Submitted by QTR's Fringe Finance

If you haven’t lately, maybe it’s a good time to refresh your memory by reading the disclaimer I put at the bottom of all my posts. Basically, it says that I’ve been wrong often and will be wrong many times again in the future.

With that being said, a follower of mine on X sent me a great podcast over the weekend featuring one of my favorite market commentators, Luke Gromen and the only CNBC host I like, Guy Adami.

In the podcast, Gromen—who has correctly been long equities the entire time I have been waiting for a crash over the last year—lays out a very succinct case as to why rate cuts don’t have him rethinking his bullish stance on stocks.

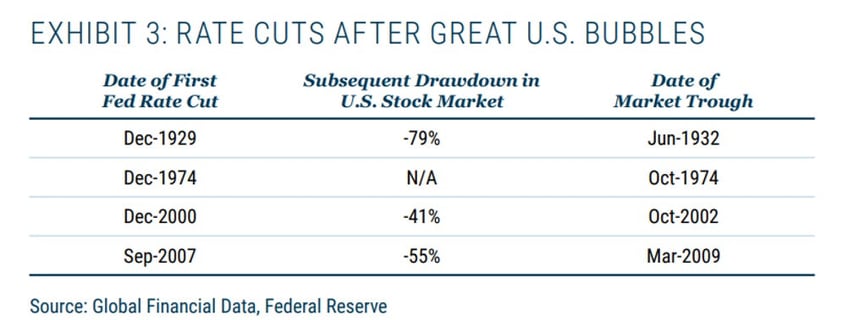

My readers know that I have suggested more than once that the market may be waiting to crash until the Fed cuts rates. As is brought up in this podcast, historically, that is what has happened: major 30% to 40% corrections in the stock market have occurred after rate cuts have begun.

But Luke Gromen does a great job explaining his position as to why this time, it may actually be different. In addition to laying out a case for why equities may not plunge this go-round, Gromen also does a great job painting a picture of the debt driven reality of economics in the U.S. today.

His analysis isn’t all too different from mine, in the sense that, putting equities aside, he believes that gold and Bitcoin will be the beneficiaries of what’s to come for the United States’ monetary policy. Luke does a great job laying out what could be coming volatility in the bond market, and talks about the only scenario he thinks could drive equities significantly lower.

And if Luke is right, this scenario...(READ THIS FULL ARTICLE, FREE, HERE).