Why Trump 2.0 Might Not Mind A Real Estate Crash

In our last post ("Why Stocks Might Not Be Number One For Trump 2.0"), we mentioned a couple of reasons why the current Trump administration might not be overly concerned if stocks and real estate go down.

— Portfolio Armor (@PortfolioArmor) March 4, 2025

One of those reasons was this:

👀 Trump Approval might be a boring 50% right now, but the age Demos are WILD!

— Mark Mitchell, Rasmussen Reports (@honestpollster) March 3, 2025

65+ - 45%

40-64 - 46%

18-39 - 60% <==🤯

Maybe America has a future again.

Trump's strongest supporters are young people, who own the least amount of stocks and real estate.

What To Do About It If You Own Real Estate

Coincidentally, one of our subscribers asked us a question related this last week. He owns a house worth 7-figures now, and doesn't want to sell it until his twins currently in college graduate. And he wanted to know if there was a way he could hedge the market value of his house over the next few years, in the event of a real estate crash.

We ran that question by our friend David Janello, PhD, CFA, who was kind enough to write the guest post below in response.

Dr. Janello is the founder of SpreadHunter, and the author of The Nuclear Option: Trading To Win With Options Momentum Strategies.

Before we get to Dr. Janello's post, a brief trading note:

We had some success recently with short term, speculative trades based on Portfolio Armor top names, including the one below, which we exited on Wednesday for a 105% gain.

We have two more of those trades teed up for Thursday; if you'd like a heads up when we place them, you can subscribe to our trading Substack/occasional email list below.

Now on to Dr. Janello's post about hedging your house against a real estate crash.

How To Hedge Your House

One of our readers asked about how to use options to hedge a decline in real estate prices. This reader owns a multi-million dollar home and is thinking about ways to protect his investment if there is a long term recession or depression in home prices.

Because residential real estate is highly variable at the regional and even the neighborhood level, this means that direct hedging of his particular neighborhood or comparable properties is not possible.

With Direct Hedging off the table, this means that our reader needs to move to the next best thing: a Cross Hedge. Cross Hedges use a similar (but not identical) asset to cover a big move down in the risky asset. The expectation is that gains on the cross hedge will partially or completely offset losses on the primary asset.

The most obvious cross hedge for our reader’s housing hedge would be to purchase Long Put Backspreads on an ETF that matches (or attempts to match) movements in residential real estate.

What is a Long Backspread? This spread consists of short (closer to the money) premium and a greater quantity of long (further from the money) options.

Here is an example with Puts:

Sell One 100 Strike Put in XYZ Corp

Buy Three 95 Strike Puts in XYX Corp at the same expiration

The max loss is the distance between the strikes at expiration, or 5.00 in this example, plus any debit paid. The maximum gain is the profit on the three long puts, minus the 5.00 strike width. If the stock makes a big move, profits from the triple long put add up really quickly. During the October 1987 crash, Steve Radez (from Essex Radez Trading, LLC, an early high frequency trading firm) reviewed his positions the day after the crash and described the behavior of the backspreads in his market maker position.

If we had on a couple more of these, we would have broken even.

Long Backspreads are usually done for as close to even money as possible. The advantage of Backspreads is that they can be done for almost no money and have potentially enormous payouts. The downside is that they have a low probability of paying off. For a hedge, this is ideal. If prices stay stable or move higher, there is no need for the huge payoff. If prices decline, on the other hand, our reader will need a very big payout to cover the losses on his substantial real estate holding.

For our purposes in hedging a house, we can assume that the reader is not really concerned about a 1-2% decline in real estate values, but is worried about a significant 40-60% decline. Kind of like the one in the early 1990s that bankrupted our current President, who famously noted to his wife that

See that homeless person on the street there? He is worth 800 million dollars more than me.

