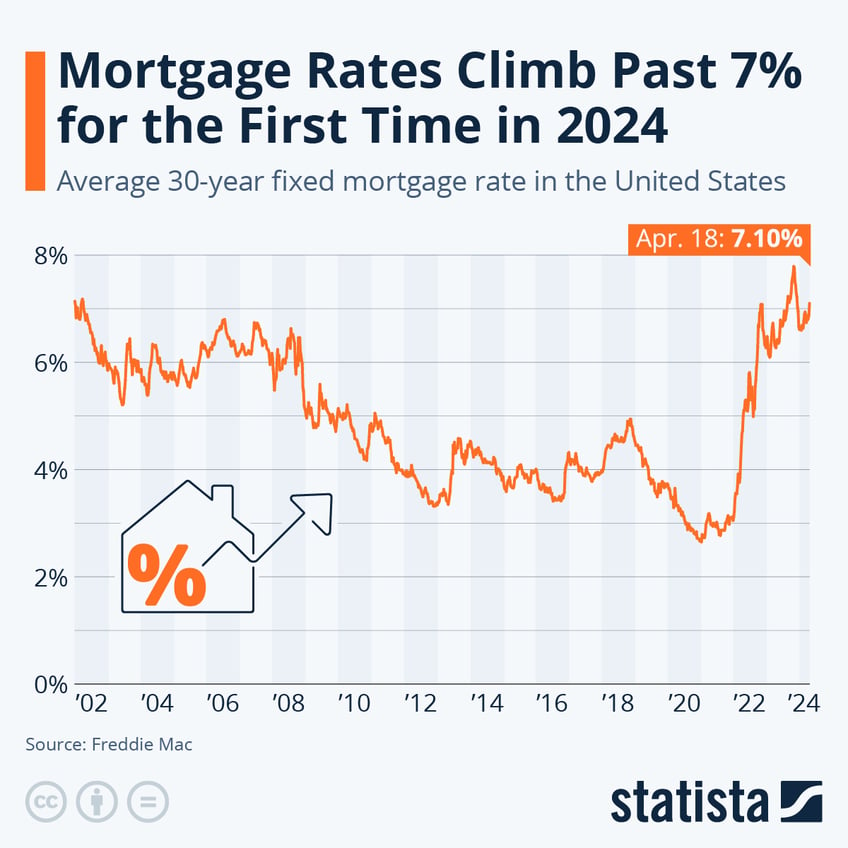

Mortgage rates in the United States climbed to the highest level since November 2023 last week, as higher-than-expected inflation readings have dashed hopes of the Fed starting to cut rates soon.

As Statista's Felix Richter reports, according to Freddie Mac, the average rate for a 30-year fixed mortgage increased to 7.10 percent in the week ended April 18, making it difficult for many would-be homebuyers to afford a house.

You will find more infographics at Statista

Along with the Fed's aggressive rate hikes, mortgage rates have climbed by almost 4 percentage points since the beginning of 2022, threatening to push more and more potential buyers out of the market, especially as high rents and other costs of living make it increasingly difficult to save for a significant down payment.

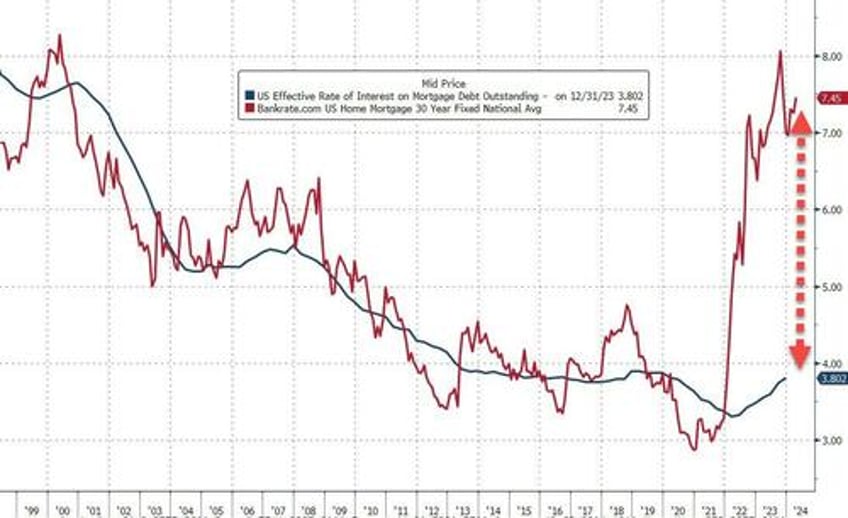

Making things even more difficult, high mortgage rates don't just affect the demand side of the market.

