A Timely Suggestion To Hedge

On November 20th, we congratulated MicroStrategy (MSTR) shareholders for their recent gains and suggested it was time to hedge. In the same X post, we included a TikTok video showing an optimal collar hedge for the stock.

⚡️Congratulations, MicroStrategy longs—you’ve been killing it.⚡️

— Portfolio Armor (@PortfolioArmor) November 20, 2024

Consider hedging now though, to lock in most of your gains.

Here’s a way you can get paid (collect a net credit) to hedge your $MSTR shares out to February. pic.twitter.com/y57T0lZ6h0

It turned out that our timing on that call was impeccable, as November 20th was when the stock peaked. Since then, MSTR shares have plummeted nearly 40%.

Let's look at the optimal collar our app presented for MSTR then, and how it has protected MSTR longs since.

Our November 20th Optimal Collar On MSTR

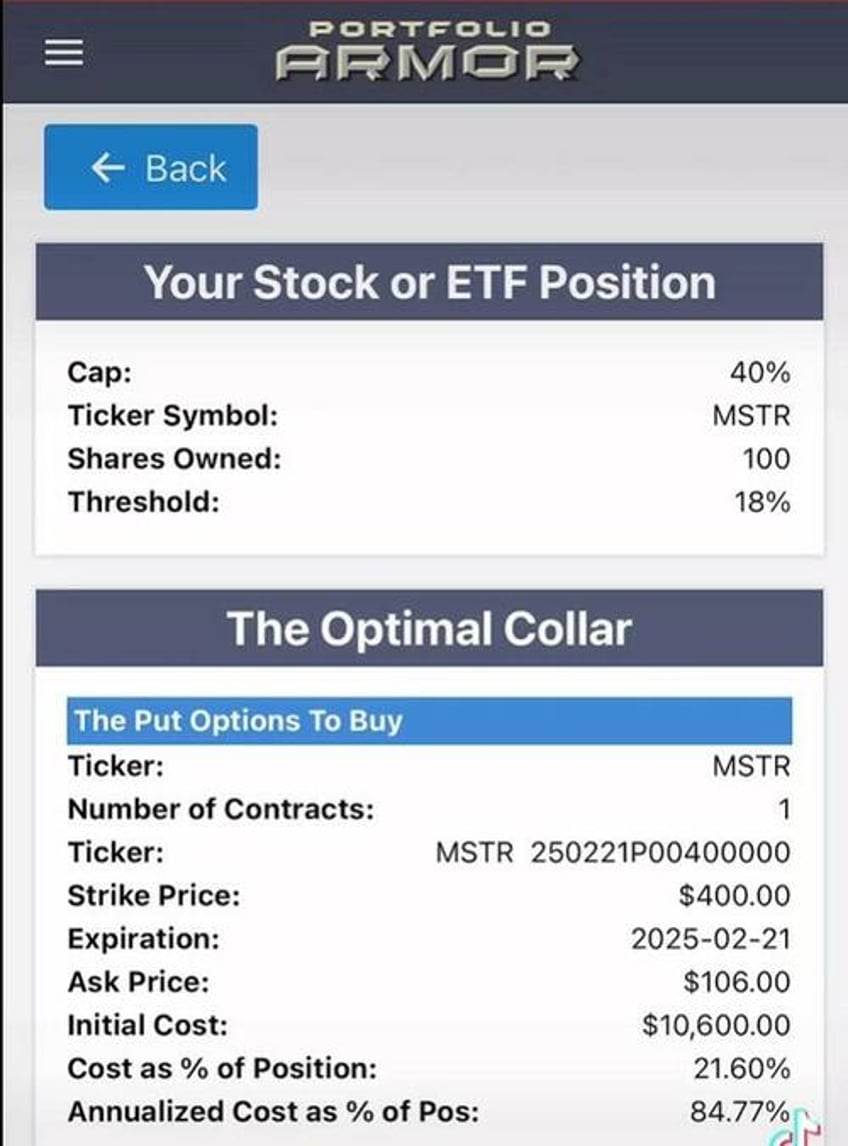

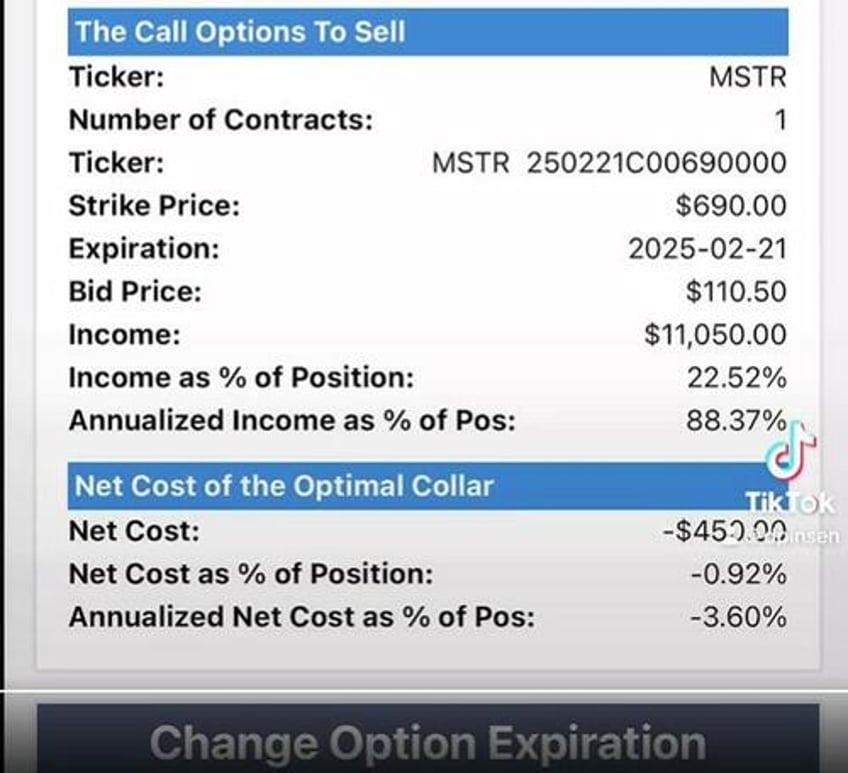

This was the optimal collar, as of November 20th's close, to hedge 100 shares of MSTR against a >18% decline over the next two months, while not capping your upside at less than 40%.

If you opened that collar on November 20th, your net position value (stock + hedge) would have been this:

$47,383 in stock + $10,600 in put options -$11,050 in call options = $46,933.

Let's take a look at the prices of those options as of Tuesday's close and see what your net position value would have been then.

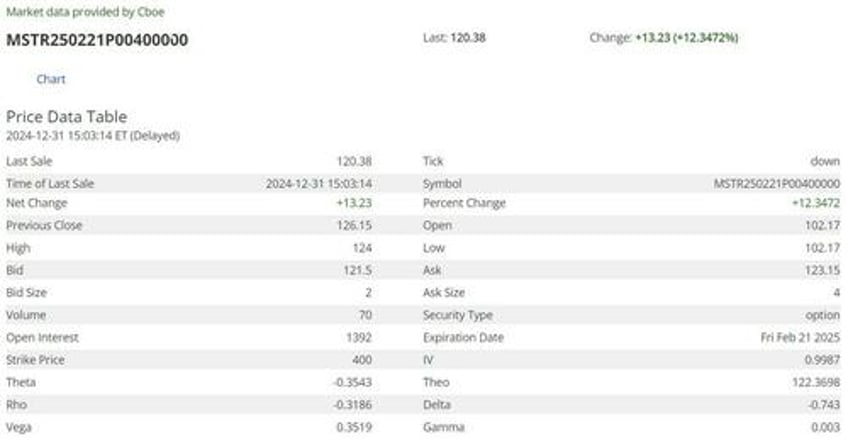

Those Options Prices As Of Year-End

As of Tuesday's close, the price of that put was $122.33, at the midpoint of the spread. That means your put leg was worth $12,233.

