The top 0.1% will weather a recession just fine, but that will offer cold comfort to the other 130 million American households.

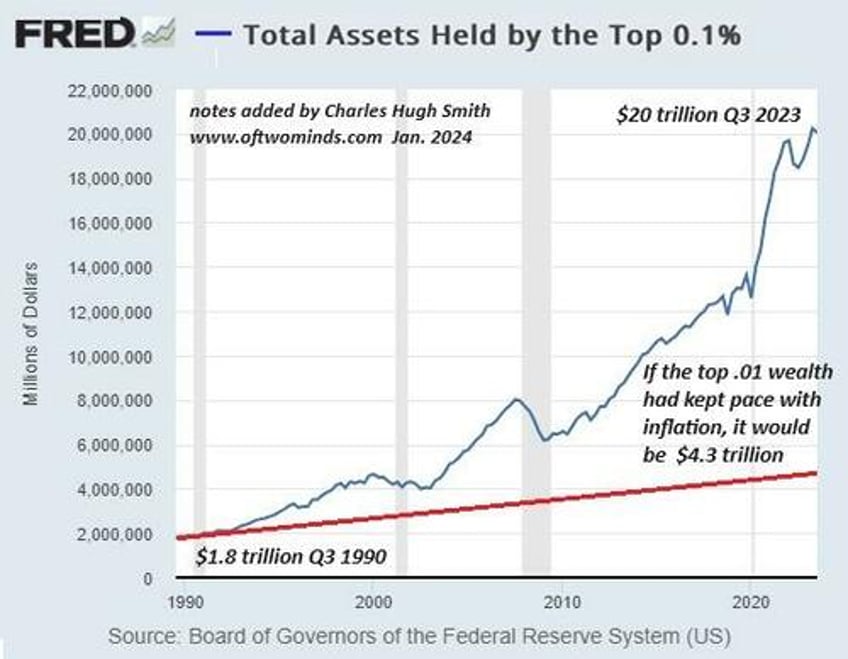

It seems at least some households are realizing they need to rein in spending. This reality is obscured by statistics which distort the financial security of average households. As always, we have to separate the top 10% who collect 40% of the income and own about 90% of the financial assets from the bottom 90%, as the top 10% distort the risks faced by the bottom 90%.

If we include the top 10% and look at all households, the average looks fine, because the wealthiest few skew the median and average upward. If we take total household wealth and divide by the total number of households, it gives the impression that households are doing great--look how much wealth the average household owns.

But this is a distortion. Remove the top 10%'s wealth and income and then re-do the calculation, and then repeat it for the bottom 50% of households. You end up with a much more accurate and much less rosy snapshot of American households' relative precarity.