Supply is also constrained as prospective sellers stay put to avoid taking out a new mortgage at a much higher rate than their current one.

Source: Bloomberg

This in turn has kept home prices elevated, or at least kept them from fully reflecting the significantly higher mortgage rates compared to two years ago.

"When rates go up, people hunker down and don’t spend," mortgage broker Rocke Andrews told Realtor.com.

"They’ve been told for so long that rates are coming down, so they just postpone."

And they made need a little more patience.

Last week, Fed chair Jerome Powell said that policymakers were in no rush to cut rates, making it unlikely for mortgage rates, which tend to follow the same trajectory as the Fed's policy rate, to come down meaningfully anytime soon.

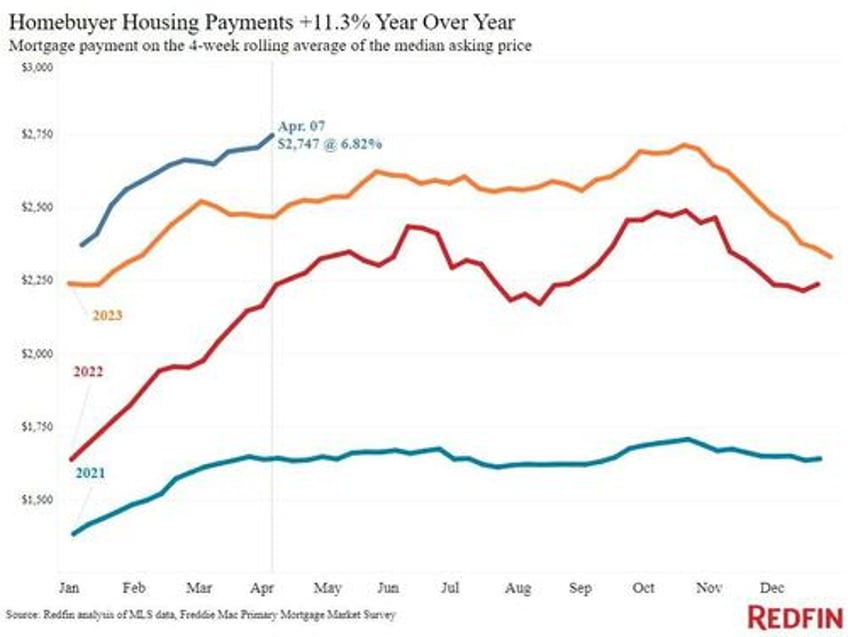

In fact, according to brokerage Redfin, U.S. homebuyers face the prospect of having to pay a “record” amount in monthly mortgage payments to buy a house amid extremely high prices and elevated mortgage rates.

“The median U.S. home-sale price increased 5 percent from a year earlier during the four weeks ending April 14, bringing it to $380,250 - just $3,095 shy of June 2022’s all-time high,” said an April 18 press release from Redfin.

“The average daily mortgage rate this week surpassed 7.4 percent, the highest level since last November, after a hotter-than-expected inflation report and the Fed’s confirmation that interest-rate cuts will be delayed.”

The 12-month inflation had jumped 0.3 percent, to 3.5 percent in March.

“The combination of high mortgage rates and prices have brought homebuyers’ median monthly housing payment to a record $2,775, up 11 percent year over year.”

According to a recent analysis by Bankrate, Americans now need an annual income of $110,871 to afford a median-priced home of $402,343. This is an almost 50 percent increase over a period of just four years.

A six-figure annual income is now mandatory to afford a median-priced home in 22 states and the District of Columbia.

Four years ago, only six states and the District of Columbia had such a high requirement.