It’s November 2024, and you might have heard there’s an election going on. Like almost all elections in living memory, this one is being billed as the single most important political event of all time; and although that’s probably an exaggeration, it will indeed have longstanding ramifications for the country–and the world.

Do elections have any impact on the gold price? If so, how much?

The Big Picture

Let’s start by climbing to the analytical mountaintop to see what we can see.

The historical evidence suggests that demand for gold increases more under Democratic administrations than under Republican ones in the very short term (~ two weeks). In the 44 years since 1980, gold prices have increased by half a percent in the two weeks following a Democratic win, compared to a decrease in a little over one percent during the same window after a Republican wins.

When looking at the interval between election day and inauguration day, the gap is a bit bigger. A Democratic taking the oath of office tends to mean an average increase of 1.5% for gold prices. There’s a price drop of 5.5% on average if it’s a Republican heading into the oval office.

To summarize gold tends to fall a little for Republicans and rise a little for Democrats, on average. While these are real differences, the big picture reality is that is that elections don’t move gold prices that much. Jeffrey Christian of CPM Group confirms this reality in our latest podcast episode.

Specific Presidencies

Now, let’s discuss the specifics of what’s happened in the last few elections. If you need a refresher, here are those matchups and the years in which they occurred (the winner is bolded):

- Donald Trump vs. Joe Biden, 2020

- Donald Trump vs. Hillary Clinton, 2016

- Barack Obama vs. Mitt Romney, 2012

Obama 2012-2016

When Barack Obama won over Mitt Romney, gold registered no price changes when the inauguration occurred, and then hopped up by 2.6% two weeks later. At the end of Obama’s second term, the gold price had fallen by roughly 20%.

Trump 2016-2020

Trump entered the Oval Office and gold dropped by more than 5% on his inauguration day. However, by the end of his four-year term it had made an all-time high of $2,067/oz (August 2020) before settling around $1,900/oz on election day 2020. Overall, the gold price rose over 50% (or as we prefer to say, the dollar fell over 50% against gold) during his presidential tenure. This kind of move goes to show that no matter whether the walls are painted red or blue in the White House, the dollar can fall dramatically.

Biden 2020-2024

Joe Biden became president next, and the gold price declined by just under 1% as the results came in and fell an additional 1.3% when he was inaugurated a few months later. From his inauguration to today, the gold price has fluctuated considerably. It declined to $1,800/oz in 2023 but has risen to make an all-time-high just last month, at $2,774.76/oz (long-term readers of Monetary Metals will know that all-time-highs in gold really mean all-time-lows in the dollar and offer little to celebrate). As we write this, it is registering a gain of around 43% during the Biden administration.

Policy over Presidents?

Having said that, what if gold responds more to policy than the specific president? We know that gold can move on geopolitical tensions, investor sentiment, and monetary and fiscal policy (both real and imagined).

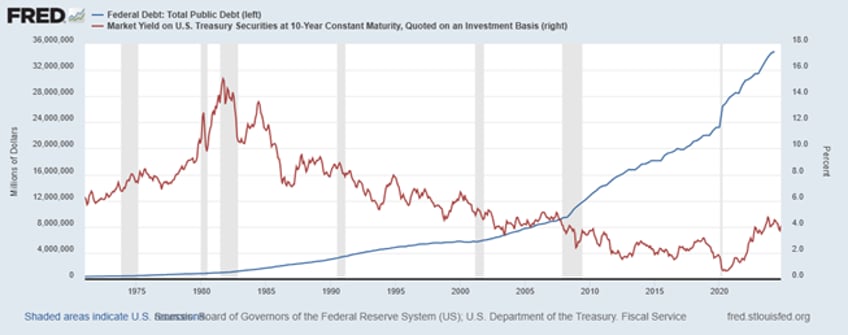

When we zoom back out it’s clear that regardless of who’s in office, the monetary and fiscal policy of the United States has been monochrome. “Borrow more to spend more” has been the universal policy for every president since Nixon’s “temporary” suspension of convertibility between gold and the US dollar.

Over this same period, the gold price has changed from $40.80/oz to over $2,700/oz. Do you expect this long-term trend to reverse any time soon?

Conclusion

In the final analysis, it’s hard to make short term predictions for gold and silver based on which party wins the election. Gold can and has moved considerably under Republican and Democratic presidential terms alike.

What isn’t hard is identifying the long-term trend. History clearly shows that regardless of who is the president elect, one should consider owning gold and silver as the dollar continues its sometimes fast/sometimes slow, decline.

What you may not have considered is how much gold and silver you could have earned during the last two Presidents’ terms in Monetary Metals’ leasing program.

Assuming you funded an account in 2016 and earned 3.55% annually (this is the current weighted average annual return of our leasing program), then you would have 32.19% more ounces of gold today as a result.

Meanwhile, the dollar is worth less than half of what it was in 2016.

That is why earning a return denominated and paid in more ounces of gold (not more dollars which are worth less) is so important. Regardless of who wins, we will continue to provide opportunities for our clients to build wealth in an asset that has stood the test of time.

Additional Resources for Earning Interest on Gold

If you’d like to learn more about how to earn interest on gold with Monetary Metals, check out the following resources:

In this paper we look at how conventional gold holdings stack up to Monetary Metals Investments, which offer a Yield on Gold, Paid in Gold®. We compare retail coins, vault storage, the popular ETF – GLD, and mining stocks against Monetary Metals’ True Gold Leases.

The Case for Gold Yield in Investment Portfolios

Adding gold to a diversified portfolio of assets reduces volatility and increases returns. But how much and what about the ongoing costs? What changes when gold pays a yield? This paper answers those questions using data going back to 1972.

© Monetary Metals 2024