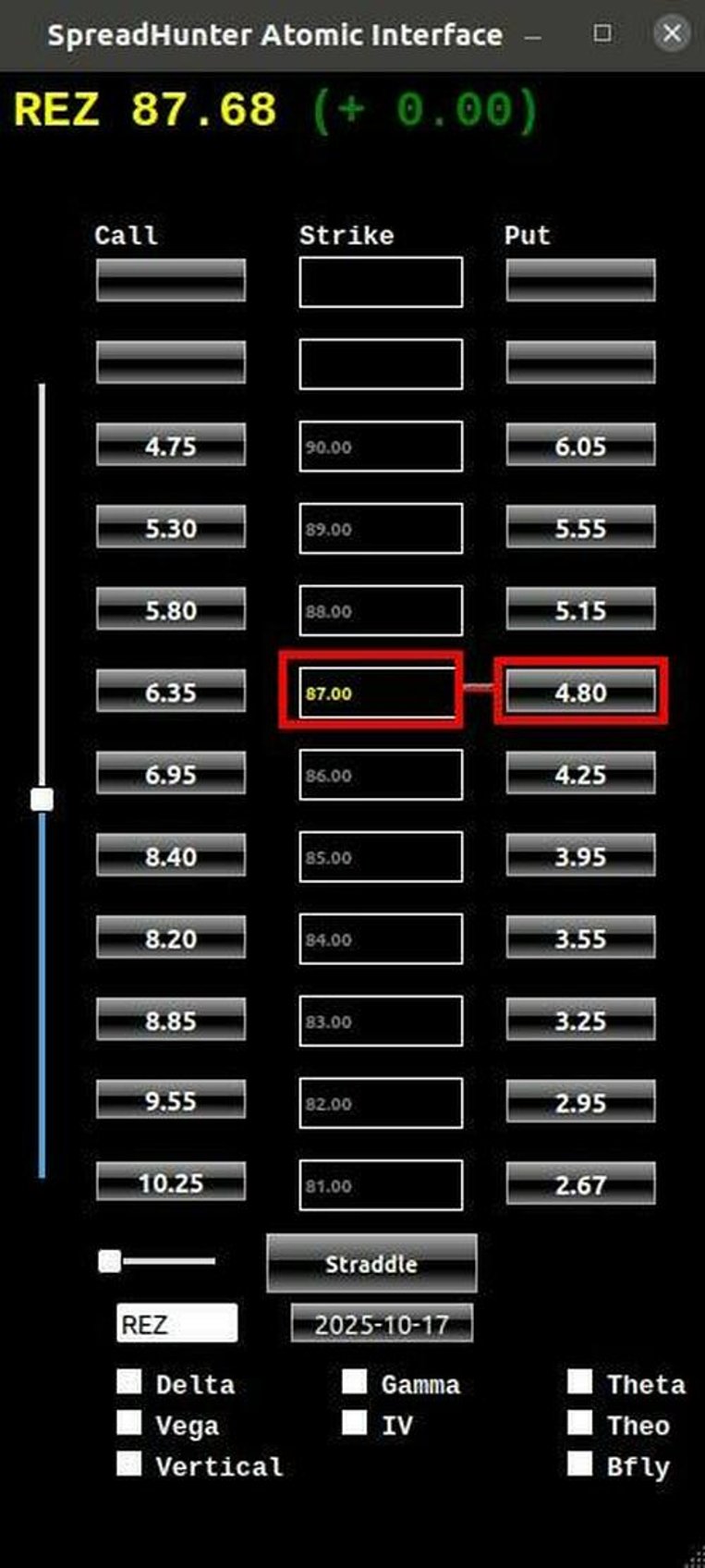

Let’s take a look at the Options Matrix for the REZ Residential Real Estate ETF and see if there are any backspread candidates. We are using an expiration date six months out.

One of the better backspreads in this chain is this:

Sell 2x 87.00 Strike Puts for 9.60 Credit

Buy 3x 82 Strike Puts for 885.00

For a credit of 75.00.

On the surface this appears to be a fantastic trade, you get an enormous payout if there is a big move down in the ETF and if it stays flat you receive a debit, just like a covered call. It is always a good idea to get paid to wait.

The downside of this trade is the liability from the short 5.00 strike difference which is 1000- per backspread. If the stock closes at exactly 82.00 at expiration, this trade will experience a max loss of 825-, from the two short options minus premium received. In practice, there are usually ways to avoid the maximum loss. If there is a slow grind to the strike you can roll down a strike and take modest losses. If there is a big move down, usually the implied volatility on the long legs covers a lot of the loss from intrisic value which buys time to adjust. If the ETF sits still, this is great because you get paid to hold a hedge.

Personally, I would not recommend this as a speculative trade or as a hedge because the underlying ETF is not that volatile, showing only a 21% implied and realized volatility. A slow grind toward the max loss strike would not be fun to manage and could easily eat into the 75- credit and even generate losses.

The alternative to the backspread would be Long Put Options or Long Put Vertical Spreads. The problem with this is that over time, the debits add up really quickly. As one leading hedge fund manager told me during the 2008 Financial Crisis,

Hedging Incinerates Cash. We only do it selectively, and when we absolutely have to.

There are other cross hedges to consider. Home builder stocks are often used to hedge real estate because they are more volatile than residential real estate in most scenarios. Let’s look at the options matrix for the NAIL 3x Levered Home Builder ETF:

Whereas the REZ Backspread example is marginal, the NAIL Backspread Candidates are horrible across the board, ranging very Very Bad to the Absolute Worst. If options are very highly priced, and quoted at almost identical prices up and down the chain, you can be sure that backspreads will not be a good option — the difference in premium across strikes is what makes backspreads work, and when that premium isn’t there, the risk from the short legs definitely is.

These two examples illustrate that for every real problem there is not always a good solution. Computer Scientist Dennis Ritchie, co-author of the UNIX Operating System and author of the C Programming Language described this situation better than anyone before or since.

Just because if it fills a vacuum, doesn’t mean it still doesn’t suck.

DISCLAIMER: All Content on the Nuclear Option Substack is for Education and Information Purposes only. It does not a soliciatation or recommendation to buy or sell any security. Before trading, consult with your Professional Financial Advisor and read the booklet Characteristics and Risks of Standardized Options Contracts, available from the Options Clearing Corporation/