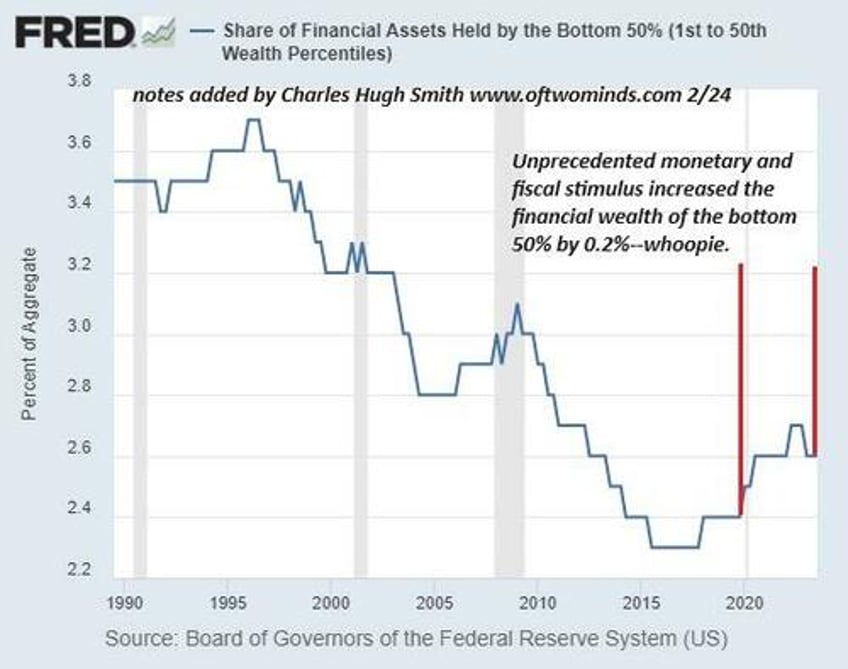

As the chart below illustrates, the share of financial assets owned by the bottom 50% of households rose a meager 0.2% to 2.6% despite trillions of dollars of stimulus flooding the economy.

It's common knowledge that most of the tsunami of cash distributed in pandemic stimulus to the bottom 90% has been spent. Once again, looking at all household savings / cash is deceptive, as the savings of the top 10% have risen because they didn't need the pandemic largesse and just stuffed the extra cash into their investment accounts.

There are many signs of belt-tightening, if we care to look for them. Short-term rentals that were solidly booked now have low occupancy /bookings. Pawn shops are finding that the goodies snapped up with pandemic cash are being pawned and not being redeemed. Restaurant traffic is down.

We're also seeing accounts like this, of households with $200,000 in income realizing there's nothing left of that income at the end of the month unless they trim their free-spending habits. We're struggling to make ends meet: our 6-figure salaries aren't enough to support our lifestyle anymore.

When it comes to cutting low-value expenses, there is a tremendous quantity of low-hanging fruit in many U.S. household budgets. Many costly mobile phone plans are bloated with unused services or bandwidth, while low-cost mobile providers offer plans at $15/month. (Which is why the big telecoms are offering teaser rates of $15/month for a year. After that, you pay the same old bloated rate.)

Cable TV has been losing customers for years, yet the cost of basic cable keeps rising. Our local provider's basic TV service is now $80/month, with a $23/month "broadcast TV surcharge" and $10 in taxes and fees, for a total of $113/month for trash TV filled with adverts. No wonder I see people waiting in line to return their cable TV box: $1,350 a year for what?

Many households have multiple streaming services they can't possibly watch enough of to justify the ballooning cost of these services. (One weird trick: choose one streaming service and go back to reading books borrowed for free from the library.)

Healthcare insurance is another high-cost burden that can sometimes be lightened by switching plans or coverage. Under-utilized gym memberships is another low-hanging fruit.

Fast food, junk food and sweetened beverages is another high-cost, low-value budget item begging to be slashed and burned. Everyone talks about comfort foods, but having some savings is comforting, too, as is improving one's health.

Many households are frugal by necessity, others are frugal by nature, and others are becoming frugal via disciplined budgeting in service of common-sense financial goals such as having some savings as a buffer against unexpected expenses.

As noted in "Outlawing" Recession Has Made a Monster Recession Inevitable, few households anticipate extended periods of unemployment in their future. Jobs are plentiful and the general expectation is they will remain so. But recessions transform abundance to scarcity faster than we might imagine, and so prudence suggest thinking through what we'd do if one of the primary earners loses their job and can't find a replacement job at the same rate of pay.

Should any of the "everything" bubbles pop, even the top 10% might be stunned by a reversal of fortune. When households earning over $200,000 are complaining they can't make ends meet, imagine what they'll feel if their bonuses and investment income plummet, or a high-earner loses their job.

The trickle of budget-tightening we're seeing now could turn into a flood that washes away corporate sales and profits in ways that few even believe is possible. But real recessions don't just trim the fat, they atrophy muscle, too, and they don't end in three months.

Those who slash spending before the recession turns abundance into scarcity will be better prepared than those maxing out their credit card living large and then getting a layoff notice.

The bottom 50% are already in precarious financial straits:

The top 0.1% will weather a recession just fine, but that will offer cold comfort to the other 130 million American households.

New podcast: Opportunities and Benefits of International Cities (49 min)

* * *