HOW GOLD AND THE VIX BECAME BROKEN

Aka: Use the indicator to manage expectations.

Authored by GoldFix ZH Edit

When an indicator is trusted by the investment community, the government will cook the indicator instead of the problems the indicator is pointing out. (But only after cnbc features it prominently onscreen)

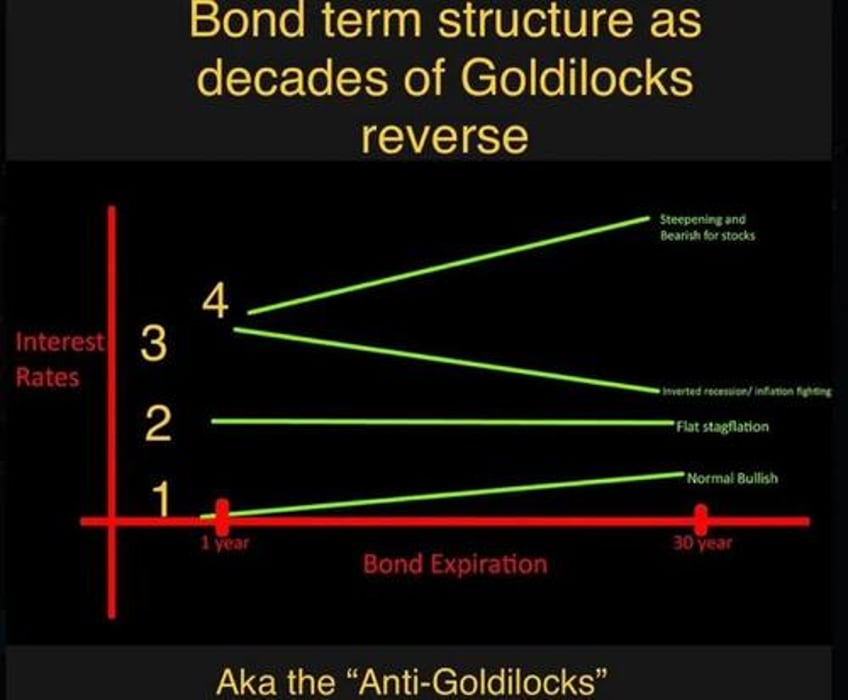

Once upon a time, Gold was a good barometer of future Inflation expectations. In combination with the long bond yield, it gave you a very good idea of how the market was perceiving inflation risk. It also gave you a likely *path* of inflation.

If you traded bonds, you traded gold.

In that era, when the price of gold dropped, it signaled long-term interest rates were doing their job and fighting future inflation. Conversely, if gold rallied while long-term interest rates were high, that was gold telling us bonds were not anywhere near the interest rate needed to stop inflation.

Also that meant for the fed to not ease rates up front.

So in his infinite wisdom, instead of actually fighting inflation, Greenspan sought to manipulate the best indicator of inflation and thus influence investor perception. In this way he could keep rates too low for too long (and stocks too high) .. why not? Gold didn’t rally!

Over the years, he and his successors broke gold’s tether to the bond market as an inflationary fighting indicator. He did this with the help of the bullion banks who borrowed and shorted gold from fortknox for carry trades.

Over time gold’s reliability as an inflationary compass waned. And then soon became openly derided as a false prophet, a pet rock etc… its corpse proof that neokeynesian fiat was better.

More recently this is what happened with the Vix.. after 2009 they completely cooked it. I remember reading ZH while trading the skew heavily on spx options and getting disappointed on every selloff having no real gamma to scalp. Vol did not pop as the skew implied it should. The result: killed having thousands of mistakenly overhedged collars short call long put over the whole vix term structure.

That, I figured out eventually was part of vix getting the gold treatment by bernanke. The fed “put” literally was them selling puts to alleviate fears post 2009.

The vix growing popularity itself just made it even easier for them to do one-stop selling and let the OEX arb funds like Susquehanna do the rest for them.

This, of course became a permanent tool once it worked for them in a crisis. (Bureaucrats love adopting emergency cures as everyday preventive medicines)

That is part of what is meant by “when an indicator becomes a target, it is no longer a good indicator”

In practice.

But now.. they want the gold. And that means the link partly re-establishes due to multipolar pricing out of BRICS.

Vix, on the other hand will never reestablish. It is a financial instrument controlled domestically.

Continues here ...

Free Posts To Your Mailbox