Time For A U.S. Infrastructure Fund (USIF)

If we're lucky, Elon Musk's Department of Government Efficiency significantly reduce America's fiscal deficit from the cost side, and President Trump's tariffs will reduce it from the revenue side. As long as we are still running fiscal deficits though, our federal debt will continue to grow.

One proposal mooted to sort of reduce the debt is to replace some of it with non-marketable, century bonds, as Jim Bianco mentions below.

5/16

— Jim Bianco (@biancoresearch) February 22, 2025

Enther MALA pic.twitter.com/e8rAa8lXHD

Here is what we think is a better proposal: let bondholders convert some of their Treasury bonds into shares of a U.S. infrastructure fund.

I. Executive Summary

The U.S. national debt has exceeded $34 trillion, with annual interest payments approaching $1.2 trillion.

Rising debt and inflation fears increase Treasury yields, further exacerbating the fiscal burden.

This proposal establishes a U.S. Infrastructure Fund (USIF) to allow Treasury bondholders to exchange bonds for equity in a revenue-generating infrastructure fund.

USIF will take equity stakes in infrastructure projects in return for providing insurance or reinsurance, regulatory assistance, tax abatement, and other government-backed incentives.

An international expansion of USIF could further increase its impact by financing joint infrastructure projects with global partners, promoting economic interdependence and geopolitical stability.

II. The Debt Problem & Why USIF is Needed

A. The Growing Debt Burden

Total U.S. debt: ~$34 trillion

Publicly held debt: ~$26 trillion

Annual interest payments (2024): ~$1.2 trillion (largest federal spending category soon)

Projected consequences of inaction:

Higher inflation and interest rates.

Crowding out of productive government spending.

Potential loss of global confidence in U.S. Treasuries.

B. Flaws of Traditional Debt Management Approaches

Higher taxes → Slows economic growth.

Spending cuts → Politically difficult, limited impact on structural debt.

Issuing ultra-long Treasuries (e.g., 100-year bonds) → Only delays debt problems without solving them.

C. The USIF Solution

Convert portions of Treasury debt into equity stakes in a U.S. Infrastructure Fund (USIF).

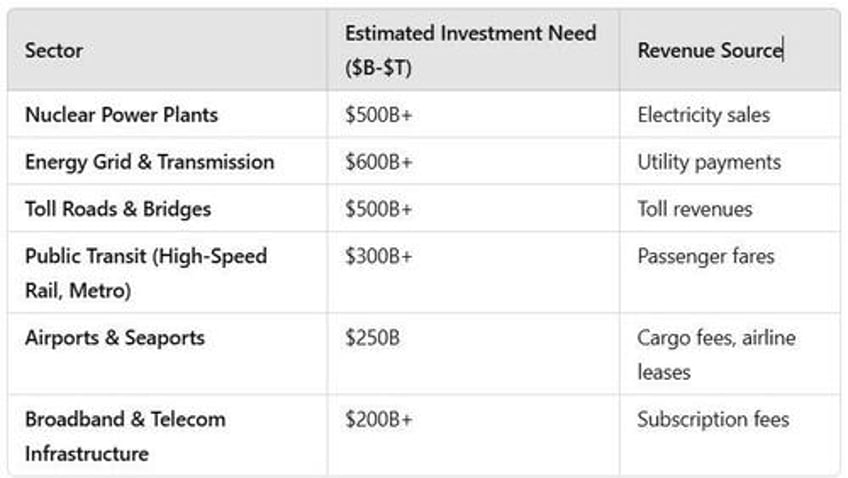

USIF takes equity stakes in revenue-generating projects (e.g., nuclear power plants, toll roads, ports) in return for insurance, tax abatements, and regulatory assistance.

Bondholders receive inflation-resistant dividends instead of fixed Treasury interest.

III. Structure of the U.S. Infrastructure Fund (USIF)

A. Debt Conversion Mechanism

Treasury bondholders can exchange bonds for an equivalent dollar value of USIF shares.

USIF does not own or operate infrastructure projects but instead takes equity stakes in them in exchange for providing government-backed support.

Dividends from project earnings replace Treasury coupon payments.

B. Eligible Infrastructure Investments

Projected near-term USIF size: $2.5T-$3.5T

Potential debt conversion: 6%-10% of publicly held U.S. debt

Projected annual revenue from USIF projects: $200B-$300B

IV. Financial Impact & Benefits

A. Reduction in U.S. Debt Burden

Debt reduction: If $3.4T (10% of total debt) is converted, it removes $120B in annual interest payments.

New revenue stream for bondholders: Instead of 3.5% Treasury yields, bondholders receive 6%-8% in USIF dividends.

Inflation protection: Unlike fixed-interest Treasuries, USIF dividends increase with inflation.

B. Economic Growth & Productivity Gains

Improved infrastructure boosts GDP through higher efficiency and job creation.

Energy independence via investment in nuclear power and smart grids.

Lower transportation costs via modernized rail, ports, and highways.

Reduces federal reliance on deficit spending.

Unlocks private-sector co-investment in public projects.

Encourages long-term investment over short-term budget band-aids.

V. International Expansion of USIF

A. Why Expand Internationally?

Larger pool of investable projects → Expands USIF capacity from $3T+ to $5T-$7T.

Stronger economic ties with global powers → Reduces geopolitical tensions.

Higher global trade efficiency → Benefits U.S. businesses & consumers.

B. Strategic Joint Infrastructure Projects

C. Government Fiscal Stability

C. Geopolitical & Peace Benefits

Economic interdependence reduces conflict risks.

Aligns major economies on infrastructure goals instead of military confrontations.

Enhances U.S. leadership in global development, countering Chinese economic influence.

VI. Implementation Plan

A. Phase 1: Establish Domestic USIF (~2 years)

B. Phase 2: Expand to International Projects (~3-5 years)

C. Phase 3: Full Integration & Growth (~10 years)

VII. Conclusion: Why This is the Best Path Forward

✅ Addresses U.S. debt crisis without raising taxes or cutting critical programs.

✅ Enhances national infrastructure for long-term economic growth.

✅ Promotes global stability through joint infrastructure investments.

Next Steps

Draft legislative framework for USIF creation.

Secure public-private investment commitments for key projects.

Initiate diplomatic talks for international infrastructure expansion.

Trade Ideas Aligned With This

If you think this sort of approach is likely to happen, here are a couple of trades we've entered recently that are aligned with it.

- A bullish bet on a nuclear energy company.

Click on the robot to go to the post. - A bet on interest rates being lower in two years.

If you'd like a heads up if we do, you can subscribe to our trading Substack/occasional email list below. And if you want to add some downside protection here, you can download the Portfolio Armor optimal hedging app by aiming your iPhone camera at the QR code below (or by tapping here, if you're reading this on your phone).

If you'd like to stay in touch

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (we're using that for our occasional emails now).