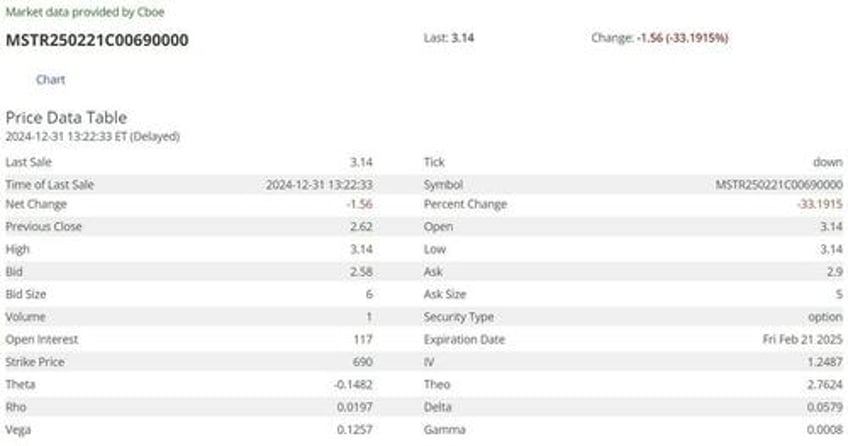

At the same time, the price of that call was $2.74, meaning your call leg was worth $274.

How That Optimal Hedge Protected You

Recall that your net position value, if you hedged 100 shares of MSTR with that optimal collar on 11/20/2024 was $46,933. This was your net position value as of 12/31/2024:

$28,962 in MSTR shares + $12,233 in puts - $274 in calls = $40,921.

$40,921 represents a 12.8% drop from $40,933.

So, although the hedge was only designed to protect against a >18% decline, and the stock dropped by 40%, you were only down 12.8% if you opened this hedge on November 12th.

What Now?

That depends on your outlook for MSTR shares:

- If you're bearish, you could exit your shares and close out that hedge for a 12.8% loss.

- If you're neutral or moderately bullish, you could buy-to-close the call leg of your hedge for $274, so your upside would be uncapped if MSTR rallies.

- If you're really bullish, you could close out the hedge, and use your profits from selling your appreciated puts to buy more MSTR shares.

Hedging gives you the space to decide, knowing your downside is strictly limited.

Do you think it's time to hedge your top holding now? If so, you can download our optimal hedging app by aiming your iPhone camera at the QR code below (or by tapping here, if you're reading this on your phone).

And if you want a heads up when we place our next trade, you can sign up for our trading Substack/occasional email list below.

If you'd like to stay in touch

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (we're using that for our occasional emails now).