According to Dow Theory, trends go through three phases, where in a bull market these phases are the:

- Accumulation phase – when prices rise alongside an increase in volume

- Public participation (or big move) phase – when retail and average investors begin to notice the upward trend and join in.

- Excess Phase - when the market reaches a point where experienced investors and traders begin exiting their positions, while the larger average investing population continues to add to their positions.

Before getting into the rules for Fan Lines, let’s first define the uptrend.

An uptrend is an overall move higher in the price, driven by higher highs, followed by higher lows. When drawing an uptrend line on a chart, your objective is to connect as many of the lows as you can and project up and out on the chart.

See Chart Below:

The first trendline drawn, most closely represents the accumulation phase of the overall trend, as outlined in the third tenet of Dow Theory.

Once you have identified the trendline, you can build the fan lines from there.

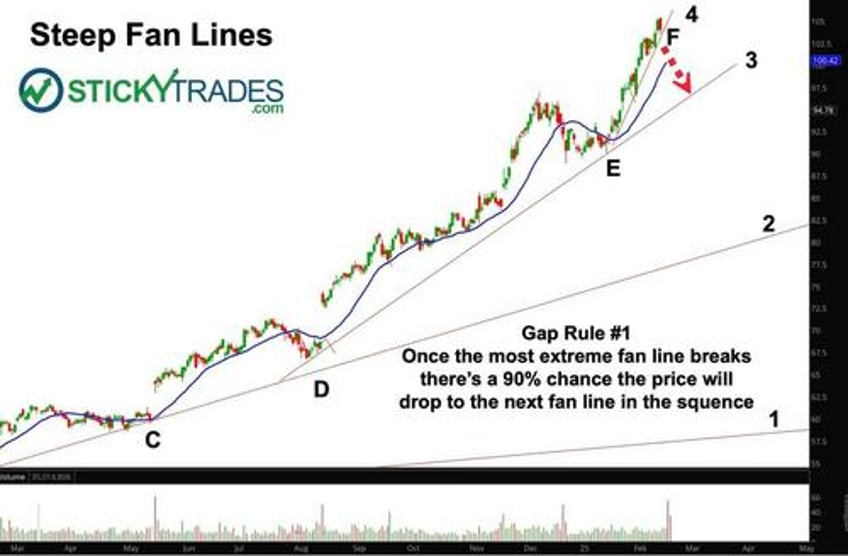

A fan line is nothing more than an “accelerated” trendline. This is where the highs and lows begin to trade in a more vertical price move. Dow Theory defines this as the Public Participation Phase, where investors begin to notice the uptrend and they join in.

The more vertical the fan lines go, the more overbought the market gets.

The angle of the fan line gives us a measure of the force behind the move, however, once the price begins to move at a steeper angle from fan line number 3, the dynamics of the market changes quite dramatically. While I am not showing the oscillating indicators such as the Stochastics and Commodity Channel Index (CCI), this is the point where the indicators continue to move into overbought territory. Once that happens, we can now draw the next fan line in the sequence of fan lines, starting from the last touch on the previous line (point D) to the next higher low (point E).

The price action cannot move vertically for an indefinite period of time.

Once you have more than 3 fan lines, the probability of a selloff in the market becomes greater. I’ve been drawing fan lines for more than 40 years and I’ve determined that once the most extreme fan line breaks, there is a 90% chance the price will drop to the next fan line in the sequence. This gives short traders, particularly option traders, a great opportunity to make money with short-term bearish strategies.

See chart with Fan Line #4 below:

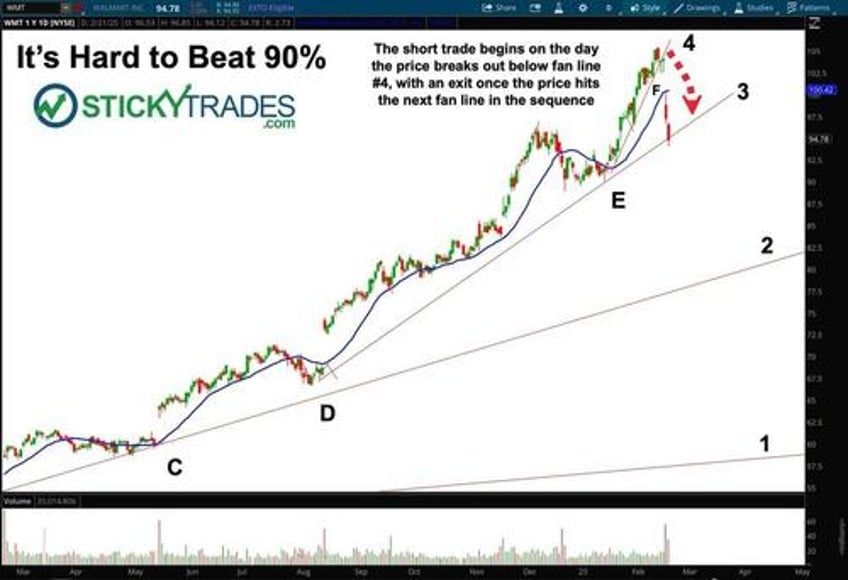

Walmart is not the only stock that has recently broken below the extreme fan lines.

All along I’ve been using Walmart as the example and as you can see from the chart below, the price has recently broken out below the most extreme fan line (#4), where many of our members took long put positions when the price started printing below the fan line. At StickyTrades.com we offer our members a 7-point trading checklist to help analyze all of the other signals we look at before placing a trade. The bearish signals started showing up long before the price traded below fan line #4, so we had enough time to set up the bearish position.

See most recent chart of Walmart:

Practice…Practice…Practice.

Learning how to draw fan lines does take practice but it is certainly NOT rocket science. I’ve always believed that repetition is the best teacher, so my best suggestion is to find stocks that are already showing signs of being overbought and draw some lines on your charts. Take a look at stocks like Rocket Lab (RKLB), Robinhood (HOOD), Alibaba (BABA) and even the SPX and you will see how vertical these stocks have gone. You can also plug into some of my webinars. See details below and come join the fun.

For a FREE, no-gimmick, two-week trial, and full access to AJ’s trade publications, education, market commentary, live webinars, & archived content, please head here.

For a StickyTrades.com offer, EXCLUSIVELY for ZeroHedge readers, check us out here.