Perceptions of broader business conditions continued to worsen in October, according to The Dallas Fed Manufacturing Survey.

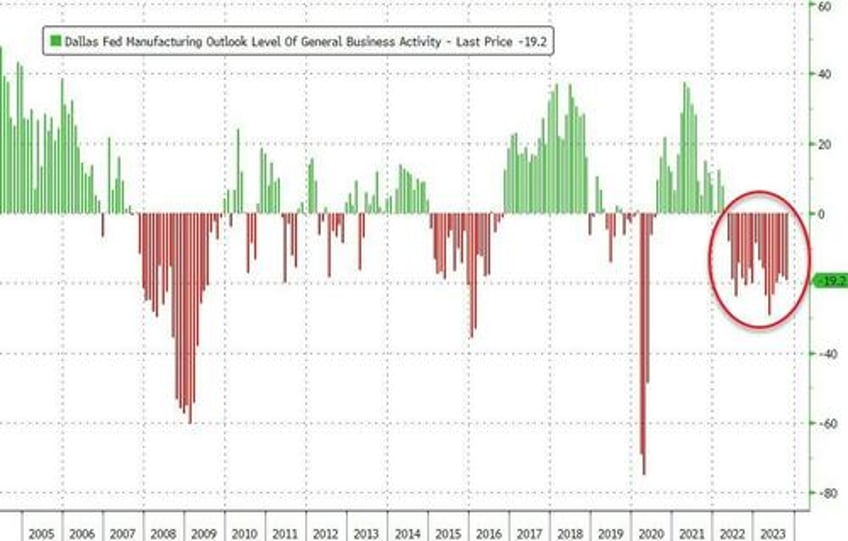

The general business activity and company outlook indexes remained largely unchanged at -19.2 and -17.1, respectively.

Source: Bloomberg

This is the 18th straight month of negative readings for the headline sentiment signal.

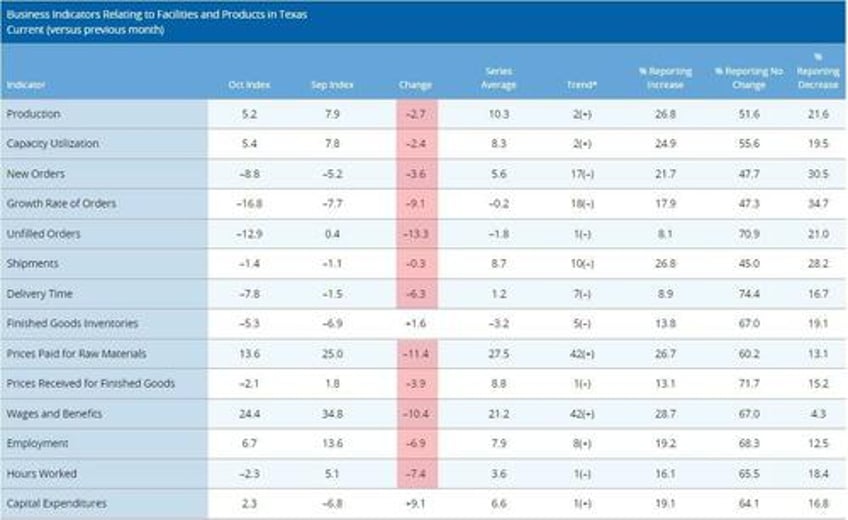

The outlook uncertainty index remained elevated but retreated from 27.0 to 20.2, but under the hood, the individual factors were almost all lower on the month...

New Orders are dumping again and the average workweek is declining...

Source: Bloomberg

The one teeny tiny bright spot... prices paid (and received) dropped on the month.

Respondents were almost perfectly, uniformly downbeat...

Six months from now is actually quite scary. The economy is uncertain, and customers cannot predict with any certainty what they see. Political pressure and the wars are now forcing customers to reevaluate their business activities and reduce their outlook. It’s very uncertain.

In a consumer business, we are hearing a lot more "I can't afford this" than we ever have before.

Business has slowed down significantly; we see no signs of improvement in business activity.

Oh, how we long for the days of a stable market. We just lost another long-time customer to China where the pricing for the finished product was what we pay for the raw material. With the inflation we have being imposed on us here in the U.S., we won't ever see those customers come back.

With the unrest in the Middle East, there is now additional global uncertainty and about how it will impact the U.S. and overall global economy. There is limited optimism; we will see a very slow recovery in the first quarter depending on the global impacts of additional conflict.

We are off by 20 percent this year so far. I don't expect it to get better. Prices of goods are going up. Shipping is going up.

Activity is definitely slowing down. We remain optimistic at this point for a turnaround, but cautiously.

The economy is slowing.

Our industry continues to be severely damaged by foreign countries dumping product into the U.S. and our territories. That, coupled with overall business being down, has caused a loss of jobs and capital dollars going back into our industry.

We anticipate that business conditions will remain constant or decline over the next three to four months, based on the rate that we are receiving orders. Oil and gas orders have been weak all year, which is strange since oil prices have been high and are anticipated to continue to increase with the uncertainty in the world order.

We are currently forecasting a 20 percent drop in 2024 versus 2023 (previously planned for a 13 percent drop), so the market forecast has worsened month over month.

Reduction in government grants, cash flow issues with customers and the uncertainty created by the lack of border controls [are issues affecting our business].

The lack of petroleum-based energy policy is troublesome.

We are seeing a pronounced slowdown in owners going forward with new projects. There is too much uncertainty in the economy and globally.

We are working our way to find a cyclical bottom. The overall economy is still the wild card, and it’s not helping. If things stay stable in the economy overall, customer inventories should have stopped draining, and our growth should resume sometime by mid next year.

Overall customer projections are said to be up for 2024, but our forecasts don't match and are down.

Bidenomics, bitches!