By Graham Summers, MBA | Chief Market Strategist

In the coming weeks, you’re going to hear a LOT about the Sahm Rule.

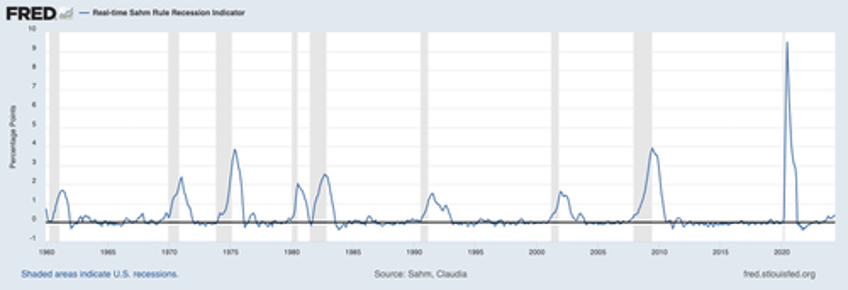

The Sahm Rule is an indicator that has accurately predicted every recession since the 1960s. In its simplest form, the Sahm Rule compares 3-Month Moving Average for the unemployment rate to the lowest unemployment rate in the prior 12 months.

If the difference between the two numbers is 0.5% or greater, it indicates a recession has begun.

As I mentioned a moment ago, this indicator has predicted every recession since 1960. The below chart shows the Sahm Rule measure (blue line) as well as historic recessions (gray bars). You can see its accuracy for yourself.

I bring all of this up, because the current Sahm Rule reading is 0.37%. And it is HIGHLY likely this metric will hit 0.4%, if not 0.5% some time this summer.

When this happens nearly every guru and strategist on the planet is going to start proclaiming that a recession is here. And they are going to start telling their clients to “sell the farm” on their stock portfolios.

However, for those of us who are interested in making REAL MONEY from our portfolios, it’s important to note that there is a BIG difference between the U.S. today and the U.S. during prior periods in which the Sahm Rule triggered a recession warning.

That difference?

Claudia Sahm, the creator of the Sahm Rule, notes that the U.S. has added 3.3 million people in net immigration in 2023. To provide some context, the U.S. added just 900,000 on average every year from 2010-2019.

As Sahm noted to Business Insider, the immigration process is time consuming. As a result, many immigrants are unable to legally find work after entering the labor force.

The end result?

The number of unemployed people jumps rapidly, resulting in a higher unemployment rate, which will trigger a Sahm Rule recession warning. But this jump in unemployment rate is due to immigration not people who were working losing their jobs.

Put simply, the coming Sahm Rule signal (or at the very least warning) is likely to be a false positive, meaning that it is NOT actually signaling a recession has arrived.

This will make it the EIGHTH false positive for a recession indicator during this business cycle. You’d think after seven false positives that people would begin to catch on that things are different this time.

After all, as investors, our job is to make money, not look for any excuse to dump stocks and panic about something bad happening. And as I’ve outlined in recent articles, this means riding bull markets for as long as possible, and then side-stepping bear markets when they eventually hit.

In the very simplest of terms, you need to be invested in stocks, until an objective, verifiable tool (not your feelings or limiting beliefs) tells you it’s time to “get out.”

I’ve developed a tool that takes ALL of the guessing work out of this problem. With just one look at this tool, you can tell whether it’s a good time to buy stocks or not. I detail it, along with what it’s currently saying about the market today in a Special Investment Report How to Predict a Crash.

To pick up a free copy, swing by

Best Regards

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research