when taken together, resemble something like this:

Just as Prophet's 3,400 subscribers was expecting to grow into the many tens of thousands, likewise with all the positive developments, announcements, and pandering, one would justifiably expect $BTC to be at least a quarter million bucks by now.

Instead, after all that, here's the reality of what BTC has done since mid-November, almost three months ago, in the midst of this absolute tidal wave of good news:

At the risk of confusing you with the technical jargon of a lifelong technical analyst, my summation of the above price action is that Bitcoin hasn't done dick.

I suspect slimy Sacks, endlessly-permabullish Michael Saylor, and other like-minded folks would counter that you ain't seen nothin' yet, and that talk of a strategic bitcoin reserve and its execution are two very different things, and million-dollar bitcoin is a mathematical certainty.

Could be. Could be. Maybe I'm stone cold wrong.

All I can tell you is that, as someone who has experienced in real life what it's like to have every rational reason to expect something to happen and, when it doesn't happen, eventually come to accept the fact that things are the way they are, and pushing on a string just isn't going to make any difference.