Yesterday, I detailed how the Fed is a political entity… and it leans left.

By quick way of review…

1) The Bernanke-led Fed launched QE 3 just three months before the 2012 Presidential election. At the time, the economy was growing, unemployment was falling, and there were no signs of systemic duress in the financial system. So this was a clear intervention to aid the Obama Administration’s 2012 re-election bid.

2) The Fed kept rates at zero for seven of the eight years President Obama was in office. Once it finally got around to raising rates, it engaged in one of the feeblest hiking schedules in history, raising them only once in 2015

and once in 2016.

3) Donald Trump won the 2016 Presidential election in a major upset to the political establishment. At that point the Fed suddenly began raising rates three to four times per year while simultaneously draining $500 billion in liquidity from the financial system.

It is possible that the above items are all coincidence. It’s also possible that Bigfoot could actually be Elvis living in disguise in the woods.

So what is the Fed up to now?

It’s trying to help President Biden win the 2024 Presidential election by juicing the two asset classes that have the largest impact on Americans’ net worth (stocks and housing ).

Today we’ll be assessing the stock market.

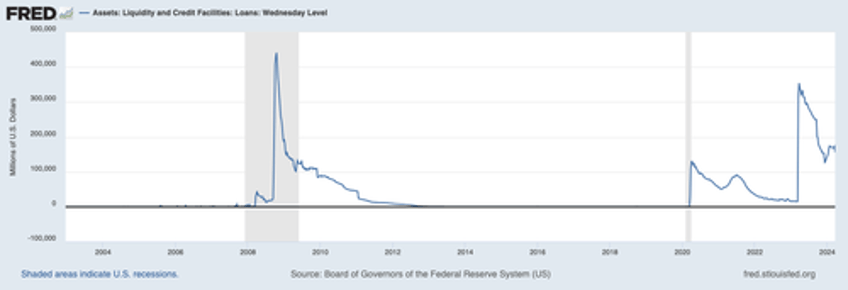

The Fed is supposed to be draining liquidity from the financial system via its Quantitive Tightening (QT) program. However, the Fed is ALSO providing $155 BILLION in liquidity via its overnight credit facilities. To put that into perspective, it’s more liquidity than the Fed was providing via this facility in MARCH 2009 right after the worst financial crisis in 80 years!

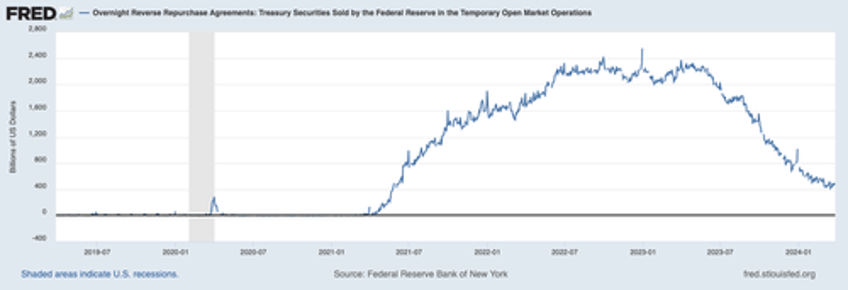

As if that’s not egregious enough, the Fed is ALSO providing nearly $500 billion in liquidity via a process called Reverse Repurchase Agreements.

Small wonder then that the stock market has been roaring higher. The Fed is providing EMERGENCY levels of liquidity to the financial system at a time when the economy is growing! So much for QT!

In the very simplest of terms, the Fed is juicing stocks higher to boost the Biden Administration’s 2024 re-election bid.

And rest assured, I’ll detail how the Fed is doing the same thing with housing in tomorrow’s article.

The good news is that those investors who are properly positioned for this stand to see extraordinary gains.

On that note, the FREE copies of our Special Investment Report detailing three investments that will profit from the next round of inflation are rapidly being reserved. So if you want reserve one, you better move fast!

To pick up your copy, go to:

Graham Summers

Chief Market Strategist

Phoenix Capital Research, MBA