The Fed is panicking.

Why?

Because, its efforts to loosen monetary policy to juice stocks and real estate higher to aid the Biden administration with its re-election campaign have unleashed another round of inflation.

Don’t believe me? See for yourself.

The Consumer Price Index (CPI) bottomed right around the time the Fed stopped raising rates. It has since flat-lined and is now turning back up.

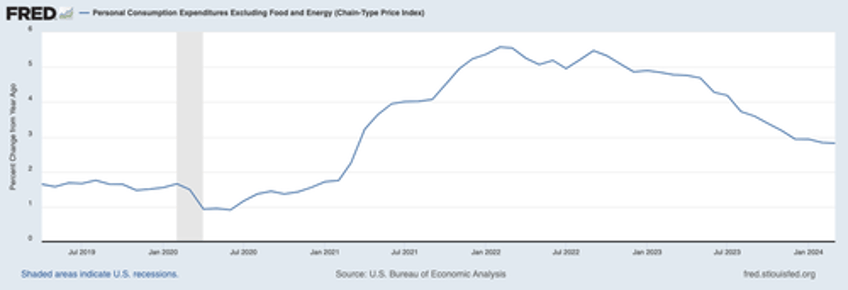

The same is true for the Fed’s preferred inflation measure, core-Personal Consumption Expenditures or core-PCE.

That little uptick doesn’t look like much, but as economist Jason Furman notes, if you annualize the 1-month and 3-month changes in core-PCE, the situation the second wave of inflation becomes clear.

Annualizing the 1-month MoM rate of change in Core-PCE gives you inflation of 3.9%.

Annualizing the 3-month MoM rate of change in Core-PCE gives you inflation of 4.4%.

Still not convinced? Take a look at what gold is doing.

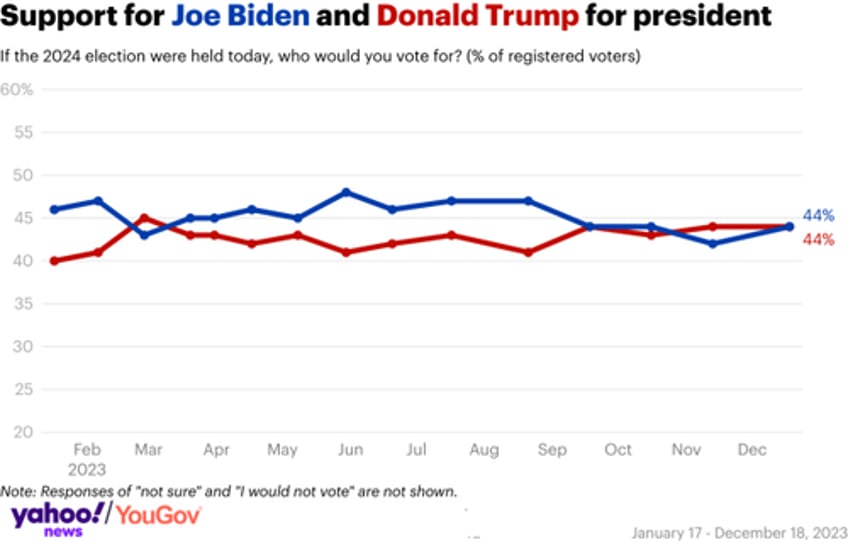

As a general rule, Americans vote with their pocketbooks. And this spike in inflation is TOXIC for the Biden administration.

Former President Trump is one of the most unlikeable candidates in history… and yet, he’s been gaining on President Biden in the polls ever since inflation started ticking back up again in September 2023 (see for yourself)

So what will the Fed do? Its monetary easing boost stocks and real estate, but it also worsens inflation, which increases the odds of former-President Trump taking the White House. And what investments will profit the most from this situation?

To answer that, we recently published a Special Investment Report detailing three investments that will profit from the Fed’s inflationary mistakes. As I write this, all three of them are exploding higher.

Normally this report would cost $499, but we are giving copies FREE to anyone who joins our daily market commentary.

To pick up your copy, go to:

Graham Summers

Chief Market Strategist

Phoenix Capital Research, MBA