A DC-based trade group says that Huawei is building a network of secret semiconductor-fabrication facilities across China in what Bloomberg describes as "a shadow manufacturing network that would let the blacklisted company skirt US sanctions and further the nation’s technology ambitions."

Huawei, which is receiving some $30 billion in state funding from the CCP and its home town of Shenzhen, moved into chip production last year according to the Semiconductor Industry Association, which says in a recent presentation that the sanctioned company has acquired at least two existing plants and is building at least three others.

The US Commerce Department under former President Donald Trump added Huawei to its entity list in 2019, which prohibits it from working with American companies under nearly all circumstances. If they're constructing facilities under undisclosed subsidiaries, however, the telecom giant may be able to dodge sanctions and indirectly purchase US chipmaking equipment and other supplies that would otherwise be banned.

The Commerce Department’s Bureau of Industry and Security, in response to questions from Bloomberg News about the SIA warnings, which haven’t been previously reported, said it’s monitoring the situation and is ready to take action if necessary. It has already blacklisted dozens of Chinese companies beyond Huawei, including two the SIA says are part of Huawei’s network — Fujian Jinhua Integrated Circuit Co. and Pengxinwei IC Manufacturing Co., or PXW. -Bloomberg

"Given the severe restrictions placed on Huawei, Fujian Jinhua, PXW and others, it is no surprise that they have sought substantial state support to attempt to develop indigenous technologies," said the BIS in a statement to Bloomberg. "BIS is continually reviewing and updating its export controls based on the evolving threat environment and, as evidenced by the Oct. 7, 2022 rules, will not hesitate to take appropriate action to protect US national security."

Last October, the Biden administration slapped China with export controls that prevent Chinese companies from acquiring certain advanced semiconductors and chipmaking equipment in an attempt to slow down the CCP's military development. The controls excluded older-generation chipmaking equipment, such as those which use 28-nanometer technology or above. Companies on the blacklist, such as Huaei, can't even buy older equipment without a rarely-issued license.

"These developments were already publicly reported on by multiple media outlets months before SIA simply highlighted these news items at an association meeting discussing market trends," the SIA said in a statement.

It’s not clear why the association is sounding the alarm on these issues now. The Washington-based lobbying group represents the majority of the world’s semiconductor makers, including Intel Corp., South Korea’s Samsung Electronics Co. and Taiwan Semiconductor Manufacturing Co. Its members also include companies that produce chipmaking equipment, such as Applied Materials Inc. and the Netherlands’ ASML Holding NV.

Certain members of the lobbying group will face competition from Chinese rivals if they’re successful in building domestic production facilities, but SIA members like ASML and Nvidia Corp. lose revenue from China as American export controls become stricter. The association may be trying to warn members to be cautious in working with companies that could have hidden ties to blacklisted entities like Huawei. -Bloomberg

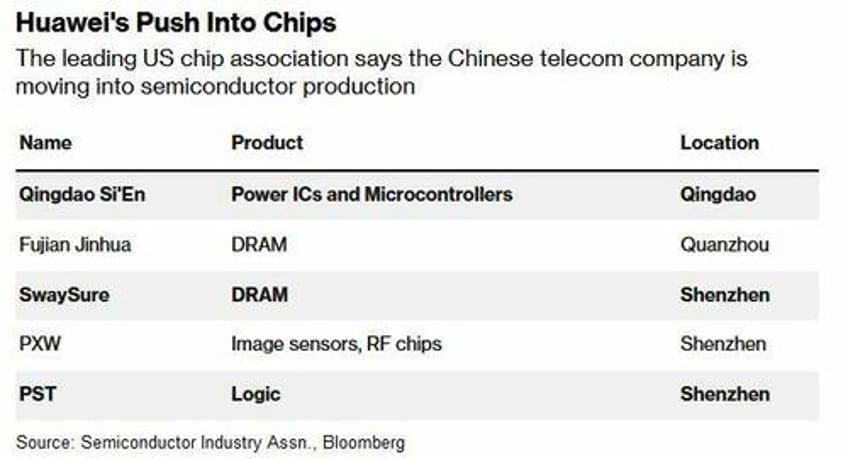

According to the SIA presentation, Huawei is backing five chip plants located primarily around Shenzhen where they are headquartered. If they operate without the Huawei label, it may be difficult for suppliers to know they're dealing with a sanctioned company.

Under BIS rules, American suppliers are obligated to adhere to "know your customer" rules requiring them to investigate whether customers are buying under suspicious circumstances, such as an item being inconsistent with a customer's stated needs.

"If there’s a red flag, then you have an obligation to investigate," said lawyer Kevin Wolf of Akin Gump. "Absent a red flag, there is no affirmative duty to verify or go beyond the company’s representations."

Since it was published in April, the SIA presentation has set off alarm bells both within the industry as well as the Biden administration, which is weighing more stringent export controls over Beijing.

The CCP, meanwhile, says the US is trying to hinder its economic development, and has vowed to develop its own local alternatives for chips, critical tech components, and production machinery.