Here are two stories about how to profit from the creation of good money, that is stable money because of its peg to gold and money immune to being debased by governments through over issue.

One story took place in 1694 with the creation of the Bank of England. The other is about the current opportunity to fund a team to launch the Bitcoin-backed Goosie coin. In both cases the money is private.

The seigniorage, or profits received by the individuals that formed the Bank of England were enormous. The current competition to build the Goosie coin (https://www.goosie.me/the-goosie-challenge.html) is designed with a similar profit potential in mind.

I am indebted to Nathan Lewis and draw heavily upon his account of the events that created the Bank of England in Gold the Final Standard pages 69-72.

(https://newworldeconomics.com/wp-content/uploads/2019/12/GTFS-3ed-eBook.pdf)

After just three years on the throne in 1692 King William III of England and Scotland had a big problem. He needed money to fund his war with France. His first attempts to borrow were small scale at rates in excess of 20%. In 1692-93 he managed to raise £1 million through the issue of government bonds at an effective rate of 14%. Another £300,000 was raised in 1694.

Nathan Lewis narrates:

The Bank of England was conceived, foremost as a coalition of private lenders to provide government finance, specifically a loan of £1.2 million at a rate of 8%.

The need for the Bank to be private was due to the lack of trust in government. This trust had been undermined by the confiscation of gold in 1638 and the Stop the Exchequer incident in 1672 when the government defaulted on its outstanding debt.

The reason for the private nature of sound money has not changed. There is still widespread lack of trust in governments’ ability to manage their finances. In the United States $1 trillion is currently being printed every hundred days, largely to service debt. Chronic and eventually unsustainable inflation is the inevitable result.

In other words the same rationale exists for the Goosie coin to be run as a private club of men and women as existed with the formation of the Bank of England.

This rationale is supported by the structure of Bitcoin, the collateral used by the Goosie coin.

Having increased in value 1 million times since the famous pizza episode in 2010 and with a current price growth of 50% a year, Bitcoin is the world’s most successful asset. The code that runs the decentralised ledger is open source. The programmers that maintain the code are private individuals. There is no incorporated body behind Bitcoin. This makes it less susceptible to changes in the regulatory environment and is an important factor contributing to its continued success.

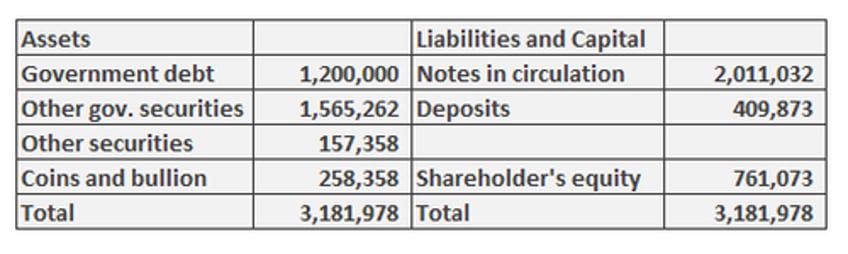

In 1696 the Bank of England’s balance sheet looked like this:

This was the beginning of the extraordinarily profitable business of large scale banknote issuance in the West. Nathan Lewis comments:

A total of £2,420,905 of banknotes and deposits had been set forth into the world, more than covering the entirety of the £1,200,000 loan that inspired the Bank’s creation; against this was coins and bullion of £258,358, a bullion coverage ratio of 10.7%. The £2.421 million was essentially seigniorage profit; assets acquired via the creation of banknotes and deposits….At a rate of 8% an additional £193,600 of profit was generated annually, a rather smart 25.4% return on equity.

The issue of the Goosie coin is even less expensive than the issue of banknotes. Performed by a tamper-proof piece of computer code (smart contract) the coins are issued to 51% of the gold value of Bitcoin deposited in the contract. Bitcoin is returned to the depositor when they repay the equivalent gold value as received at the time of deposit, again in the Goosie coin.

As there is no third party involved in the Goosie issue and no interest to pay on the loan, compensation is generated for the individual who funds the first implementation of Goosie by receiving 0.5% of all Goosie minted. As the global M2 money supply is currently $103 trillion, and Goosie are minted to 51% the value of the Bitcoin deposited, this gives an initial earning potential of $202 billion for a capital outlay that is likely to be in the region of $2-5 million.

The private nature of the Bank of England was a key factor in its success. Governments such as the American Colonies, France and China experimented with issuing their own notes but in all cases quick over-issue and devaluation were the chronic results. The Bank of England as a private third party responsible for the issue of new notes gave a general confidence that the system would not be abused.

The issuers of the Goosie coin are distributed. They are the men and women who deposit their Bitcoin into the smart contract. This distributed nature lends robustness to the system as there is no centralised authority responsible for the increase or decrease in supply who could abuse their position. Men and women issue the coin when they see it to their advantage to create liquidity against their Bitcoin asset. This distributed network of issuers together with a deterministic smart contract safeguard against over-issue and devaluation.

The second key factor to the success of the individuals who established the Bank of England was the peg of notes to gold. As the Bank’s balance sheet indicates, a peg to gold does not mean each note is backed one for one with its equivalent to gold. Instead it means each note can be redeemed for gold at the official pegged rate. This became known as the gold standard – the benchmark of sound money.

The peg creates good money not because of the inherent value of gold. Many items are considered valuable including diamonds, silk and other precious metals. Gold serves as a basis of good money because it has the most enduring stable value in history. This stable value is not perfect, but for thousands of years it has demonstrated its ability to remain the best measure of constant value known.

(https://newworldeconomics.com/?s=gold+stable+value)

Having a stable currency to price items is indispensable for an efficient economy. If the currency is inflationary or volatile it is very difficult to tell whether the price of, say, bread has gone up or the currency has lost value.

From a commercial perspective an inflationary (fiat) currency has the effect of destroying shareholder value. A company needs to make the rate of inflation each year before it can consider any profitable activity.

With the formation of the Bank of England for the first time in history money was being made primarily by private banking institutions rather than a government mint. Not only was its creation extraordinarily profitable for the initial 1,268 subscribers but its success prompted the spread of gold-pegged money around the world and helped to fuel the greatest economic expansion during the 19th and 20th centuries the world has ever seen. The gold standard was finally abandoned in favour of fiat in 1971 under President Nixon.

Goosie represents a return to sound money based on the same principles that created the Bank of England including its seigniorage potential for the team that implements the first instance of the smart contract. The Build Rules are open source and can be downloaded here:

https://www.goosie.me/build-rules.html